Are you preparing for a financial audit meeting and need a solid agenda template? Having a structured agenda is crucial for ensuring that all key points are addressed efficiently. It not only keeps the meeting focused but also helps participants come prepared with relevant information. So, let's dive into the essential components of a financial audit meeting agenda to pave the way for a successful discussion.

Introduction and Objectives

The financial audit meeting agenda typically begins with an introduction that outlines the purpose of the gathering. Key objectives include ensuring compliance with regulatory standards, such as the Generally Accepted Accounting Principles (GAAP), assessing internal controls within financial reporting processes, and evaluating the overall accuracy of the financial statements, including balance sheets and income statements from the previous fiscal year. Stakeholders, including auditors from firms like Deloitte or PricewaterhouseCoopers, will discuss primary findings and recommendations to enhance financial practices. A clear understanding of objectives will set the foundation for productive discussions throughout the meeting.

Review of Financial Statements

The financial audit meeting will focus on the thorough review of financial statements, emphasizing accuracy and compliance with accounting standards such as GAAP (Generally Accepted Accounting Principles). Key documents include the balance sheet, which provides an overview of assets, liabilities, and equity as of December 31, 2022, and the income statement detailing revenue and expenses during the fiscal year. The cash flow statement will also be analyzed, highlighting cash inflows and outflows, crucial for understanding liquidity. Participants include the finance team, external auditors from XYZ Audit Firm, and relevant stakeholders, ensuring comprehensive oversight. Discussions will cover discrepancies, audit findings, and recommendations for improvements. The meeting venue is Conference Room A at the corporate headquarters, located at 100 Finance Drive, with access to necessary documents.

Discussion of Audit Findings

During the financial audit meeting, scheduled for November 15, 2023, at the Downtown Business Center, the agenda will focus on the comprehensive discussion of the audit findings from the fiscal year 2022-2023. Key auditors from Smith & Co. will present critical insights into discrepancies identified in the balance sheet, specifically examining the $250,000 variance in the accounts receivable and its implications for cash flow management. Additionally, the team will address compliance issues related to the adherence to the Generally Accepted Accounting Principles (GAAP), underscoring the need for enhanced internal controls to mitigate risks. The meeting aims to clarify these findings, propose actionable recommendations, and establish a timeline for implementing necessary changes before the next quarterly report in January 2024.

Risk Assessment and Control Environment

The financial audit meeting agenda includes key topics such as Risk Assessment and Control Environment. Risk Assessment involves identifying potential financial uncertainties, quantified by various risk factors, including market volatility, regulatory changes, and operational weaknesses. Control Environment encompasses the organizational framework, including policies, procedures, and staff competencies, that promotes accountability and efficient operations. Key elements to consider are compliance with standards set by the International Financial Reporting Standards (IFRS) and internal control measures that safeguard assets valued in millions. The goal is to evaluate the effectiveness of existing controls and enhance processes for risk mitigation, ultimately leading to improved financial integrity and trust.

Action Items and Follow-Up Plan

The financial audit meeting agenda focuses on key action items and a clear follow-up plan. Participants include auditors from Deloitte, financial officers from XYZ Corporation, and department heads from various sectors. The agenda outlines critical discussions regarding the fiscal year 2022 budget analysis, compliance with the Sarbanes-Oxley Act, and discrepancies in quarterly financial reports. Specific action items may include reviewing expense reports for the last three quarters, assessing internal controls regarding cash handling, and implementing recommendations made by auditors. The follow-up plan highlights timelines for each action item, ensuring accountability with scheduled check-ins, including a final review meeting on March 15, 2024, for progress updates and resolution of outstanding issues.

