Have you recently experienced an event that requires you to report an insured occurrence but aren't sure where to begin? Crafting the right letter can make all the difference in navigating the claims process smoothly. In this article, we'll walk you through the essential components of a clear and effective letter template tailored for reporting insured events. So, grab a pen and paper, and let's dive into how to articulate your situation successfully!

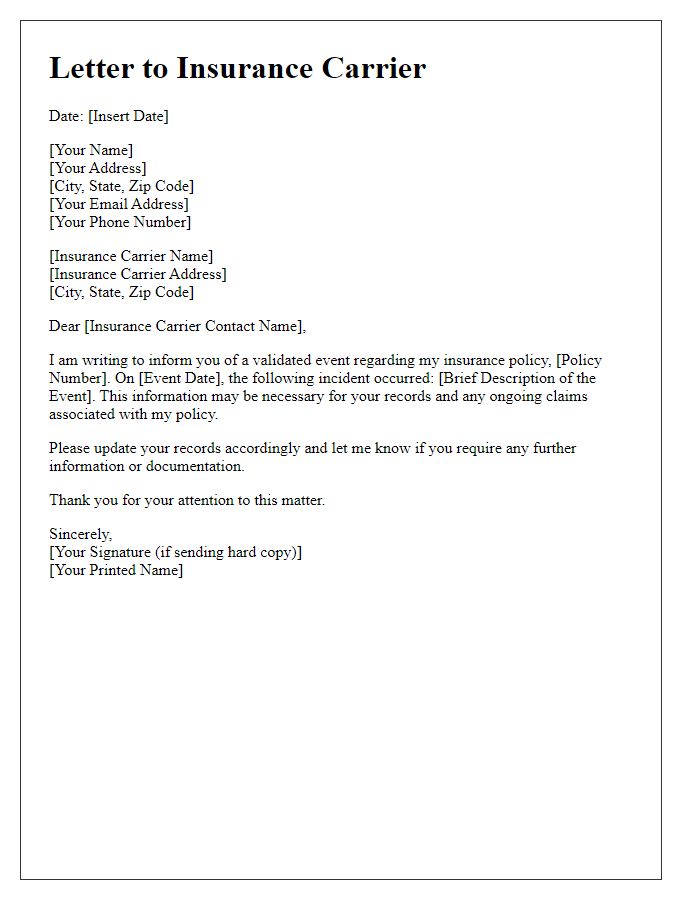

Subject Line Precision

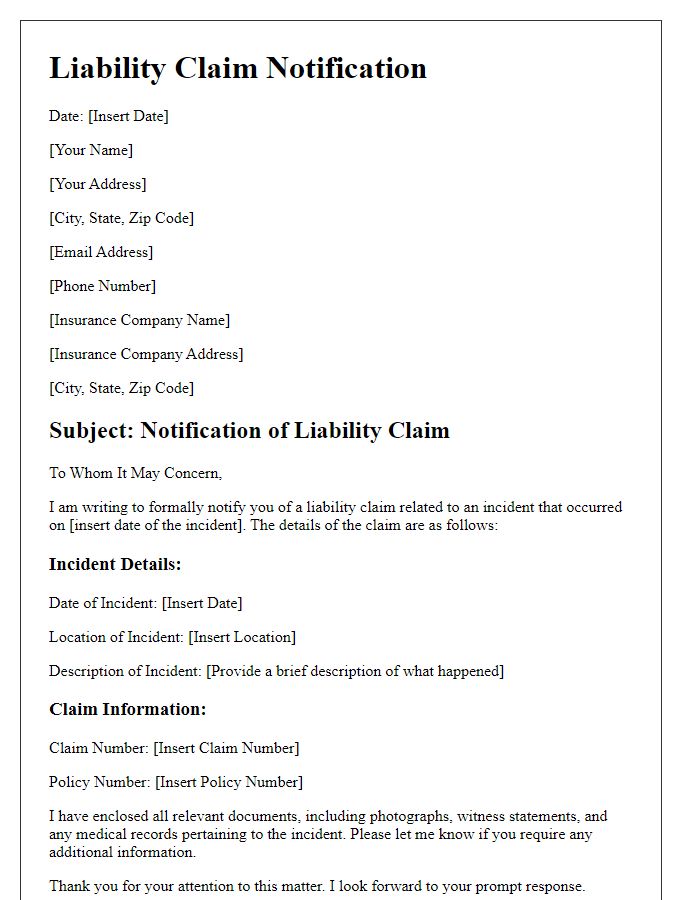

Reporting an insured event occurrence requires a clear and concise subject line that captures the essence of the report. Effective subject lines typically include the type of insured event, the date of occurrence, and any relevant policy numbers. For instance, "Claim Submission: Theft Incident at 123 Maple Street on October 5, 2023, Policy #456789." This allows the recipient to quickly understand the nature of the correspondence and prioritize its review. Including critical details right in the subject line improves clarity and expedites processing, ensuring efficient communication with the insurance provider.

