If you're feeling the strain of mounting business debts, you're not alone. The world of finance can be daunting, and many entrepreneurs find themselves needing to negotiate more manageable terms. Crafting a thoughtful letter can open the door to discussions that alleviate some of the financial pressure. Curious about how to navigate this delicate conversation? Let's dive deeper into creating an effective debt negotiation letter that can help you find relief.

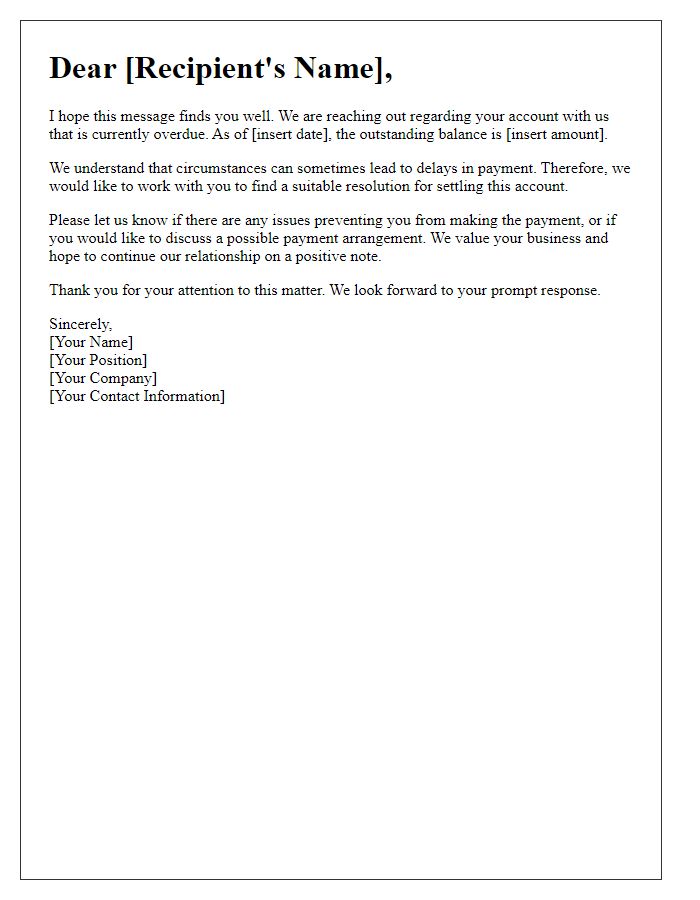

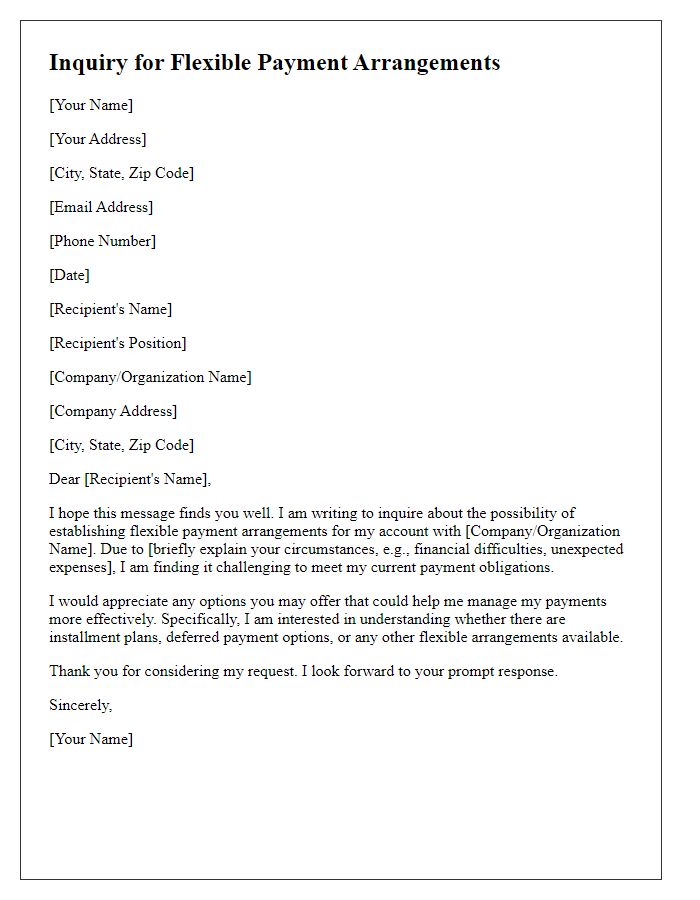

Polite and Professional Tone

Effective debt negotiation strategies require careful planning and communication. A well-structured letter can set the tone for a productive discussion. Key components should include a clear statement of the outstanding debt, the amount owed, and the original payment terms. It's vital to emphasize the desire for a mutual resolution, expressing willingness to explore flexible repayment options. A professional tone should be maintained throughout, reaffirming the long-standing business relationship and commitment to settling the debt satisfactorily. Additionally, providing specific examples of current financial challenges facing the business can support the negotiation process.

