Have you ever found yourself grappling with the complexities of employer insurance policies? Navigating the intricacies of coverage can be overwhelming, especially when it comes to filing appeals. In this article, we'll break down the essential steps to effectively communicate your case to your employer regarding their insurance decisions. So, if you're ready to empower yourself with the knowledge needed to advocate for your rightful claims, stick around and read more!

Clear Contact Information

In the realm of employer insurance policy appeals, having clear contact information is crucial for efficient communication. The contact information should include the name of the employee, their employee identification number, and the specific insurance policy number associated with the claim. It is advisable to provide a direct phone number, such as a mobile contact, for immediate inquiries and a professional email address (compliant with data security measures) for documentation purposes. Additionally, the physical address of the employee, city, and state should be included to facilitate any necessary formal correspondence. This clarity minimizes confusion and ensures that the appeal reaches the appropriate department swiftly, aiding a more streamlined resolution process.

Policy and Claim Details

In an intricate landscape of employer insurance policies, each document represents a crucial layer of coverage designed to protect against various risks associated with employee welfare. The multi-faceted nature of such policies typically includes elements like liability coverage, which can reach upwards of $1 million in general liability limits, and workers' compensation benefits, often mandated by state law across the United States. Claim details play a pivotal role in tracking incidents; for instance, a claim filed on January 15, 2023, related to workplace injury must adhere to specific filing deadlines, commonly ranging from 30 to 90 days, depending on policy terms. The particulars of such policy documents, often housed under a group policy number, reflect not only the unique identifiers of each plan but also the intricate clauses defining the extent of coverage, ranging from occupational hazards to gradual injury claims. The distinctive elements of both policy and claims documentation contribute significantly to navigating the appeal process in the event of a denied claim, ensuring that all relevant information--such as claim numbers, incident reports, and policy exclusions--is clearly articulated for effective resolution.

Reason for Denial

Insurance claims can be denied due to various reasons, each dependent on specific policy terms. Common reasons for denying employer insurance claims include incomplete documentation, such as missing medical records or insufficient evidence, as seen in many healthcare claims processed under policies by providers like Aetna and Blue Cross Blue Shield. Other reasons could involve pre-existing conditions not covered under the terms of the policy. A notable case from 2021 illustrated this when a claim was denied for a condition that was documented prior to the policy start date, specifically impacting individuals seeking treatment for chronic illnesses like diabetes. Furthermore, discrepancies between the reported incident and the policy coverage--examples include injuries sustained during prohibited activities or outside of a work-related context--can lead to denial. Understanding these specific denial reasons is crucial for crafting an effective appeal.

Explanation and Justification

An employer insurance policy appeal requires a thorough understanding of the specific policy details and the justifications for the appeal. A well-structured appeal clearly outlines the exceptional circumstances surrounding the denied claim or coverage request. For instance, if an employee sustained a work-related injury in a manufacturing facility, documentation of the incident, medical reports, and testimonies from coworkers can substantiate the appeal. The submission should reference policy numbers, claim dates, and any pertinent communication held with the insurance company. Additionally, citing relevant state labor laws and regulations that emphasize employer responsibility for workplace injuries can strengthen the argument. Providing a detailed narrative that highlights the employee's commitment and the nature of their role within the company can personalize the appeal, reflecting the organization's responsibility towards its workforce. Ultimately, a compelling presentation of facts allows the employer to advocate effectively for the insurance claim's reconsideration.

Supporting Documentation

An employer insurance policy appeal requires comprehensive supporting documentation to ensure a strong case. This documentation often includes claim forms, medical records, and correspondence between the employee and insurance representatives, detailing claim submission dates and responses received. For instance, medical records can provide crucial evidence of treatment received for a specific condition, such as a documented diagnosis of carpal tunnel syndrome from a licensed physician in July 2022. Additionally, copies of previous insurance policy documents, policy numbers, and summaries of coverage can outline the entitlements under the policy, highlighting discrepancies in claim handling. Correspondence logs, including emails and letters from the insurance company or employer, establish a timeline for claim processing and communication efforts. Ensuring all documentation is organized and clearly labeled can significantly strengthen the appeal's presentation to the insurance company.

