When facing a critical illness, the last thing you want to worry about is the paperwork involved in claiming your insurance. Understanding the nuances of a critical illness insurance claim can bridge the gap between stress and financial relief during a challenging time. With the right letter template at your side, you can effectively communicate your needs to your insurance provider, ensuring they have all the necessary information to process your claim smoothly. Ready to learn more about crafting the perfect letter for your critical illness insurance claim?

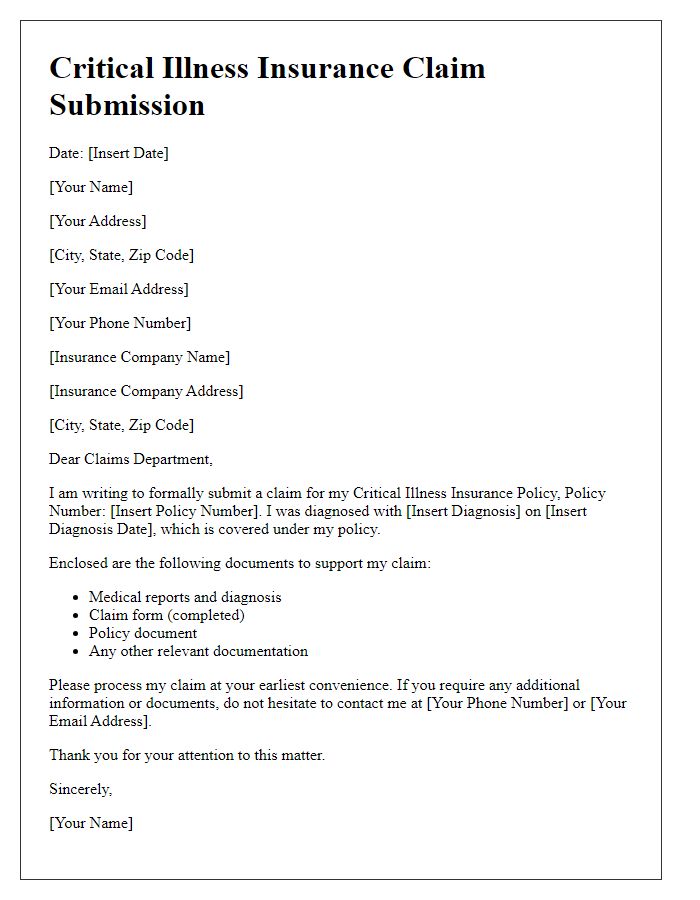

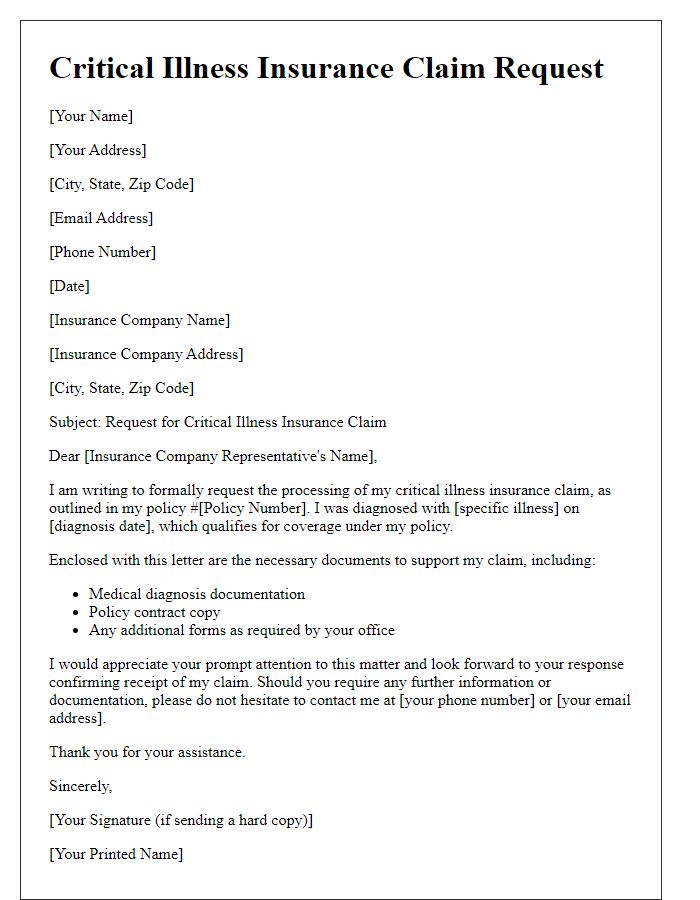

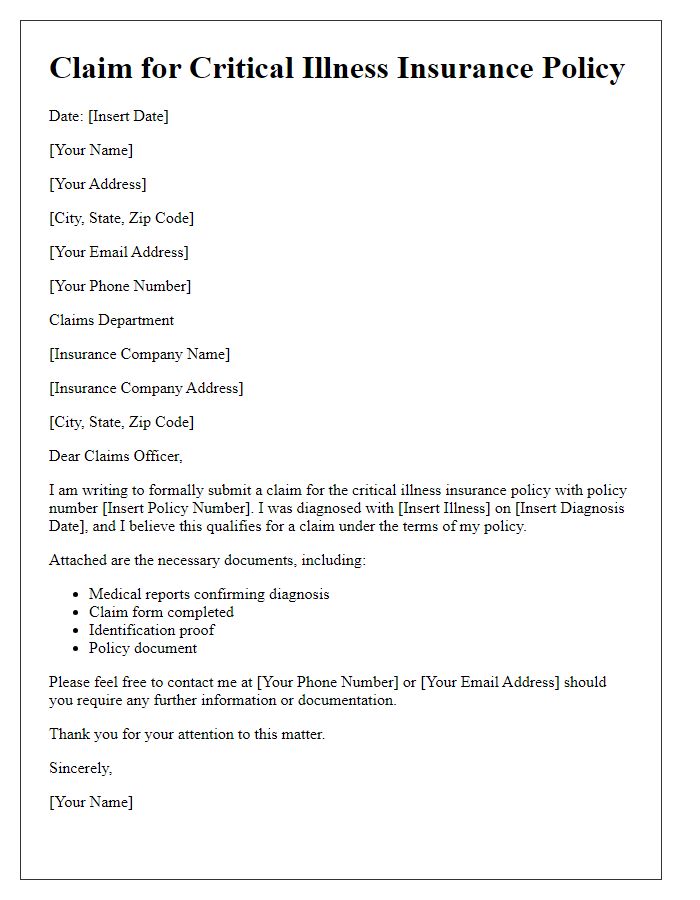

Policyholder Information

Critical illness insurance coverage provides financial support when diagnosed with life-threatening conditions. Policyholder information typically includes personal details such as full name, policy number, date of birth, and contact information. Essential documents may include the original policy, proof of diagnosis (such as medical reports or hospital discharge summaries), and potentially additional identification forms. Accurate and thorough submission of this information is crucial for timely processing of claims. Many insurance companies have specific guidelines to follow, ensuring that required documentation is included to prevent delays in receiving benefits.

