If you've recently canceled your policy and are wondering about the process to request a premium refund, you're not alone! Many people are in the same situation and may feel a bit confused about the next steps. Writing a concise and clear letter can make all the difference in getting your money back smoothly. Ready to learn the ins and outs of crafting the perfect refund request letter? Let's dive in!

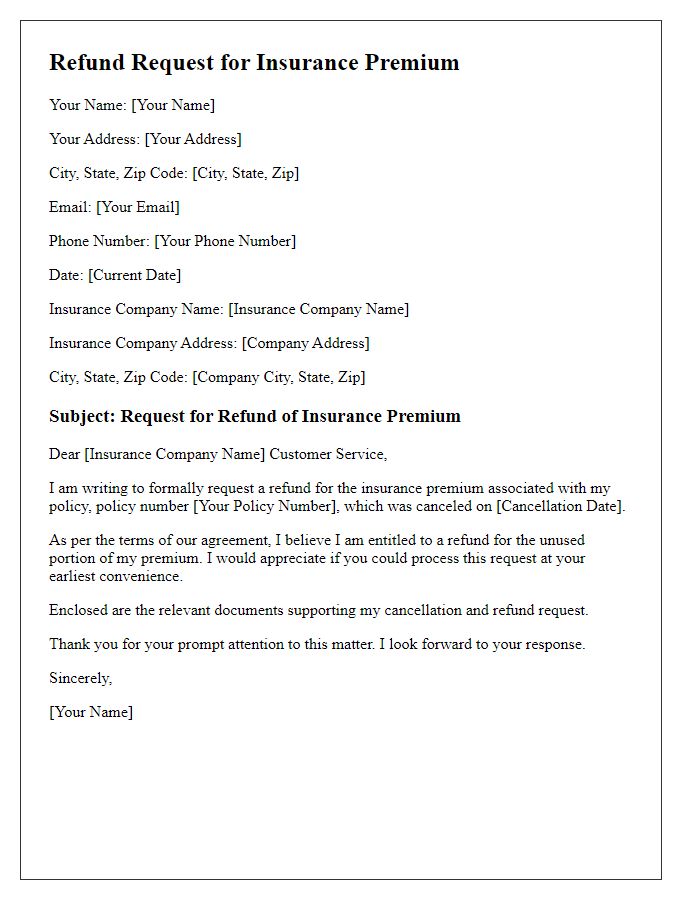

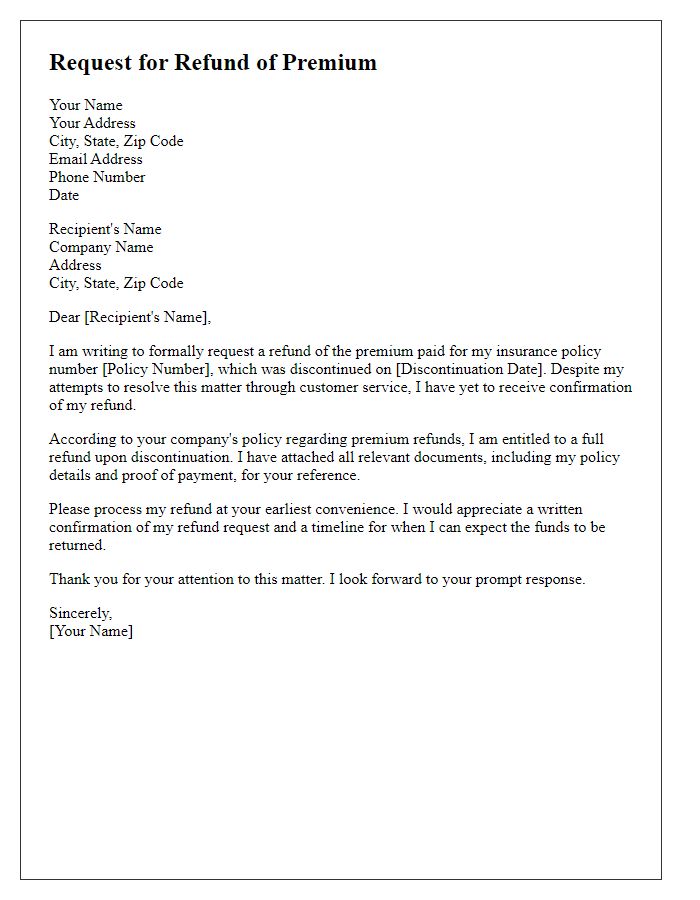

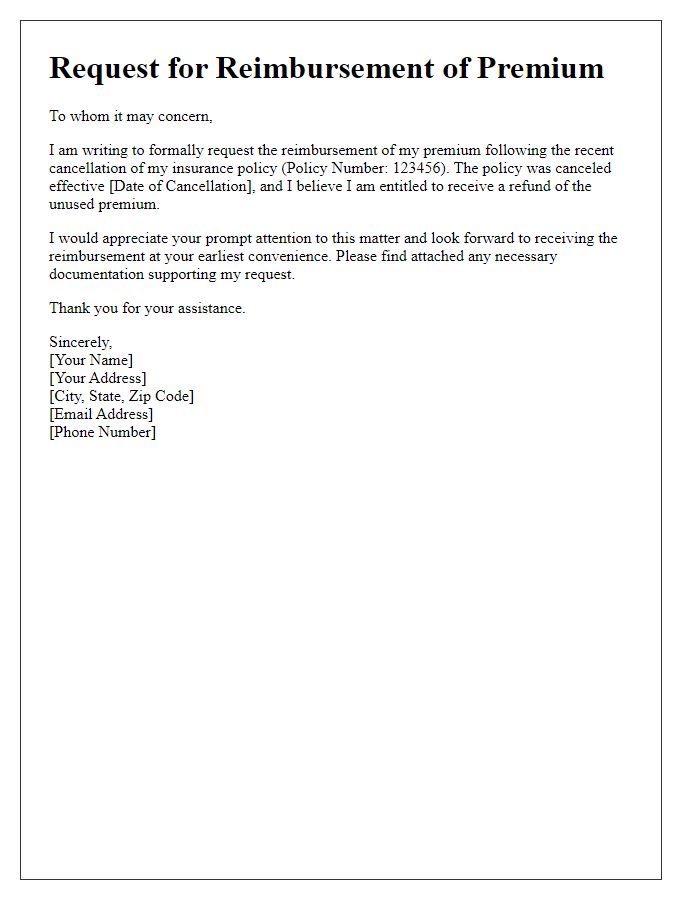

Customer information (name, address, policy number)

The premium refund request process requires specific customer information to ensure a seamless transaction. Essential details include the full name of the policyholder, comprehensive address including street, city, state, and zip code, alongside the unique policy number associated with the insurance agreement. These identifiers are critical for the financial department to accurately locate the account in their database and expedite the refund transaction, often processed within 30 days of the cancellation notice, maintaining compliance with regulations outlined by the National Association of Insurance Commissioners (NAIC).

Cancellation details (date, reason for cancellation)

To request a premium refund after cancellation, provide specific details about the cancellation. For instance, include the cancellation date, such as October 15, 2023, alongside the reason, like financial constraints or dissatisfaction with services. Mention the policy or subscription number to facilitate processing. State the premium amount expected for a refund, and emphasize adherence to terms and conditions regarding refunds stated in the agreement. This ensures clarity and urgency in the request, leading to a quicker resolution.

Refund request (specific amount, payment method)

After the recent cancellation of my premium subscription for the streaming service, I am seeking a refund of $99.99 processed via my credit card. The subscription, which provided access to exclusive content and features, was terminated as of October 1, 2023. According to your company's refund policy, customers are entitled to a full refund if the cancellation occurs within the first 30 days. Therefore, I kindly request this amount to be credited back to my credit card account as soon as possible. Thank you for your attention to this matter.