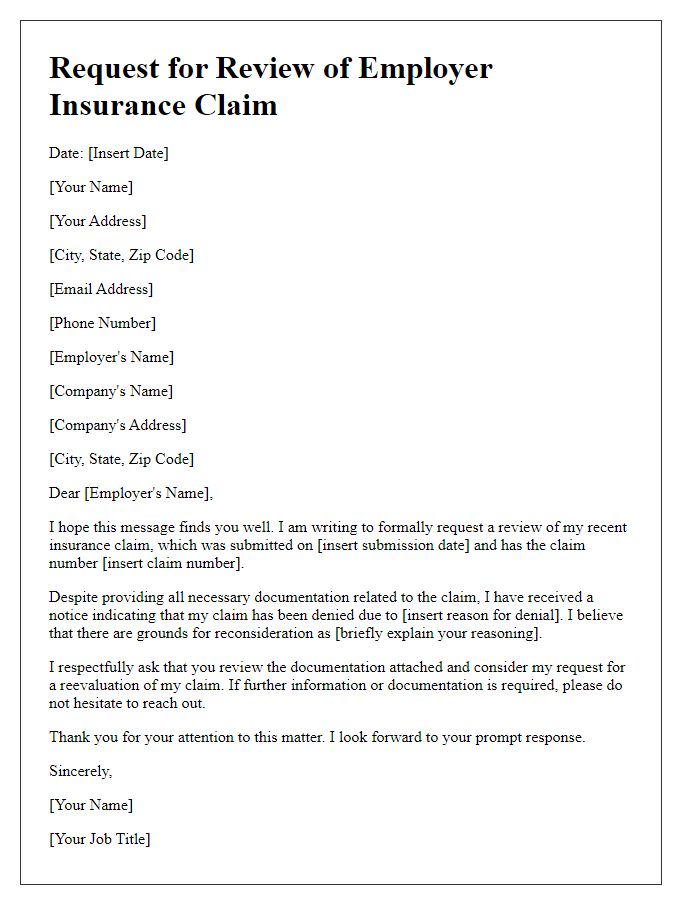

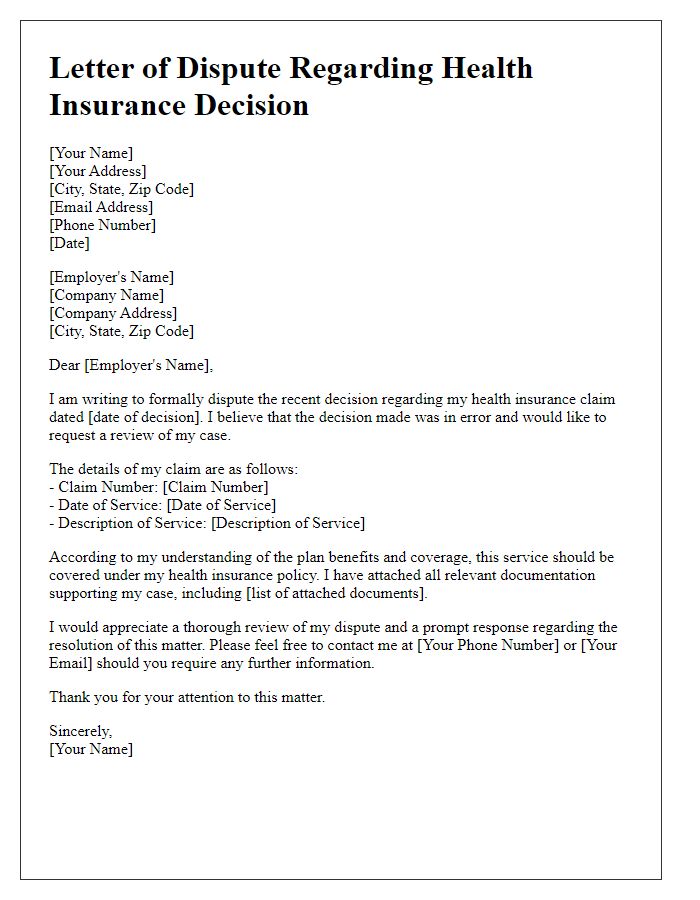

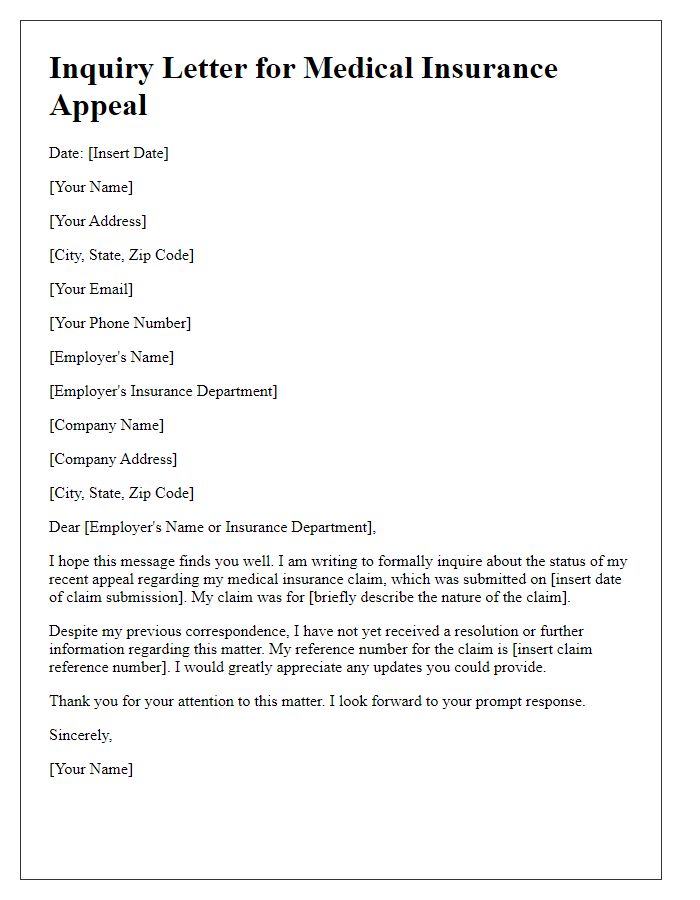

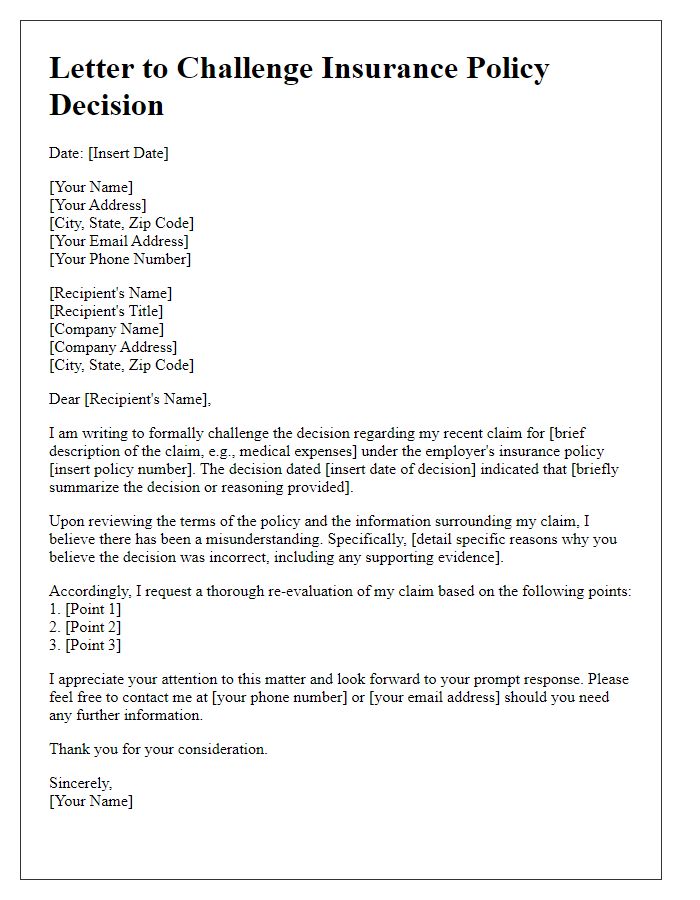

