Are you feeling frustrated with the process of filing an insurance claim? You're not alone! Many people find themselves overwhelmed by the complexities and requirements of lodging a complaint regarding their insurance claims. In this article, we'll guide you through a simple, effective letter template that can help you articulate your concerns and get the attention you deserveâso stick around for more tips and insights!

Policyholder Information

Policyholder information is crucial for lodging an insurance claim complaint. It includes full name, contact details (such as phone number and email address), and policy number, which uniquely identifies the insurance agreement. The mailing address provides the insurance company with necessary location details for their records. Additionally, including the date of the insurance policy's inception can clarify coverage timelines. Any relevant documentation, such as prior correspondence regarding the claim, should accompany the information to streamline the complaint process. Timely submission of accurate policyholder details ensures efficient communication with the insurance provider.

Policy and Claim Details

Lodging an insurance claim complaint involves providing comprehensive details about your policy and the corresponding claim. Your insurance policy, often associated with a Provider like ABC Insurance Company, typically includes a unique Policy Number, covering specific incidents such as home damage or vehicle accidents. The Claim Number assigned during the claim process is vital for tracking. Recent events leading to the claim should be documented, including dates, descriptions of the incident, and any communication with claims adjusters. For a streamlined resolution, attaching supporting documents like photographs, repair estimates, or police reports can substantiate your complaint and expedite the investigation process.

Description of Incident

A recent incident occurred on September 15, 2023, when a severe storm swept through Charleston, South Carolina, resulting in extensive property damage. High winds, reaching up to 70 miles per hour, uprooted trees and caused debris to impact the residence located on Oak Street. Water infiltration from shattered windows led to significant damage to the interior walls and flooring, particularly in the living room and kitchen, compromising the structural integrity of the home. Personal belongings, including electronics and furniture, were also affected, with estimated losses surpassing $15,000. This incident necessitated emergency intervention, including temporary boarding-up of windows and water extraction services, highlighting the urgent need for an insurance claim to mitigate financial losses.

Reason for Dispute

Filing an insurance claim complaint due to a dispute typically involves many key factors that can be crucial for a successful resolution. Insurance policies, like those offered by major companies such as GEICO or State Farm, often detail specific coverage limits and exclusions that can affect claims. The disputed claim may relate to a denied reimbursement for damages incurred during a natural disaster, such as Hurricane Ida in August 2021, which caused widespread flooding in parts of Louisiana. Key circumstances include policyholders' expectations of coverage based on their understanding of the insured risks and the claim amount, which can often exceed thousands of dollars. Additionally, the claim timeline plays a role; prompt reporting within a 30-day window may influence the insurer's response, yet delays can lead to complications. Documenting all communications, including dates and representatives spoken to, can serve as critical evidence in substantiating the dispute and improving the chances of a favorable outcome.

Desired Resolution

Submitting an insurance claim complaint regarding delayed processing can be crucial for timely resolution. Policyholders often face challenges when claims are not addressed within the promised time frame. For example, homeowners in New York may experience significant financial strain if a claim related to storm damage is stalled beyond the usual 30-day processing period. Desired resolution typically includes a prompt review of the claim, potential compensation for damages incurred, and a formal communication detailing the cause of the delay. Ensuring customer service representatives are reachable for follow-ups is also crucial for reinstating client trust. Addressing these issues efficiently can remarkably improve overall satisfaction with the insurance provider.

