Have you ever checked your credit report only to find an unauthorized inquiry that you didn't recognize? It can be frustrating and concerning, especially if you're trying to maintain a good credit score. Understanding how to dispute these inquiries is essential for protecting your financial health. In this article, we'll guide you through the steps to effectively address unauthorized credit inquiries, so stick around to learn more!

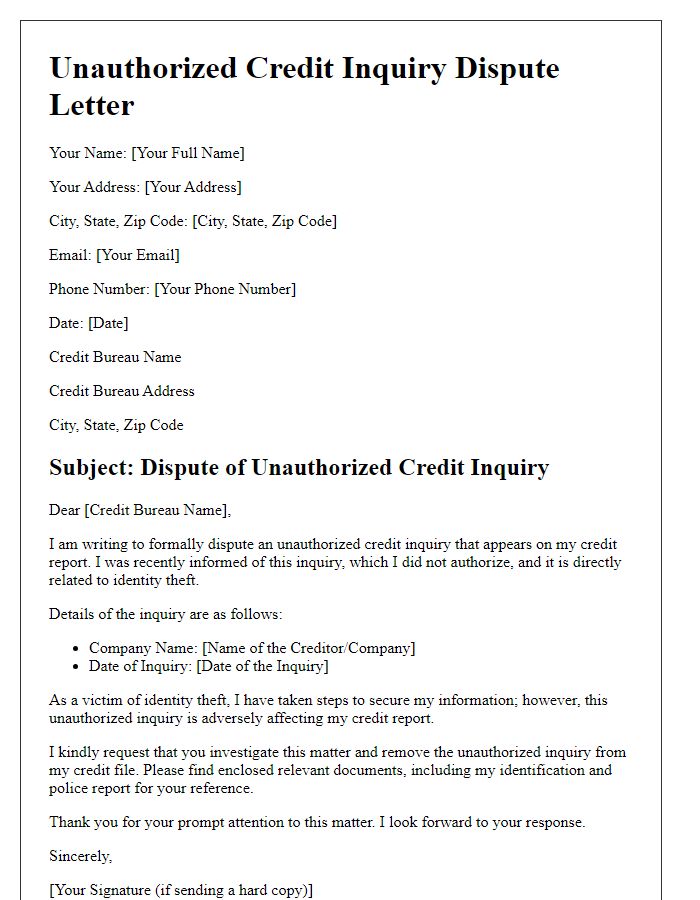

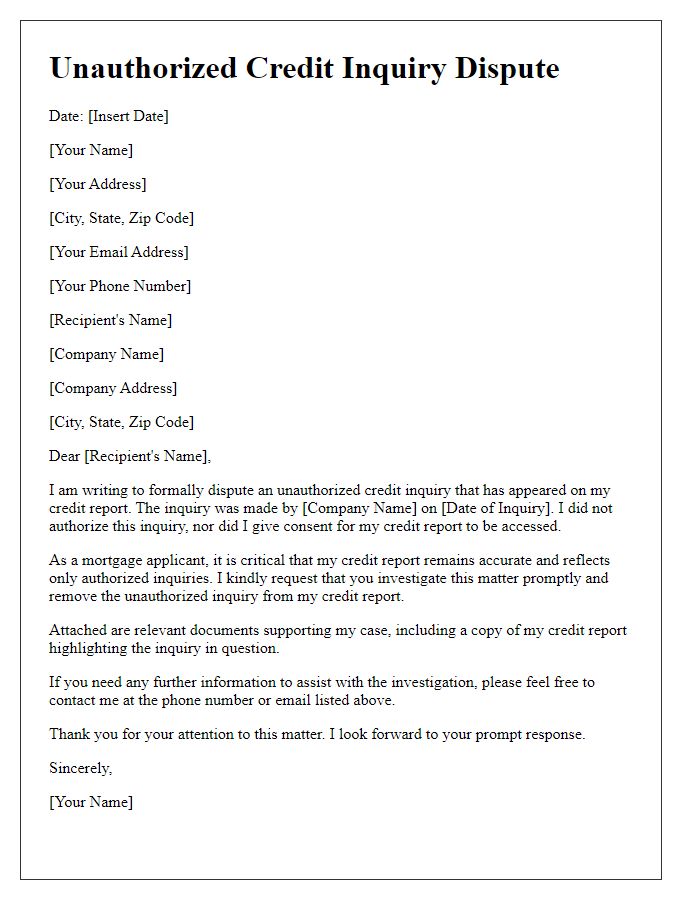

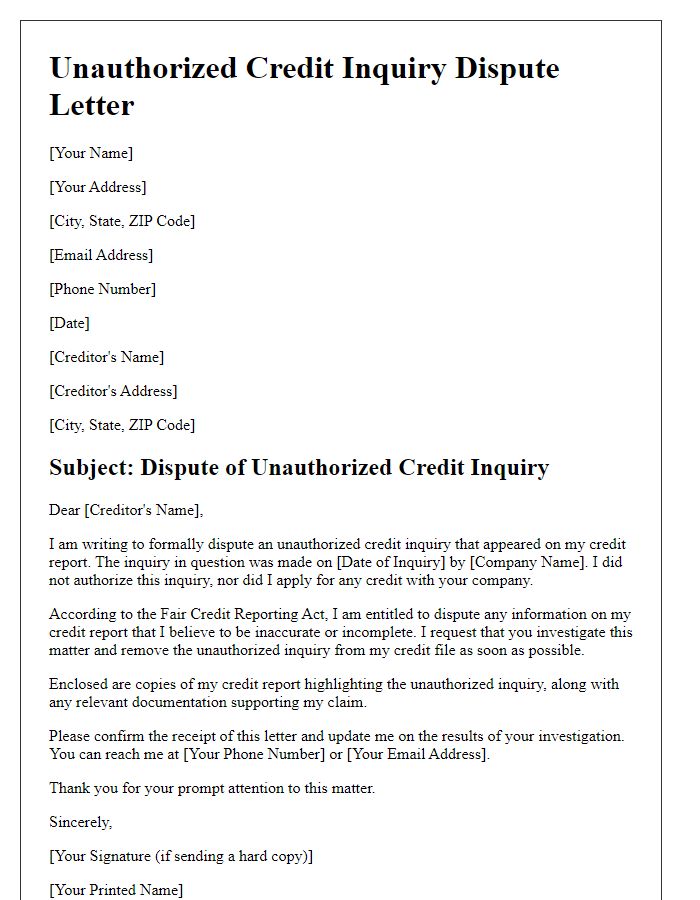

Recipient Information: Name, address, contact details.