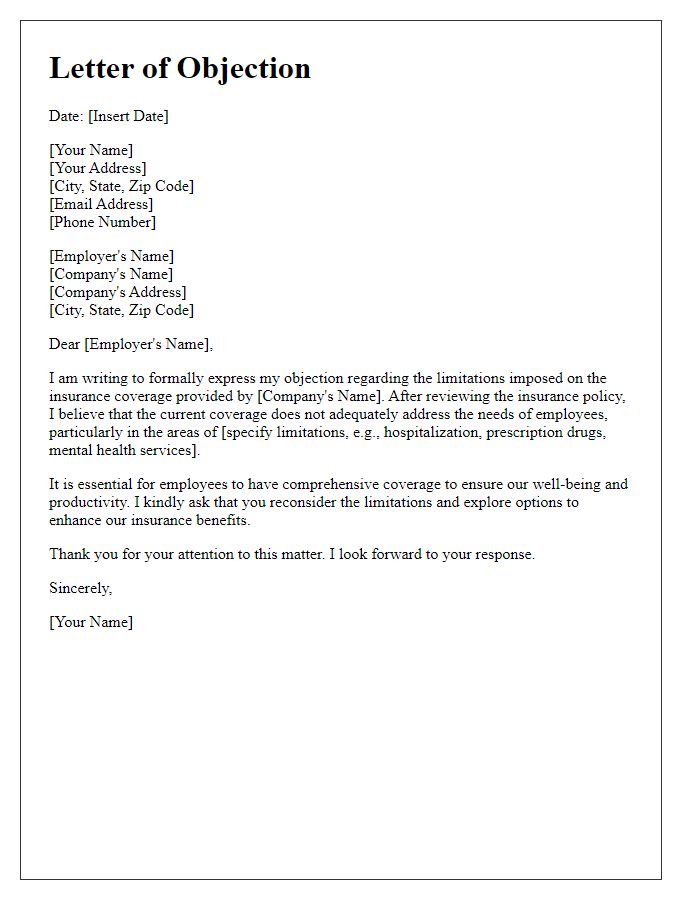

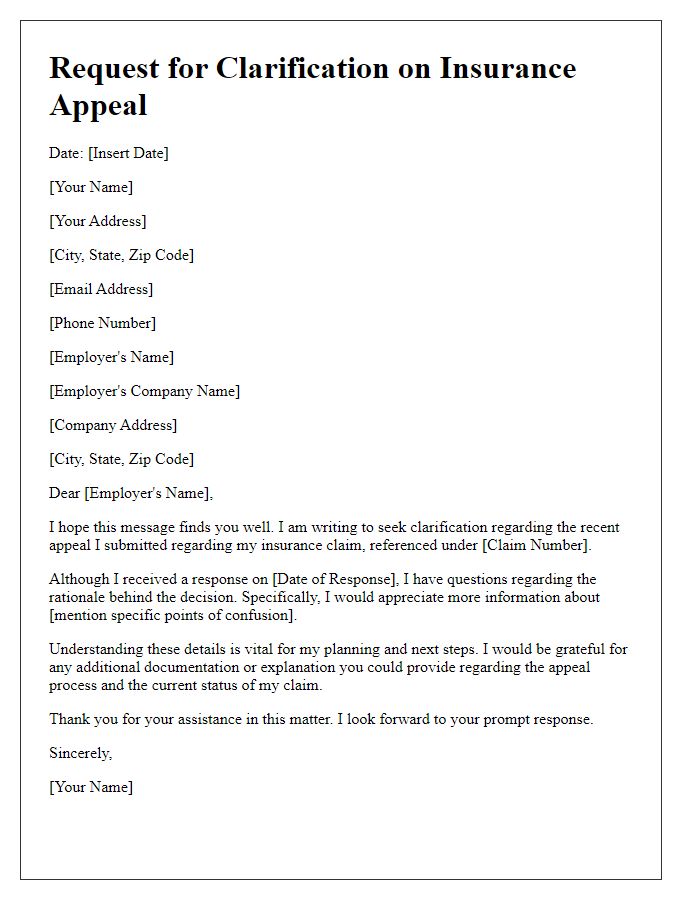

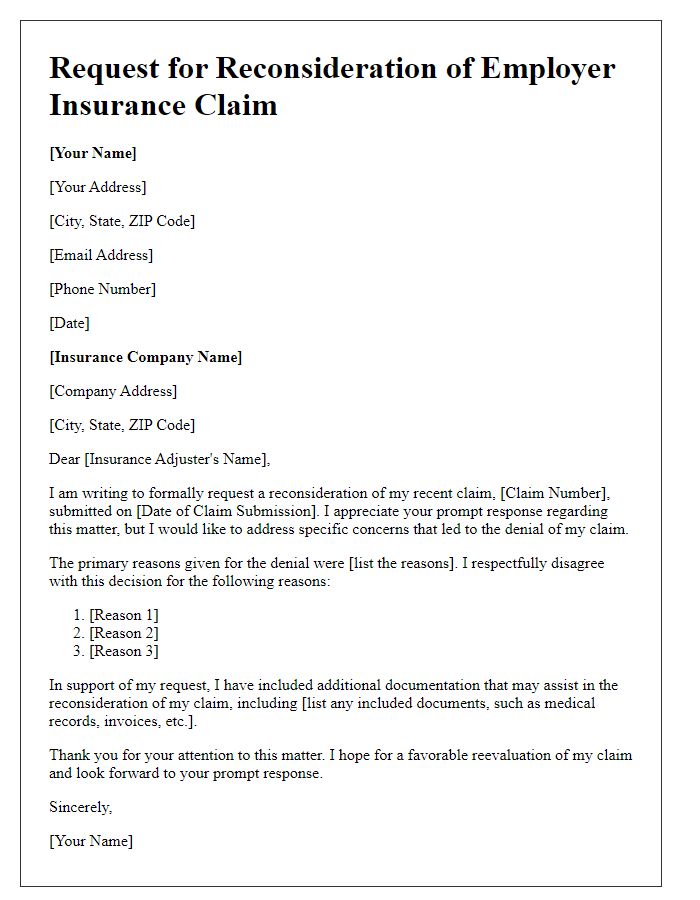

