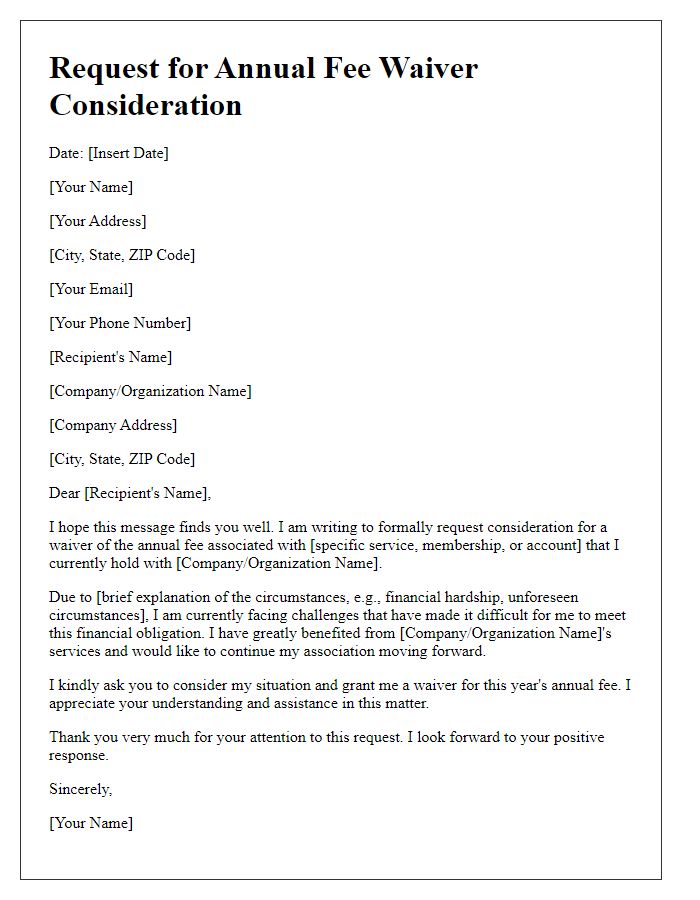

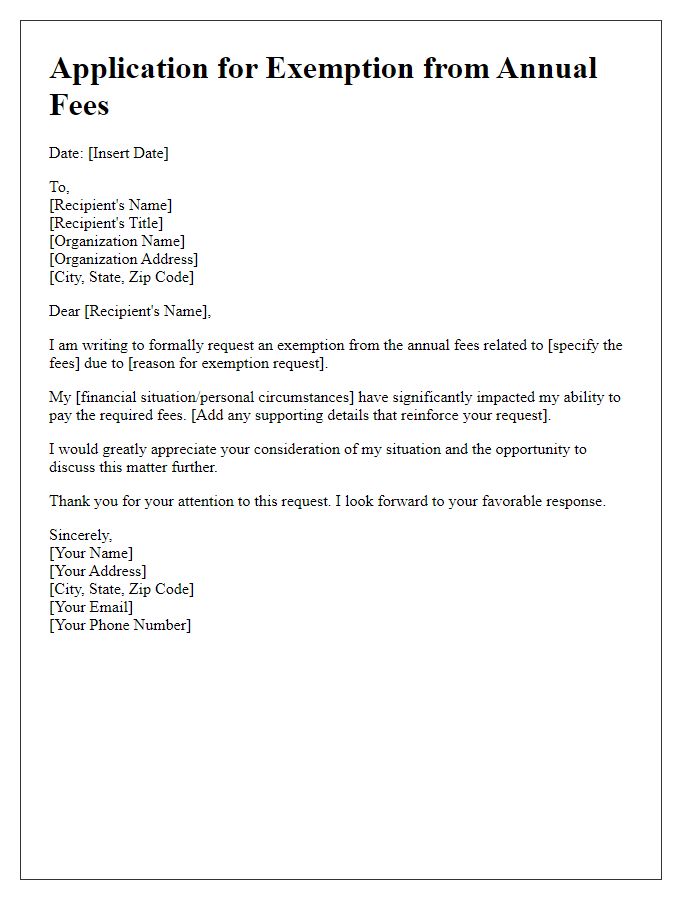

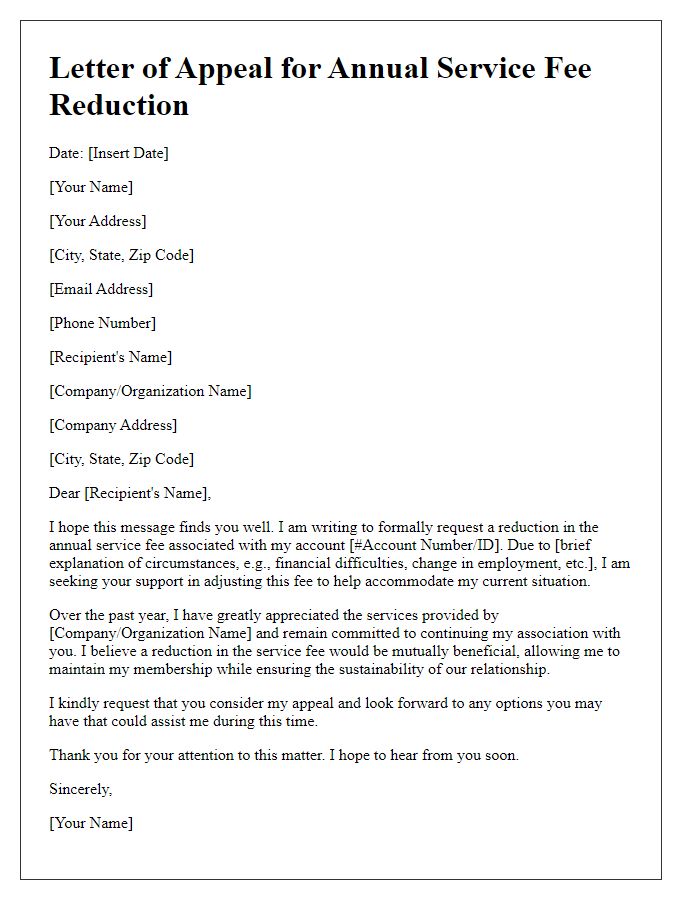

Are you looking to secure a waiver for your annual fees? You're not alone; many individuals and organizations find themselves navigating the often-complex world of fee waivers. Whether it's for a membership, subscription, or service, crafting the perfect request can make all the difference. Dive into our comprehensive guide on how to effectively write a letter for annual fee waiver approval and discover tips that could help your case!

Customer's account details

Annual fee waiver requests often hinge on specific account details. Customers typically seek exemptions for fees, such as membership charges, associated with credit card accounts or premium banking services. Important account details include the account number, customer identification (ID), account type (e.g., checking, savings, credit card), and account age (duration since account was opened). Financial institutions may also evaluate transaction history, such as monthly deposits or spending patterns, and any prior fee waivers granted. Policies regarding fee waivers may vary between banks, with some requiring proof of hardship or loyalty thresholds, like maintaining a minimum balance for an extended period. Understanding these facets can facilitate a smoother approval process for an annual fee waiver request.

