Are you feeling a bit overwhelmed by the intricacies of your insurance benefits? You're not alone; many people find it challenging to navigate the maze of terms and policies. In this article, we'll break down the essential components of your insurance benefits in a simple and straightforward manner. So, grab a cup of coffee and join us as we unravel the details that will empower you to make the best decisions for your coverage!

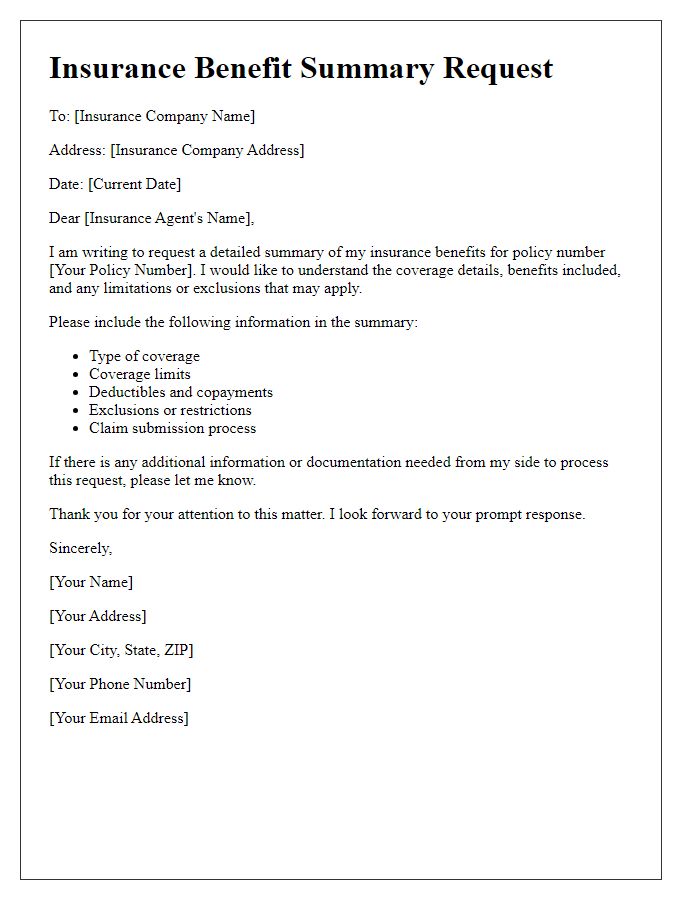

Policyholder information

Policyholders should be aware of the essential details regarding their insurance benefits, which include coverage amounts, terms, and conditions specific to each plan. The policy number serves as a unique identifier for your insurance agreement, while the effective date marks the beginning of coverage. Beneficiary information, which designates individuals entitled to receive benefits, is crucial in the event of a claim. Additionally, premium payment schedules outline the frequency and amount due, ensuring continued protection. Comprehensive understanding of exclusions and limitations can prevent potential misunderstandings during claims processing. Engaging with customer service representatives for clarification on specific terms enhances awareness and enables informed decision-making regarding policy adjustments or renewals. Proper documentation, including claims forms and medical records when applicable, ensures smooth processing and faster benefit disbursement. Always review the latest policy amendments for any changes affecting coverage and benefits.