Letter Template For Employer Insurance Policy Appeal Samples

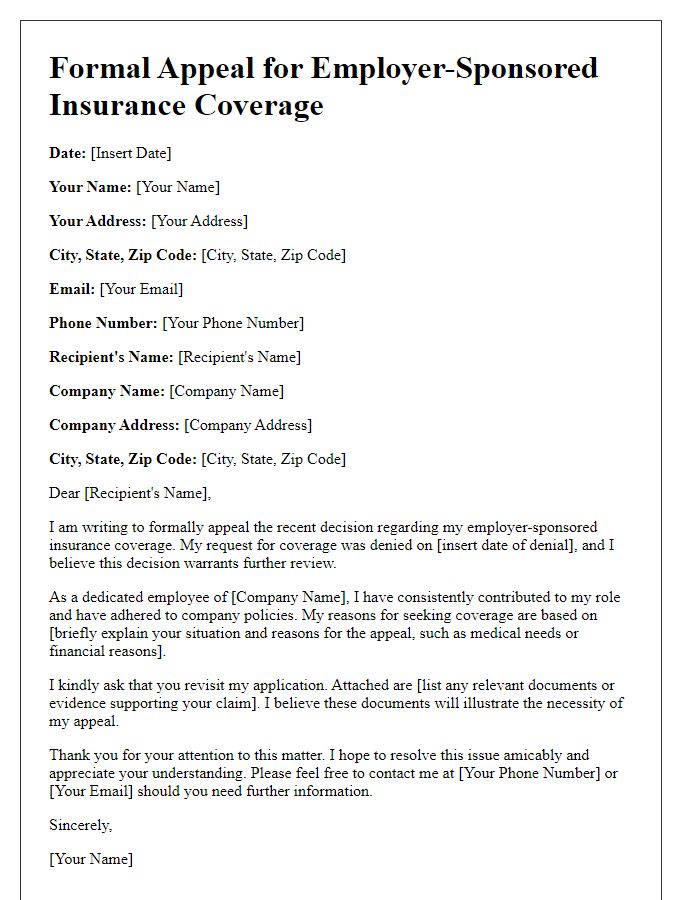

Letter template of formal appeal for employer-sponsored