Are you struggling to navigate the financial hurdles life has thrown your way? Many of us find ourselves in challenging situations that require a bit of explanation and documentation, especially when seeking assistance or support. Crafting a clear and compassionate letter can make all the difference in conveying your current circumstances to those who can help. If you're ready to tackle this important task, join us as we explore effective letter templates for documenting financial hardship.

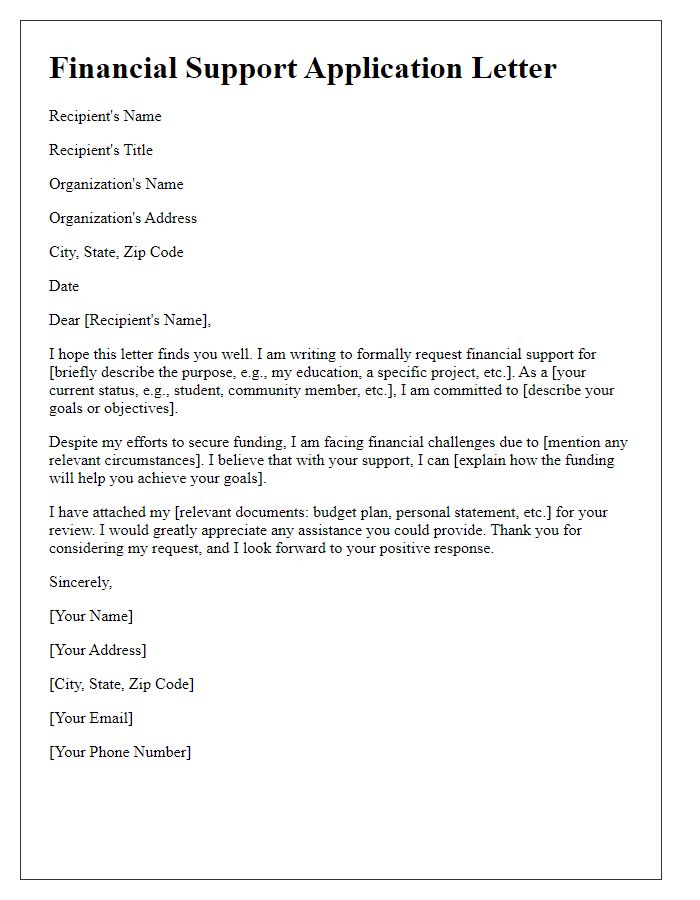

Personal and Contact Information

Financial hardship documentation often requires comprehensive personal and contact information for verification and processing. Essential details include full name, such as John Doe; residential address, for example, 123 Main Street, Springfield, IL, 62701; phone number, ideally a mobile, such as (555) 123-4567; and email address, like johndoe@email.com. Additional relevant data may encompass Social Security Number (SSN) or tax identification number (TIN), along with the date of birth to establish identity, such as January 15, 1980, and any dependent information if applicable. Documenting employment status, including job title, employer's name, and duration of employment, for instance, Sales Associate at XYZ Corp for 5 years, also aids in illustrating the financial situation comprehensively.