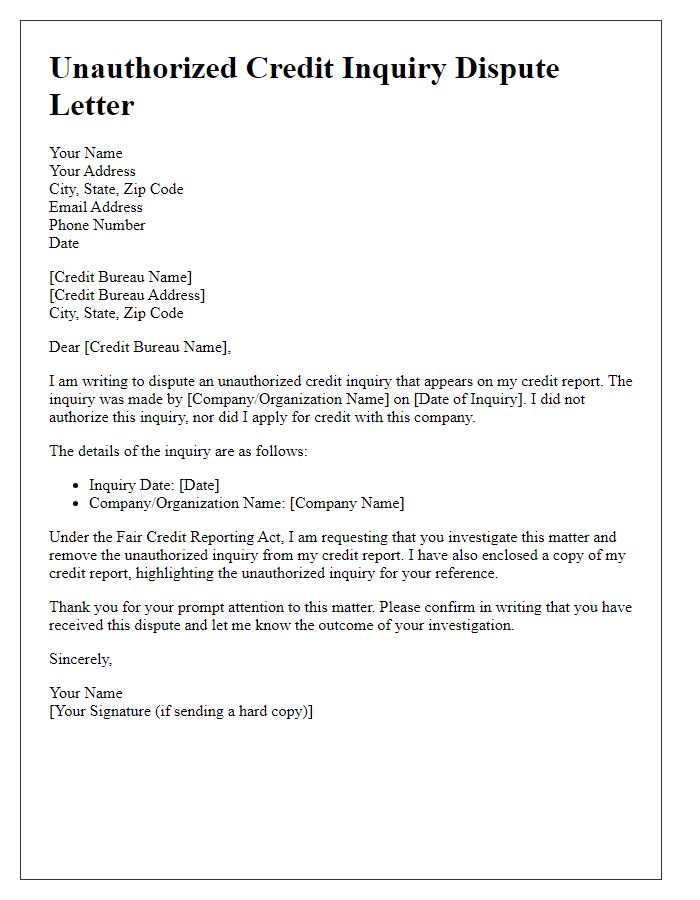

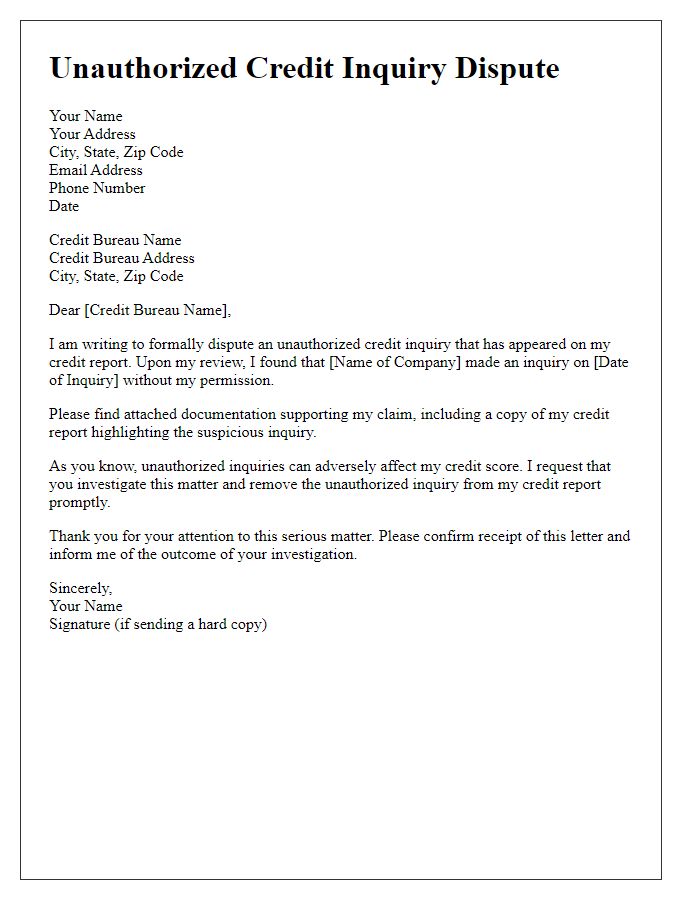

Unauthorized credit inquiries can negatively impact credit scores, leading to financial consequences in credit applications and loan approvals. Individuals must ensure to monitor their credit reports closely, particularly by utilizing services from major credit bureaus like Experian, TransUnion, and Equifax. Sending a dispute letter requires accurate recipient information, including the name of the credit agency, the address (usually found on their official website), and contact details for effective communication. This letter should assert the unauthorized nature of the inquiry, reference the specific date of the inquiry, and request its investigation and removal, with potential documentation supporting the claim provided for verification purposes.

Personal Identification: Full name, address, account number.

Unauthorized credit inquiries can significantly impact an individual's credit score, a crucial factor in determining loan eligibility and interest rates. When disputing such inquiries, personal identification information must be clearly outlined. This includes full name, ensuring accurate identification (e.g., John Michael Smith), current address, crucial for locating the individual's records (e.g., 123 Maple Street, Springfield, IL 62701), and account number, linking the inquiry to the specific credit account (e.g., Account #123456789). Proper presentation of this information in the dispute helps expedite resolution and aids in correcting any inaccuracies on the credit report.

Inquiry Details: Date of inquiry, creditor's name, reason for dispute.

Unauthorized credit inquiries can negatively impact credit scores and financial stability. A recent inquiry on September 15, 2023, from XYZ Financial Services raised concerns about its legitimacy. The inquiry was noted without proper consent, as outlined in the Fair Credit Reporting Act (FCRA). The unapproved access to sensitive credit information poses risks of identity theft