If you've ever faced unexpected disruptions during your travels, you know how crucial it is to have travel insurance by your side. Navigating the claims process can be daunting, but with the right guidance, you can secure the reimbursement you deserve. In this article, we'll break down the essential elements of a letter template specifically designed for travel insurance claim reimbursement. So, grab a cup of coffee and let's delve into the steps that will make your claim process smootherâread on for everything you need to know!

Policy Details

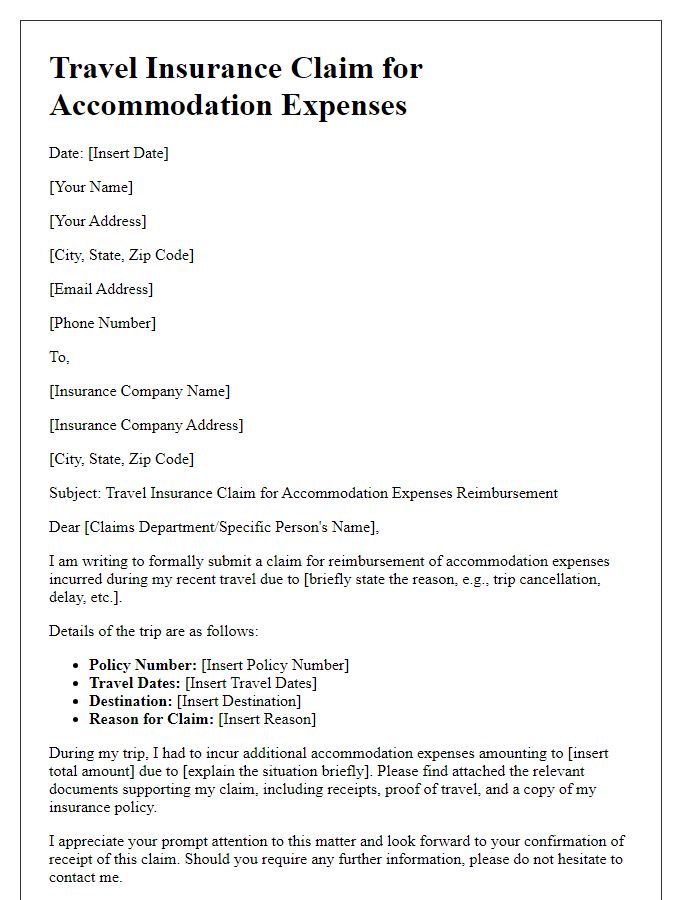

Travel insurance reimbursement claims require specific policy details to facilitate processing. The policy number, typically a unique alphanumeric identifier, should be prominently noted; this number allows insurance companies to quickly reference your coverage terms. The insurer's name, such as Allianz or World Nomads, along with contact information, preferably a customer service number or email, establishes clear communication channels. The coverage dates, indicating the start and end of your travel insurance policy, serve as critical references for validating claims. Include the type of coverage, whether for trip cancellation, medical emergencies, or lost luggage, highlighting the specific incidents leading to reimbursement requests. Additionally, any relevant claim forms and documents, like receipts or incident reports, should accompany your submission, ensuring a comprehensive claim file.

Claim Incident Description

Travel insurance claims often arise from incidents such as trip cancellations, medical emergencies, or lost luggage. For instance, travelers experiencing a sudden illness, such as appendicitis requiring surgery during their trip in Paris, France, may need to provide detailed documentation. This can include hospital records, medical bills, and a physician's note. Similarly, if a flight is canceled due to severe weather conditions (like hurricane season in the Caribbean), it is crucial to document the airline's notification and any additional expenses incurred, such as accommodation or meals. Lost luggage incidents should include the original airline report along with receipts for essential items purchased while waiting for the baggage. Detailed evidence of the incident, including dates, locations, and amount spent, significantly enhances the likelihood of successful reimbursement from the insurance provider.

Documentation and Receipts

Travel insurance claims require thorough documentation and receipts for reimbursement consideration. Essential documents include original invoices from healthcare providers, itemized receipts for emergency services, and proof of payment such as bank statements or credit card statements. Each receipt must clearly indicate the date of service, location (e.g., hospital or clinic name, city), and type of treatment provided (e.g., hospitalization, medication). Travel-related expenses, such as flight cancellations or lost luggage, should be supported by documented evidence like booking confirmations, cancellation notices, and any additional fees incurred. Organizing these documents logically, in chronological order, can significantly expedite the claims process and increase the likelihood of successful reimbursement.