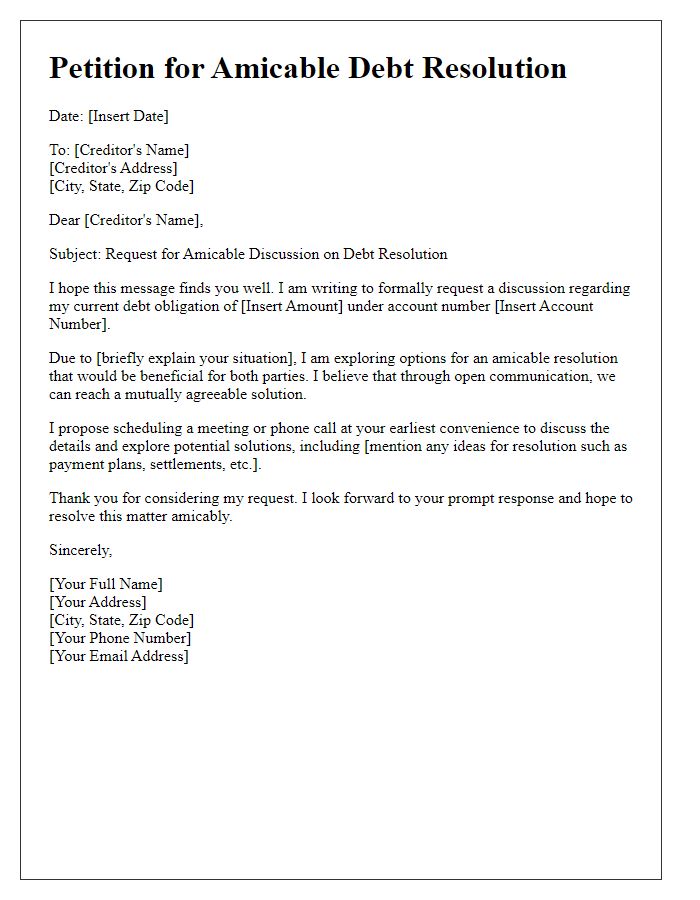

Clear Identification of Parties Involved

In the context of business debt negotiation, a clear identification of the parties involved establishes the foundation for effective communication and resolution. The creditor, a company or financial institution that provided the loan or credit, must be distinctly noted, including their official name, contact information, and relevant account or invoice numbers. The debtor, typically the business entity seeking negotiation, should also be clearly identified with their registered name, contact details, and legal business registration number. Further details about the original debt amount, terms of the agreement, and any outstanding balances play a crucial role in the negotiation process. Establishing these identities accurately ensures transparency, reduces misunderstandings, and facilitates a smoother negotiation that can lead to a mutually beneficial outcome.