Supporting documents (proof of payment, cancellation confirmation)

To initiate a premium refund request following the cancellation of an insurance policy, it is essential to gather supporting documents, including proof of payment and cancellation confirmation. Proof of payment, typically a bank statement or invoice, should clearly indicate the transaction details, such as the date, amount, and payment method, ensuring the insurer can quickly verify the financial exchange. Cancellation confirmation, often an email or official letter from the insurance provider, must detail the cancellation date and the policy number, demonstrating that the policy has indeed been terminated. Collecting these key documents streamlines the refund process, facilitating timely resolution and ensuring compliance with the insurer's policies on refunds for canceled services.

Contact information (phone number, email for follow-up)

A premium refund request represents a formal appeal for reimbursement of fees paid for a service or product. In cases of cancellation, such as a subscription for a streaming service or an insurance policy, the customer typically seeks a clear resolution. Essential contact information is crucial: a phone number (such as a mobile or home number for direct communication) allows the service provider to verify identity and clarify details. An email address (for example, to facilitate documentation and follow-up correspondence) serves as a reliable channel for responses and confirmations. Including a structured timeline, such as the cancellation date (important for eligibility), enhances the effectiveness of the request.

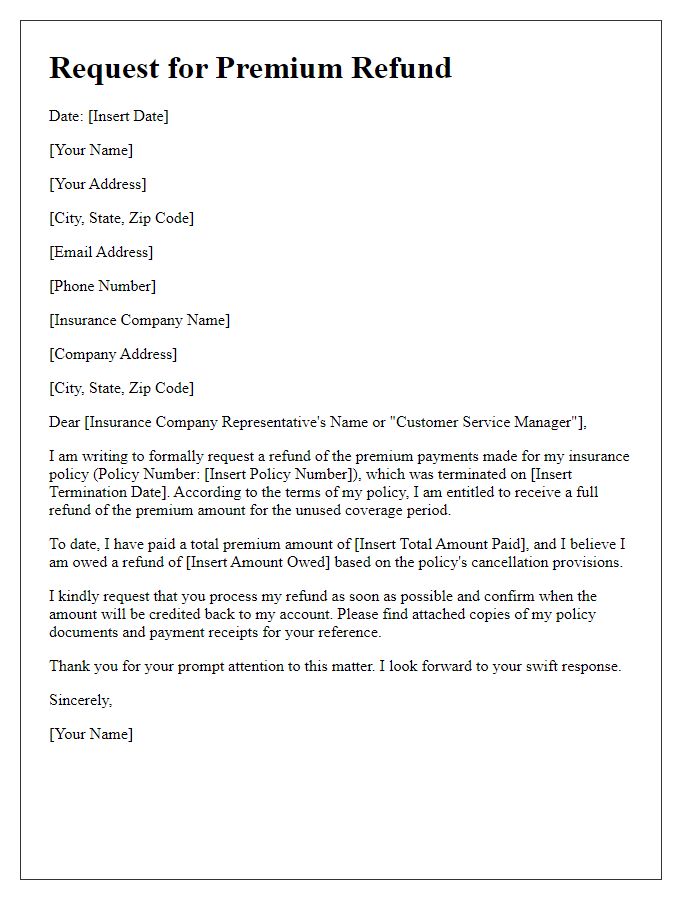

