Have you ever experienced the unsettling feeling of discovering unauthorized charges on your credit card? It can be alarming and overwhelming, but knowing how to respond quickly can help protect your finances and personal information. In this article, we'll guide you through creating an effective credit card fraud alert letter that ensures your concerns are addressed promptly. Read on to learn the essential steps to take and safeguard your account!

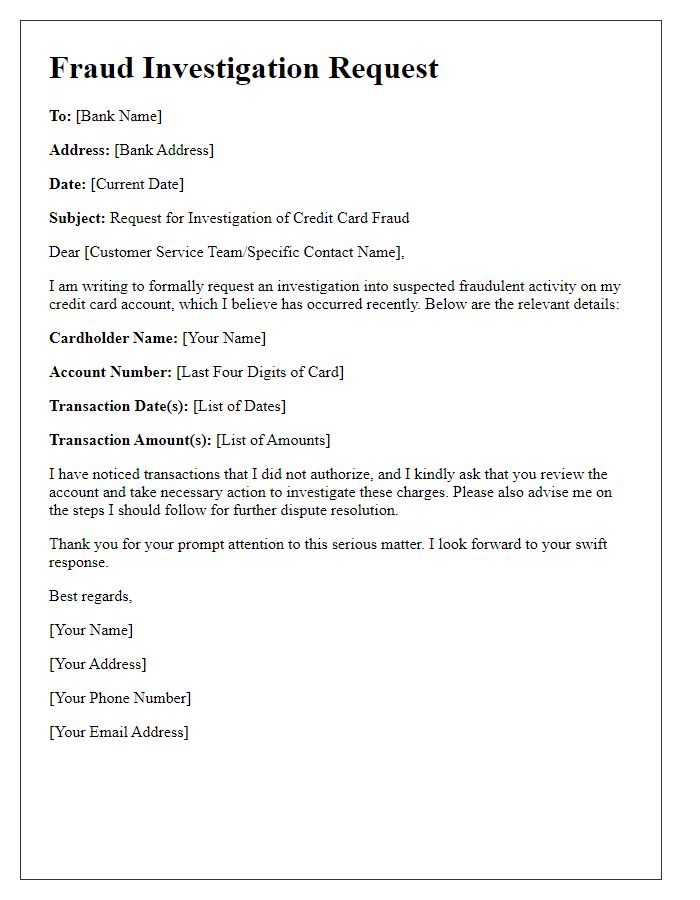

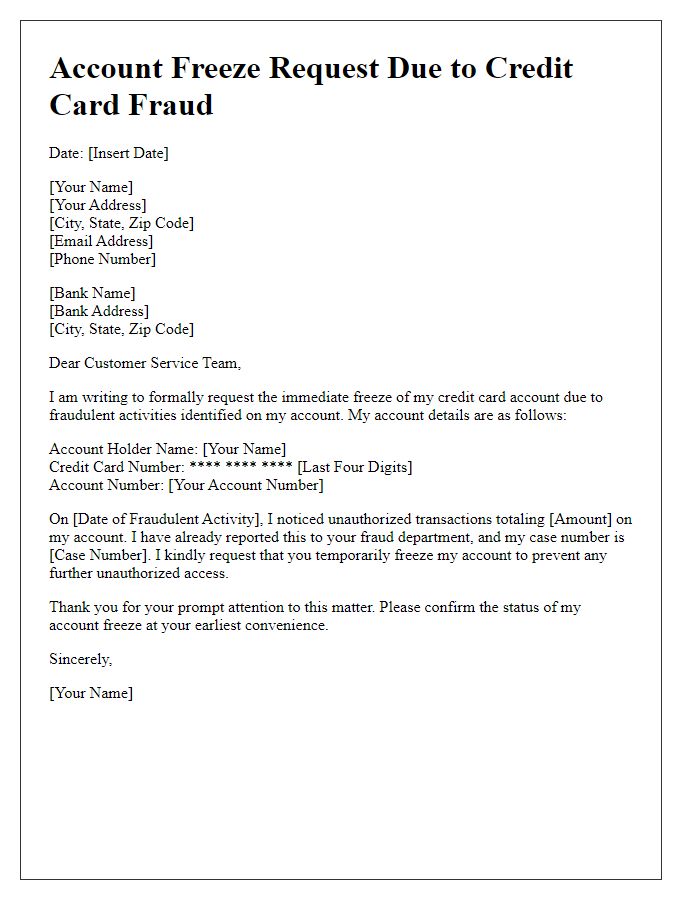

Clear Subject Line

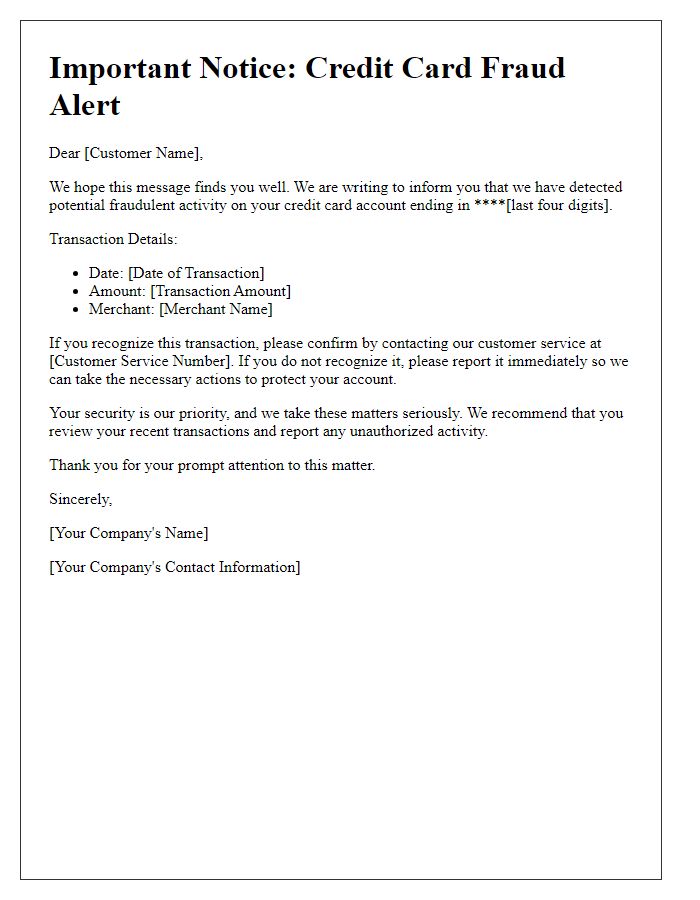

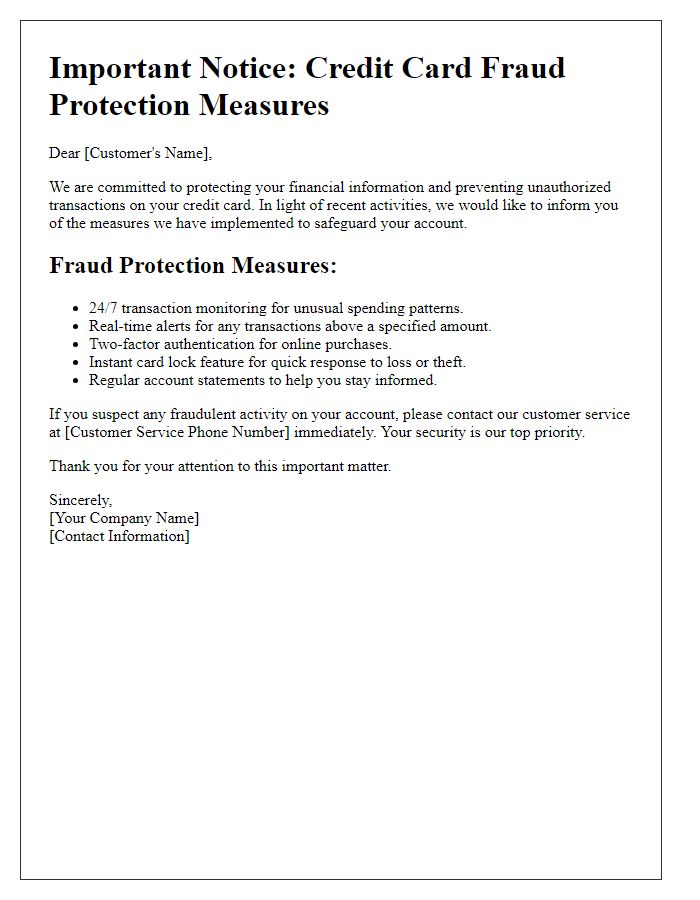

Credit card fraud alerts, issued by financial institutions like Visa or Mastercard, are critical notifications sent to customers when unusual activity occurs on their accounts. These alerts can be triggered by transactions above a certain threshold, such as purchases exceeding $500 at retail stores. Alerts aim to notify cardholders swiftly to prevent unauthorized access to their accounts. Fraudsters often target online platforms like Amazon or eBay, where credit card information can be compromised. Customers are advised to monitor their statements regularly for unfamiliar charges and to report any suspicious activity immediately to secure their financial information.