Letter Template For Lodging Insurance Claim Complaint Samples

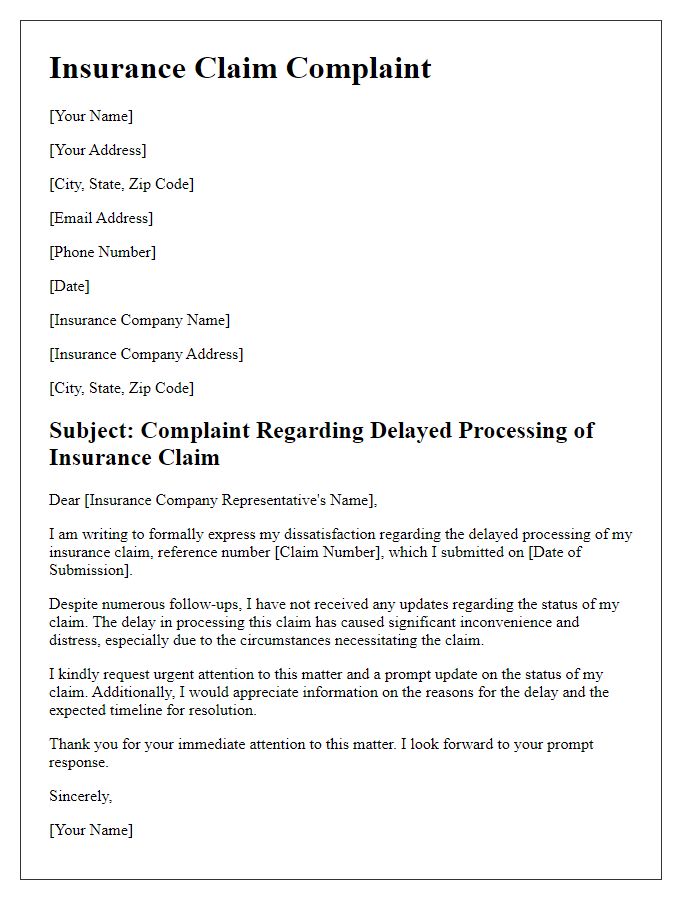

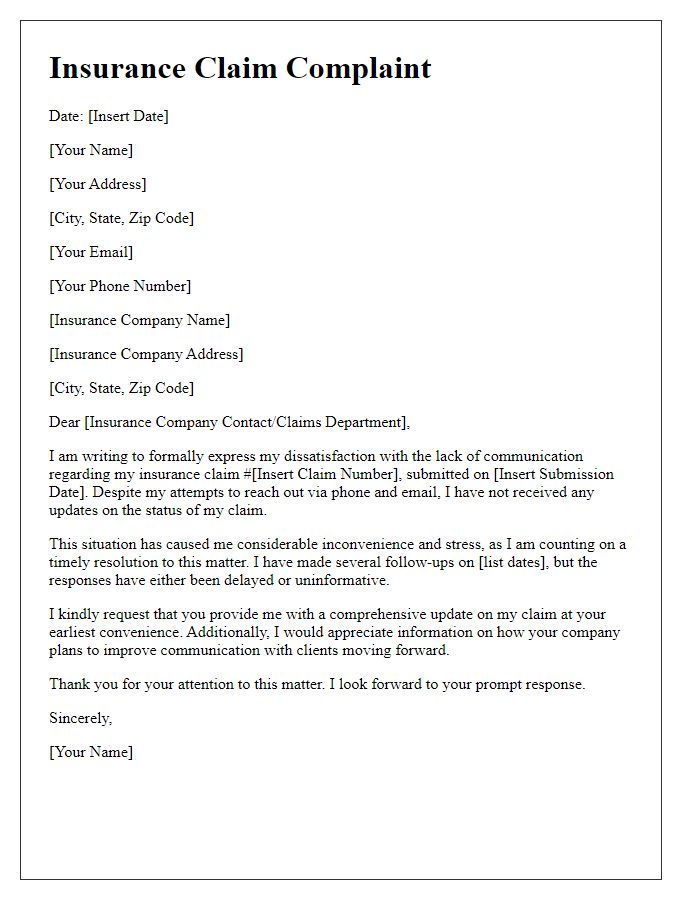

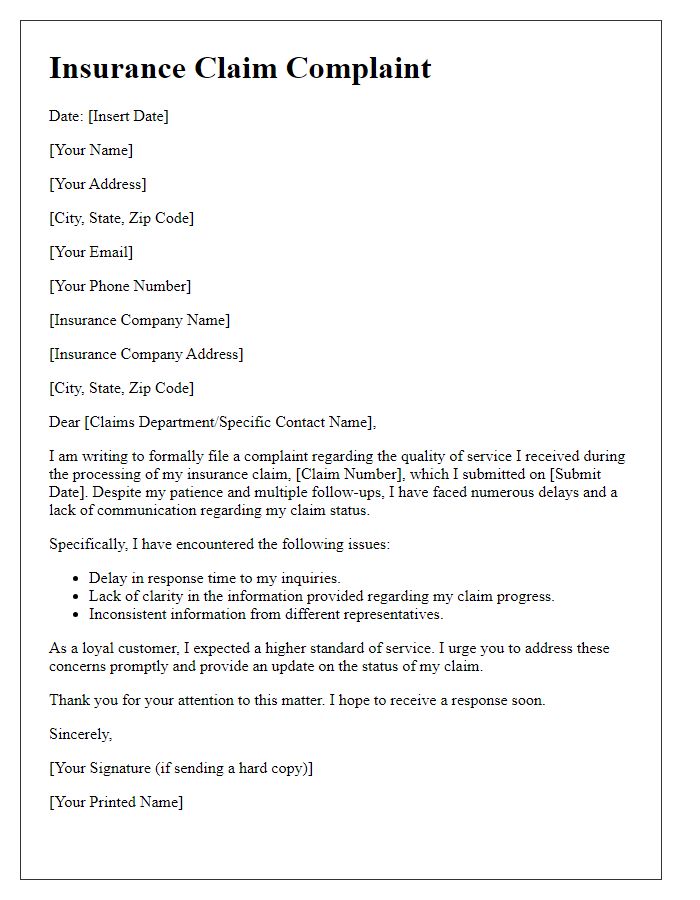

Letter template of insurance claim complaint regarding delayed processing.

