Are you considering a variable interest insurance policy but unsure about how to make a formal request? Crafting the perfect letter can seem daunting, but we're here to help streamline the process. In this article, we'll share an easy-to-follow template that includes essential elements to ensure your request is clear and professional. Dive in to discover how you can effectively communicate your needs and get the coverage you deserve!

Recipient's Details

A variable interest insurance policy allows policyholders to allocate premiums towards various investment options, thereby tying the policy's cash value and death benefit to market performance. In these policies, interest rates fluctuate based on the performance of selected investment funds (equities, bonds, or money market instruments). Key details include the policyholder's name and contact information, the insurance company's address, and the policy number for easy identification. Additionally, it is essential to specify the request type--whether for a new policy, information on current variable interest rates, or changes in investment allocations. This clarity ensures quick and efficient processing by the insurance provider.

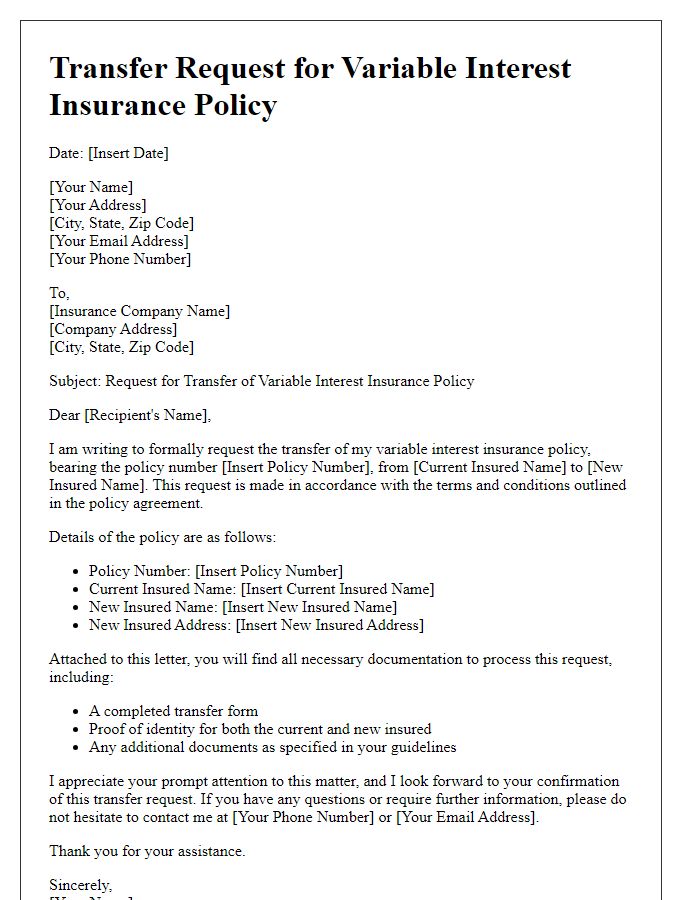

Sender's Personal Information

Variable interest insurance policies offer individuals flexible investment opportunities while providing life coverage. These financial instruments typically allow policyholders to allocate premiums to various investment accounts, such as mutual funds or stocks, increasing potential returns based on market performance. Key variables include interest rates, investment returns, and policyholder decisions, which can directly impact cash value growth. Providers like Prudential or MetLife often highlight benefits and risks associated with these policies, ensuring consumers understand factors like market volatility and fees. Successful management of these policies may require ongoing assessment of investment choices to achieve desired financial outcomes.

Policy Reference and Details

The variable interest insurance policy, known for its adaptability, ties returns to market performance, making it appealing for long-term financial objectives. Policy holders must provide specific details such as Policy Reference Number, issued by the insurance company, coverage inception date, amounts invested in different equity funds, and the duration of investment periods. Additionally, the request should clarify the nature of the adjustments sought, whether regarding premium payments or the allocation of funds among available investment options. This information is crucial for the insurer to process the request accurately and promptly, ensuring that policy holders can maximize their potential returns and align their investment strategy with their financial goals.

Request Statement and Purpose

Variable interest insurance policies offer policyholders the opportunity to engage with investment options tied to market performance, allowing for fluctuations in cash value over time. Such policies create a unique financial strategy providing potentials for higher returns linked to equity markets, bonds, or mutual funds. In these arrangements, the insurer typically allocates premiums into various investment accounts, with interest rates influenced by market conditions. Understanding the specific terms, including investment options, risk factors, and withdrawal policies, is critical for making informed decisions. Clarifying these elements ensures alignment with financial objectives and risk tolerance while maximizing the benefits offered by variable interest insurance products.

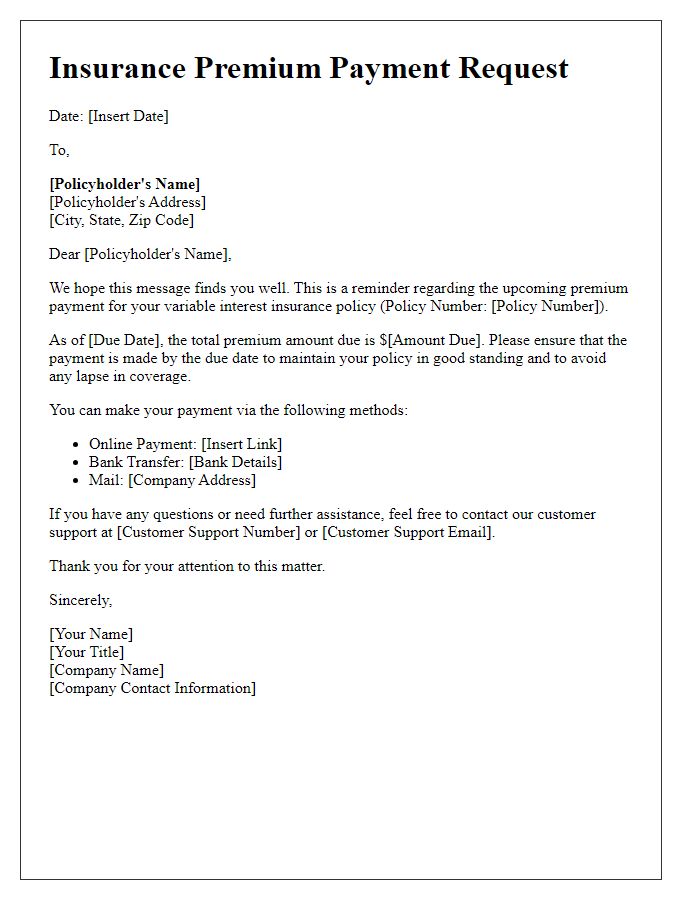

Contact Information and Follow-up Instructions

In seeking a variable interest insurance policy, it is essential to provide accurate contact information for seamless communication. Include your full name, address, phone number, and email address to ensure the insurance provider can reach you promptly. Follow-up instructions should highlight the preferred method of contact, such as phone calls or emails, and specify the best times for communication, ensuring that responses occur during business hours. Additionally, inquire about any necessary documentation to accompany the request, streamlining the application process and enhancing overall efficiency in securing the desired insurance coverage.

Letter Template For Variable Interest Insurance Policy Request Samples

Letter template of variable interest insurance policy information request

Comments