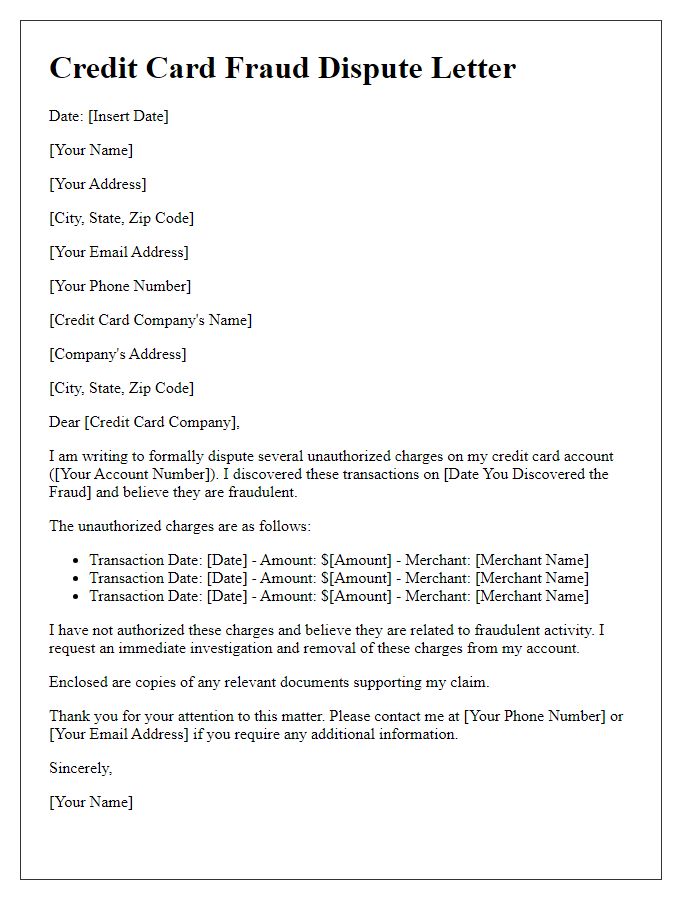

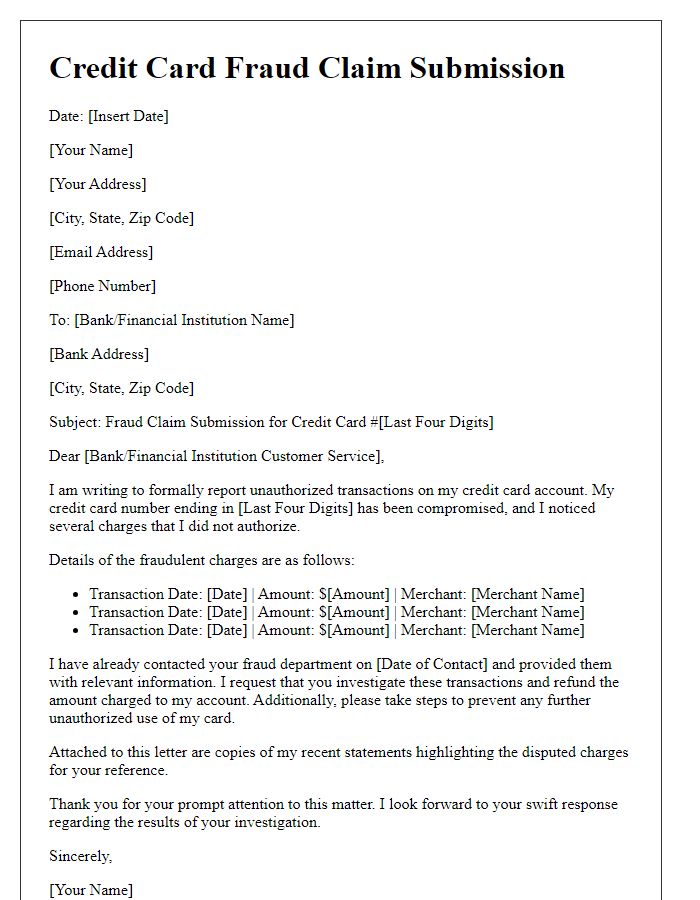

Detailed Incident Description

Credit card fraud incidents can significantly impact individuals and financial institutions. In November 2022, a series of unauthorized transactions amounting to $5,000 were reported on a victim's account associated with Chase Bank. Transactions occurred in multiple locations, including a high-end electronics store in San Francisco and an online luxury goods retailer. The victim, who resides in Los Angeles, noticed discrepancies when reviewing statements, leading to an immediate alert to Chase's fraud department. Investigation revealed the use of compromised credit card information obtained through a data breach at a retail chain, affecting approximately 3 million customers. This incident underscores the importance of monitoring account activity and swift reporting to mitigate financial loss.

