Are you facing a situation where you need a little extra time to settle your premium payment? You're not aloneâmany individuals sometimes find themselves in need of flexibility when it comes to their financial commitments. Crafting a polite and well-structured letter can make all the difference in securing that extension. Join me as we explore the essential elements of requesting a premium payment extension and how you can approach it effectively!

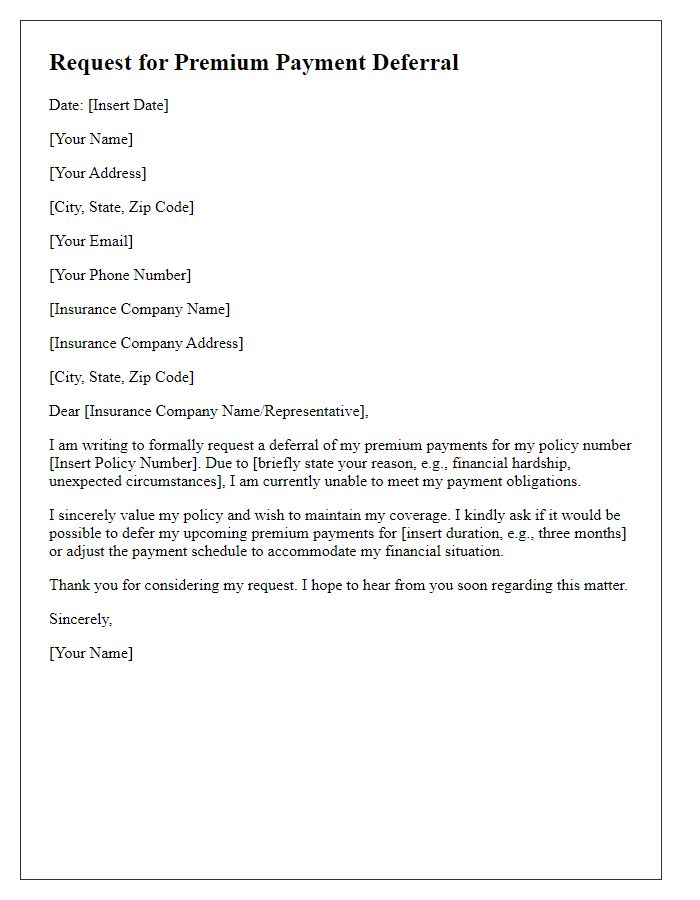

Account Information

Account information management is essential for maintaining accurate records in financial transactions such as insurance policies. A premium payment extension for accounts may involve specific details like policy number (e.g., 123456789) and account holder's name (e.g., John Doe), often housed within insurance companies such as Allstate or State Farm. Timely communications regarding premium payments can prevent lapses in coverage, and extensions may be granted due to various reasons, including unexpected financial hardships or natural disasters affecting the client's ability to pay. Providing a compelling reason for the extension request can significantly increase the likelihood of approval by the insurer's human resources or customer service department.