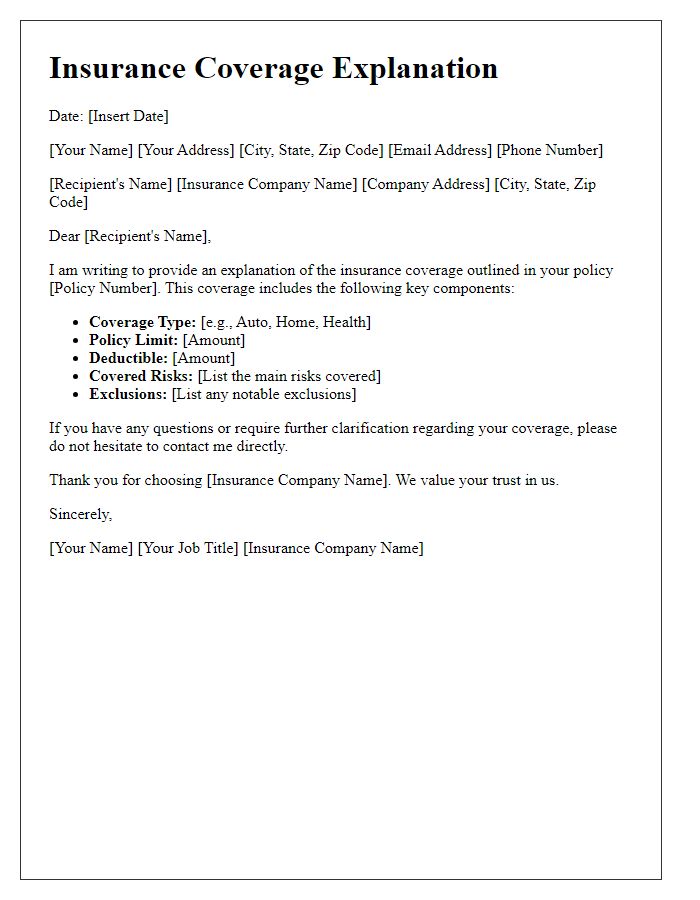

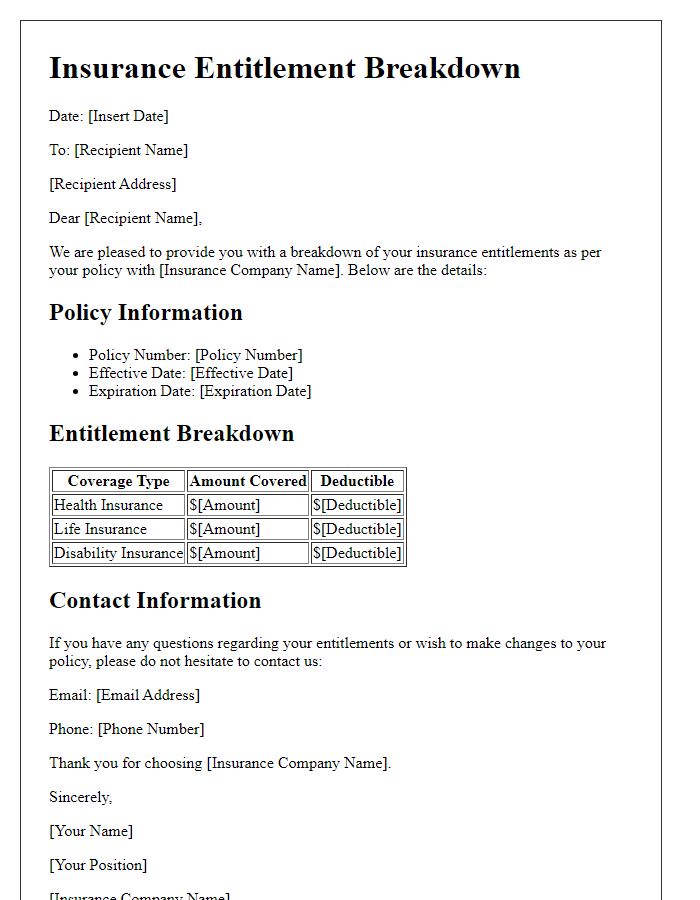

Coverage details

Insurance benefit coverage details provide crucial information about the extent of protection against potential risks and losses. The policy limits delineate the maximum amount payable by the insurer for covered claims, often expressed in thousands or millions of dollars. Deductibles represent the amount policyholders must pay out-of-pocket before coverage kicks in. Specific conditions may apply to natural disasters, accidents, or theft, outlining exclusions that clarify situations not covered under the policy. Benefit provisions, such as replacement cost coverage versus actual cash value, determine how claims are settled, significantly impacting the financial benefit received during challenging events. Regular updates to policy information, such as coverage limits and premiums, are essential to maintain adequate protection over time.

