Are you considering requesting a policy premium adjustment? Whether faced with financial changes, new circumstances in your life, or simply seeking a better insurance rate, navigating these adjustments can feel daunting. In this article, we'll guide you through the process, offering tips and examples to help you craft the perfect letter for your insurance provider. Stick around to discover how you can advocate for yourself and potentially save on your premiums!

Policyholder Information

The policyholder information section is critical for processing a premium adjustment request. This section includes essential details such as the policyholder's name, which should reflect the individual or entity holding the insurance policy. Additionally, the policy number, usually a unique identifier assigned by the insurance company, is necessary to ensure the correct file is accessed. The contact information, encompassing both telephone numbers and email addresses, facilitates efficient communication regarding the adjustment status. Furthermore, the mailing address allows for any official correspondence or documentation to reach the policyholder promptly. Finally, including details about the type of insurance policy--such as auto, home, or health insurance--provides context for the premium adjustment request, ensuring that the designated department reviews it appropriately.

Current Policy Details

Current policy details include the policy number, which serves as a unique identifier for the contract, and the effective date, marking the commencement of coverage. The insured individual's name represents the person or entity entitled to the benefits under the policy, while the premium amount reflects the financial obligation incurred for the coverage during the policy period. Additionally, the coverage limits specify the maximum payout in case of a claim, and the deductibles outline the portion of expenses the insured must pay before the insurer contributes. Notable endorsements or riders may also be associated with the current policy, enhancing the coverage by adding specific provisions or features tailored to unique needs.

Reason for Premium Adjustment

A policy premium adjustment request typically arises from changes in the insured's circumstances or external factors influencing risk assessments. For example, increased claim activity (such as a surge in natural disasters like hurricanes and floods) may lead to higher premiums for policyholders in impacted areas like Florida or Texas. Conversely, improvements in risk management practices (like enhanced cybersecurity measures within businesses in the tech industry) may justify a reduction in premium. Changes in personal circumstances, such as moving to a safer neighborhood or installing advanced security systems, also play a factor. These adjustments must reflect accurate assessments of risk based on reliable industry data and underwriting guidelines to ensure fair and transparent modifications in policy premiums.

Supporting Documentation

Policy premium adjustments may require supporting documentation such as financial statements, proof of loss, and risk assessment reports. Comprehensive financial statements offer insights into income and expenses, allowing insurers to evaluate the policyholder's financial standing. Proof of loss documents, including photographs and repair estimates, substantiate claims made under the policy, demonstrating the need for adjustments. Risk assessment reports, prepared by licensed professionals, provide evaluations of current risk factors influencing the policy premiums, such as changes in property value or industry risk levels. Collecting and submitting these documents ensures a coherent process for premium adjustment reviews.

Contact Information and Preferred Response Method

Seeking a policy premium adjustment necessitates detailed information regarding the insured party and preferred communication methods for efficiency. Essential contact details include the policyholder's full name, policy number, and updated address (if applicable). Preferred response methods may consist of email, phone call, or postal mail, emphasizing the urgency associated with the premium adjustment request. Clarity regarding preferred times for contact enhances the effectiveness of communication, ensuring prompt attention to financial obligations tied to the insurance contract within specified timelines.