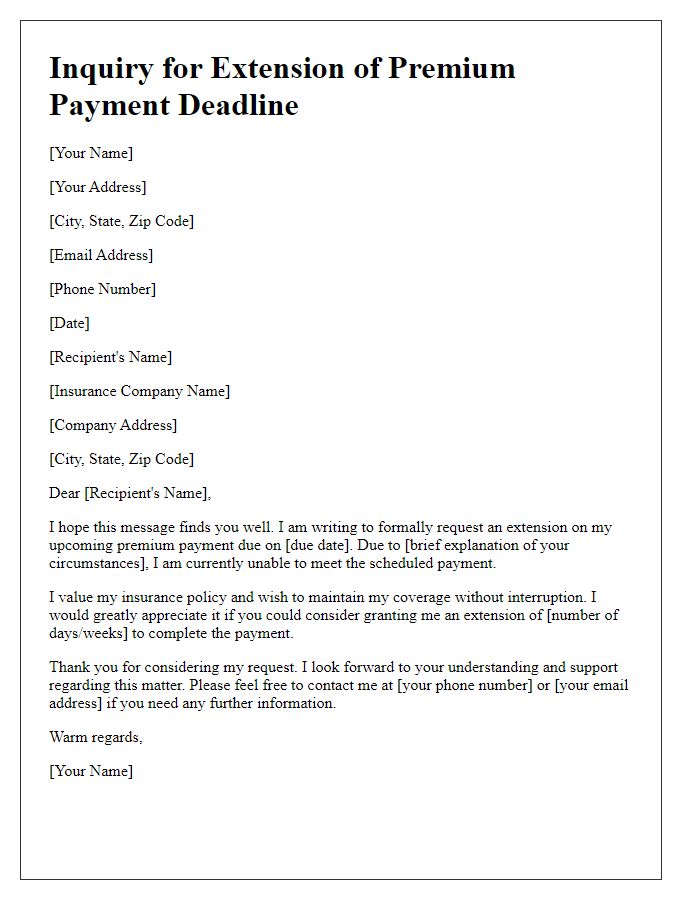

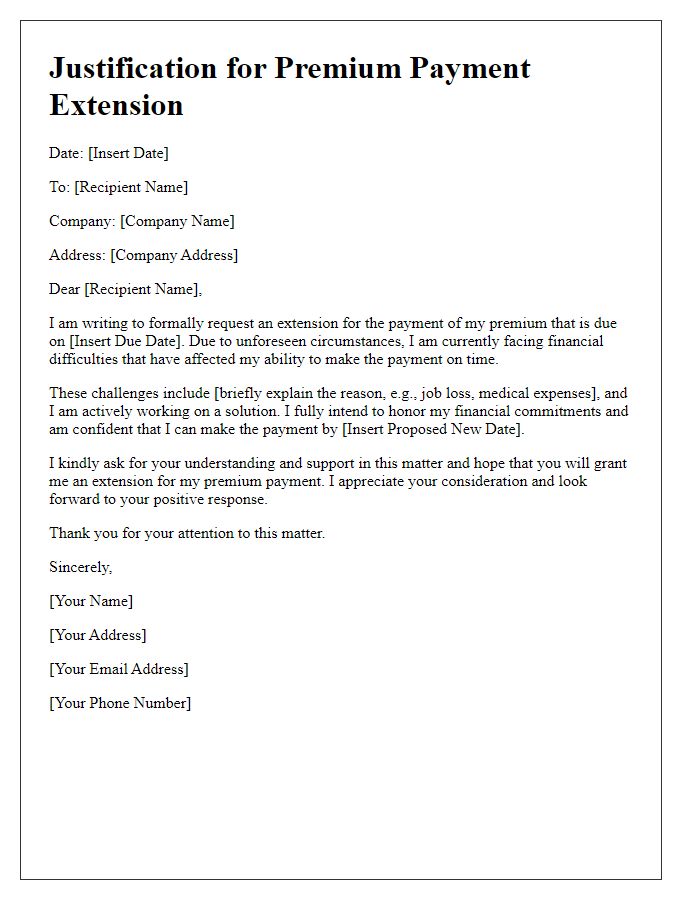

Reason for Extension

Individuals facing financial hardships may seek a premium payment extension for insurance policies. Such circumstances could include job loss (unemployment rates rising to 6.1% in the United States in 2023) or unexpected medical expenses (average hospital stay costs can exceed $10,000). Policyholders may contact insurance providers, including companies like State Farm or Allstate, to request these extensions for paying premiums due on specific dates. Providing documentation, such as proof of income loss or medical bills, can enhance the chances of approval. Maintaining communication with insurers can help prevent policy cancellations while ensuring continued coverage during challenging times.