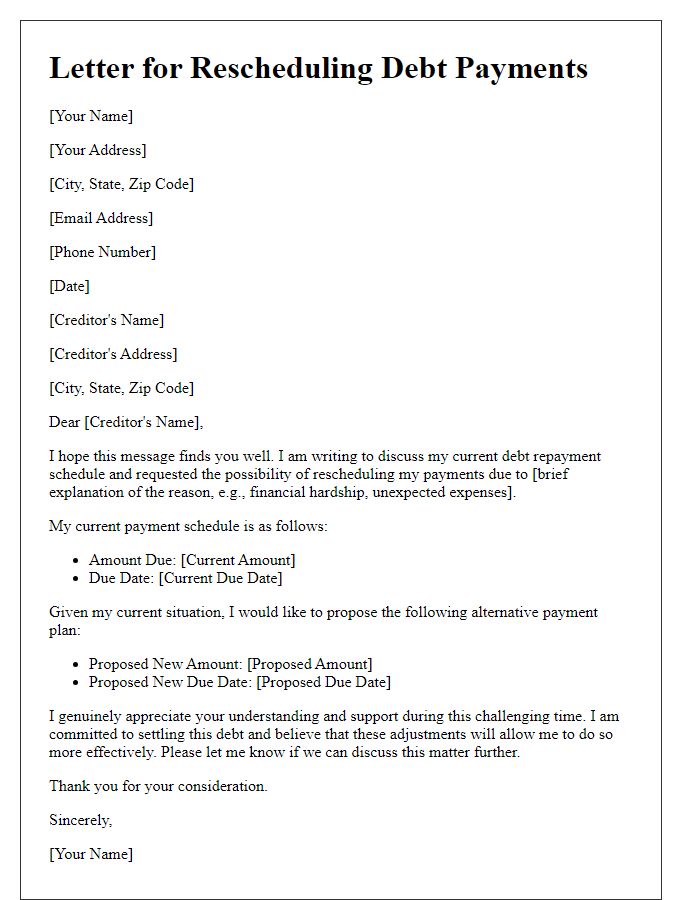

Specific Details of Debt Amount and Terms

A business debt negotiation request should outline critical details such as the outstanding balance of $50,000 owed by Company XYZ to Lender ABC, established due to a loan agreement signed on January 15, 2022, with a 6% interest rate. The original repayment period was set for 24 months, ending on January 15, 2024. Due to unexpected market fluctuations in the retail sector, Company XYZ seeks to renegotiate the terms to extend the repayment period by an additional 12 months, proposing revised monthly payments of $2,500, more manageable given the current cash flow constraints. An open dialogue between both parties could lead to a mutually beneficial resolution, ensuring the lender receives repayment while allowing the borrower to maintain operational stability amidst financial challenges.

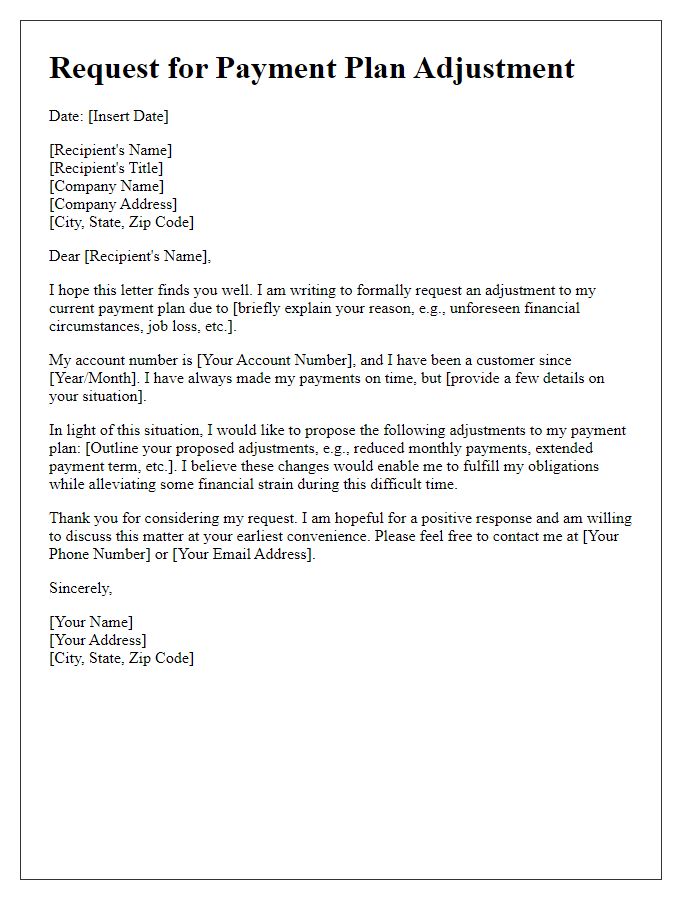

Proposed Negotiation Terms or Solutions

A business debt negotiation involves presenting a proposal to adjust payment terms or reduce the overall debt amount owed. The process typically requires detailed financial information, such as remaining balance, interest rates, and payment history. Specific negotiation terms may include a request for reduced monthly payments, extended repayment periods, or a settlement for less than the full amount owed. Additional solutions could involve offering collateral, agreeing upon a lump-sum payment option, or refinancing the debt, potentially leading to lower interest rates. Effective communication during this process is crucial, as it influences the willingness of creditors to adjust terms favorably for the business's financial health.

