Are you navigating the often complex world of residential insurance claims? Writing a clear and effective letter can make all the difference in your pursuit of resolution. In this article, we'll walk you through a comprehensive template that not only simplifies the process but also helps articulate your situation effectively. Ready to enhance your understanding of how to secure your claim? Let's dive in!

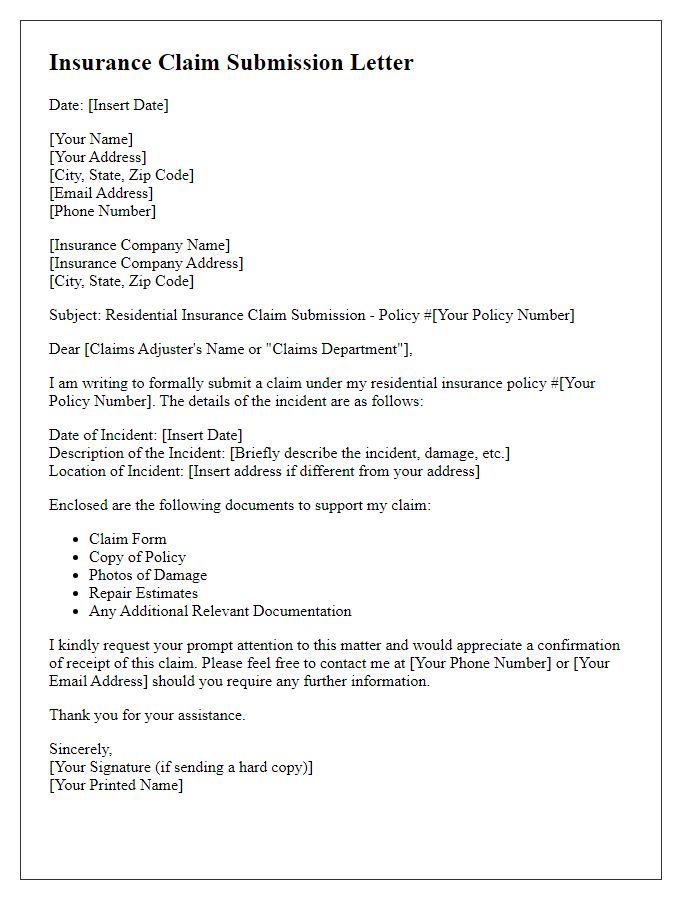

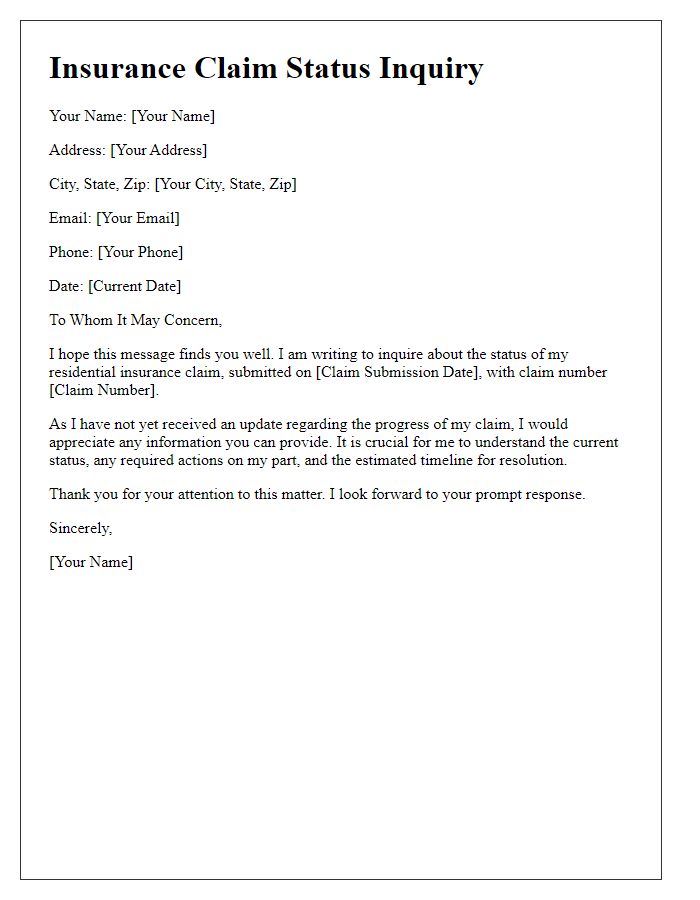

Policyholder Information

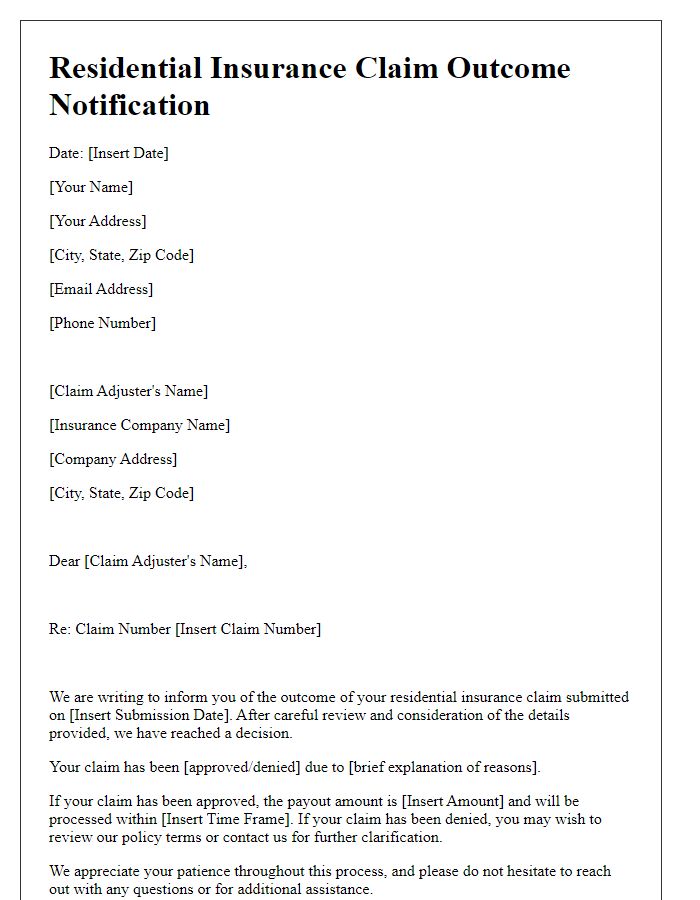

Residential insurance policies, typically ranging from standard homeowners' insurance (HO-3) to condo insurance (HO-6), provide essential financial protection against various risks like natural disasters, theft, and liability claims. Policyholder information, including name, address, and contact details, establishes ownership and ensures accurate communication with the insurance provider. Additionally, policy numbers serve as a unique identifier for each coverage plan, facilitating efficient processing of claims. It is imperative for policyholders to understand terms such as coverage limits, deductibles, and exclusions to navigate the claims process effectively. Familiarity with local regulations, such as those stated in the National Flood Insurance Program (NFIP), may also be crucial in scenarios involving specific damage claims.