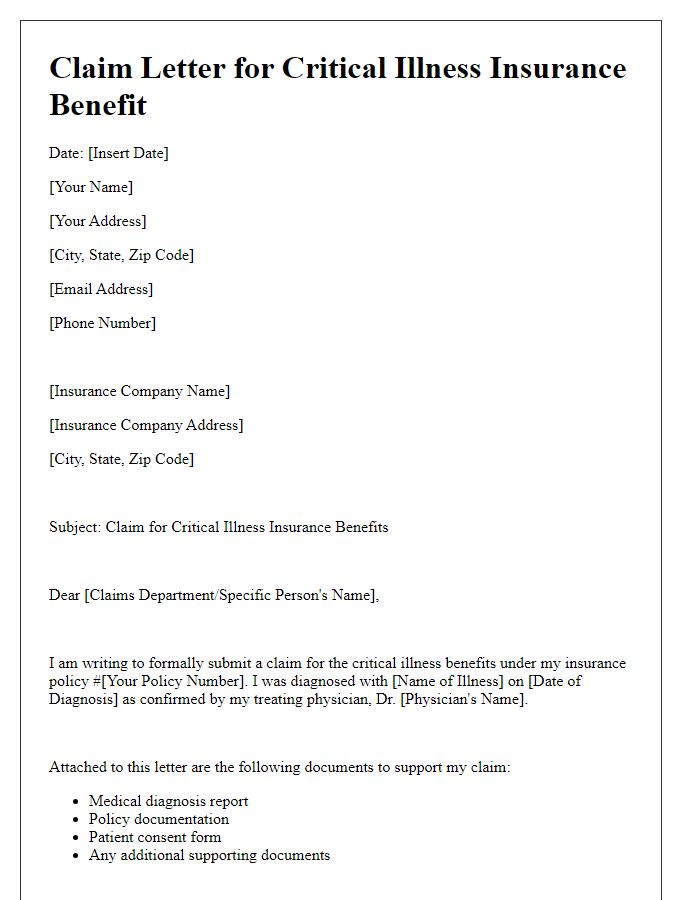

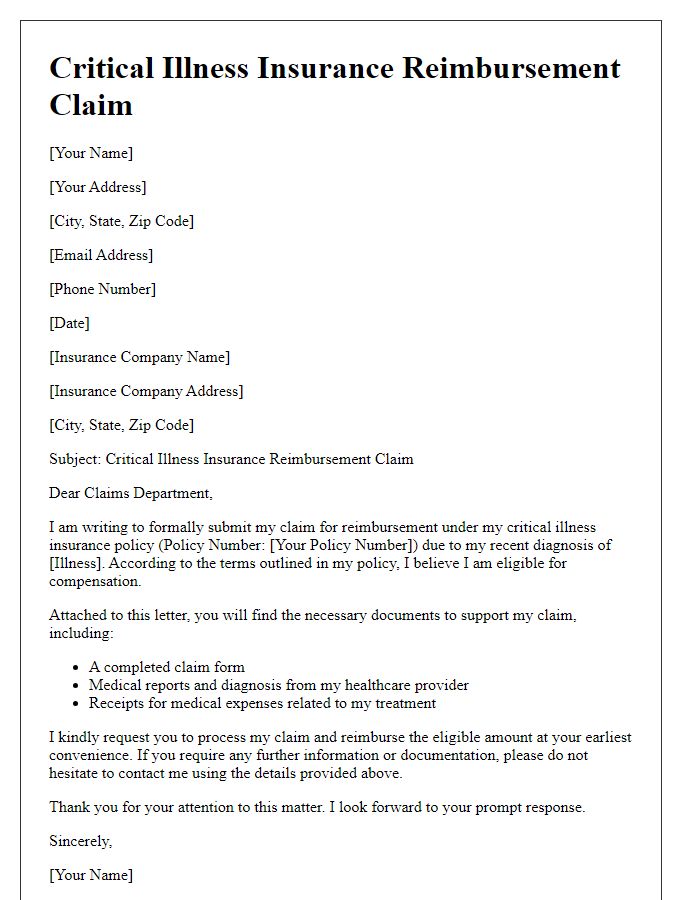

Description of Illness

Critical illness insurance claims often require a detailed description of the illness being claimed. A comprehensive overview includes the diagnosis, symptoms, ongoing treatment plans, and prognosis. For instance, if an individual is diagnosed with Stage 2 breast cancer in September 2023, details about lump discovery, imaging results, and biopsy confirmation are essential. Treatments like chemotherapy sessions at a specific oncology center, appointments scheduled biweekly for six months, and potential side effects experienced can emphasize the severity and impact. Furthermore, discussing the individual's current health status, including fatigue, weight loss, and emotional challenges, provides insight into how the illness affects daily life and activities. Noting follow-up appointments and ongoing monitoring plans with healthcare professionals enhances the depth of the claim.

Medical Documentation

Medical documentation for critical illness insurance claims must include comprehensive details regarding the diagnosis and treatment of the illness. Essential documentation includes an official diagnosis from a licensed healthcare professional, typically a physician specializing in relevant fields such as oncology or cardiology. Medical reports should specify the type of critical illness, for example, stage 2 breast cancer, along with supporting laboratory test results highlighting biomarker levels. Treatment records, such as chemotherapy sessions or surgical procedures, should be clearly outlined, including dates and medical facility names, ensuring all care is appropriately documented. Additionally, prescriptions for medications or ongoing therapies should be included alongside patient discharge summaries from hospitals if applicable. Complete documentation aids the claims process for critical illness benefits efficiently and accurately.