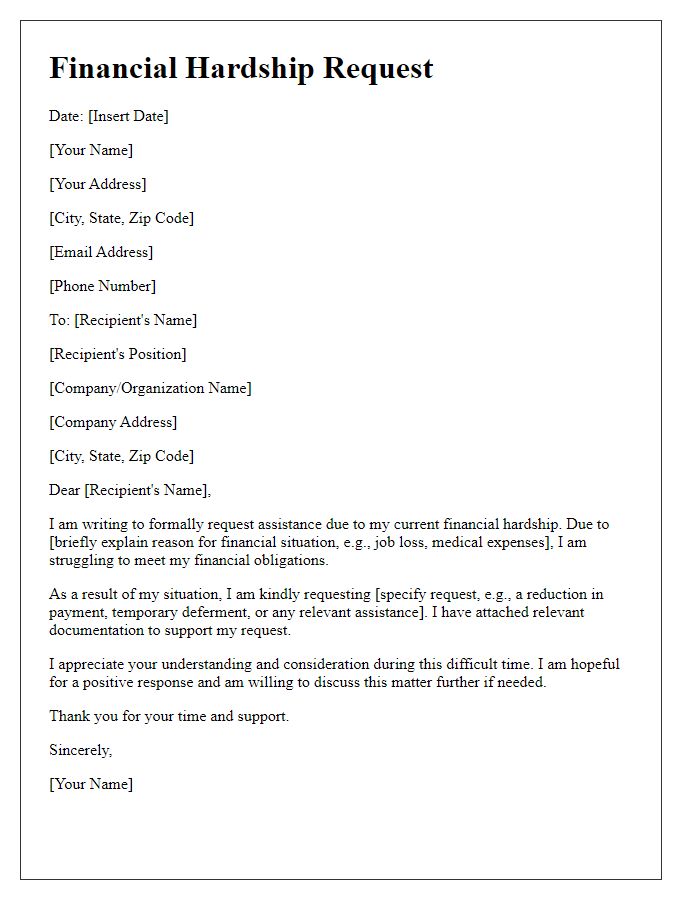

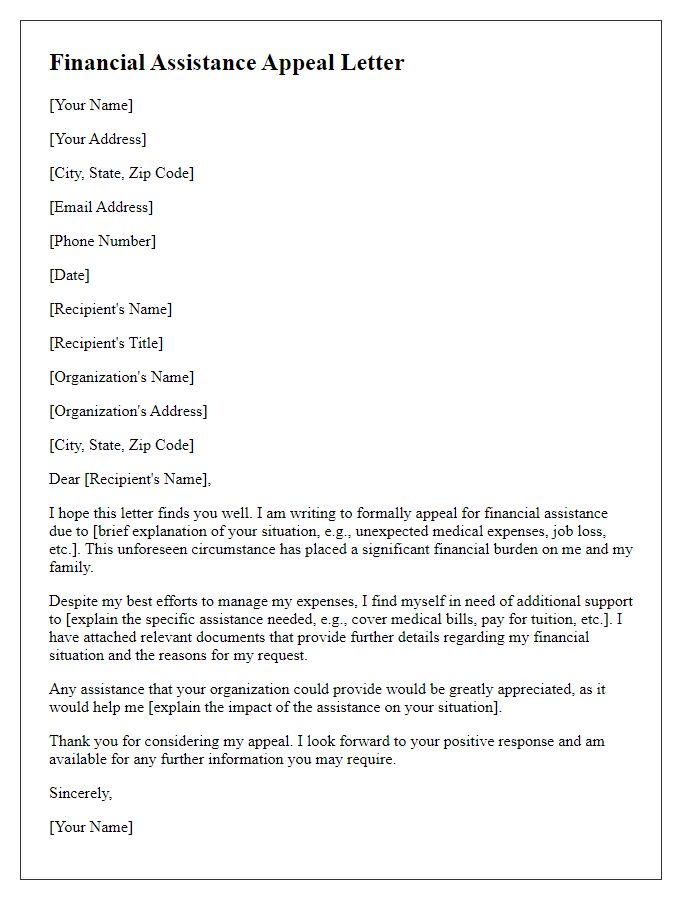

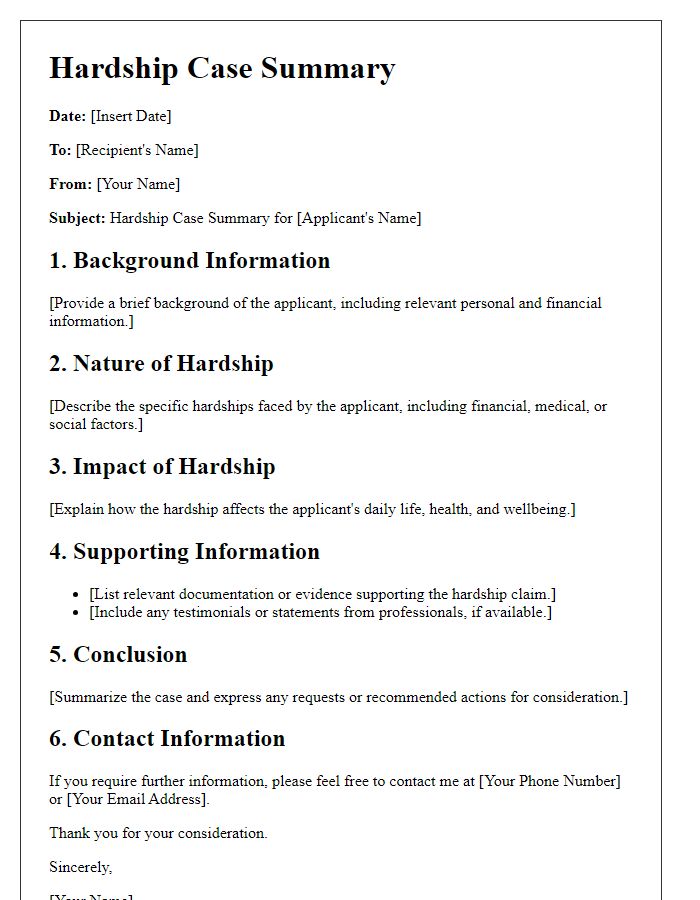

Detailed Description of Hardship

A letter template for financial hardship documentation serves as a formal written format designed to articulate the specifics of an individual's financial difficulties. This crucial document typically includes personal identification details, such as the recipient's name and contact information, alongside a clear and concise description of the circumstances leading to financial strain. Essential elements often involve job loss, medical expenses, or unexpected emergencies that contribute to an inability to meet financial obligations. Highlighting the emotional and practical implications of the hardship, this letter aims to evoke empathy and understanding from the recipient, which may include creditors, lenders, or social service agencies. Clarity and honesty in detailing the situation are vital, as this template ultimately seeks to convey a genuine appeal for assistance or leniency.