and misleading credit assessments. Additionally, maintaining an accurate credit report is crucial for securing favorable loan terms and interest rates in future financial endeavors. Prompt resolution of this dispute is essential to ensure the integrity of the credit profile maintained with major bureaus such as Experian, Equifax, and TransUnion.

Legal References: Mention of FCRA rights and obligations.

Unauthorized credit inquiries can adversely affect an individual's credit score, which is a crucial factor in loan approvals and interest rates. The Fair Credit Reporting Act (FCRA), established in 1970, protects consumers by ensuring that their credit information is accurate and confidential. Under Section 604 of the FCRA, only entities with a permissible purpose may access a consumer's credit report. Unauthorized inquiries can lead to potential identity theft or credit fraud, emphasizing the importance of safeguarding personal information. Consumers have the right to dispute any inaccuracies, including unpermitted inquiries, by providing documentation to credit reporting agencies. Such disputes can initiate investigations that may remove erroneous entries from credit reports, thereby restoring credibility and improving overall financial health.

Action Requested: Correction, removal request, response deadline.

Unauthorized credit inquiries can significantly impact credit scores, potentially affecting future loan approvals. A dispute letter should contain details such as the date of the unauthorized inquiry, the name of the creditor, and the reason for disputing the inquiry. A clear request for correction or removal of the inquiry must be included alongside a specified deadline for response, typically 30 days from receipt of the letter, in accordance with the Fair Credit Reporting Act (FCRA). This ensures adherence to legal requirements and encourages a timely response from credit reporting agencies. Supporting documentation may strengthen the case, ensuring the dispute is processed effectively and efficiently.

