Hey there! If you've been navigating the world of investments, you know how crucial it is to keep track of your income statements. Whether you're a seasoned investor or just starting, understanding your investment income can vastly improve your financial strategy. In this article, we'll break down everything you need to know about creating and interpreting an investment income statement, making it easier for you to stay informed. So grab a cup of coffee and let's dive inâread on to discover valuable insights!

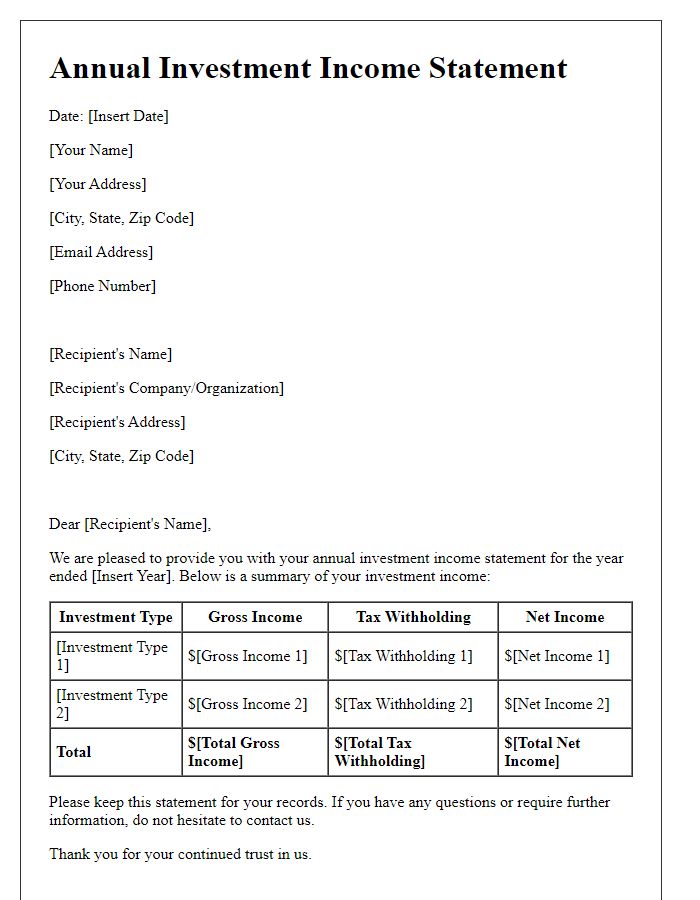

Accurate financial figures

An investment income statement provides detailed insights into the financial performance of assets over a specific reporting period. Key figures include net investment income, which typically represents the sum of dividends and interest earned minus expenses. For example, if an investment portfolio holds assets worth $500,000, and generates $25,000 in dividends alongside $15,000 from interest over the year, the total investment income would amount to $40,000. Moreover, expenses such as management fees may reduce overall earnings. Accurate financial figures are crucial for stakeholders to assess asset performance, make informed decisions, and strategize for future enhancements, ensuring alignment with personal or corporate financial goals.