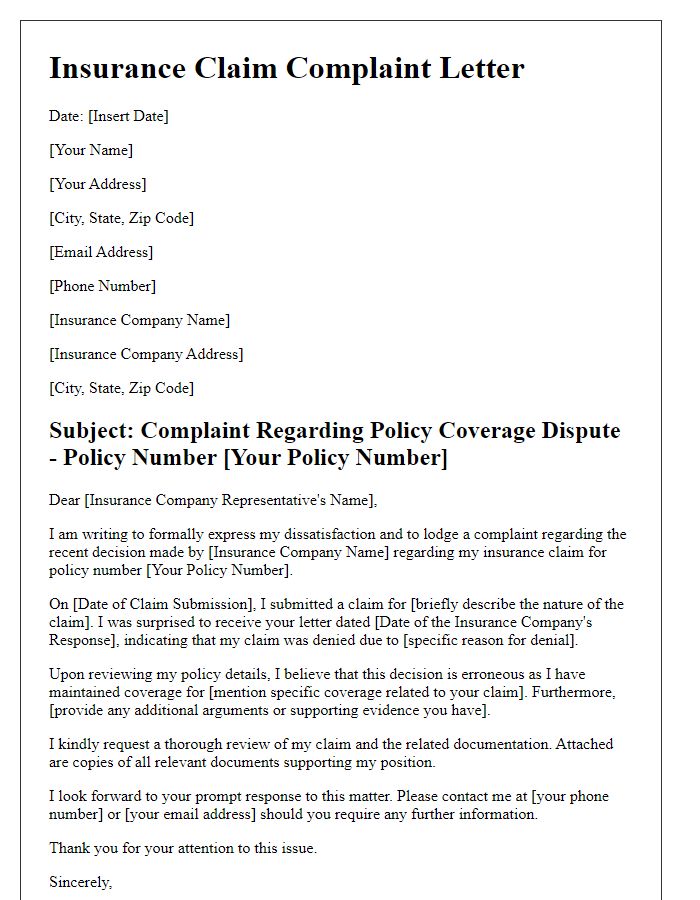

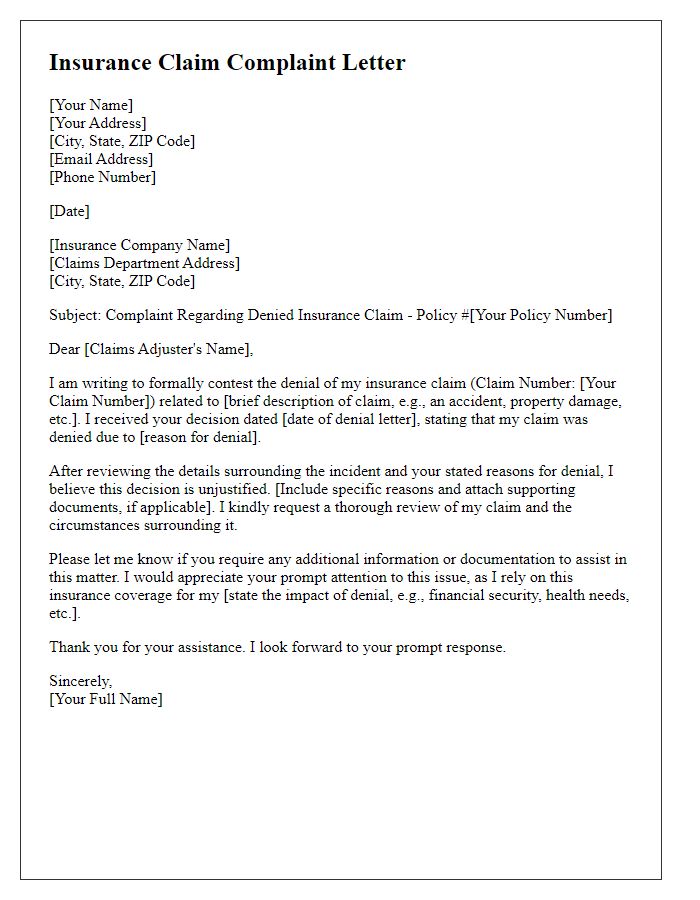

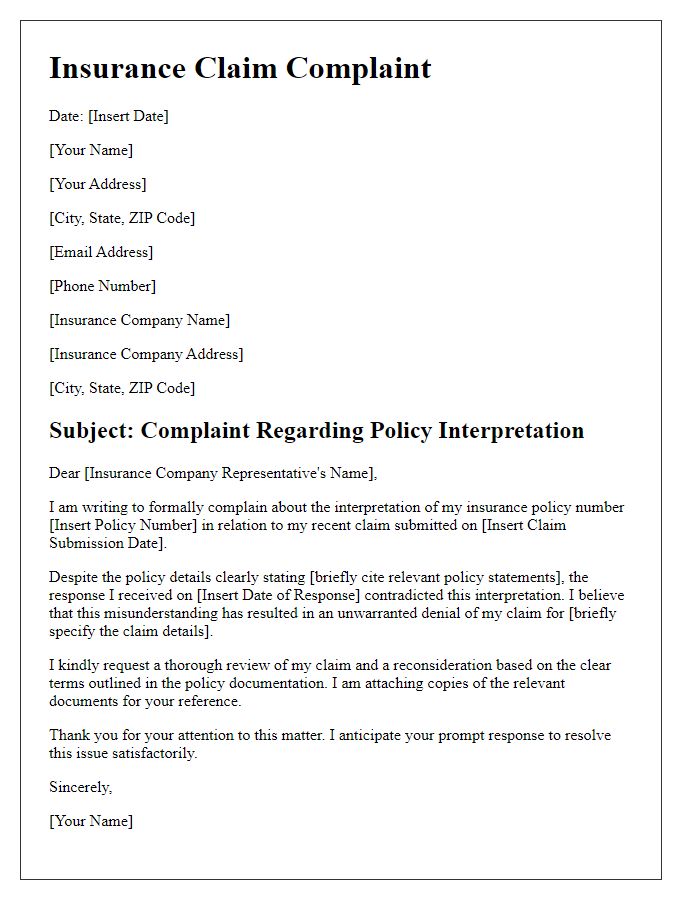

Letter template of insurance claim complaint for policy coverage dispute.