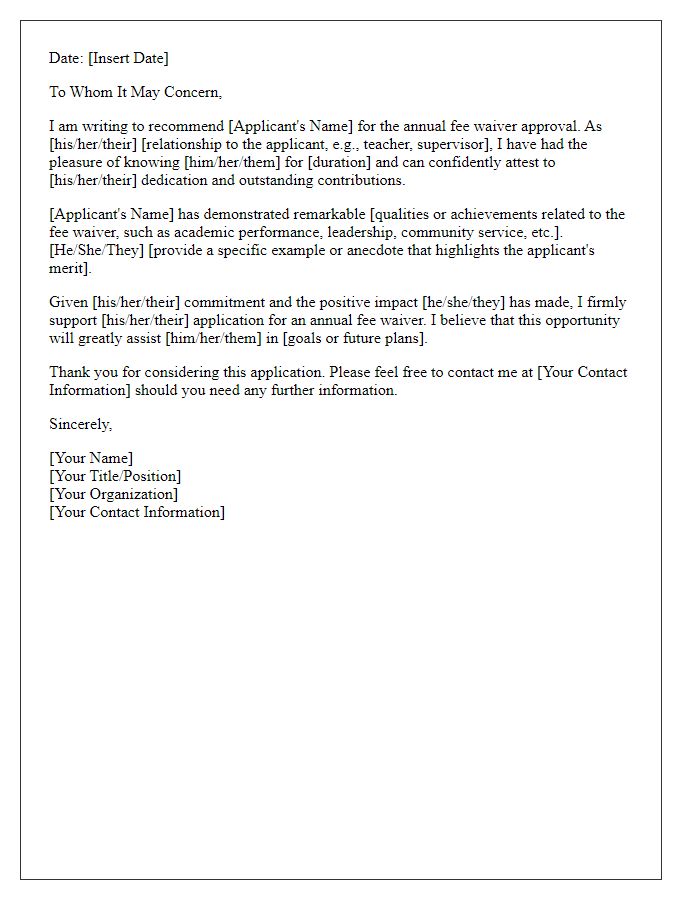

Positive account history

Customers with a positive account history often seek annual fee waiver approvals from credit card companies. These accounts frequently display timely payments (95% on-time rate), low credit utilisation (generally below 30% of the credit limit), and consistent usage patterns. A long-standing relationship with the financial institution (over three years for many clients) significantly boosts the chances of receiving a fee waiver. Additionally, clients engaging in multiple services, such as savings accounts and personal loans, may see enhanced approval rates due to the perceived loyalty and trustworthiness built over time. Each aspect of a positive account history plays a critical role in the approval process for annual fee waivers.