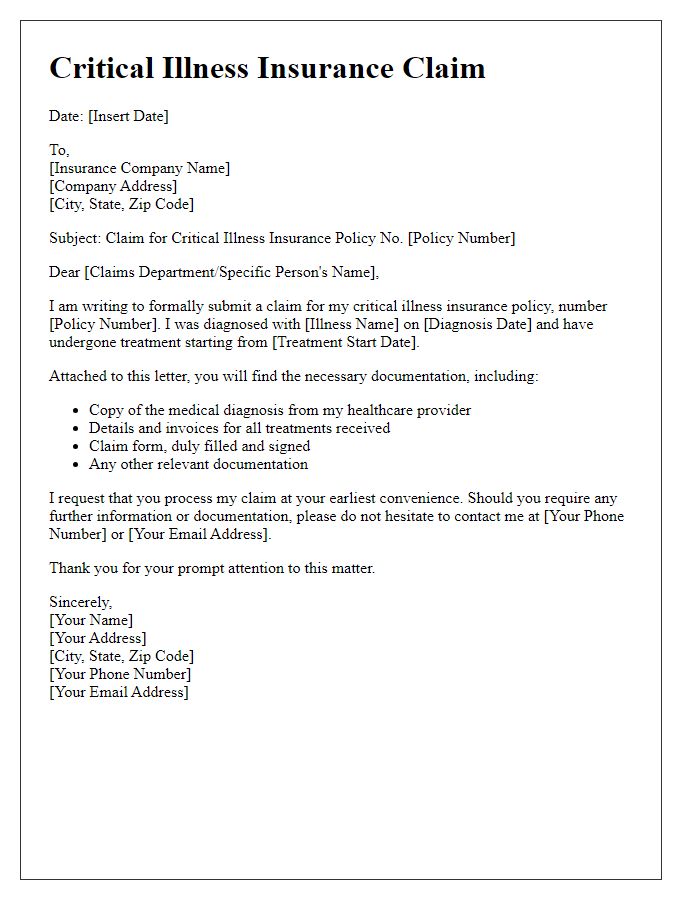

Policy Details and Coverage

Critical illness insurance policies provide financial support to policyholders diagnosed with specific severe medical conditions, covering expenses such as medical treatment and recovery costs. Commonly covered illnesses include heart attack, stroke, cancer, and kidney failure, each requiring a detailed medical diagnosis to trigger the payout. Policies often specify a list of covered conditions, with variations in exclusions based on the insurer, including pre-existing conditions and waiting periods. Claimants must submit evidence, including medical certificates, treatment records, and policy documentation, to validate their claims and ensure a timely payout in accordance with policy terms. Specific insurers may have distinct requirements regarding documentation and claim submission timelines, emphasizing the importance of understanding individual policy stipulations.

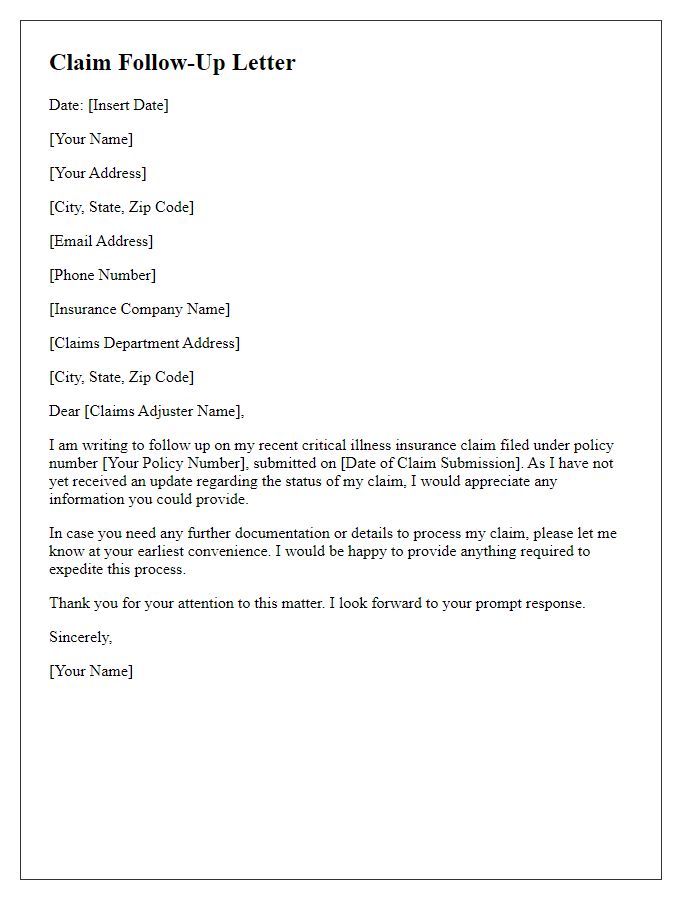

Claim Request and Contact Information

Critical illness insurance claims require thorough documentation to ensure a smooth process. Policyholders must submit a claim request form along with necessary medical documentation, including diagnosis reports, physician statements, and treatment records. Contact information, including policy number, claimant's full name, and phone number, should be clearly stated to allow for efficient communication. Insurers often require clear identification of the specific critical illness, as defined in the insurance policy, such as heart attack or cancer, to validate the claim effectively. Timely submission of this information is crucial to comply with the claim deadlines outlined in policy documents.

Comments