Are you considering a condo insurance policy review but not quite sure where to start? It's vital to ensure that your coverage aligns with your current needs and protects your valuable assets. By evaluating your policy regularly, you can identify any gaps in coverage or uncover potential savings. Join us as we dive deeper into the essential aspects of condo insurance to help you make informed decisions for your peace of mind!

Policy Details and Coverage Limits

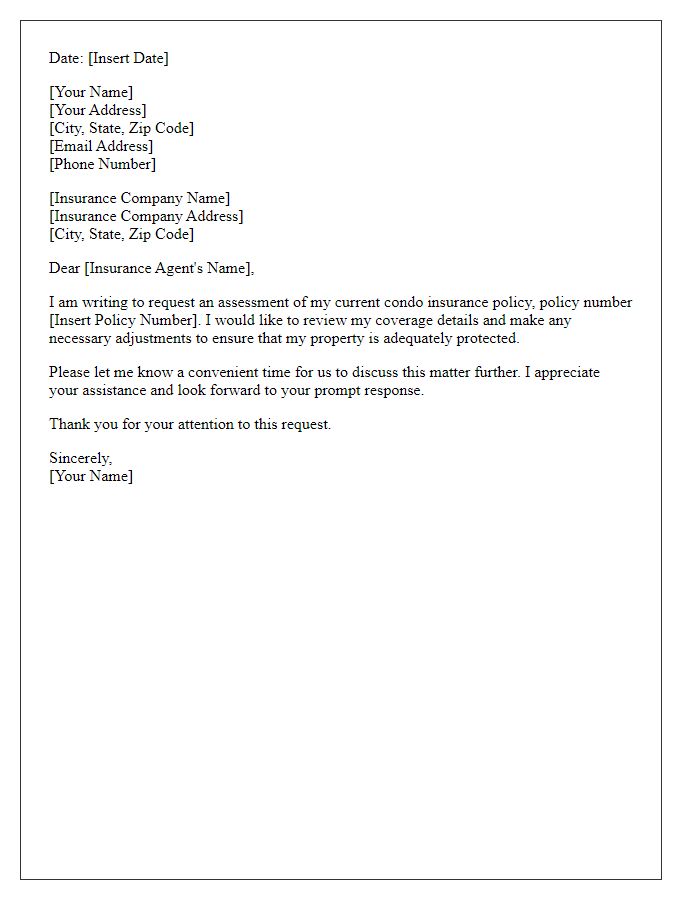

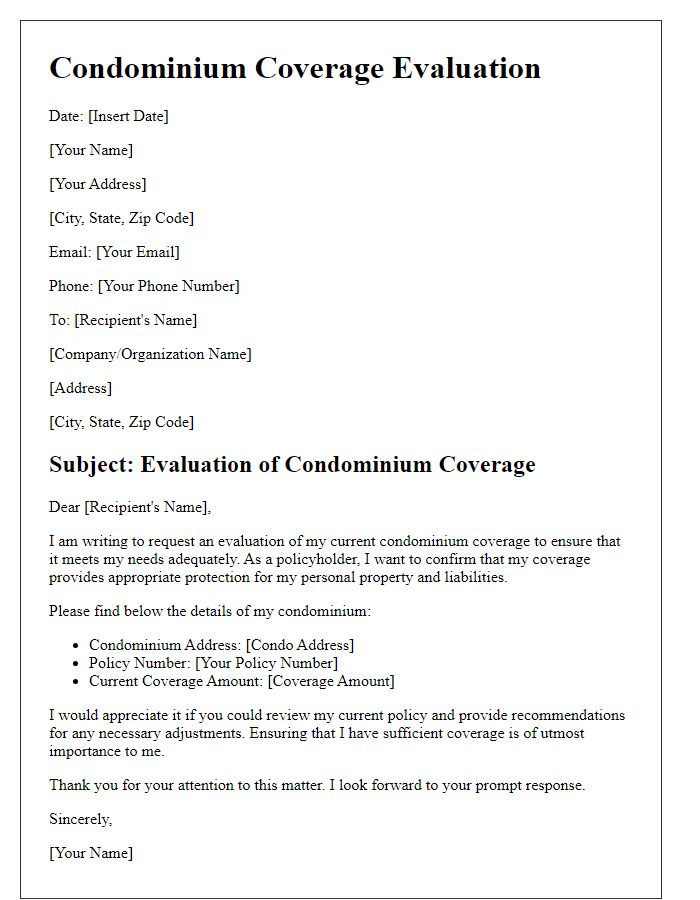

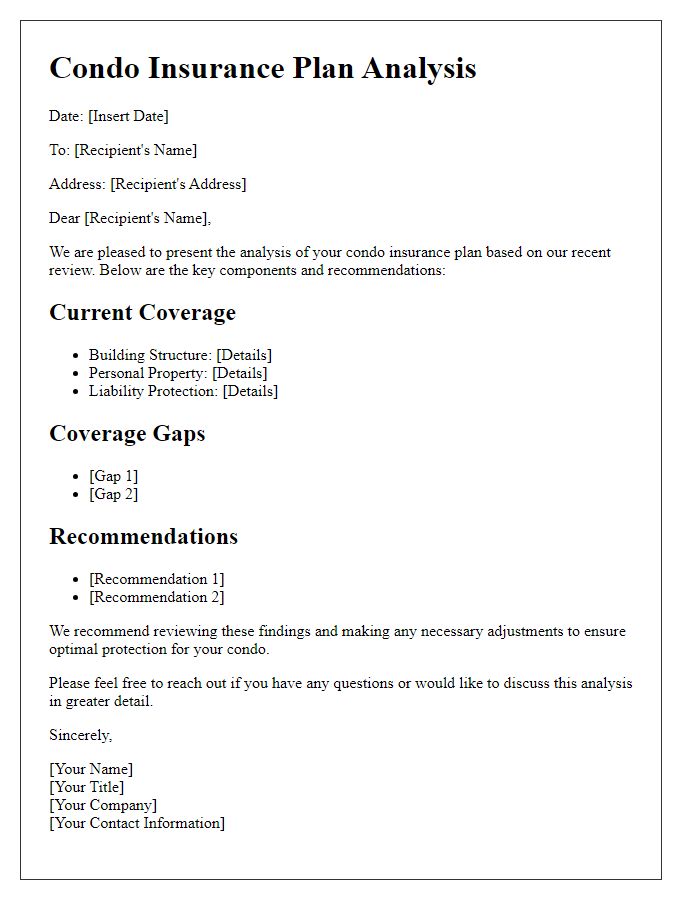

Reviewing a condo insurance policy involves examining essential details such as policy numbers, coverage limits, deductibles, and specific inclusions and exclusions. The policy number serves as a unique identifier for the insurance coverage provided by the insurer, such as Allstate or State Farm. Coverage limits define the maximum amount the insurer will pay for various claims, including personal property and liability coverage, typically ranging from $50,000 to $500,000 depending on individual needs and property value. Deductibles represent the out-of-pocket costs incurred before coverage takes effect, commonly set between 500 and 2,500 dollars. Inclusions might cover loss of personal belongings due to theft or damage and liability coverage for injuries occurring on the property. Exclusions clarify what is not covered, such as natural disasters like floods or earthquakes, and may necessitate additional endorsements or policies for comprehensive protection, which could involve filing claims for specific events or damages. Regular reviews ensure alignment with changing property values and personal circumstances, protecting investments and providing peace of mind.

Deductibles and Premium Costs

Condo insurance policies typically include various components such as deductibles and premium costs. Deductibles refer to the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in, often ranging from $500 to $5,000 depending on the policy terms. Premium costs represent the regular payments made for maintaining the insurance coverage, with averages spanning from $300 to $1,500 annually based on factors such as location, coverage options, and property value. Analyzing these elements is critical for ensuring adequate protection against potential risks, including natural disasters, theft, or liability claims within condominium units. Regular reviews of the policy can help determine if adjustments are necessary based on any changes in personal circumstances or shifts in market conditions.