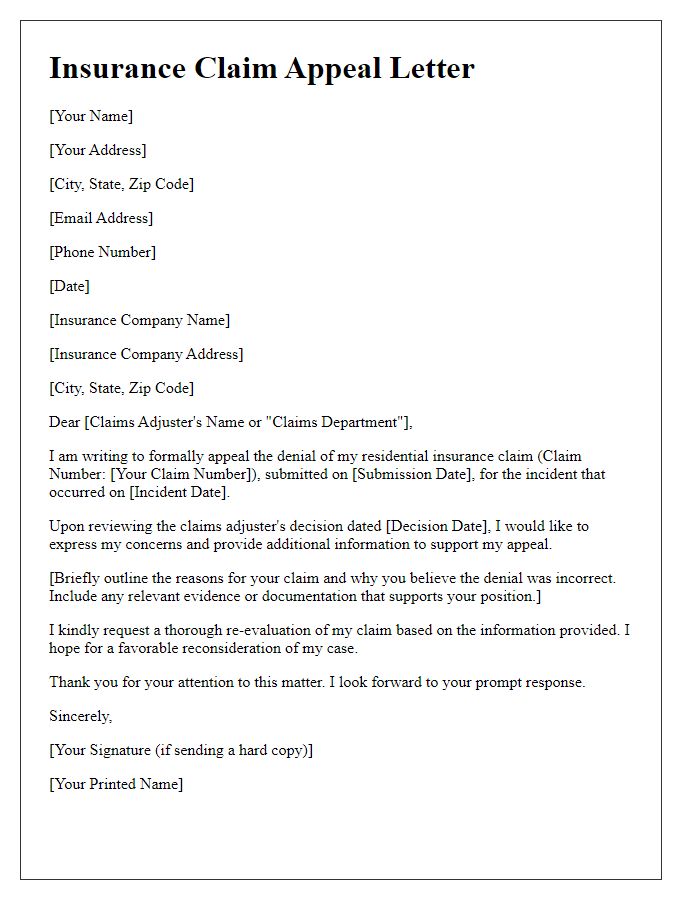

Claim Reference Number

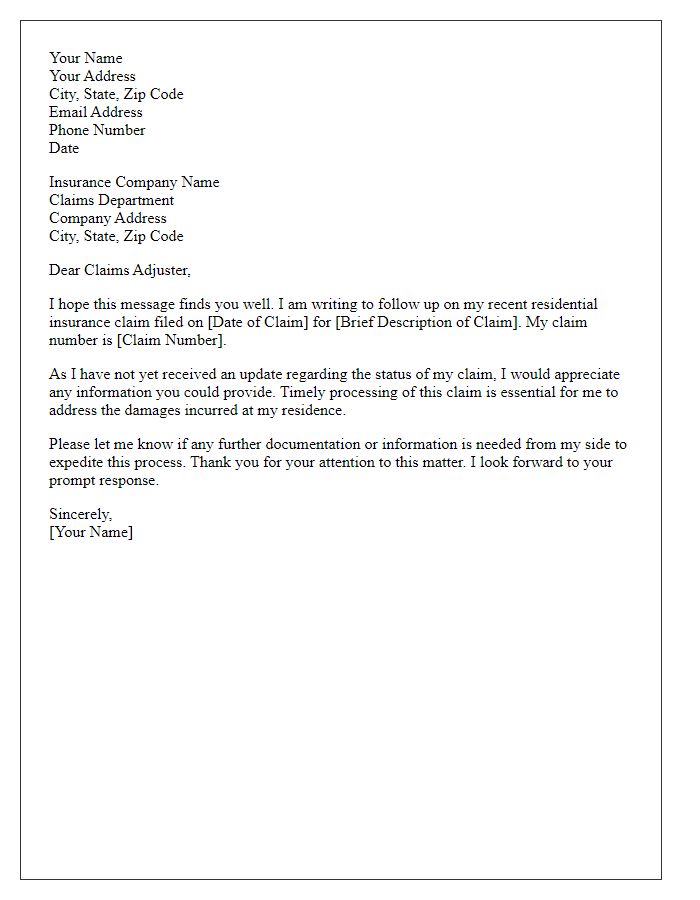

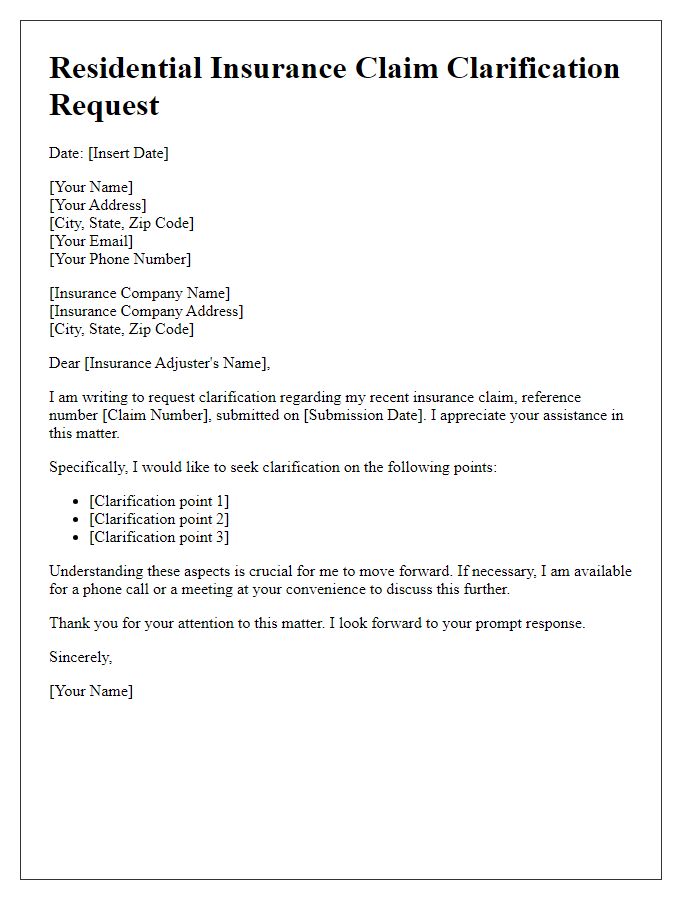

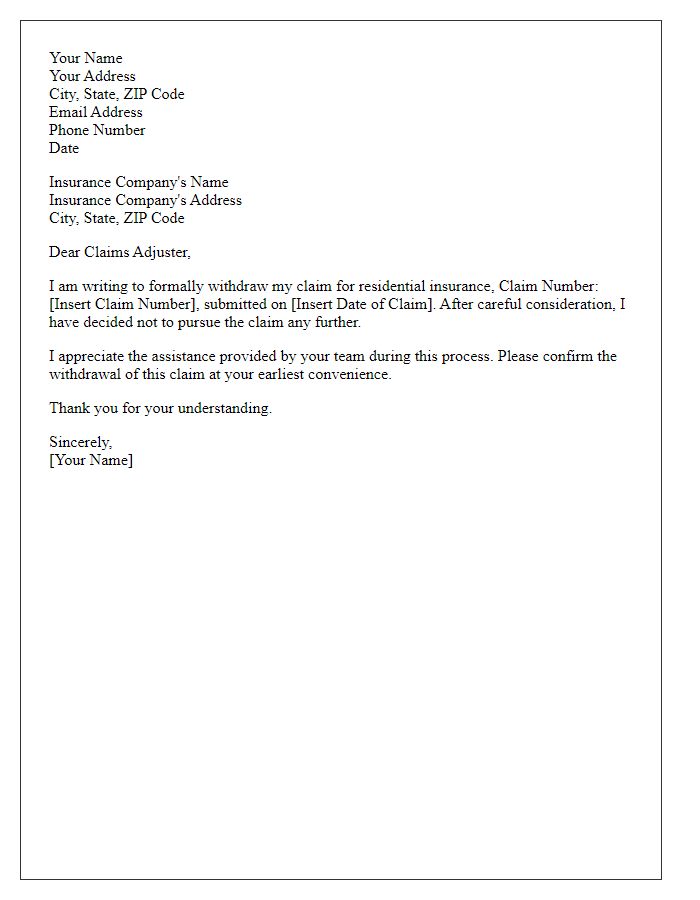

A residential insurance claim, referenced by a specific claim number such as 123456789, is typically initiated following a significant event, often involving property damage. Common causes include natural disasters like hurricanes or flooding, causing structural damage to homes located in vulnerable areas. Affected homeowners must document the damage through photographs, receipts, and a detailed inventory of lost or damaged belongings, including high-value items such as electronics or valuable art pieces. Insurance adjusters assess the claim based on coverage types outlined in the homeowner's policy, which may include dwelling coverage, personal property protection, and additional living expenses. Timely submission of the required documentation is crucial for expediting the claim process with the insurance company.