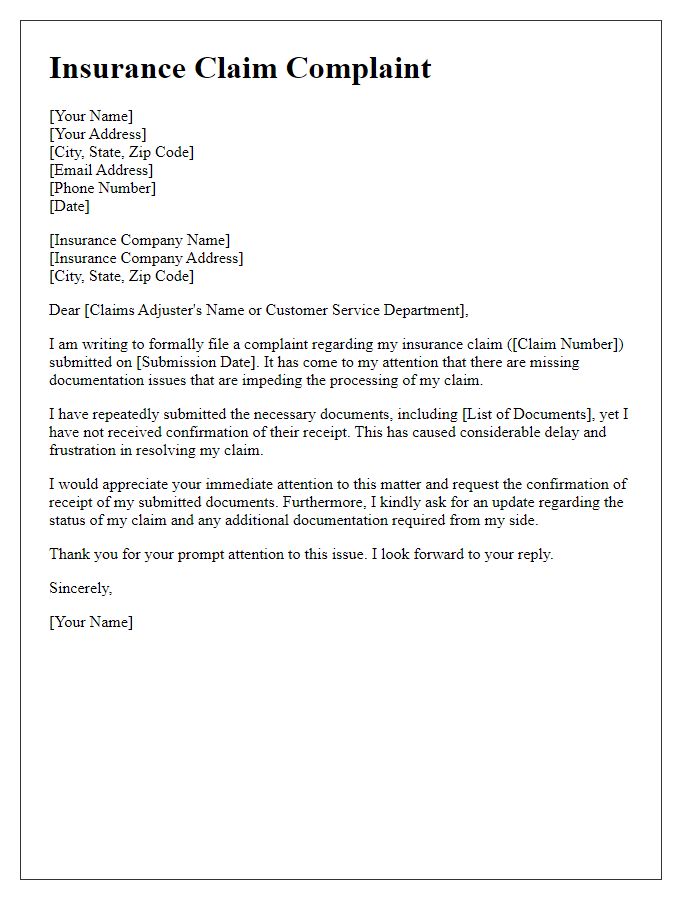

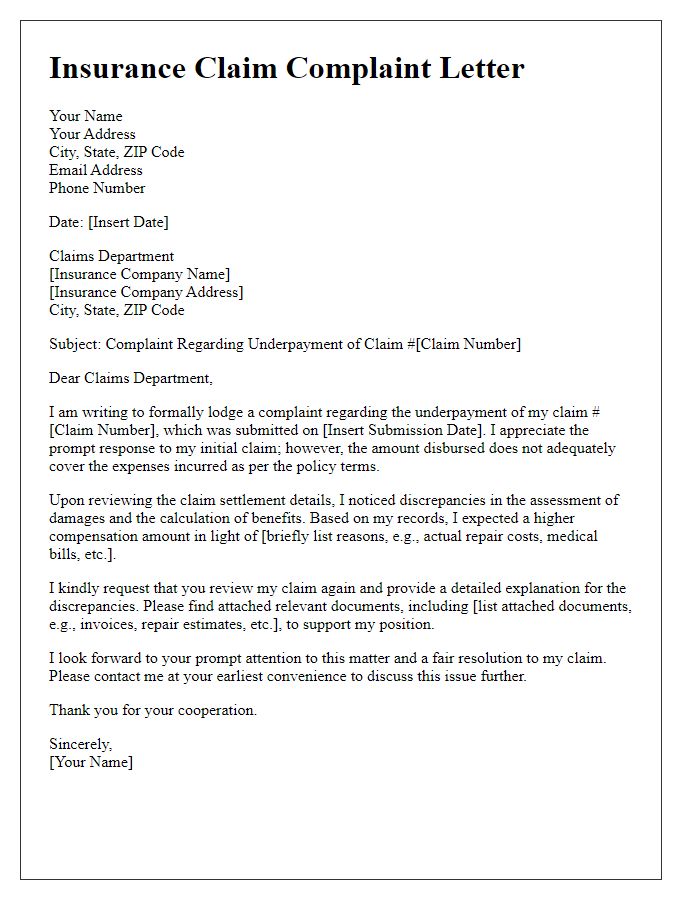

Letter template of insurance claim complaint concerning missing documentation.

