Have you recently faced a situation where you need to navigate a landlord insurance claim? Understanding the intricacies of your policy can feel overwhelming, but getting it right is crucial for protecting your investment. In this article, we'll break down the essential steps and tips to effectively handle your claim process. So, grab a cup of coffee and let's dive into the details that will help you safeguard your property and peace of mind!

Policy Details and Documentation

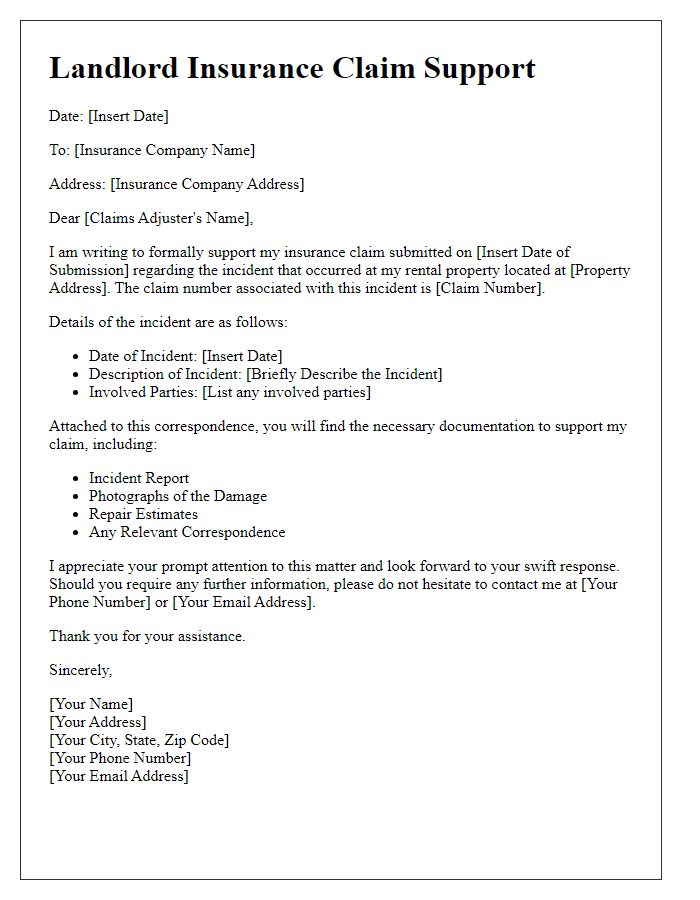

Landlord insurance claims require comprehensive documentation and precise policy details to ensure a smooth process. Important documents include the policy number, coverage limits, and specific exclusions. Events triggering the claim must be clearly outlined, such as property damage or tenant-related incidents. Photographic evidence of damage and repair estimates from certified contractors are essential for substantiation. Additionally, gathering pertinent communication records with tenants and previous claims history can provide context to the claim. Timeliness is crucial; submitting claims within the stipulated period, typically 30 days from the incident, is necessary to comply with policy guidelines and avoid disputes.

Nature of the Claim

A landlord insurance claim involves various scenarios such as property damage, theft, liability claims, or loss of rental income. In cases of property damage (for example, from a natural disaster like a hurricane or water damage from a plumbing issue), it's crucial to document the extent of the damage with clear photographs and professional estimates. Theft claims require a police report and detailed inventory of stolen items, emphasizing monetary loss. Liability claims may arise from tenant injuries, necessitating medical documentation and witness accounts. Additionally, loss of rental income claims need meticulous records of previous rental agreements and any lease terms affected by the incident. Each scenario demands specific documentation to ensure a smooth claims process with the insurance provider.

Supporting Evidence

Landlord insurance claims require thorough documentation to ensure a successful submission. Essential supporting evidence includes photographs (high-resolution images documenting property damage), repair estimates (detailed quotes from licensed contractors), and police reports (for incidents like theft or vandalism). Additional documents may consist of a copy of the lease agreement (outlining tenant responsibilities), correspondence (emails or letters exchanged with the tenant regarding issues), and prior inspection reports (to establish the property's condition before the incident). These items collectively provide a comprehensive overview of the situation, substantiating the claim and facilitating a smoother review process by the insurance provider.