Policy Information

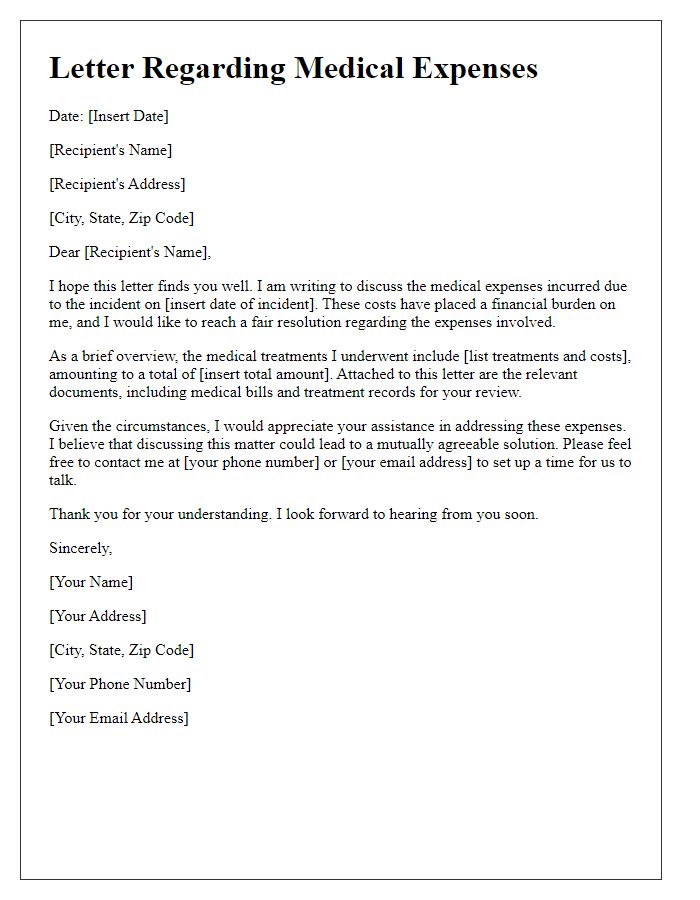

Insurance policies provide coverage for various incidents, ensuring financial protection for policyholders. Each insurance policy contains critical information such as the policy number, typically consisting of 10 to 12 alphanumeric characters, which uniquely identifies the agreement. In cases of insured events, such as accidents or natural disasters, the date of occurrence is crucial, capturing the specific moment the event took place. Reported incidents may include car accidents, home damage from storms, or medical claims related to illnesses. Theinsured's personal details, including full name, address, and contact information, are vital for processing any claims. Additionally, documentation supporting the claim, such as photographs of damage or police reports, can expediently facilitate the claims process. Understanding this context can significantly affect response times and reimbursement amounts in the event of a claim.