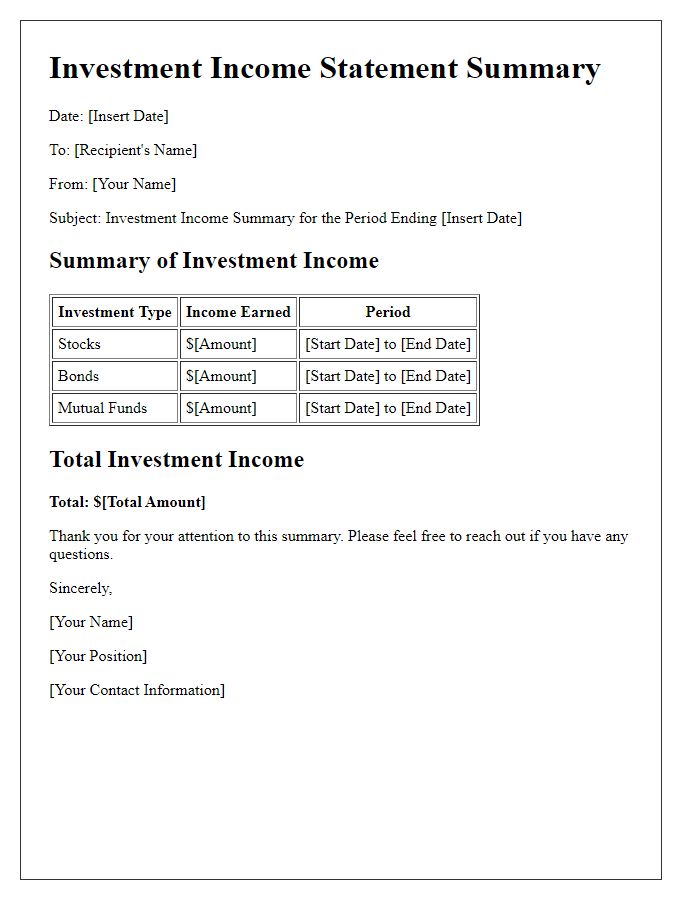

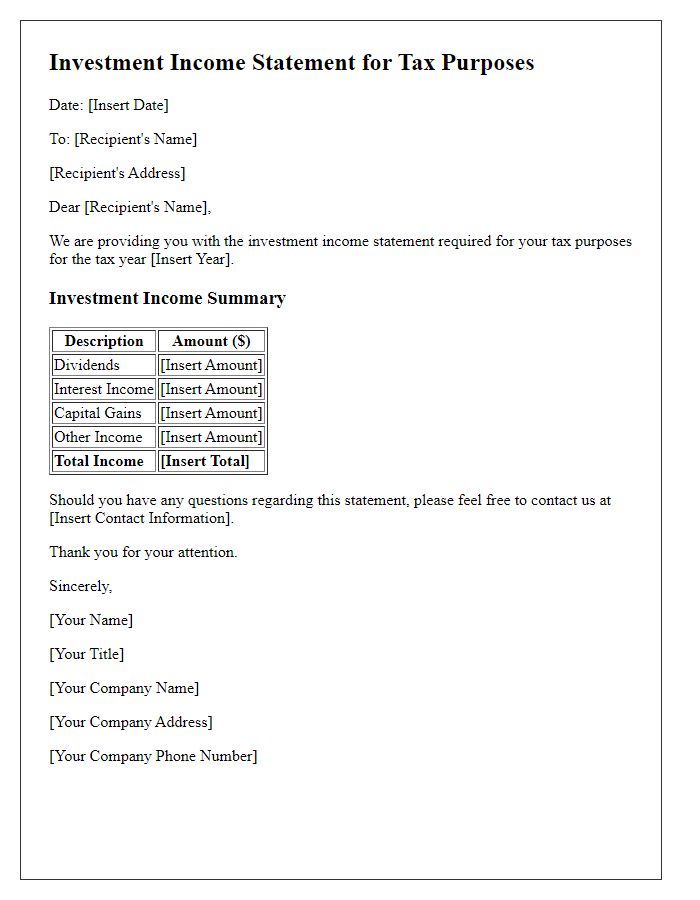

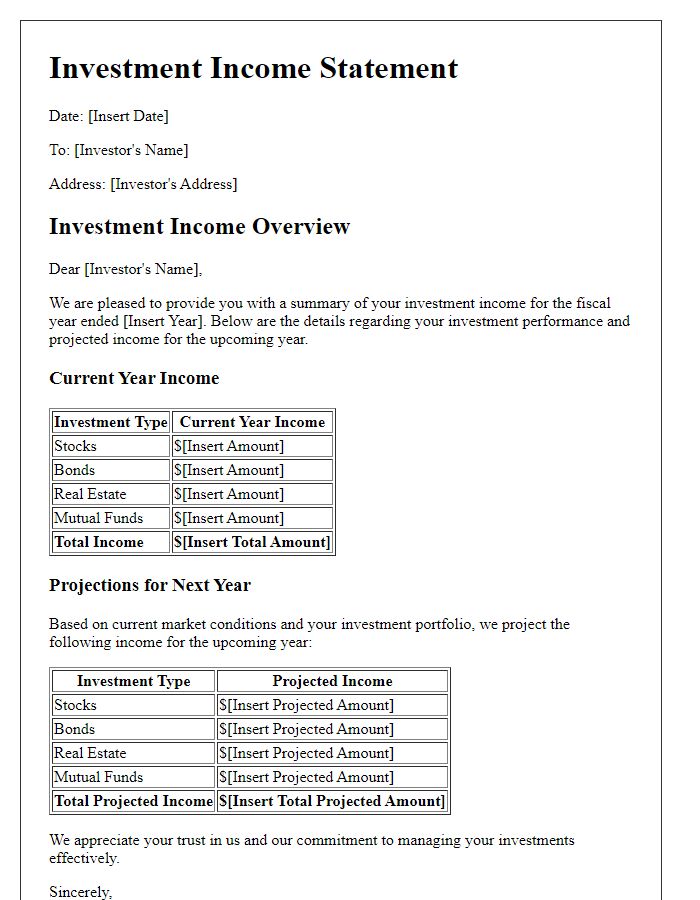

Clear income breakdown

Investment income statements provide a comprehensive overview of financial gains generated from various assets, such as stocks, bonds, and real estate. Key components include dividend income, which refers to cash payments distributed by corporations to shareholders, often on a quarterly basis. Interest income arises from the interest accrued on fixed-income investments, such as Treasury bonds, which may vary yearly based on the prevailing market rates. Capital gains represent the profitability realized from the sale of investments, calculated as the difference between the purchase price and the sale price, subject to taxation rates that can differ significantly depending on holding periods. A detailed breakdown is crucial for investors to assess their portfolios and make informed financial decisions.