Contact Information

Travel insurance claims require specific documentation to ensure the reimbursement process runs smoothly. Policyholders need to provide essential contact information, including the full name (as stated on the insurance policy), permanent address (including city and ZIP code), phone number (preferably a mobile number), and email address (for electronic communication). Additionally, it is crucial to include the policy number, which typically consists of a series of alphanumeric characters specific to the insurance provider, and any claim reference numbers issued during the claim initiation. This information should be formatted clearly and legibly to expedite processing by insurance representatives.

Clear Request for Reimbursement

Travel insurance claims can be initiated for various reasons, such as trip cancellations, medical emergencies, or lost luggage, affecting travelers significantly. Documenting expenses meticulously, including receipts for medical bills (with some exceeding $1,000), accommodation changes (often costing around $150 per night), or transportation delays (like taxi fares averaging $50), provides essential support for the reimbursement process. Policy numbers, claim forms, and a detailed explanation of incidents encountered during travel, such as flight cancellations due to severe weather events or theft of personal belongings in tourist hotspots like Rome, should be included. Claimants must submit all documentation within the timeframe stipulated by the insurance provider, usually within 30 days to ensure prompt processing and reimbursement, facilitating their financial recovery related to unexpected travel disruptions.

Letter Template For Travel Insurance Claim Reimbursement Samples

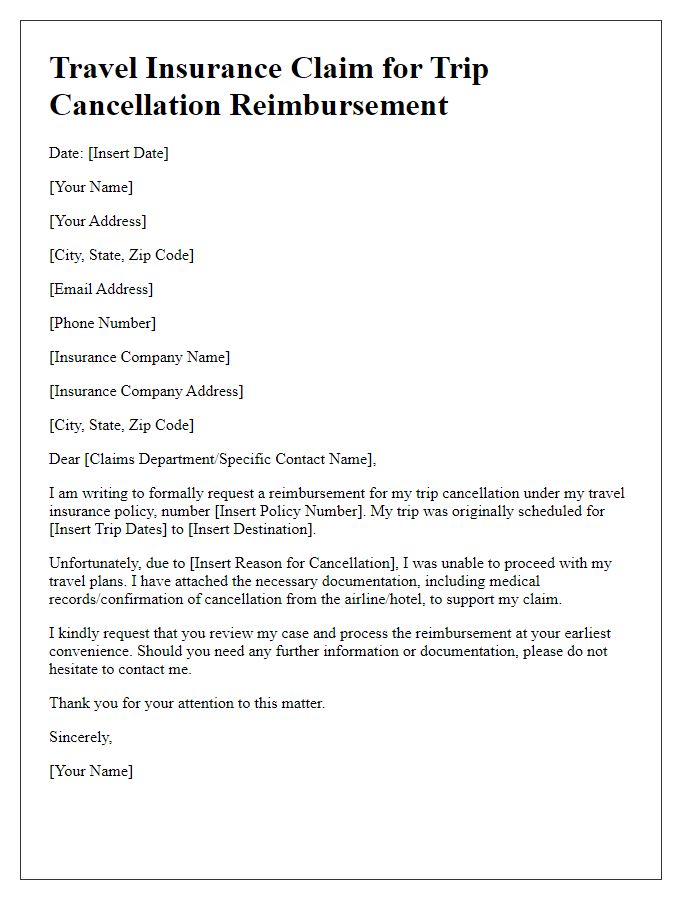

Letter template of travel insurance claim for trip cancellation reimbursement

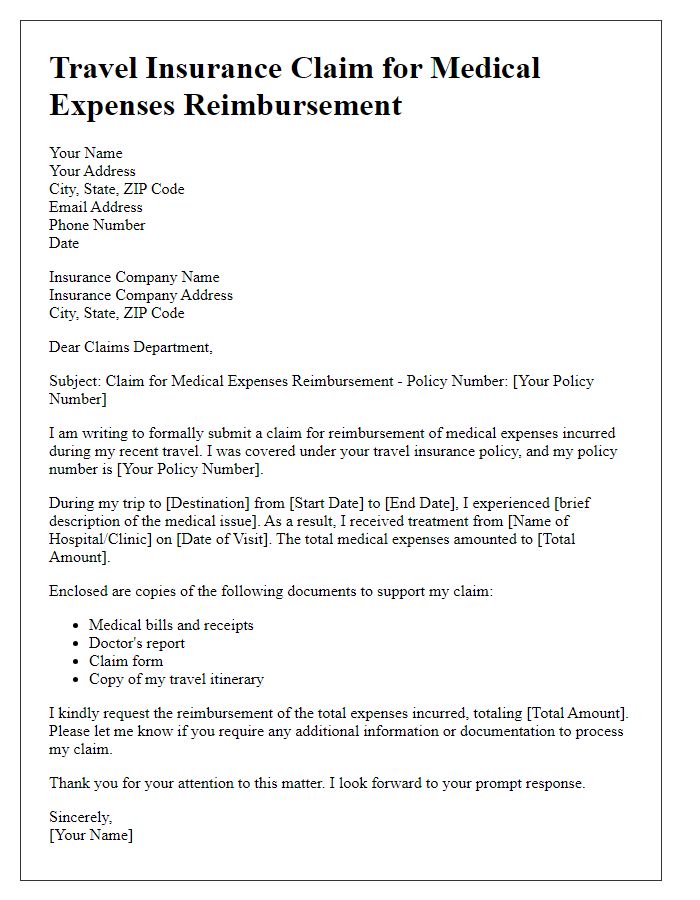

Letter template of travel insurance claim for medical expenses reimbursement

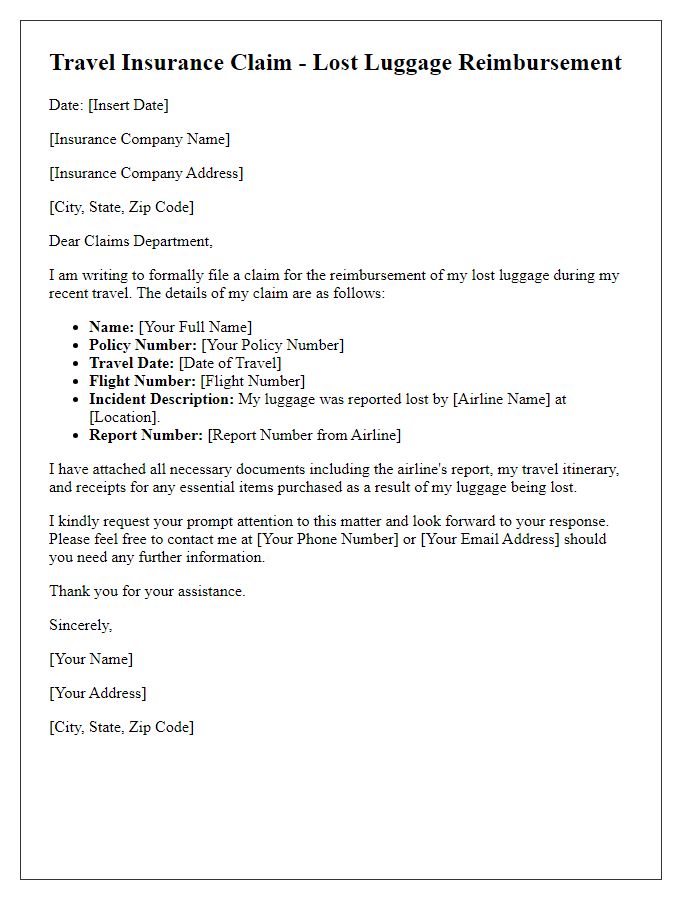

Letter template of travel insurance claim for lost luggage reimbursement

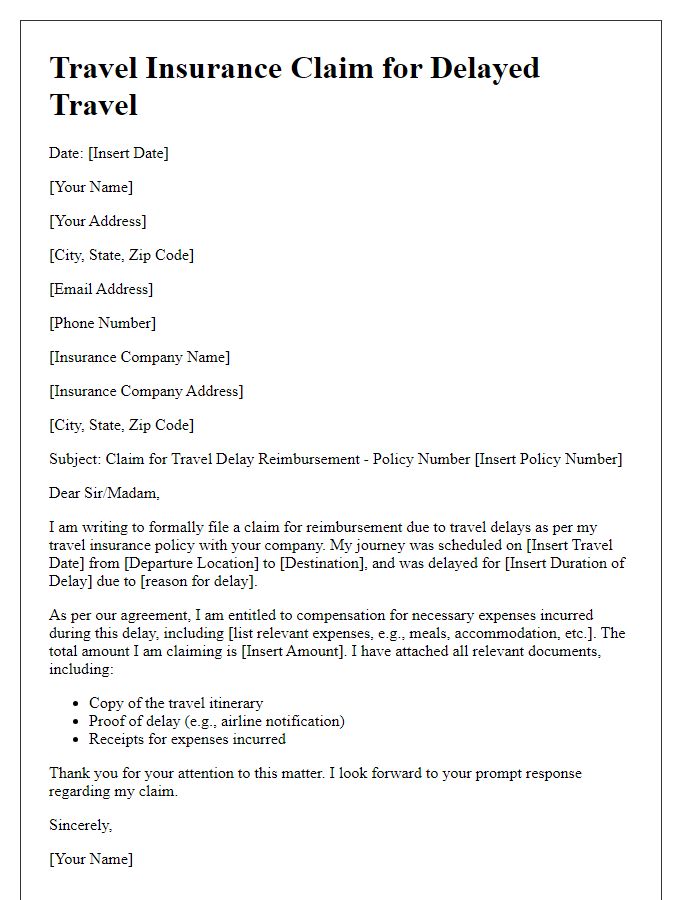

Letter template of travel insurance claim for travel delays reimbursement

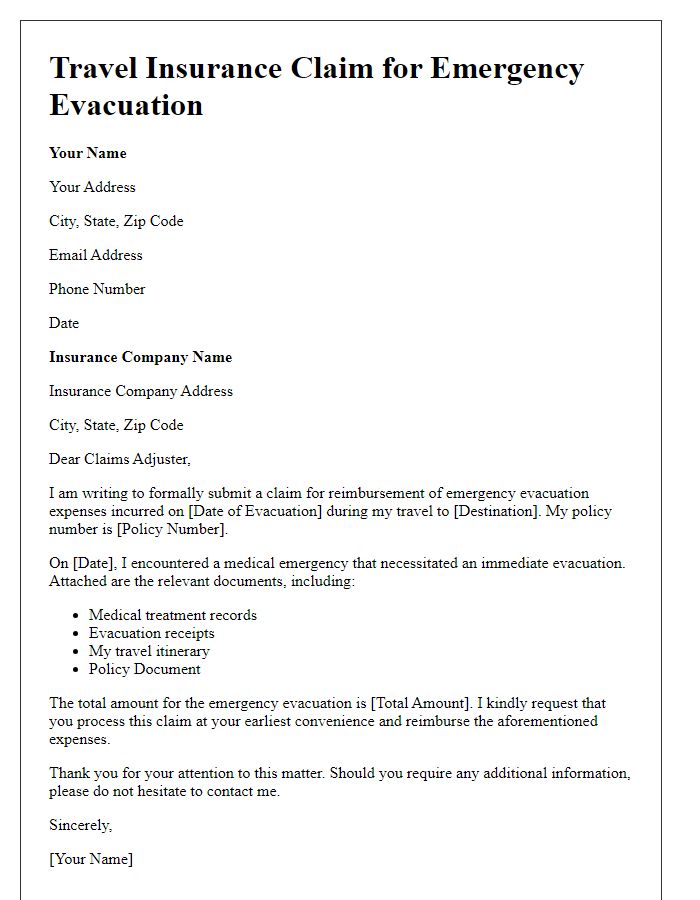

