Navigating the world of insurance legal liability can often feel overwhelming, but understanding the essentials is crucial for both individuals and businesses alike. Legal liability coverage protects you against claims that could arise from accidents, negligence, or injuries, ensuring you aren't left vulnerable in unexpected situations. It's not just about safeguarding your assets; it's also about peace of mind, knowing you have a safety net in place. Ready to dive deeper into the intricacies of insurance legal liability? Let's explore more!

Policyholder Information

Insurance legal liability is a critical aspect for policyholders in protecting against potential claims resulting from negligence or damages incurred during everyday activities. Coverage details often include limits on monetary liability, typically ranging from $100,000 to $1 million, depending on the policy level chosen by the policyholder. The surrounding events, such as accidents (like slip and fall incidents) that occur on personal or commercial property, significantly influence the claim's validity. Additionally, jurisdiction can play a crucial role, as different states, like California or Texas, have varying laws regarding liability claims. Understanding exclusions, including intentional acts or damage caused by vehicles, ensures policyholders are aware of the scope of their protection under the insurance contract.

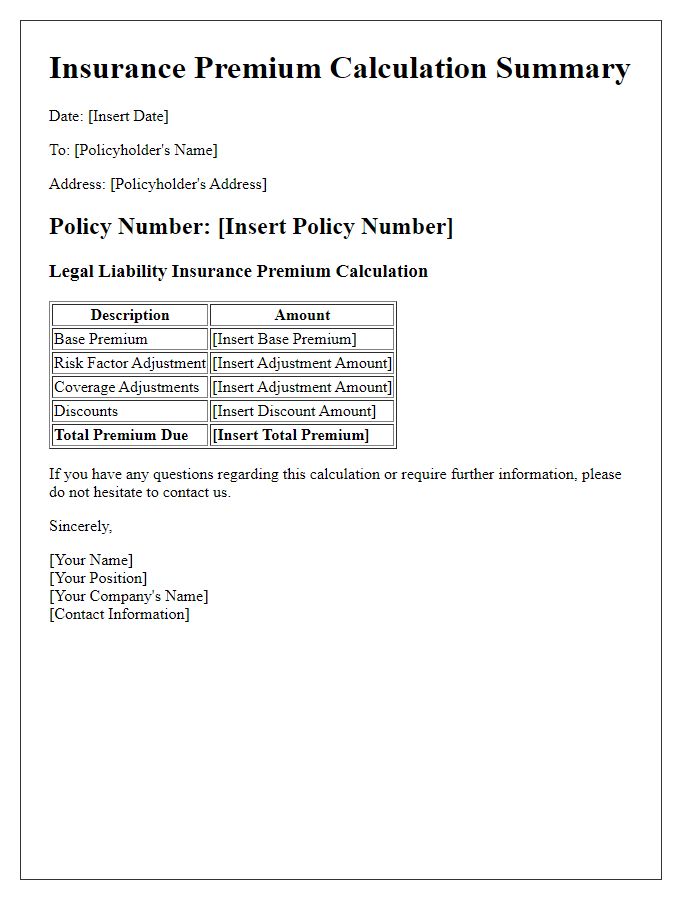

Policy Coverage Details

Insurance policies provide legal liability coverage designed to protect individuals and businesses from potential financial losses arising from claims of negligence or harm to others. This coverage typically includes general liability, which shields against third-party bodily injury and property damage claims, with coverage limits often ranging from $1 million to $2 million per occurrence. Professional liability, also known as errors and omissions insurance, protects professionals like doctors or accountants against claims of inadequate service or malpractice. In addition, commercial auto liability coverage safeguards businesses that use vehicles for operations, ensuring protection for both bodily injury and property damage caused by employees. It's crucial to understand policy exclusions, such as intentional acts or contractual liabilities, which can significantly affect claims eligibility.

Incident Description and Context

A recent incident involving a commercial vehicle occurred at the intersection of Main Street and Second Avenue in New York City on October 5, 2023. A delivery truck, belonging to Mega Logistics, collided with a parked car during a scheduled delivery at approximately 3 PM. Witnesses reported that the truck driver failed to yield to the oncoming pedestrian, resulting in minor injuries to an individual crossing the street at the time. Emergency services responded quickly, and the injured pedestrian was transported to St. Vincent's Hospital for assessment. The police conducted an investigation, documenting the scene, and taking statements from witnesses. As a result, liability concerns were raised, focusing on the truck driver's adherence to traffic regulations and the company's safety protocols. This incident could potentially lead to legal repercussions under the New York State vehicle and pedestrian safety laws.

Liability Assessment and Analysis

Liability assessment (the evaluation of responsibility for damage or injury) in legal terms involves examining various factors, including contractual obligations and statutory duties. Insurance policies, such as general liability insurance, protect businesses against claims resulting from injuries and damage to people or property. Typically, this process examines incidents like accidents (occurring in locations such as workplaces or public properties), negligence (failure to take appropriate action), and breach of duty. In jurisdictions like the United States, the legal framework, including tort law and regulations, guides the determination of liability. Key metrics, such as economic and non-economic damages (monetary compensation for losses), play a crucial role in assessing potential payouts and protecting corporate interests. Documentation, including incident reports and witness statements, forms the basis for analyzing exposure and formulating a risk management strategy against potential litigation.

Legal and Policy References

Legal liability in insurance frameworks often revolves around various regulations and policy stipulations. Liability insurance protects individuals and businesses from civil liabilities arising from injuries or damages incurred by third parties. Key legal references include the Tort Law, which governs civil wrongs and compensations, and the principles of Negligence, requiring proof of duty of care, breach of duty, and direct causation of harm. Policy exclusions often encompass intentional acts, worker's compensation claims, and contractual liabilities, which can significantly impact coverage limits and claims acceptance. Regulations such as the Insurance Services Office (ISO) guidelines are pivotal in establishing standardized terms for liability insurance agreements. Understanding these elements ensures informed decision-making in securing appropriate legal protection.

Comments