Letter Template For Policy Premium Adjustment Request Samples

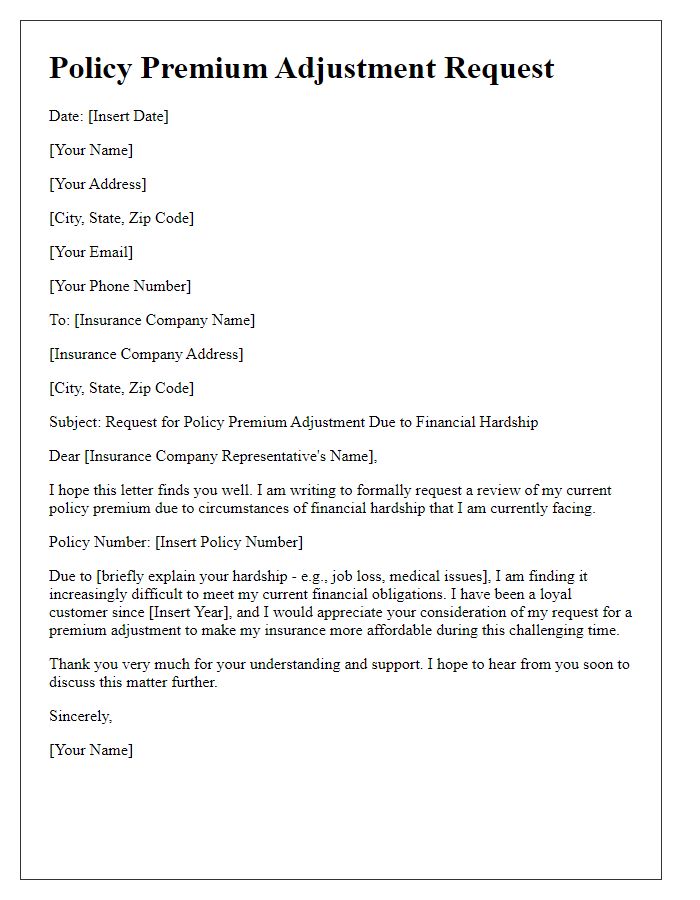

Letter template of policy premium adjustment for financial hardship request

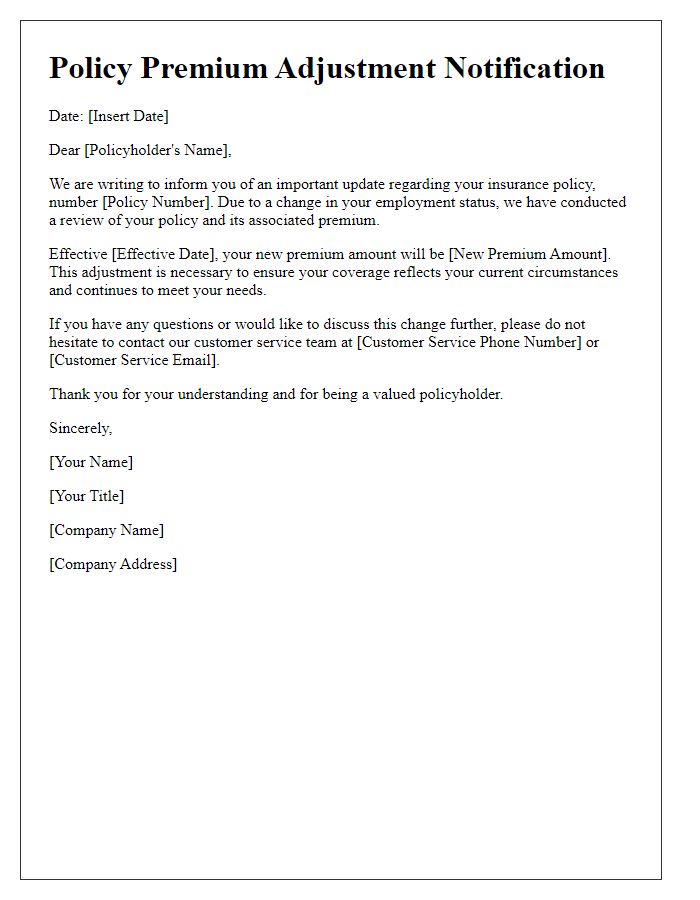

Letter template of policy premium adjustment due to employment status change

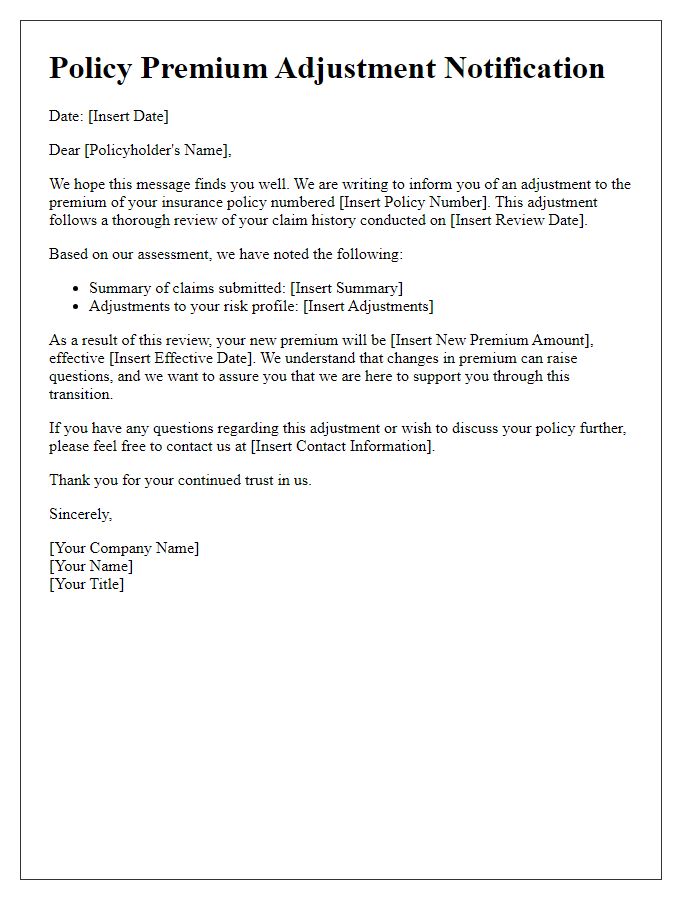

Letter template of policy premium adjustment following claim history review

Letter template of policy premium adjustment because of increased competition

Letter template of policy premium adjustment after risk assessment reevaluation

Letter template of policy premium adjustment for temporary suspension of coverage

Letter template of policy premium adjustment based on family size changes

Comments