Letter template of travel insurance claim for emergency evacuation reimbursement

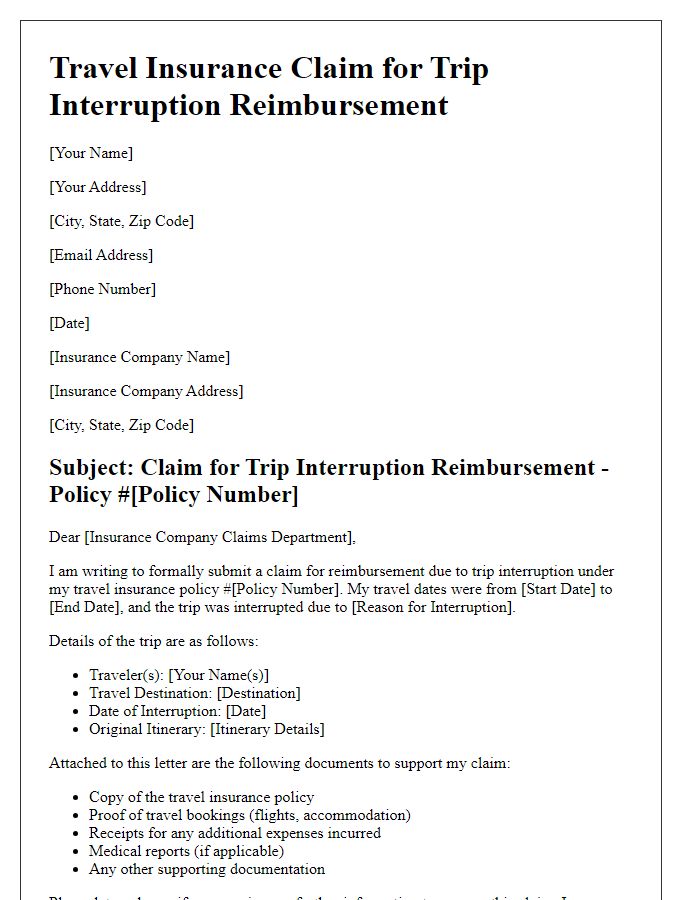

Letter template of travel insurance claim for trip interruption reimbursement

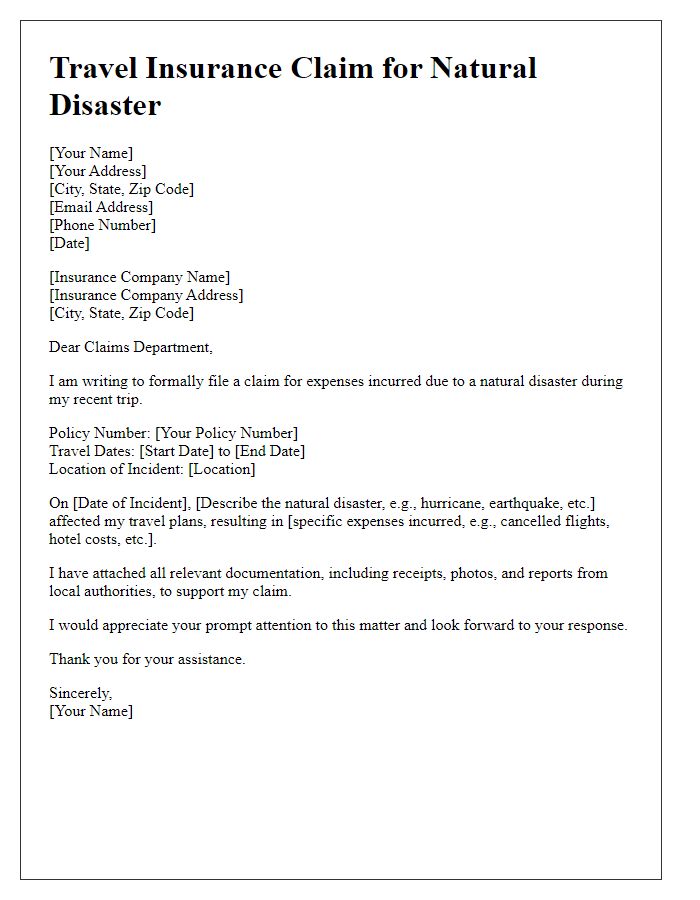

Letter template of travel insurance claim for natural disaster-related expenses

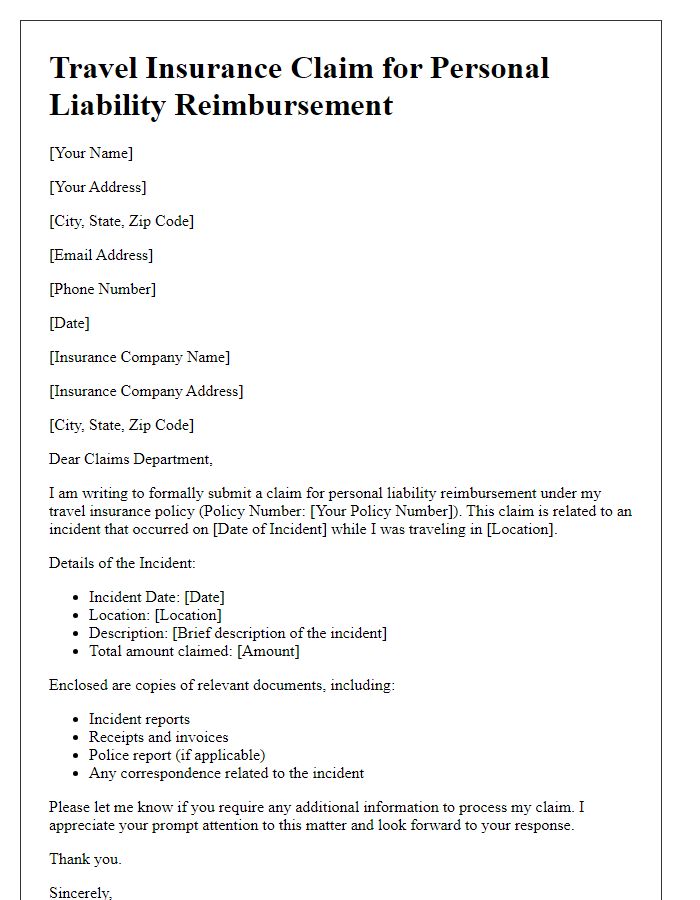

Letter template of travel insurance claim for personal liability reimbursement

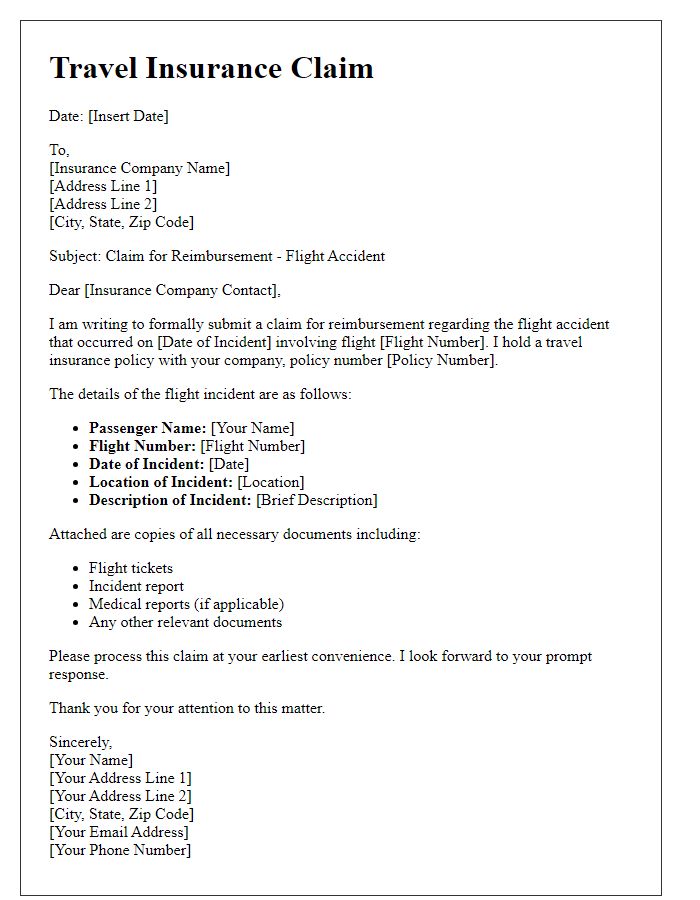

Letter template of travel insurance claim for flight accident reimbursement

Comments