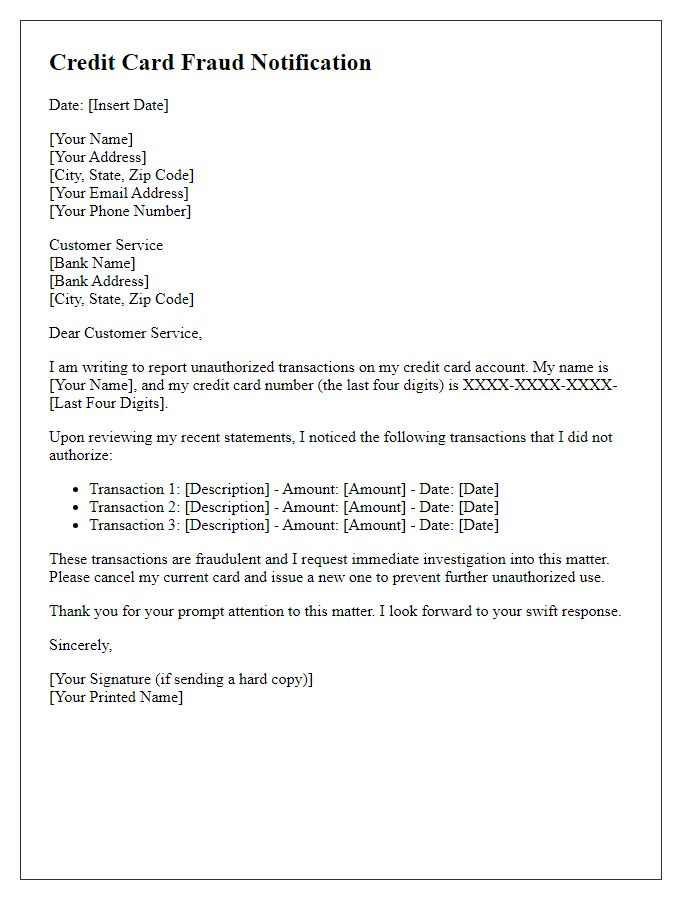

Account and Transaction Information

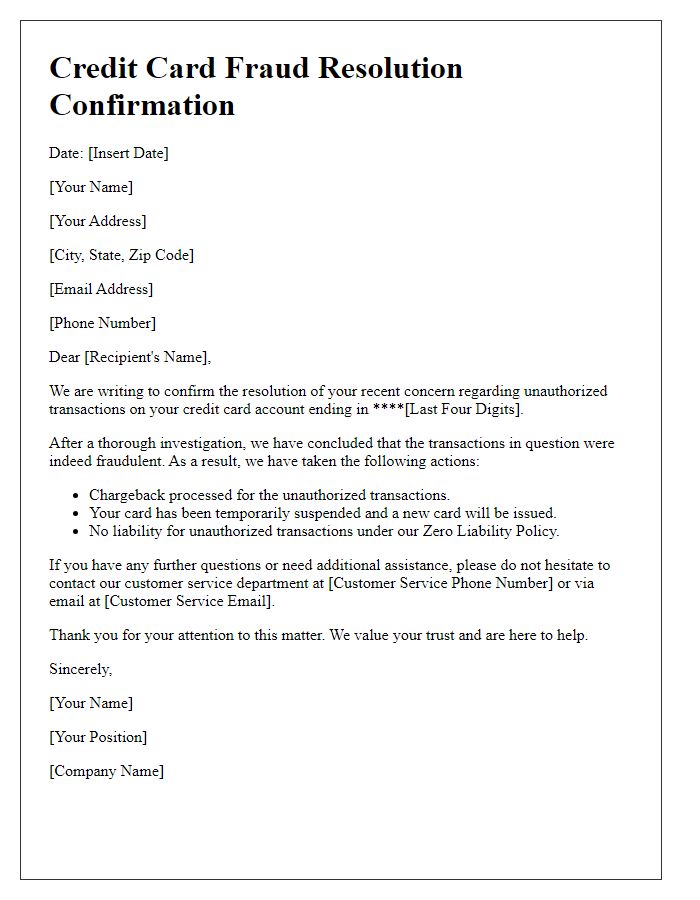

Credit card fraud alerts are essential for safeguarding financial security. Bank accounts, linked to credit cards, can be compromised by unauthorized transactions, often resulting in substantial losses. Fraudulent activity might include unfamiliar purchases or withdrawals, typically occurring within a short timeframe. For instance, transactions over $100 made in overseas locations like Asia or Europe can raise red flags. Signature verification discrepancies during point-of-sale transactions can further indicate potential fraud. Immediate reporting to financial institutions can help mitigate damage by freezing accounts or issuing new cards, ensuring customer protection.