Exclusions and Conditions

Condo insurance policies often include specific exclusions and conditions that homeowners should thoroughly understand. Notable exclusions may encompass flood damage, which typically requires separate flood insurance, and coverage for personal property in shared spaces like basements or laundry rooms. Additionally, conditions such as proper maintenance and timely reporting of damages play crucial roles in ensuring claims are honored. Policyholders should also pay attention to details concerning liability coverage in communal areas, which can vary significantly between different insurance providers. Furthermore, understanding the specifics of deductible amounts is essential, as they affect out-of-pocket expenses during a claim. Regular reviews, ideally annually or during significant life changes, ensure policies remain functional and adequate against evolving risks.

Renewal Options and Terms

During the condo insurance policy review, key factors such as coverage limits, deductible amounts, and premium costs are essential to analyze. Your current insurer, often a local provider, may offer renewal options that include both standard and enhanced policy features, addressing specific risks like fire damage in urban areas or water damage from adjacent plumbing systems. Comparing terms, such as liability coverage up to $500,000 and personal property protection ranging from $20,000 to $300,000, can reveal gaps in coverage that need addressing. Evaluating these elements will assist in deciding whether to renew, switch insurers, or adjust coverage levels to safeguard your condo effectively. Always consider the impact of regional regulations in your state or municipality on insurance requirements and best practices.

Claim Process and Support Information

A comprehensive condo insurance policy review highlights essential elements like claim processes and support information. The typical claim process involves documenting damages, notifying the insurance company, and submitting a claim form, which must be completed accurately to avoid delays. Support information includes a dedicated claims hotline, often available 24/7 for immediate assistance, and a claims adjuster's contact details for personalized help. Additionally, policyholders should be aware of any required documentation, such as photographs of damages or receipts for repairs, which can expedite the claims review process. Understanding these aspects ensures condo owners navigate claims efficiently and receive the necessary support when unexpected events occur.

Comments