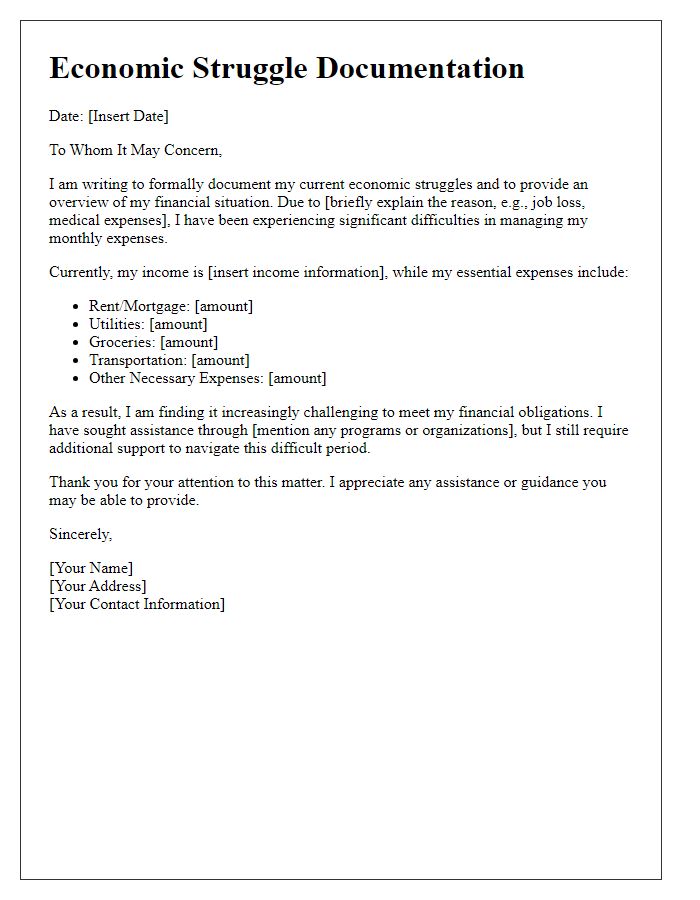

Income and Expense Overview

Many individuals facing financial hardship must provide a detailed income and expense overview to qualifying for assistance programs. This overview typically includes monthly income from various sources like wages, social security benefits, child support, or unemployment compensation. Significant expenses include housing costs such as rent (average rent in urban areas can reach $2,500), utilities (electric, water, and gas), groceries (approximately $400 for a small family), transportation, and healthcare expenses. Detailed records of these figures help organizations assess eligibility for financial aid programs, allowing individuals to demonstrate their financial challenges effectively and seek necessary support. Providing this documentation is crucial for navigating situations of distress and accessing resources needed to regain stability.

Supporting Documentation List

Financial hardship documentation often requires comprehensive evidence to substantiate claims. Essential documents may include recent pay stubs (dating within the last 30 days) to verify income levels, bank statements (covering the last three months) to showcase financial behavior, tax returns (for the previous year) for accurate income reflection, and proof of expenses such as utility bills (not older than 60 days) illustrating monthly obligations. Additional documents like a letter of termination (if applicable) from employers can clarify unemployment status, while medical bills (showing outstanding balances) may reveal unexpected financial burdens. Lastly, any relevant agreements (such as lease or mortgage documentation) should be included to indicate monthly financial commitments.

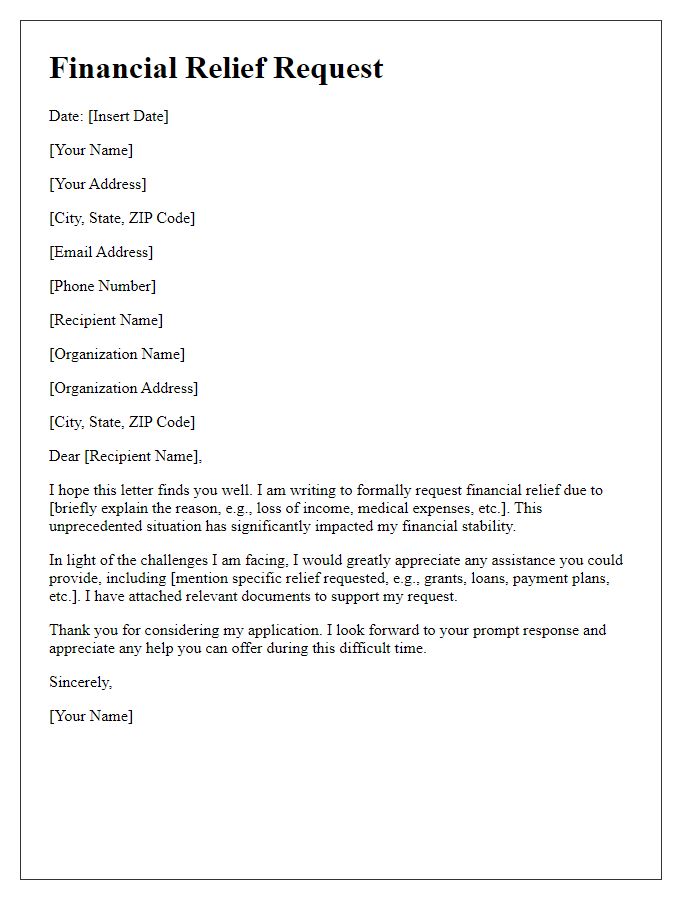

Statement of Intent and Request

Financial hardship affects individuals and families across various demographics, necessitating a formal documentation process to convey their circumstances. A statement of intent typically outlines the reasons behind financial difficulties, which may include unexpected medical bills, job loss, or significant life events such as divorce. The request portion often seeks assistance from organizations, creditors, or government agencies, detailing specific help needed, such as reduced payments, deferment options, or access to emergency funds. These statements may also highlight relevant laws or programs in place, like the Federal Housing Administration guidelines for mortgage relief, which can support individuals facing economic challenges.

Comments