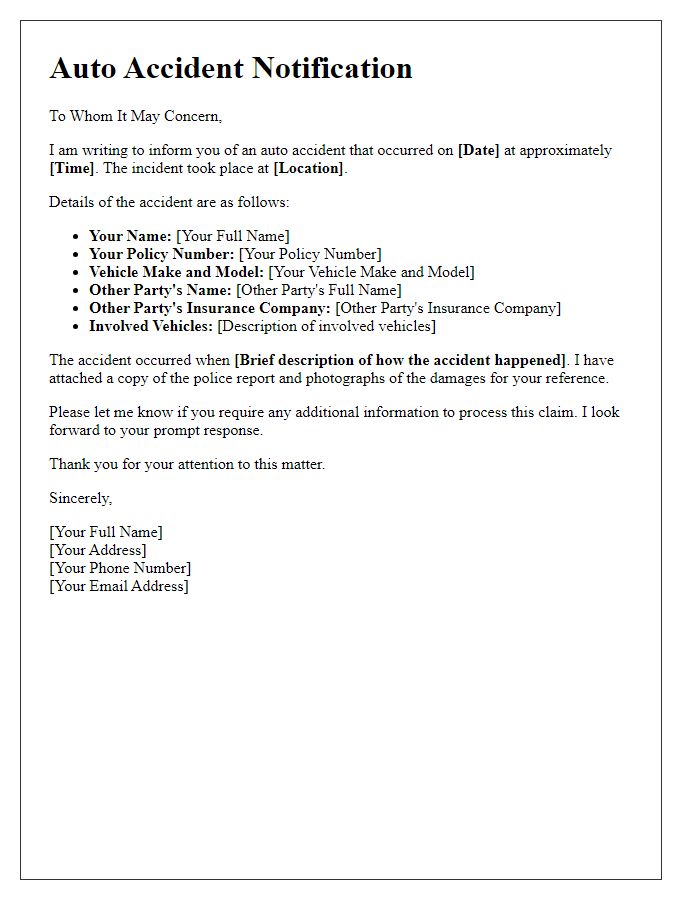

Detailed Incident Description

In the bustling city of Chicago, on November 15, 2023, at approximately 3:30 PM, a significant incident occurred involving a silver 2018 Toyota Camry and a cyclist. The car, traveling along the busy North Avenue, collided with the cyclist, a male in his mid-thirties, who was making his way through the designated bike lane. Eyewitnesses reported that the weather was clear, with temperatures hovering around 55 degrees Fahrenheit, reducing visibility issues. Emergency services arrived swiftly, with the local police (CPD) responding to the scene to gather statements from witnesses and assess the situation. The cyclist sustained injuries requiring immediate medical attention, highlighting the importance of safety protocols in urban environments. Incident documentation includes photographs of the vehicle, bike lane conditions, and witness accounts that are essential for insurance processing and any legal implications following this unfortunate event.