Date of Incident

A date of incident is crucial in residential insurance claims, as it marks the beginning of the event that triggered the need for coverage. For example, on January 15, 2023, a severe snowstorm caused significant property damage in several regions, including Minneapolis, Minnesota, where heavy snowfall exceeded 15 inches. Homeowners experienced broken roofs and flooded basements due to snow accumulation and rapid melting. Accurate recording of this date not only establishes the timeline for assessing the claim but also determines eligibility for coverage under policies specific to weather-related events. Insurers often require this information to process claims efficiently and evaluate damages relative to policy limits and deductibles.

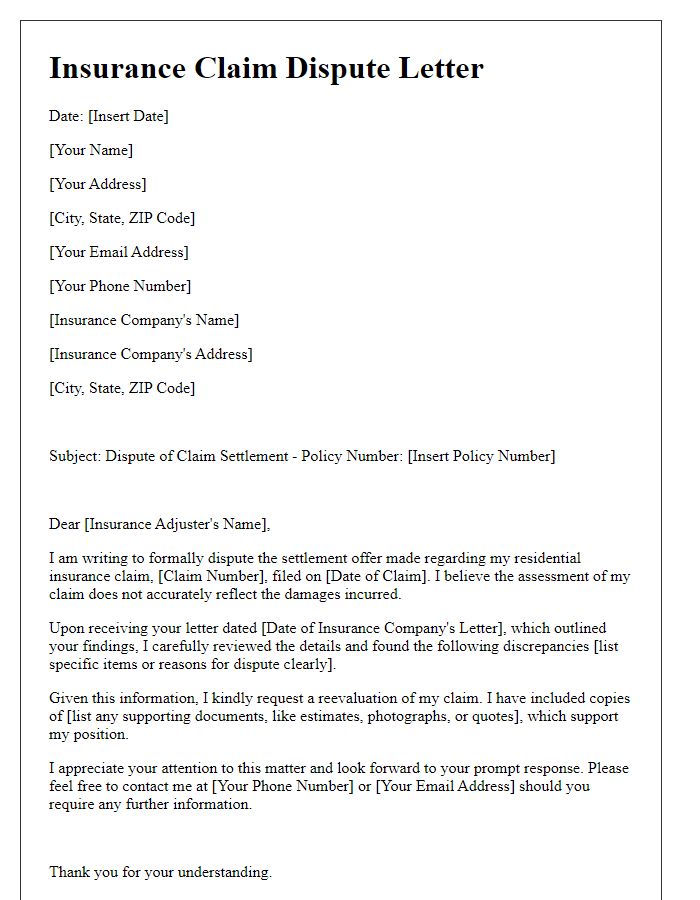

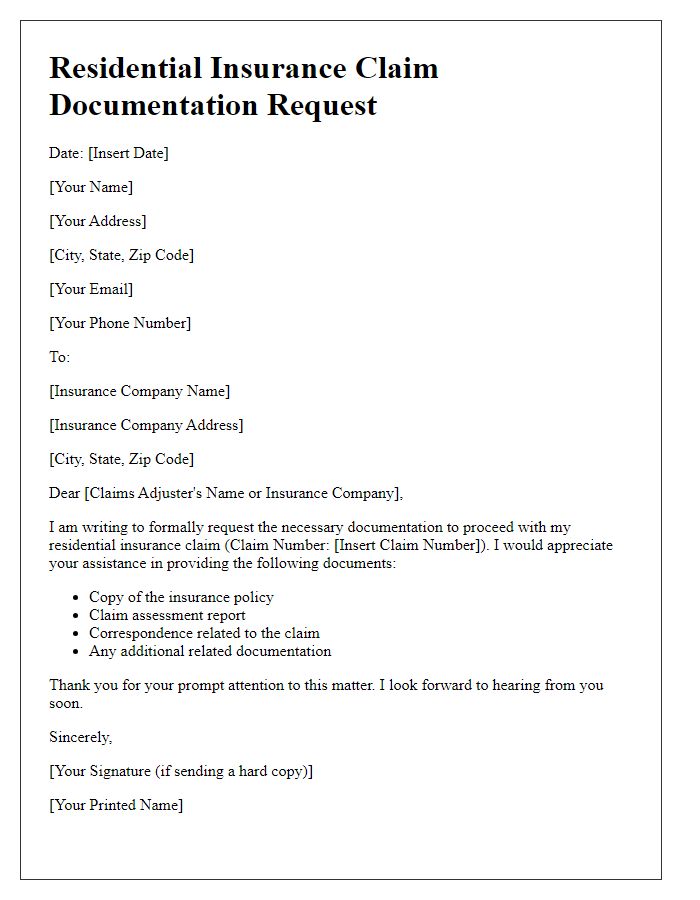

Description of Loss or Damage

A residential insurance claim can arise from various circumstances, such as severe weather events like hurricanes or tornadoes, leading to structural damage. For instance, significant water damage due to a burst pipe can cause extensive harm to drywall, flooring, and personal property within a home. Additionally, fire-related incidents may compromise kitchen appliances and electrical wiring, resulting in costly repairs. Items such as furniture and electronics can also suffer irreparable damage due to exposure to smoke or water. During