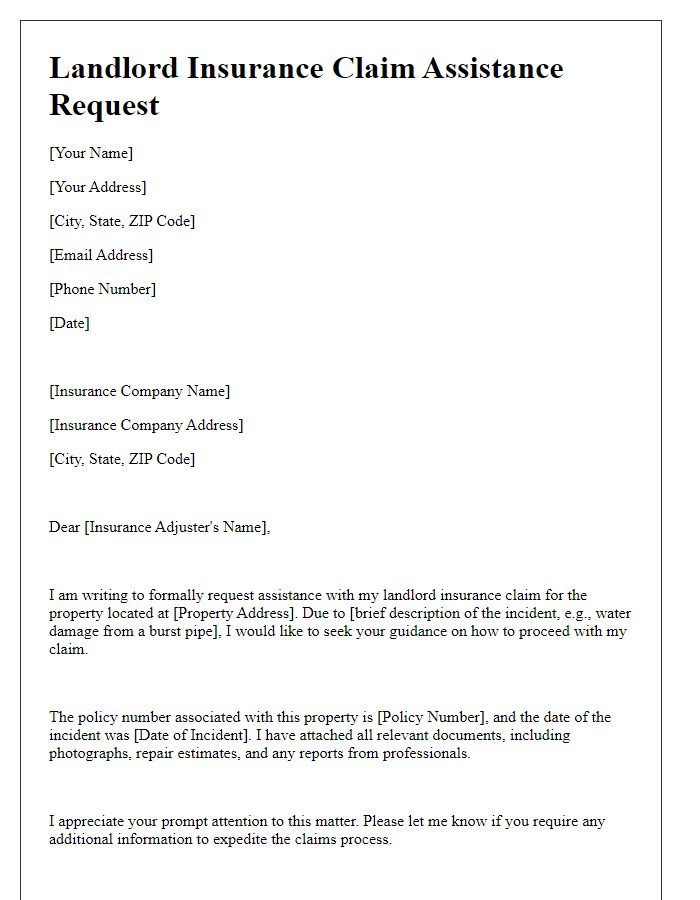

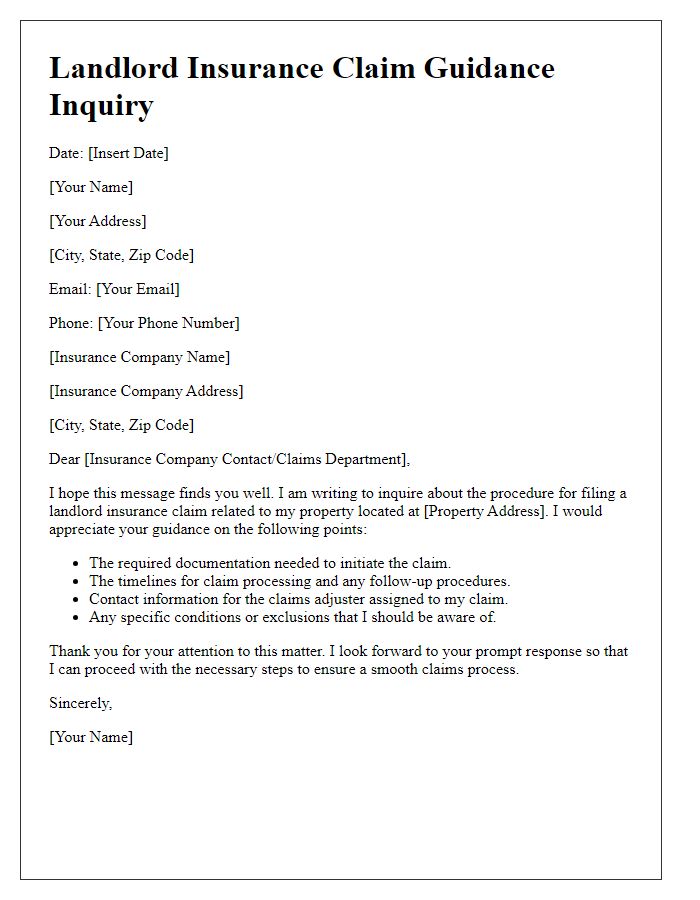

Communication Protocol

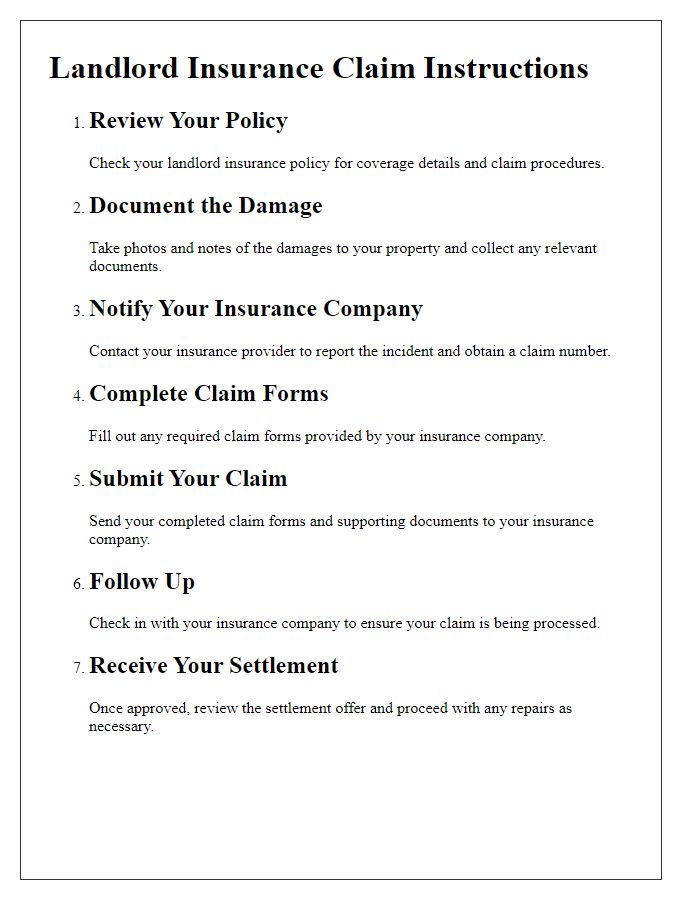

Effective communication protocols for landlord insurance claims involve several key steps. Initiate the claim process by contacting your insurance provider, such as Allstate or State Farm, using dedicated claim service hotlines. Document key incidents, including tenant lease details and property address, and gather essential evidence, such as photographs of damages or reports from local authorities. Submit a detailed claim form outlining the nature of the loss, estimated repair costs, and any related invoices. Follow up consistently, maintaining records of all correspondence, emphasizing timelines like the 30-day notice period typically required for claims verification. Engage an insurance adjuster to assess property damage on-site, ensuring transparency during the process. Utilize available resources like the Insurance Information Institute for additional guidance about claims adjustments and dispute resolution if delays arise.

Timeline for Resolution

Landlord insurance claims can involve complex timelines for resolution. The average processing time for claims through major providers, such as Allstate or State Farm, usually spans between 30 and 60 days. Initial notification of the claim must occur promptly after an incident, like a tenant leaving unexpectedly or property damage from a natural disaster, such as a flood or fire. Once reported, an adjuster typically visits the property within 5 to 14 days for an assessment. After the inspection, additional documentation may be required from the landlord, which can prolong the process. The final decision, including repairs or compensation, may take an additional 10 to 30 days. Timely communication with the insurance provider, alongside maintaining organized records, greatly influences the efficiency of the resolution timeline.

Comments