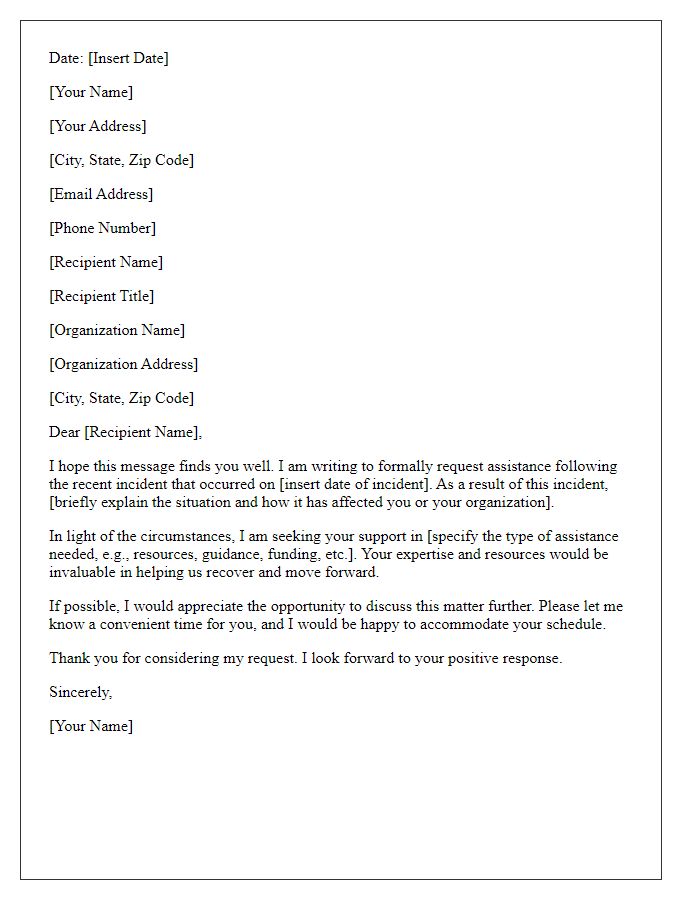

Contact and Claimant Information

In the event of an insured incident, accurate documentation of the Contact and Claimant Information is crucial for effective claims processing. The claimant's full name should be clearly stated, along with the contact number, which is essential for any follow-up communication. A detailed address, including street name, city, state, and zip code, is necessary to confirm the claimant's identity and location. Furthermore, it is important to include the policy number associated with the insurance coverage for quicker reference. Specific details regarding the insurance provider's name and contact information should also be noted, as this facilitates direct communication between the insurer and the claimant during the claims process. Accurately recording this information can significantly influence the efficiency and outcome of the claim.

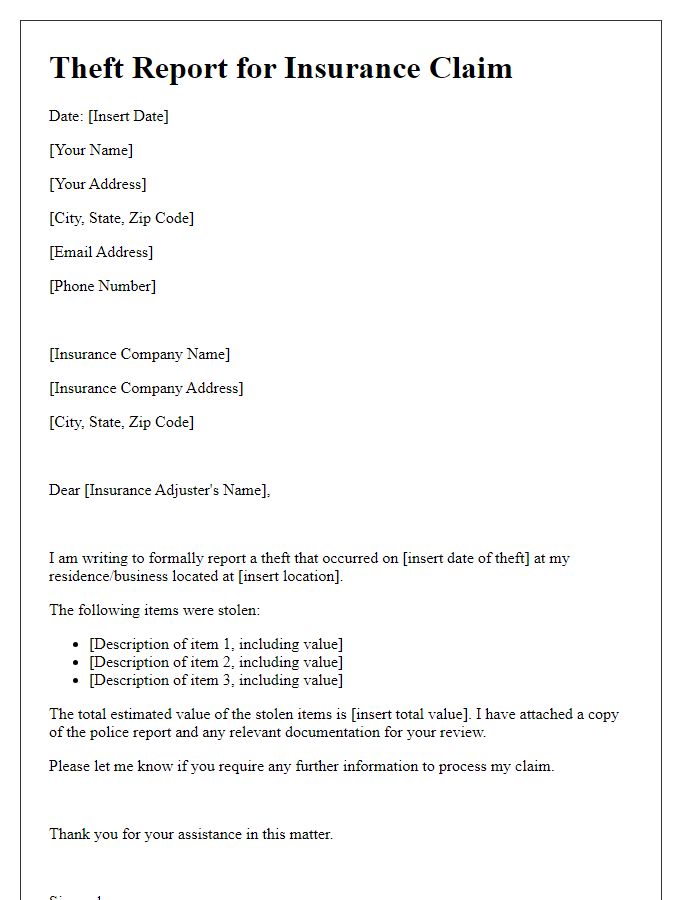

Required Documentation Checklist

When reporting an insured event occurrence, a detailed documentation checklist is essential for a smooth claims process. First, include a completed claim form (typically provided by the insurance company) that outlines the specifics of the incident. Next, gather event-related evidence such as photos of the damage or loss, which must clearly show the extent of the incident. Then, compile police reports if applicable, especially for theft or accidents, as these provide official documentation of the event. Supporting documents, including receipts or invoices for damaged property, can help establish the value of the loss. Lastly, include any witness statements or contact information to corroborate the account of the incident, ensuring a comprehensive submission for the claims adjuster.

Letter Template For Reporting Insured Event Occurrence Samples

Letter template of informing a home insurance company about property damage.

Comments