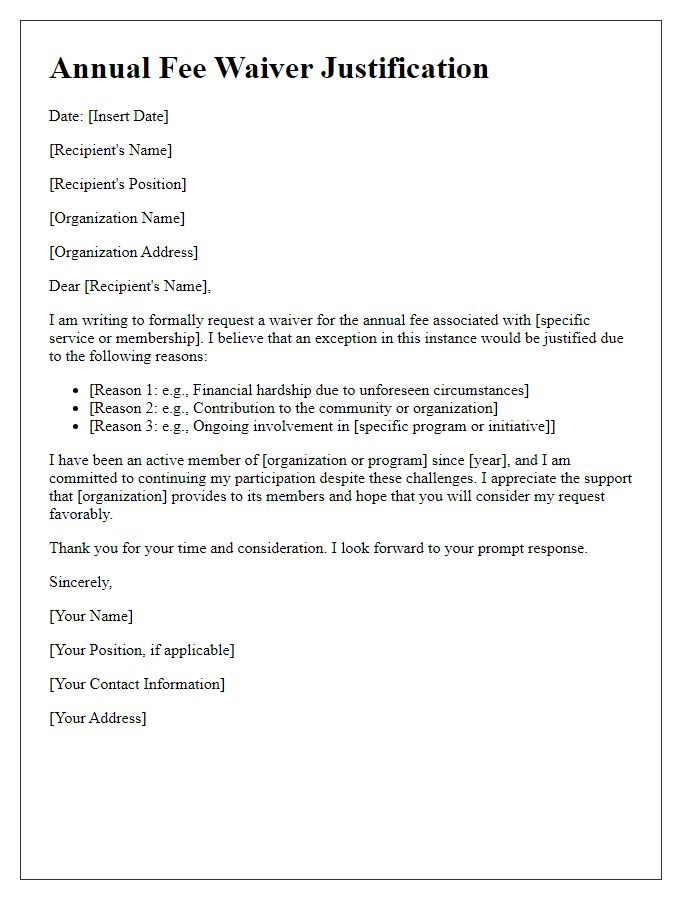

Reason for waiver request

Annual fee waivers can greatly alleviate financial burdens for individuals enrolled in educational programs or subscription services. These requests typically arise due to unforeseen circumstances such as job loss, medical emergencies, or significant personal hardships. Organizations often consider these factors when assessing waiver eligibility, ensuring fairness in maintaining access to important resources and opportunities. Supporting documentation like income statements or medical bills may be required to substantiate claims. A thorough review process allows decision-makers to evaluate the legitimacy of requests while upholding institutional policies and standards.

Company's fee waiver policy

The annual fee waiver policy enables eligible clients to avoid the customary fees associated with their accounts, enhancing customer satisfaction and retention. Specific criteria include maintaining a minimum balance, utilizing additional services, or demonstrating loyalty over a designated period of time. Each request for fee waiver approval is reviewed by a designated committee, ensuring compliance with the company's financial guidelines. Successful submissions often lead to significant savings, potentially ranging from $50 to $500 annually, depending on the account type and service utilization. Documentation such as account statements or evidence of service usage may be required to support the request process.

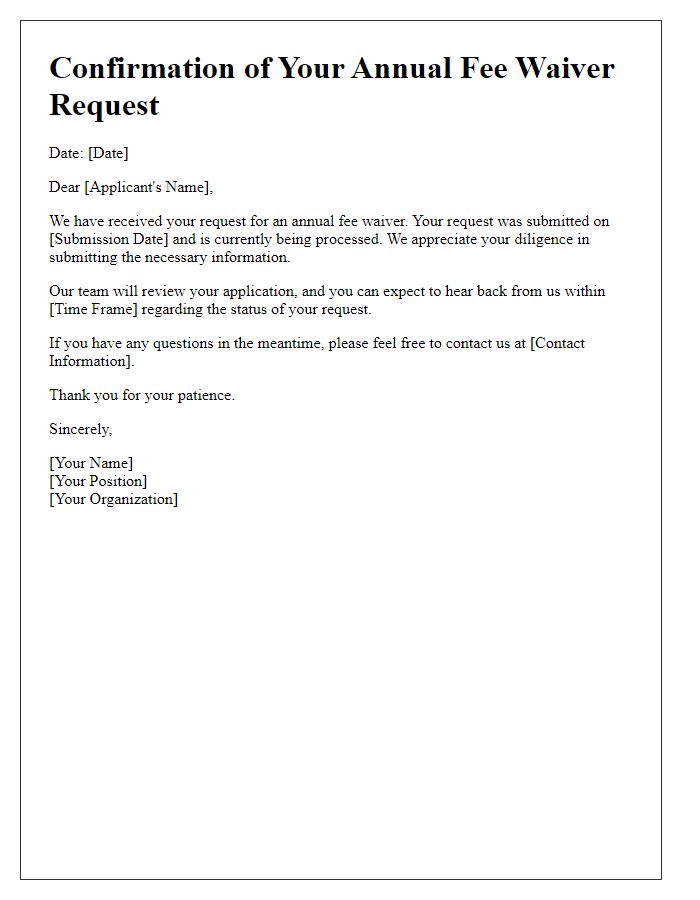

Contact information for further assistance

Annual fee waivers often apply to various memberships or subscriptions, offering individuals relief from financial obligations. Specific procedures exist for requesting these waivers, typically involving submission of relevant documentation and forms. Approval for fee waivers may depend on factors like income level, financial hardship, or special circumstances recognized by the organization. Contact information for further assistance is usually provided, often including a dedicated customer service phone number, an email address for inquiries, and an official website featuring FAQ sections. Prompt communication can expedite the review process and enhance the likelihood of approval, making it crucial for applicants to stay informed throughout the process.

Comments