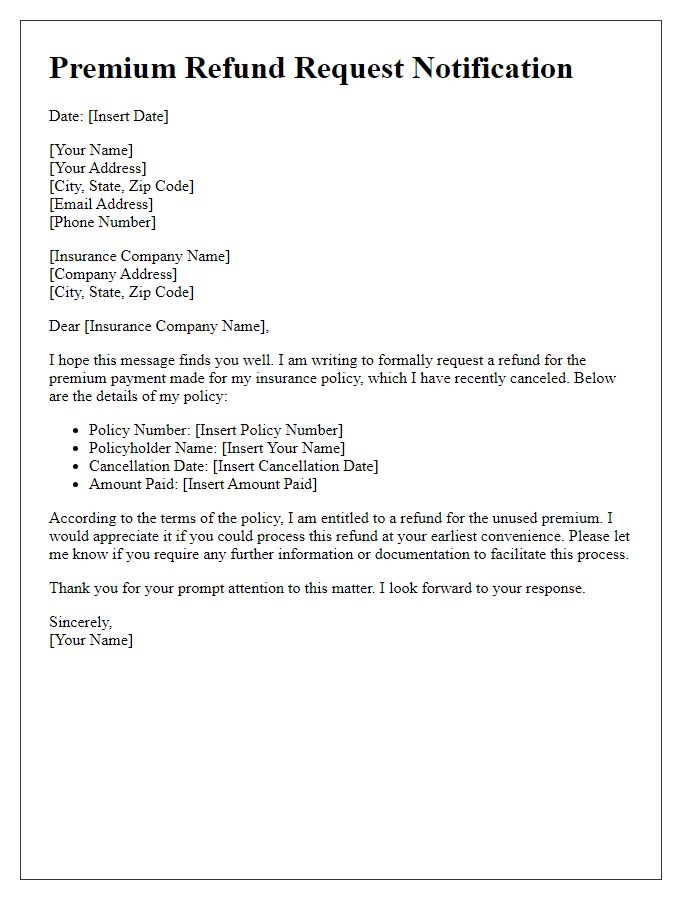

Letter Template For Premium Refund Request After Cancellation Samples

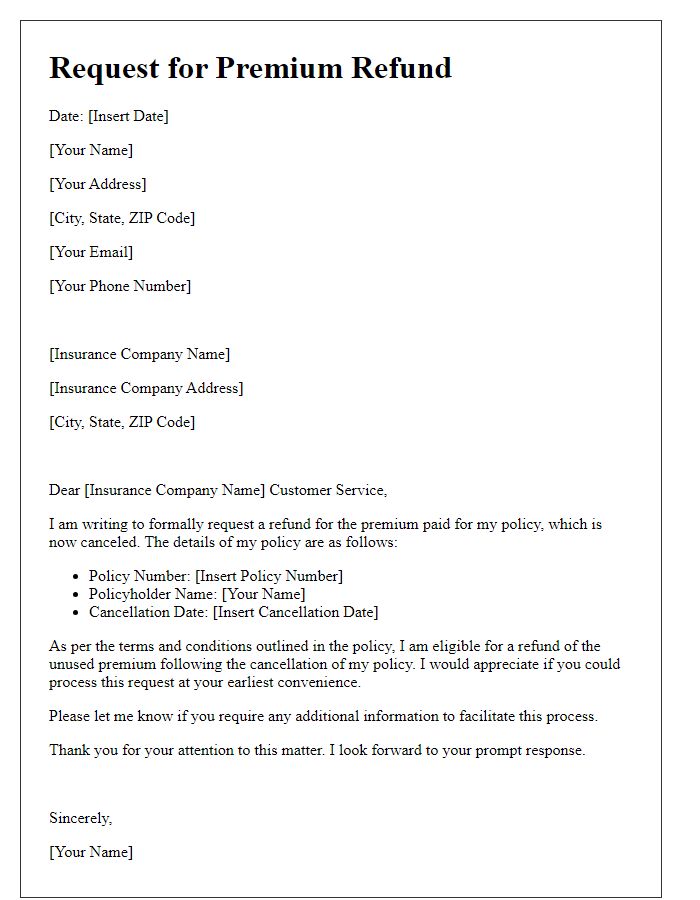

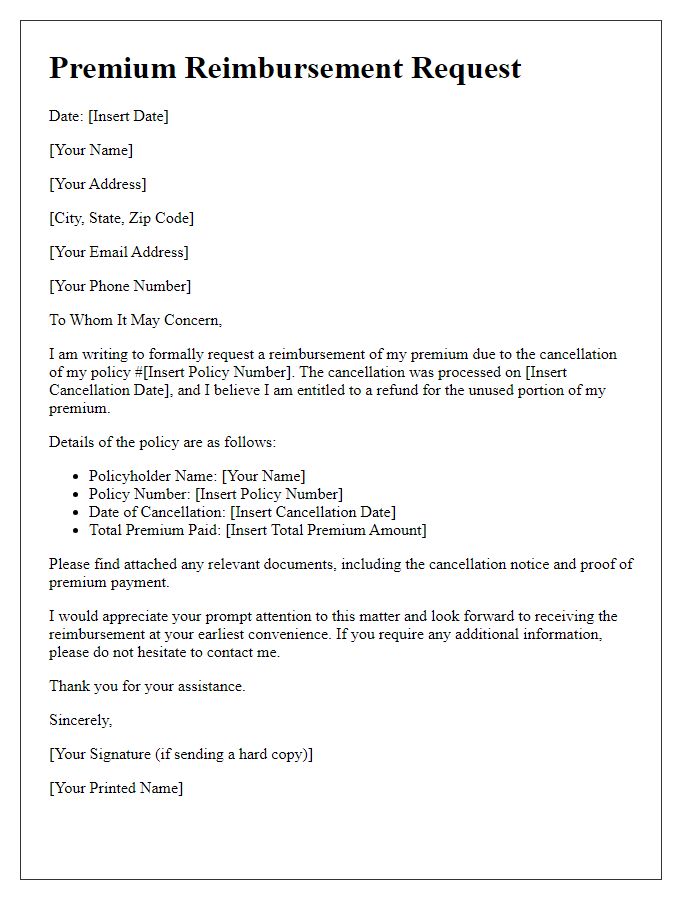

Letter template of refund request for insurance premium after cancellation

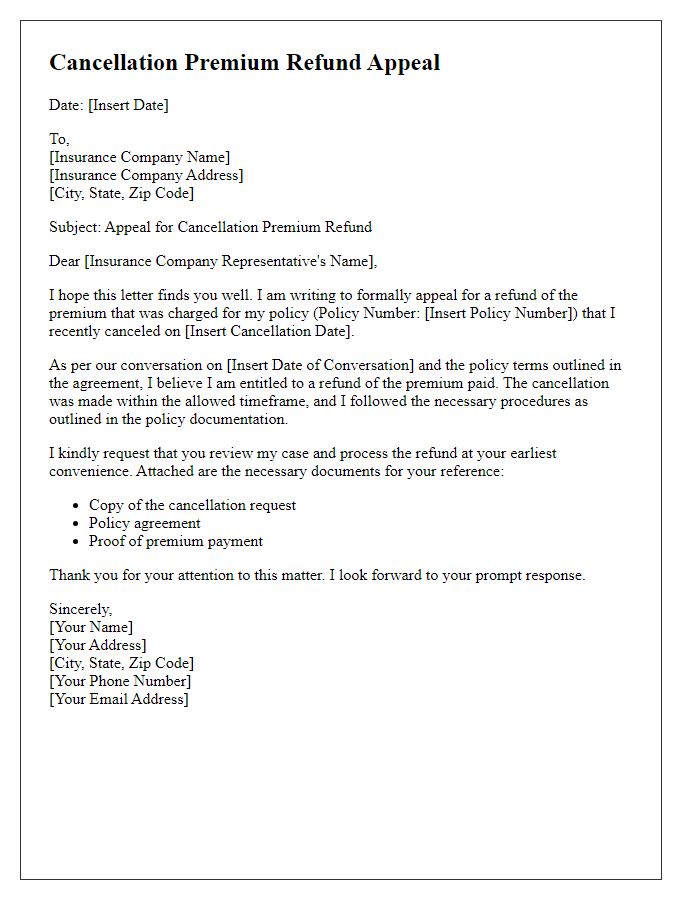

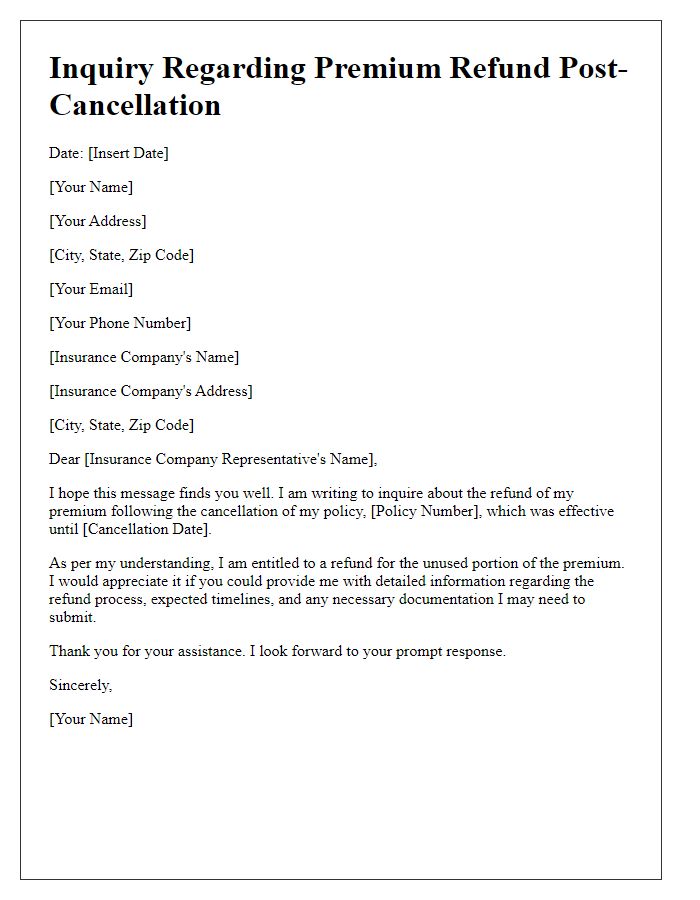

Letter template of formal request for refund of premium after discontinuation

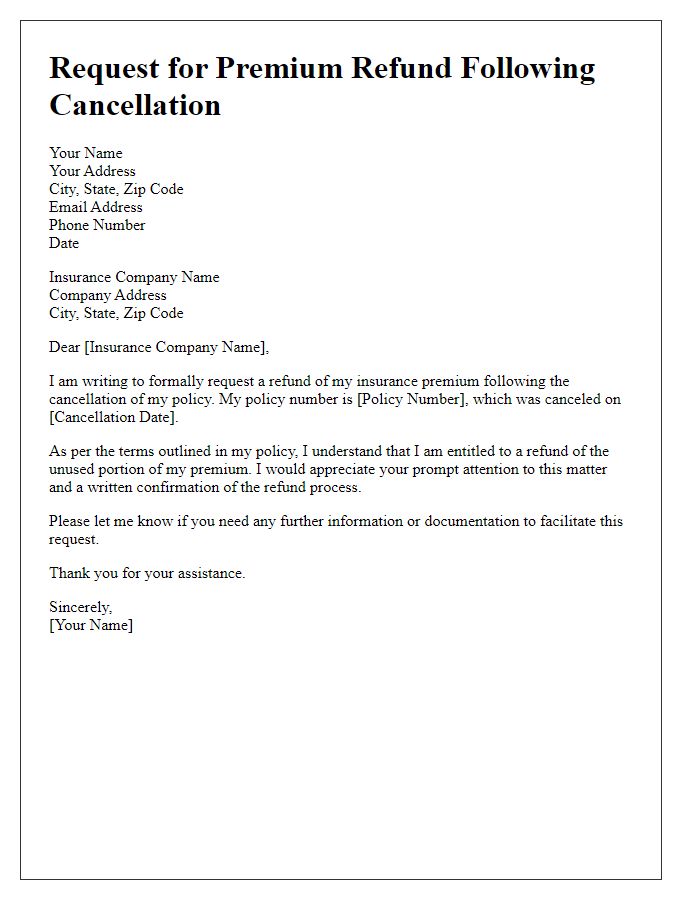

Letter template of request for reimbursement of premium following policy cancellation

Comments