Are you looking to take control of your finances with effective budget planning? Our comprehensive budget planning service is designed to help you manage your expenses, save for the future, and achieve your financial goals. We understand that every individual's financial situation is unique, and our tailored approach ensures that you receive personalized support every step of the way. Curious to learn how we can help you get started on your path to financial success? Read more!

Client's financial goals and objectives

Crafting a financial plan requires a clear understanding of clients' financial goals and objectives, which often encompass short-term and long-term aspirations. Clients might aim to save for significant events, such as purchasing homes in desirable locations like Seattle or funding children's college education at prestigious universities like Harvard. Retirement planning often emerges, targeting age milestones such as 65 years, ensuring a comfortable lifestyle supported by anticipated social security benefits. Debt reduction can be crucial, focusing on eliminating high-interest credit card debts averaging 20% APR. Furthermore, clients may desire to create emergency funds with three to six months' worth of living expenses securely saved, enhancing financial resilience. Insurance considerations also play a key role, protecting key assets such as homes, vehicles, and health against unforeseen events. Regular assessments will help track progress, adapting to changes in income, employment, or market conditions, ultimately ensuring that financial plans remain aligned with evolving personal goals.

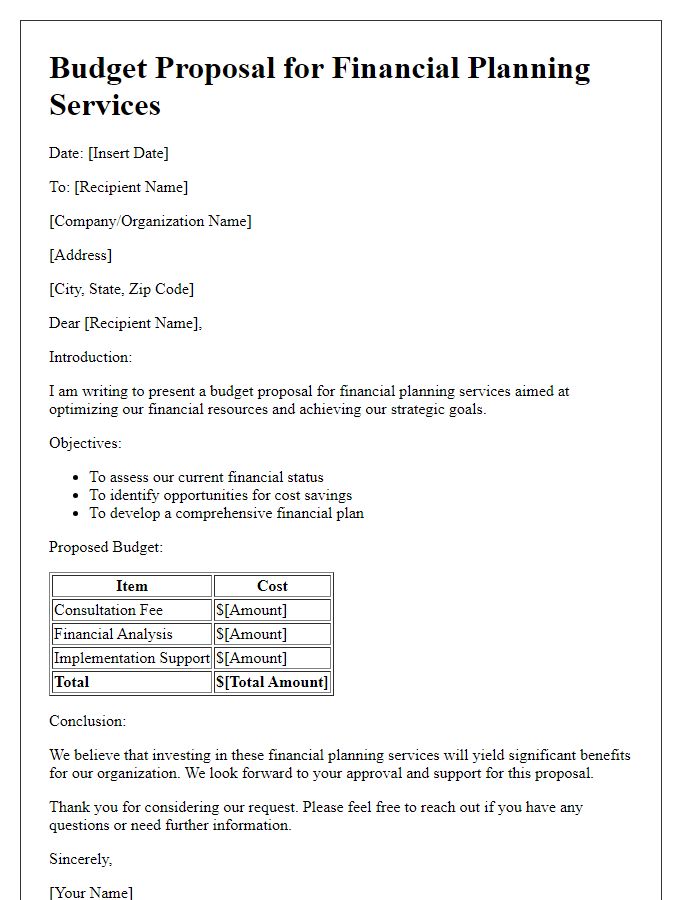

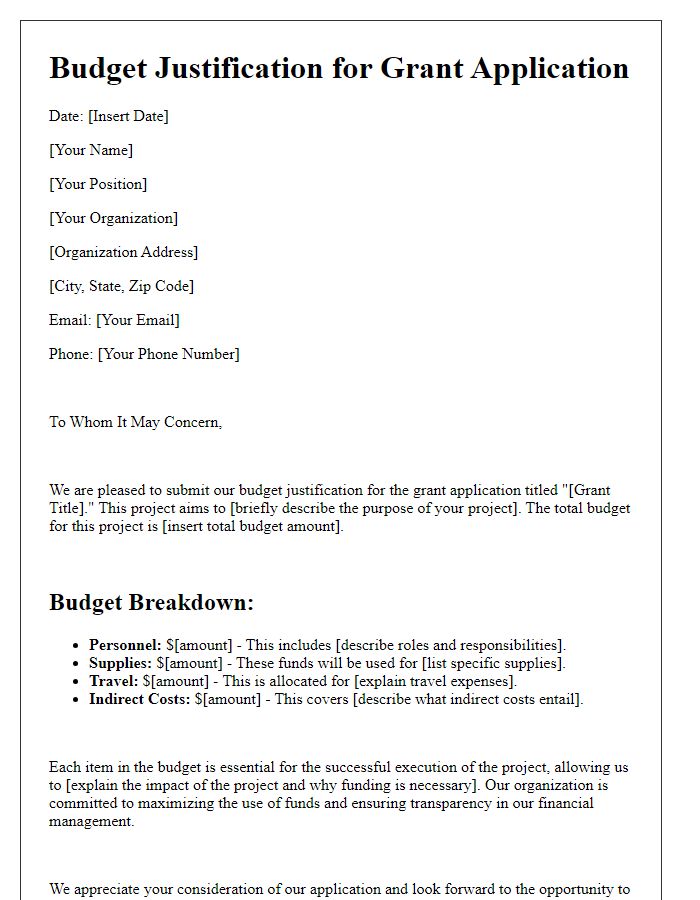

Detailed budget breakdown

A detailed budget breakdown is essential for effective financial planning and management in various contexts, such as individual households, small businesses, or large organizations. This process typically includes categorizing income sources, such as salaries, dividends, or sales revenue, alongside various expenses, including fixed costs (mortgages, insurance premiums) and variable costs (utilities, groceries). Additionally, allocating funds for savings, emergency funds, or investments plays a crucial role in long-term financial stability. Utilizing budgeting frameworks, such as the 50/30/20 rule (where 50% of income is allocated to needs, 30% to wants, and 20% to savings), can enhance the planning process. Regular reviews and adjustments to the budget ensure alignment with changing financial circumstances, helping individuals or entities maintain control over their financial health and future goals.

Timeline and milestones