Contact Information and Call to Action

Many businesses encounter challenges with outstanding debts, necessitating negotiations for better payment terms. Effective communication is crucial in this process. Clear contact information, including phone numbers, email addresses, and physical addresses, ensures swift responses. A persuasive call to action encourages prompt follow-up, urging the recipient to consider the proposed arrangement seriously. Creating a concise yet compelling message outlines the importance of resolving such matters amicably while fostering a long-term professional relationship. Engaging tone and professional language enhance the overall impact, facilitating constructive dialogue aimed at a mutually beneficial agreement.

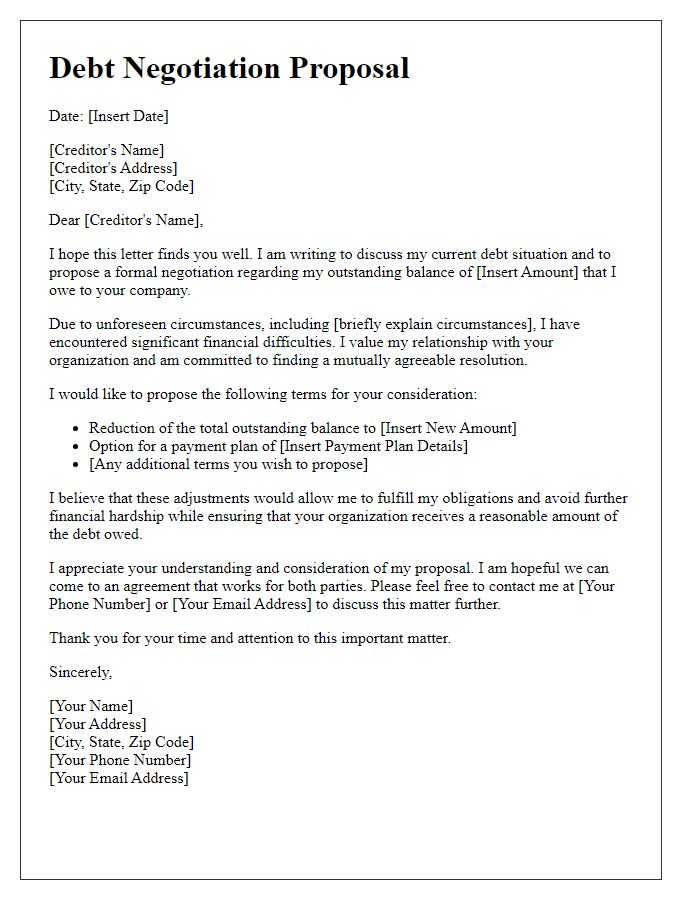

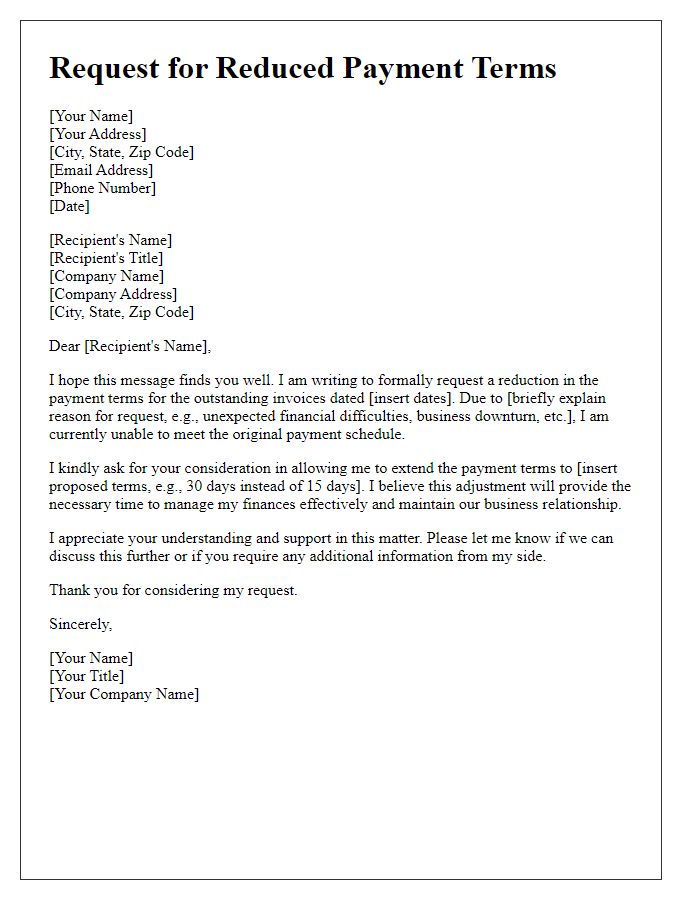

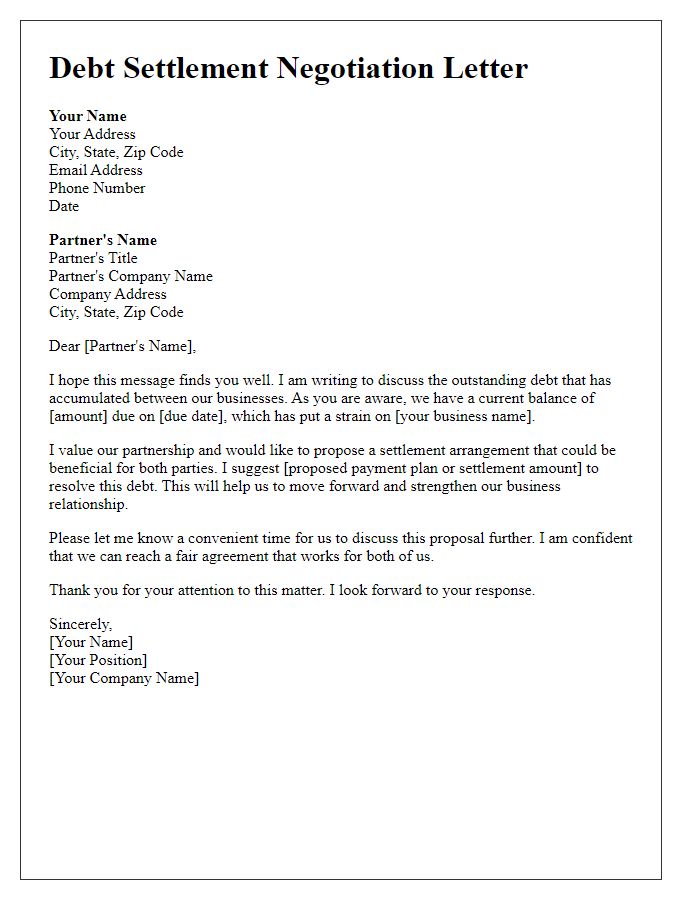

Letter Template For Business Debt Negotiation Request Samples

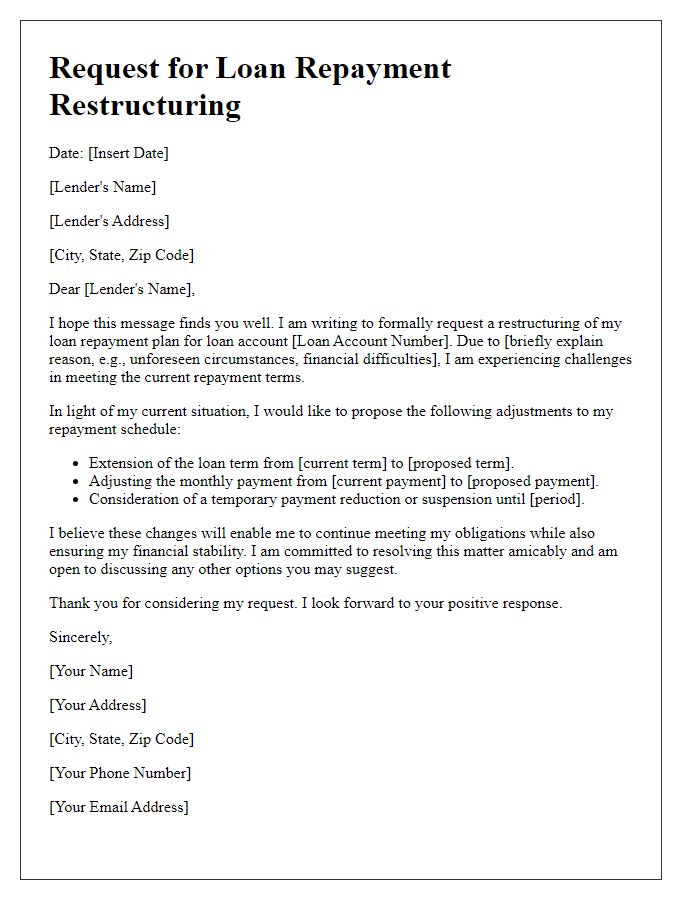

Letter template of negotiation request for loan repayment restructuring.

Comments