Letter Template For Unauthorized Credit Inquiry Dispute Samples

Letter template of unauthorized credit inquiry dispute for identity theft victims.

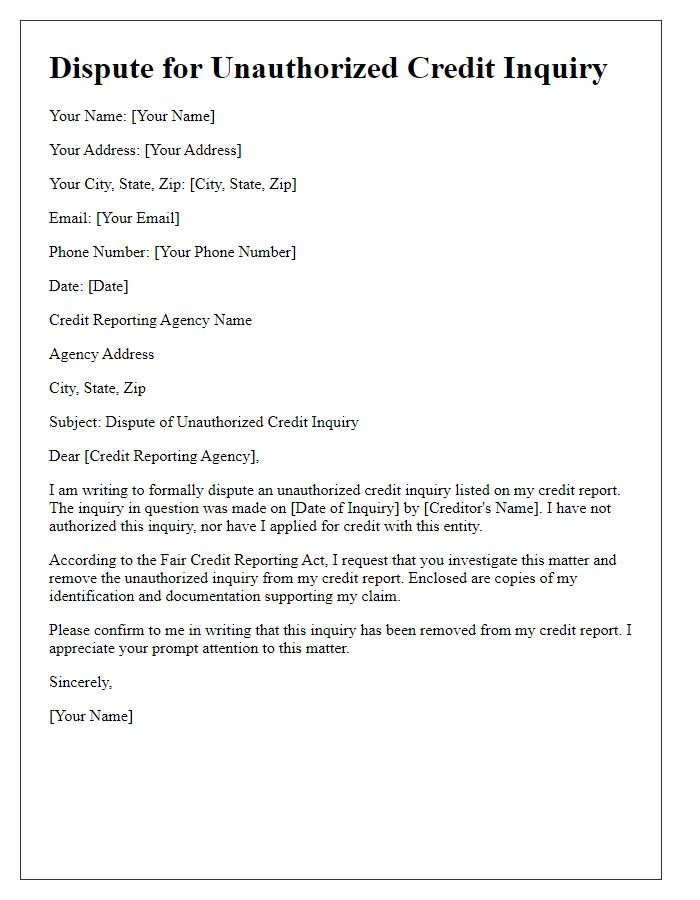

Letter template of unauthorized credit inquiry dispute for credit report inaccuracies.

Letter template of unauthorized credit inquiry dispute for mortgage applicants.

Letter template of unauthorized credit inquiry dispute for loan applications.

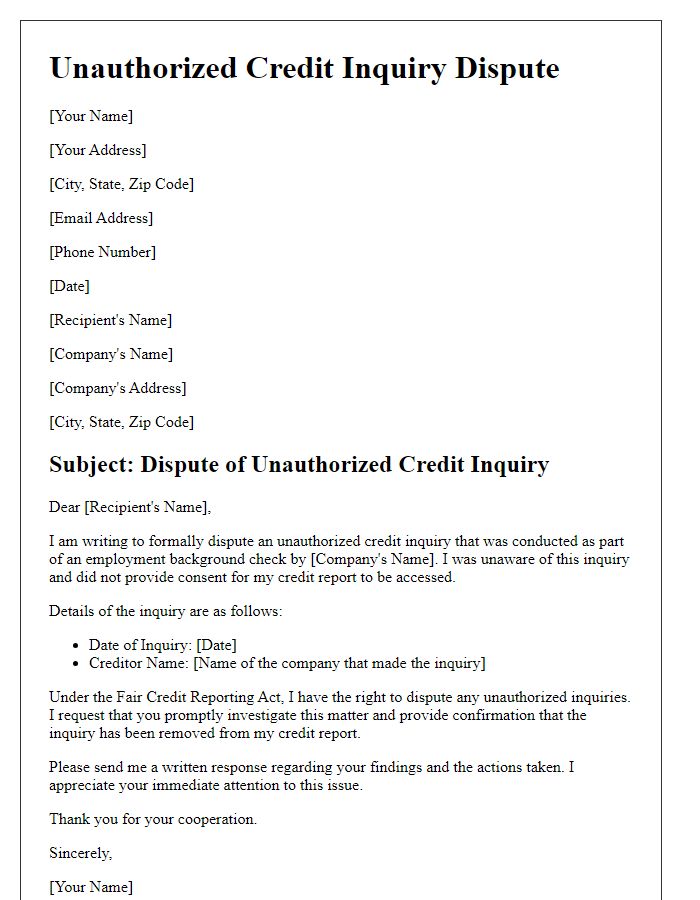

Letter template of unauthorized credit inquiry dispute for employment background checks.