A comprehensive budget planning service involves a structured timeline and set milestones, essential for achieving financial objectives efficiently. Initial assessment phase spans two weeks, allowing clients to gather and analyze financial data, including income statements and expense reports. Following this, the goal-setting phase, conducted over one week, focuses on identifying short-term (within the next fiscal year) and long-term (three to five years) financial goals. The creation of a detailed budget plan occurs in three weeks, incorporating projected cash flow analysis and expense categorization. Implementation of the budget will take an additional four weeks, enabling clients to track adherence and make necessary adjustments. Finally, a review phase, scheduled six months after implementation, will assess progress against initial goals and provide recommendations for future adjustments based on financial performance metrics.

Communication and consultation frequency

Frequent communication and consultation are essential for successful budget planning services. Regular meetings, ideally on a bi-weekly basis, ensure alignment between financial goals and strategies. Scheduled quarterly reviews provide an opportunity to assess ongoing progress and make necessary adjustments. Budget updates can also be communicated through monthly reports, offering insights into spending patterns and trends. Additionally, immediate consultations following significant financial events, such as unexpected expenses or revenue changes, allow for timely decision-making. Utilizing digital platforms for instant messaging can enhance real-time communication, facilitating a responsive approach to budget management.

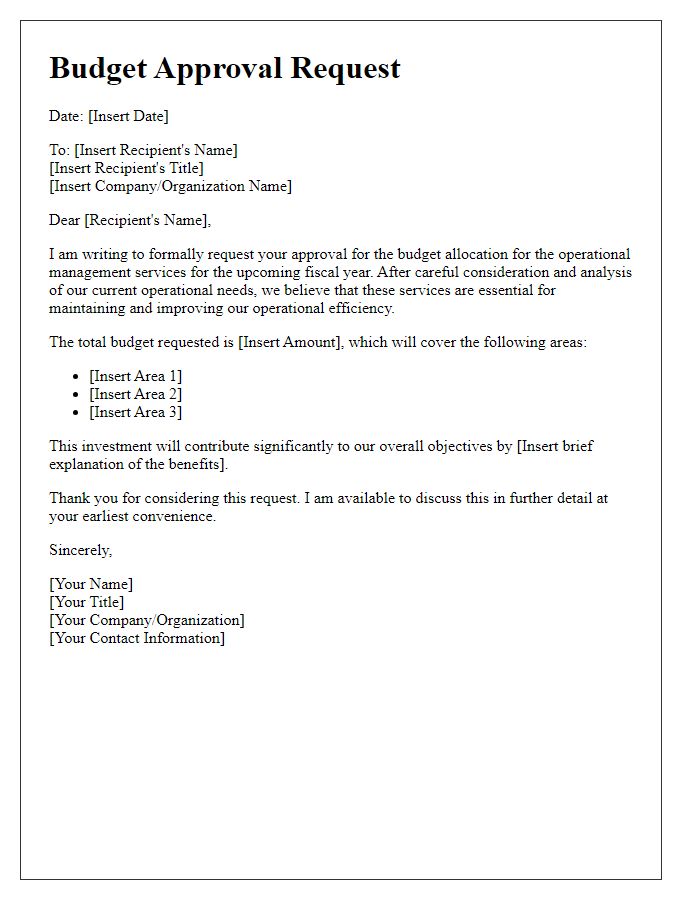

Terms of service and agreement conditions

The budget planning service provides clients with a comprehensive financial strategy tailored to individual goals and circumstances. Clients participating in this service agree to furnish accurate financial information, including income sources, fixed expenses, and discretionary spending habits. The service operates under confidentiality protections, ensuring all shared data remains secure. Changes in financial status should be communicated promptly to adjust budget recommendations. Additional fees may apply for revisions beyond the agreed consultation periods, typically defined as quarterly reviews (every three months). Clients can terminate the service with a 30-day written notice, after which access to resources and support will cease. All services adhere to best practices outlined by the Financial Planning Association (FPA).

Letter Template For Budget Planning Service Samples

Letter template of budget allocation request for project management service

Letter template of budget adjustment notification for accounting service

Letter template of budget forecasting analysis for strategic planning service

Letter template of budget reconciliation statement for fiscal management service

Letter template of budget update communication for team collaboration service

Comments