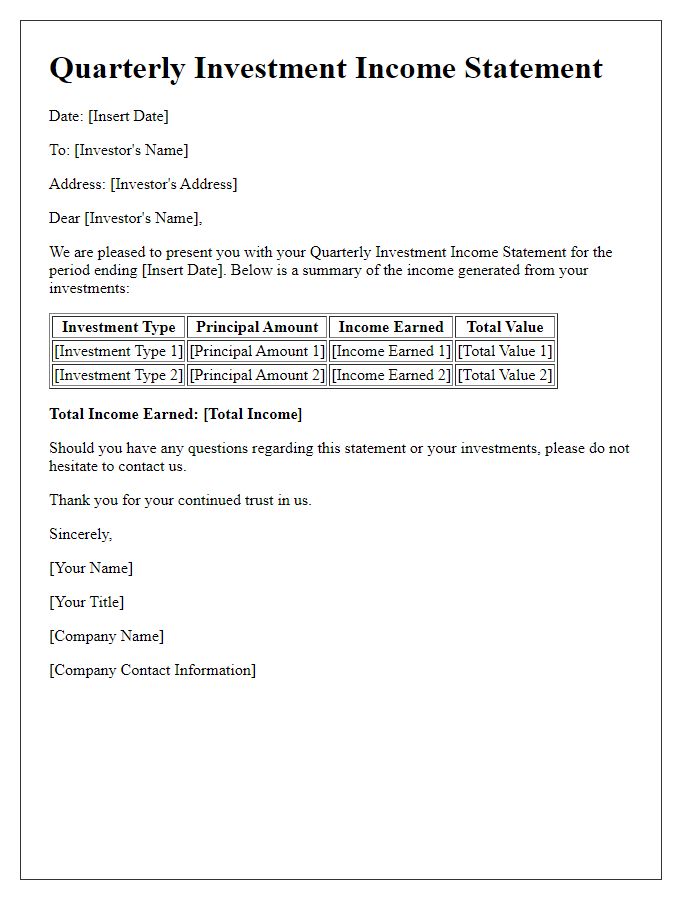

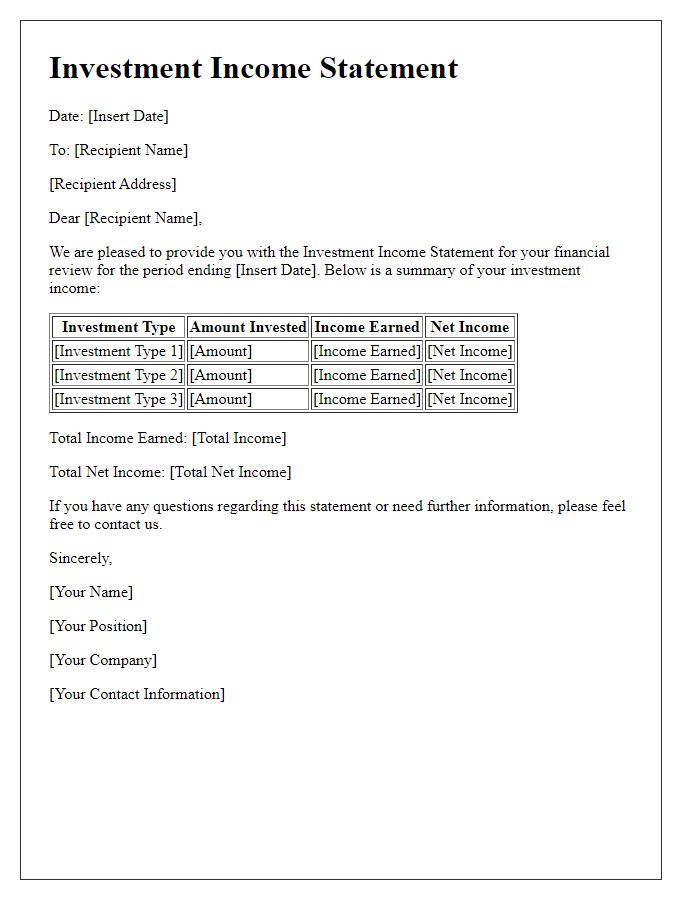

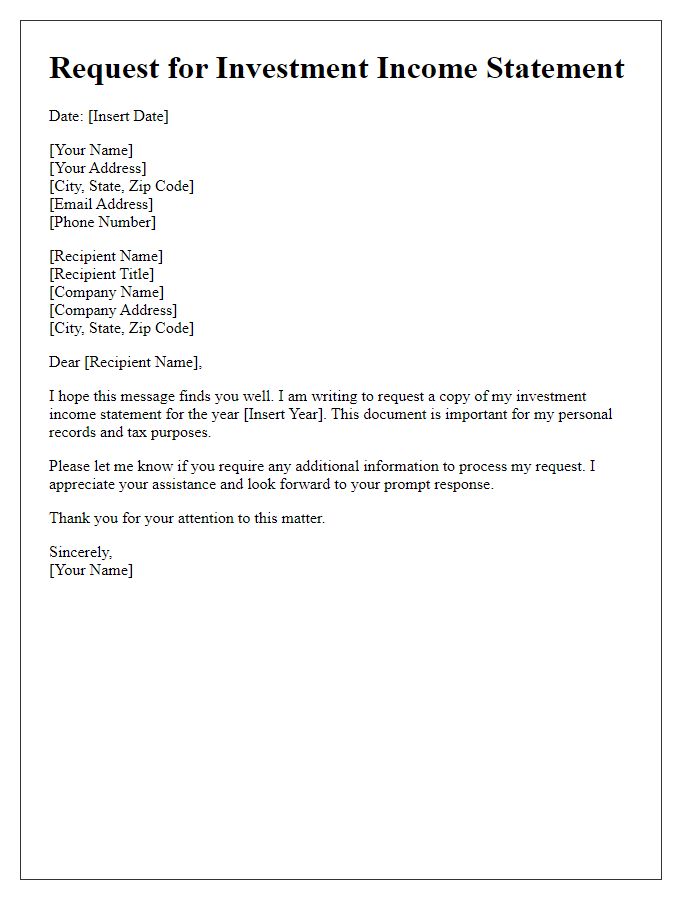

Investment performance summary

The investment performance summary provides a comprehensive overview of portfolio performance within a specific time frame, typically the fiscal year ending December 31, 2022. The report highlights key metrics such as total return, which includes both realized gains and unrealized gains or losses across various asset classes, including stocks, bonds, and real estate investments. Additionally, this summary may detail the performance of investment funds, indicating the percentage growth or decline relative to market benchmarks like the S&P 500 index or the Bloomberg Barclays U.S. Aggregate Bond Index. The report also addresses the impact of management fees and other expenses on net returns, providing transparency for stakeholders and investors in understanding the effective yield on their investments.