insurance coverage

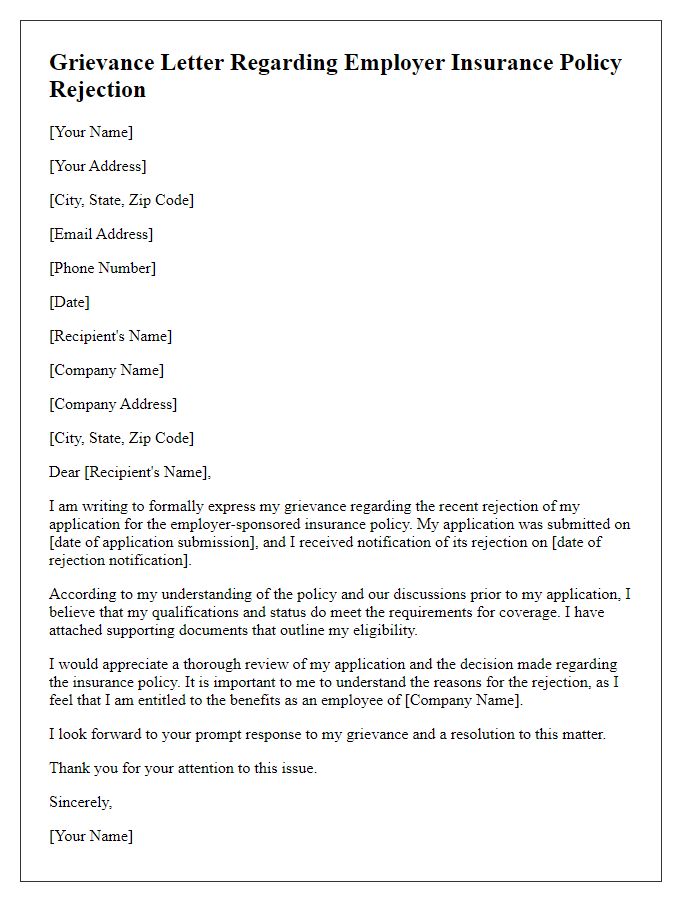

Letter template of grievance regarding employer insurance policy rejection

Comments