Proposed New Payment Date

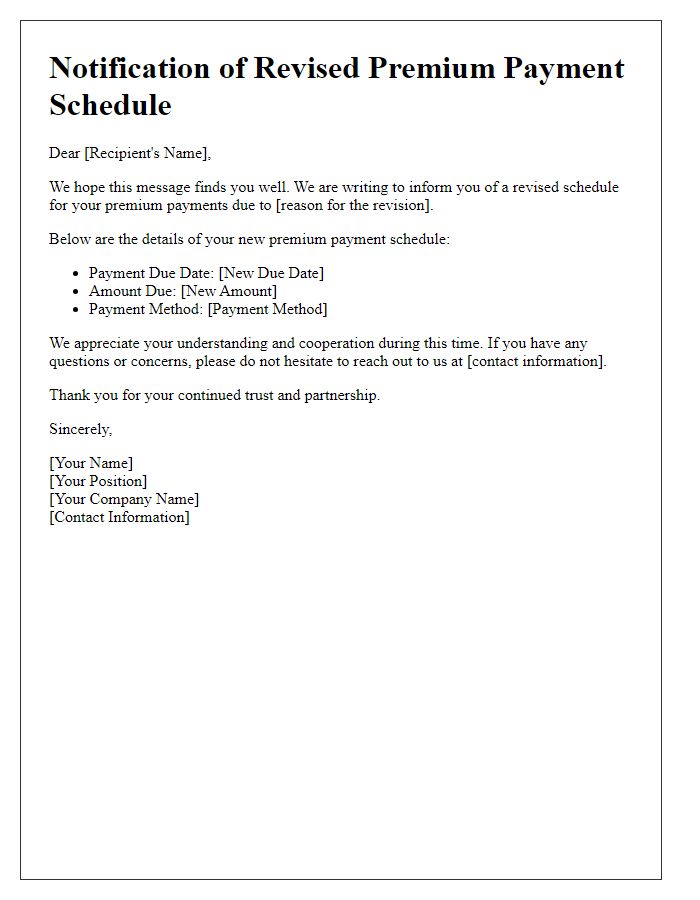

A request for a premium payment extension often arises from various circumstances, such as financial strain or unforeseen events. Insurers typically evaluate these requests based on the reasons provided and the history of timely payments by the policyholder. By proposing a new payment date, policyholders can demonstrate commitment while seeking additional time to secure funds. The proposed new payment date should ideally be realistic, accommodating at least a few weeks to a month to allow for necessary arrangements. Clear communication, including the policy number and other essential identifiers, enhances the request's clarity and increases the likelihood of approval.

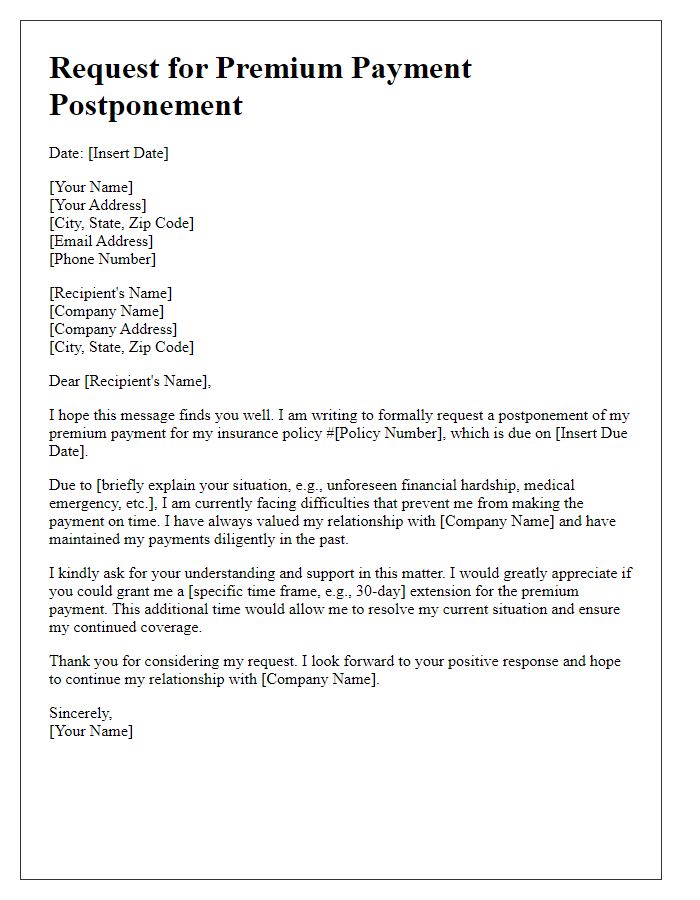

Assurance of Payment

Many individuals often seek payment extensions for annual premium bills, particularly in insurance contexts. Companies, such as State Farm or Allstate, typically provide a grace period of 30 days for policyholders facing financial difficulty. The premium amounts may range from a few hundred dollars to several thousand dollars depending on the policy type, like auto or home insurance. It is essential for the request to include the policy number, personal identification details, and a brief explanation of circumstances requiring the extension. Clear communication can lead to favorable outcomes, ensuring the maintenance of coverage during challenging times.

Contact Information

A premium payment extension request may involve important components such as policyholder contact details, insurance policy number, and the due date of the premium. The contact information should include the policyholder's full name, phone number, email address, and physical address. An insurance policy number uniquely identifies the policy and ensures that the request is processed accurately. Specifying the due date helps the insurance company understand the urgency of the request. Additionally, any relevant account history or prior communication with the insurer regarding the payment can enhance the context and strengthen the case for the extension.

Comments