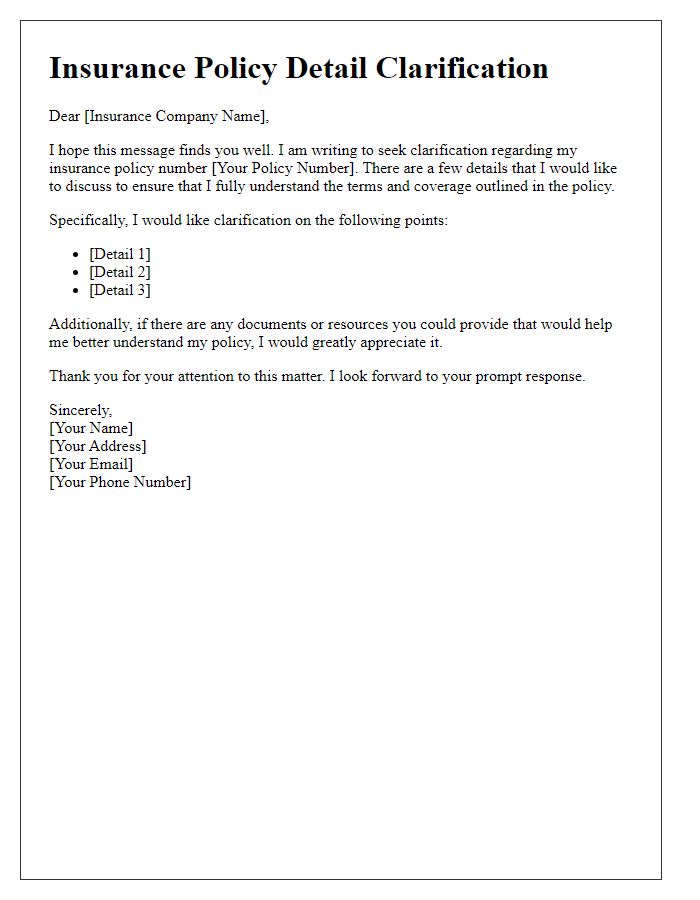

Benefit eligibility criteria

Benefit eligibility criteria for insurance claims often require a thorough understanding of specific guidelines. Coverage typically necessitates a defined period of continuous employment, usually ranging from 30 to 90 days, depending on the insurance provider. Individuals must demonstrate a legitimate need for coverage, such as a critical illness diagnosis, accidental injury, or other unforeseen events, which may necessitate healthcare intervention. Policyholders often must provide documentation, such as medical records or incident reports, to substantiate their claims. Additionally, premium payments must be up to date; lapses in payment can result in denial of benefits. Each insurance policy may have unique exclusions, such as pre-existing conditions or high-risk activities, which can significantly affect eligibility. Understanding these criteria is essential for individuals seeking to access their benefits effectively.

Claim process guidelines

The claim process for insurance benefits typically involves several key steps to ensure a smooth and efficient experience for policyholders. Initially, filing a claim requires submitting a claim form and supporting documents, including incident reports and medical bills, depending on the type of insurance. Claimants should carefully check the specific requirements outlined by their insurance provider, as each company may have varying guidelines. Following submission, the insurance adjuster, a professional who assesses claims, will review the provided information to determine eligibility and the extent of coverage. This step may include a thorough investigation involving interviews, claim reviews, and even consultations with specialists, especially for complex claims. Once a decision is made, the policyholder will receive a notification, including the claim's status and any approved benefits or compensations. Adhering to timelines, tracking claim progress through the insurance website or customer service, can also enhance the efficiency of the process.

Contact information for inquiries

Insurance policies often provide comprehensive coverage for various risks, including health, life, and property. Policyholders may have questions regarding their insurance benefits, including eligibility, claim procedures, and coverage limits. Inquiries can be directed to dedicated customer service departments usually reachable via phone or email. For example, a typical insurance company's customer service hotline operates Monday through Friday, 9 AM to 5 PM EST. Additionally, many companies have online portals where users can submit questions or access FAQs. It's essential to gather relevant policy numbers and personal identification details before making inquiries to expedite the process. Client support is an invaluable resource for clarifying terms and ensuring that policyholders understand their rights and responsibilities under the insurance contract.

Comments