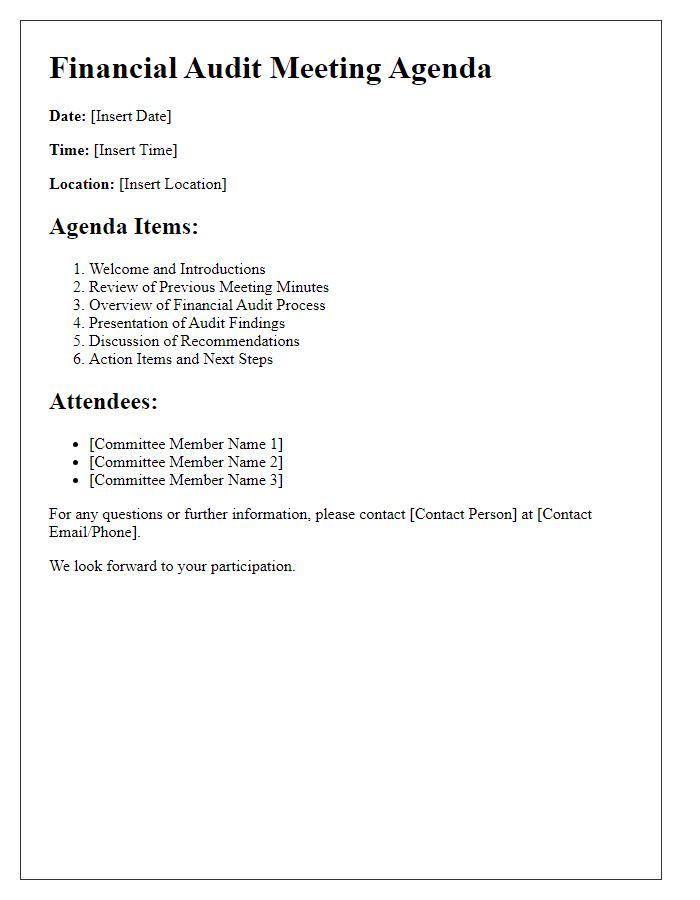

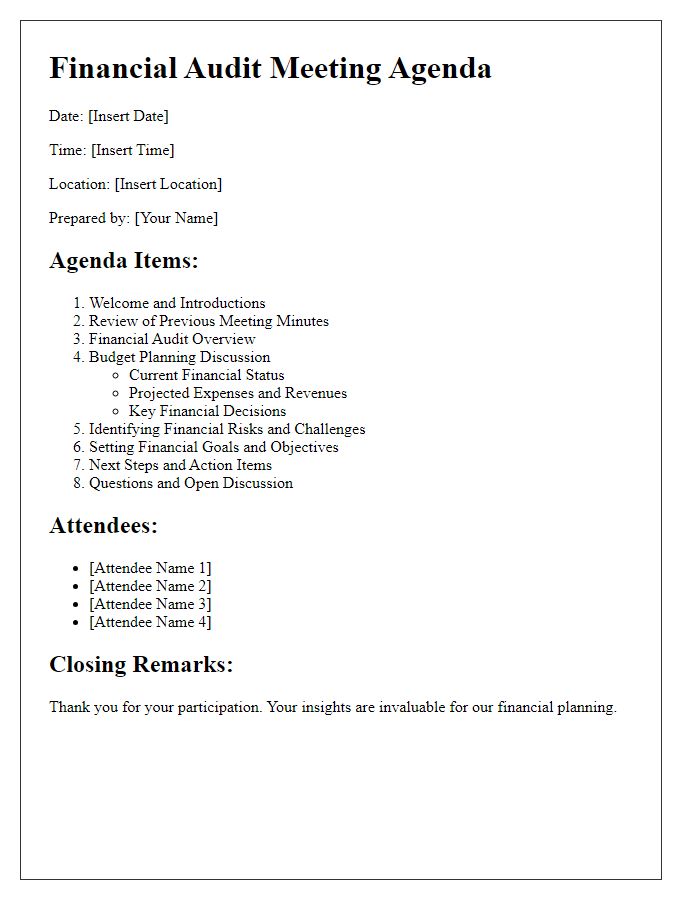

Letter Template For Financial Audit Meeting Agenda Samples

Letter template of financial audit meeting agenda for internal audit team

Letter template of financial audit meeting agenda for finance department

Letter template of financial audit meeting agenda for compliance officers

Letter template of financial audit meeting agenda for operational leaders

Comments