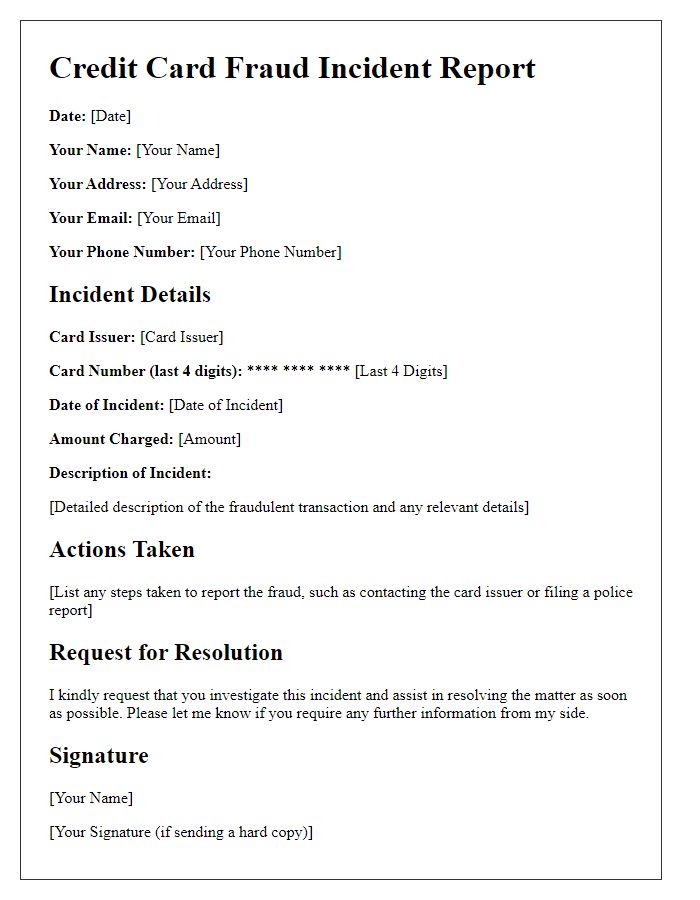

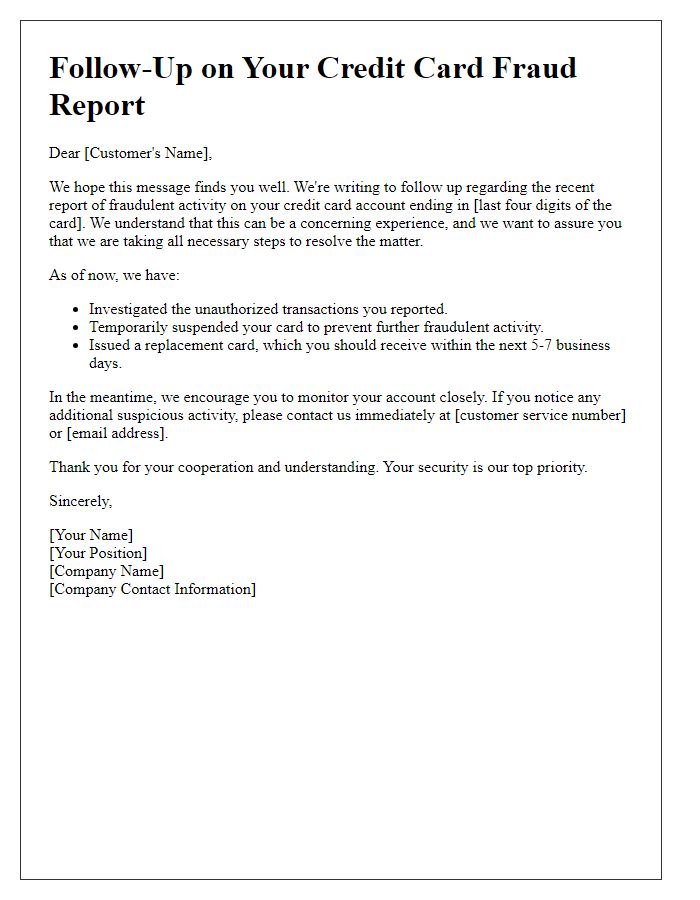

Immediate Action Steps

Credit card fraud alerts require immediate attention to protect personal finances. The first step involves notifying the issuing bank, such as Chase or Bank of America, preferably through their dedicated fraud hotline. This call should be made as soon as suspicious transactions appear on account statements, especially if transactions exceed $100 or originate from unfamiliar locations. Following the call, it is crucial to review recent statements for unauthorized charges and document all discrepancies. Freezing the card and requesting a replacement is essential to prevent further fraudulent activities. Understanding consumer rights under the Fair Credit Billing Act can empower individuals, ensuring liability is limited to $50 for unauthorized charges. Regularly monitoring credit reports from agencies like Experian, Equifax, and TransUnion can assist in identifying potential identity theft.

Contact Information for Further Assistance

Credit card fraud alerts are critical in preventing unauthorized transactions. In cases where fraudulent activity is detected, immediate action is necessary. Contacting customer service provides essential assistance; for example, financial institutions usually have dedicated fraud hotlines. These numbers, often found on the back of the credit card, operate 24/7. Furthermore, major banks like Chase or Bank of America typically assign specific representatives to handle fraud cases efficiently. Providing personal details such as account number or Social Security number may be required for verification. Proactive communication prevents further financial damage and secures customer accounts.

Comments