the assessment, it is crucial to document each item affected, including detailed descriptions, approximate values, and photographs of the loss or damage sustained. This comprehensive account ensures a thorough evaluation by insurance adjusters and facilitates a smoother claims process.

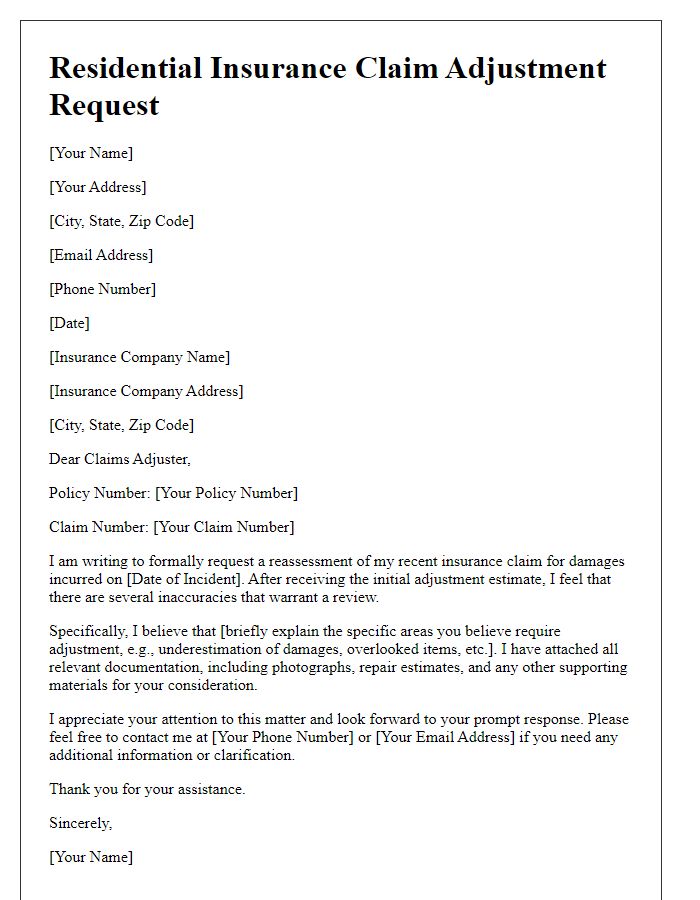

Detailed Itemization and Cost Estimation

A comprehensive residential insurance claim must include a detailed itemization of losses and a precise cost estimation to effectively communicate damages suffered during the incident. Each item should be listed with specific details, such as the date of purchase, original cost, estimated depreciation value, and current replacement cost. For example, a damaged dining room table, originally purchased for $1,200 in 2018, might have a current market value of $800 after accounting for wear and tear. Additionally, photographs documenting damages, repair estimates from licensed contractors, and invoices for temporary housing or emergency repairs should be provided. Detailed cost breakdowns from local suppliers for necessary repairs, such as $150 for drywall, $80 for paint, and $400 for floor repairs, are crucial for substantiating claims. Accurate documentation throughout the process strengthens credibility and facilitates smoother interactions with the insurance adjuster, ultimately aiding in faster resolution of the claim.

Comments