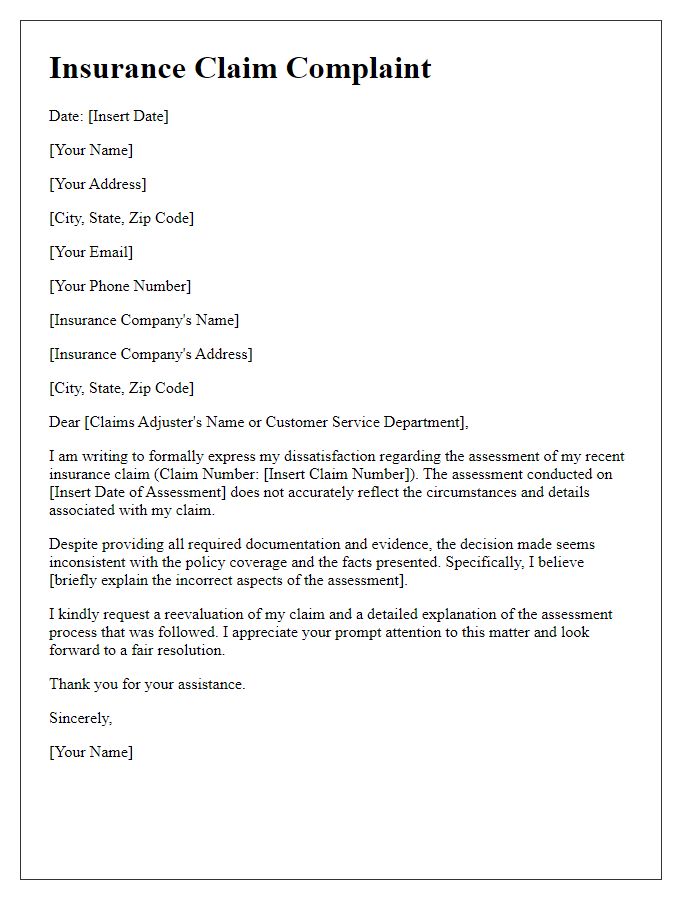

Letter template of insurance claim complaint for incorrect claim assessment.

Comments