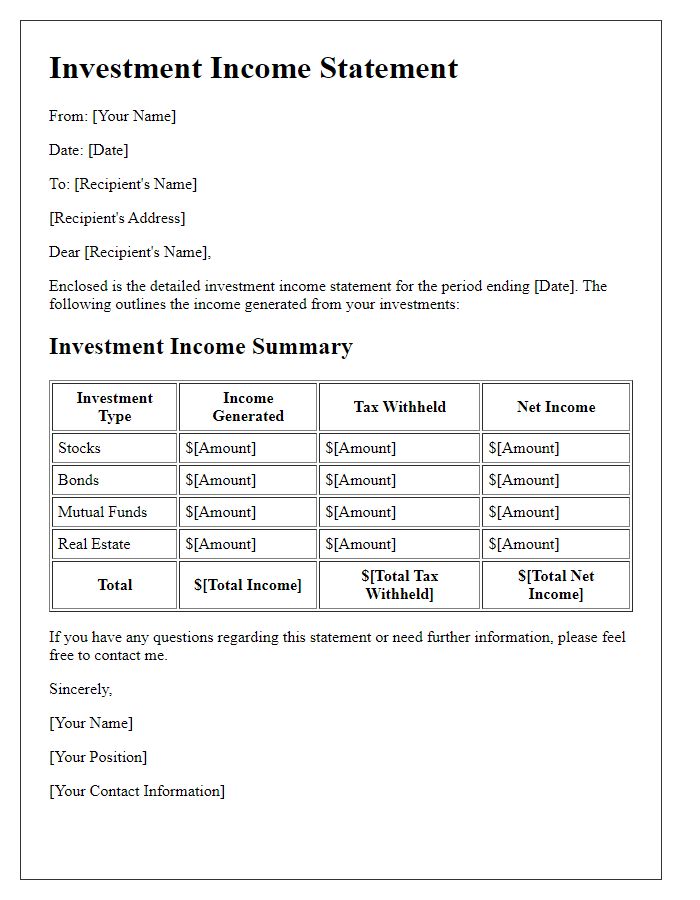

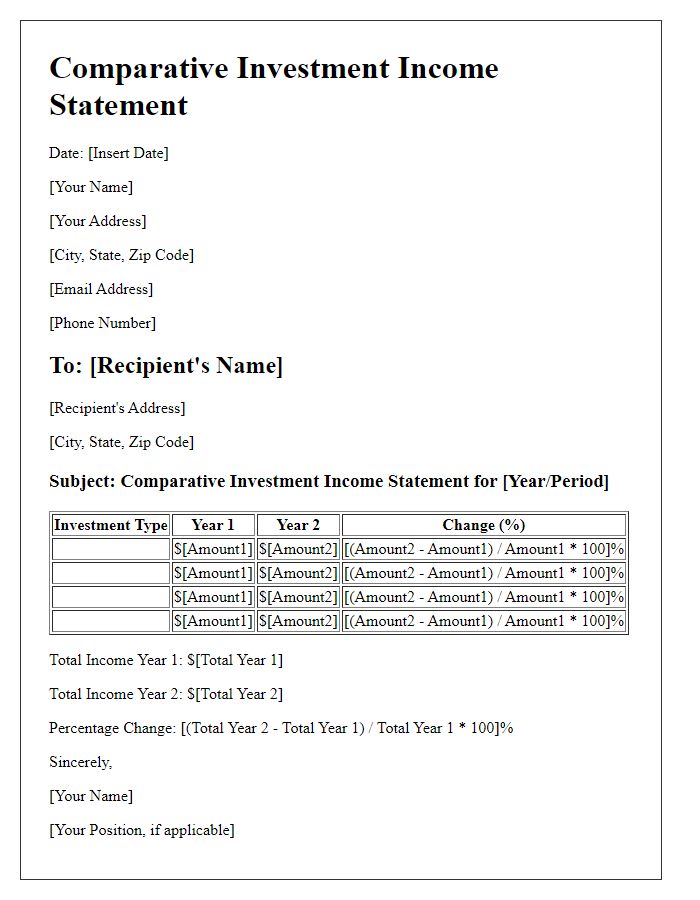

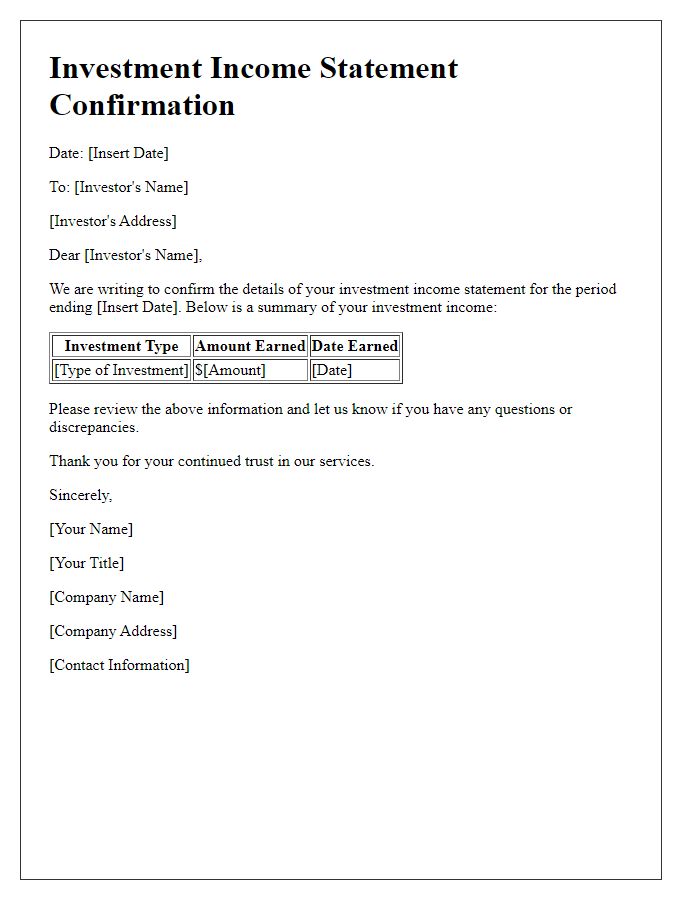

Consistent formatting style

An investment income statement highlights financial performance, detailing revenue generated from various investment assets. Key components include total income from dividends (for instance, $1,500 from stocks), interest earned (like $600 from bonds), and capital gains (such as $2,000 from real estate sales). The report typically features designated sections for each type of income, ensuring clarity through consistent formatting with headings, font styles, and bullet points for ease of reading. Additional notes on expenses related to management fees and taxes (for example, 15% on profits) provide a comprehensive overview of net income, assisting stakeholders in evaluating investment effectiveness and making informed decisions for future strategies.

Compliance with financial regulations

Investment income statements must comply with stringent financial regulations to ensure transparency and accuracy. These regulations include the Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) globally, which dictate how income, expenses, and profits should be recognized and reported. Non-compliance can result in legal penalties and loss of investor trust, affecting firms across various sectors, such as banking and asset management, which generate billions in revenues annually. Additionally, relevant agencies like the Securities and Exchange Commission (SEC) enforce rules to protect investors from fraudulent reporting practices, thus underscoring the importance of adherence to legal and ethical standards in financial reporting.

Comments