Letter template of unauthorized credit inquiry dispute for personal finance management.

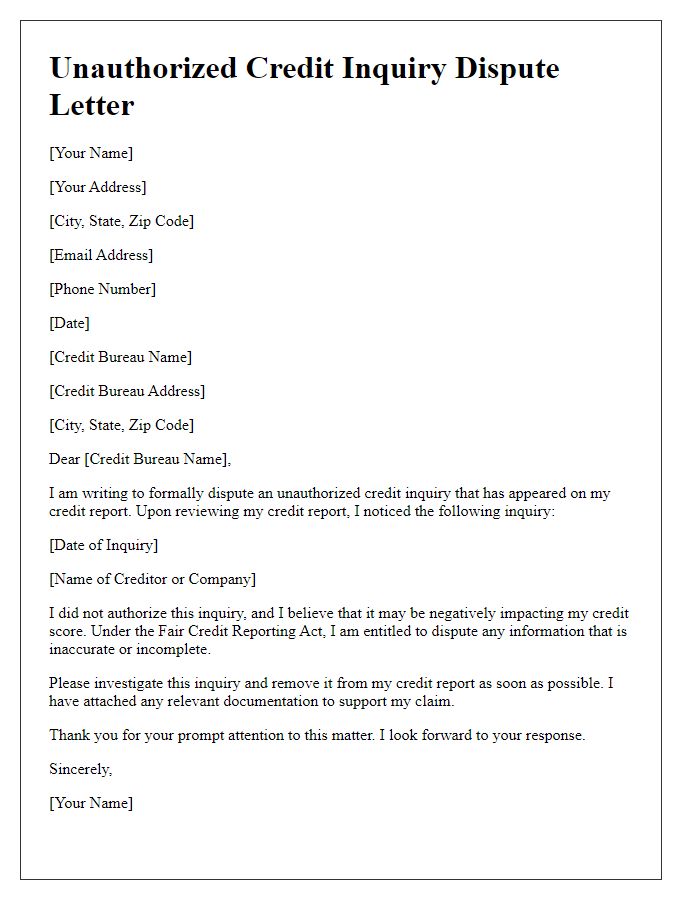

Letter template of unauthorized credit inquiry dispute for credit score improvement.

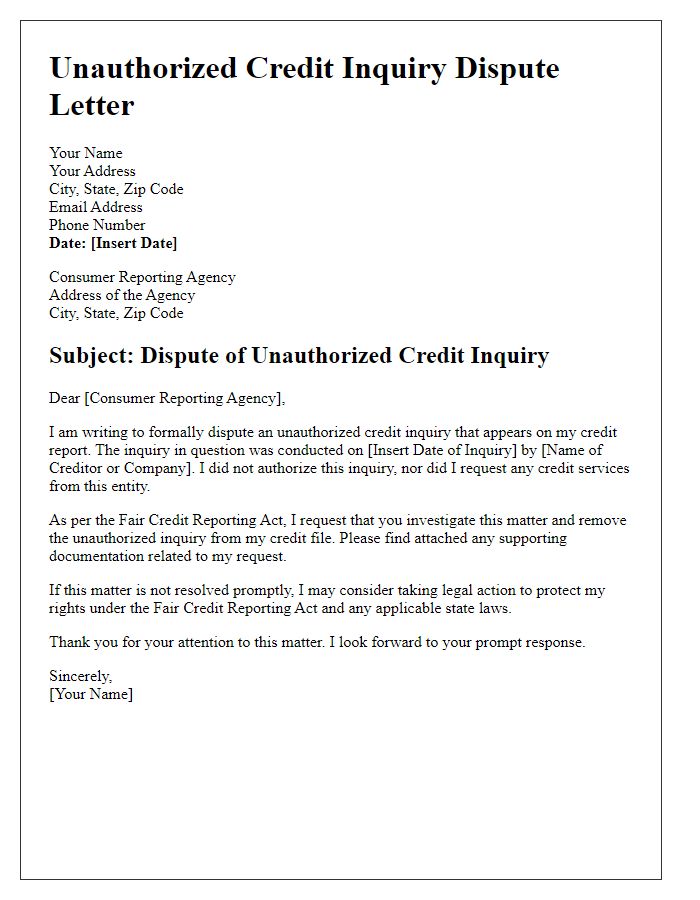

Letter template of unauthorized credit inquiry dispute for legal action considerations.

Comments