Are you feeling frustrated over an unpaid balance that doesn't seem right? You're not alone, as many find themselves in similar situations when managing their finances. Equally important is addressing these discrepancies promptly to ensure your records are accurate and up-to-date. Dive in to discover how to craft the perfect letter to dispute an unpaid balance error and take back control of your financial standing!

Clear subject line and recipient information.

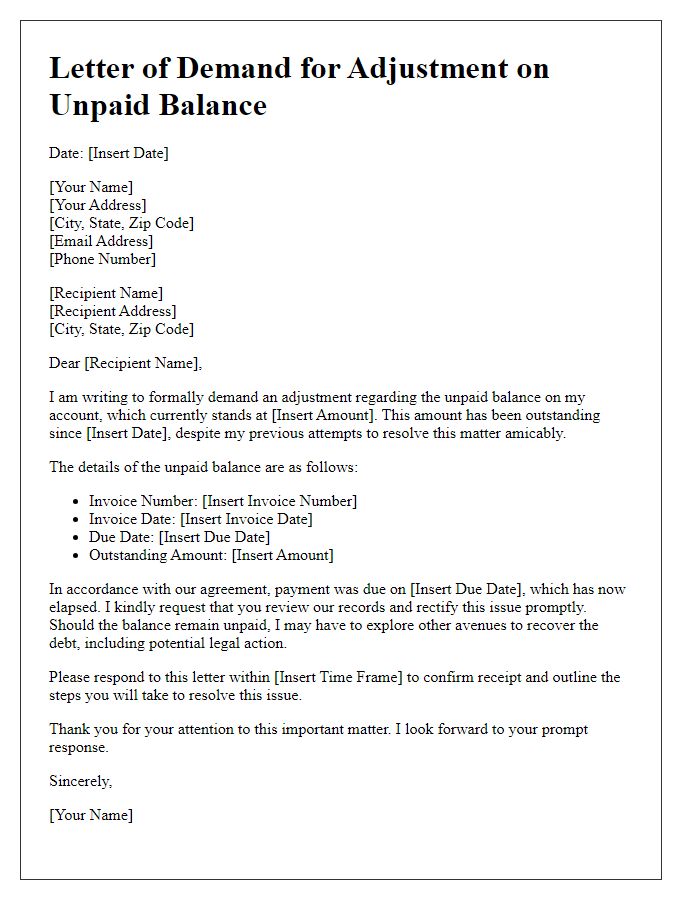

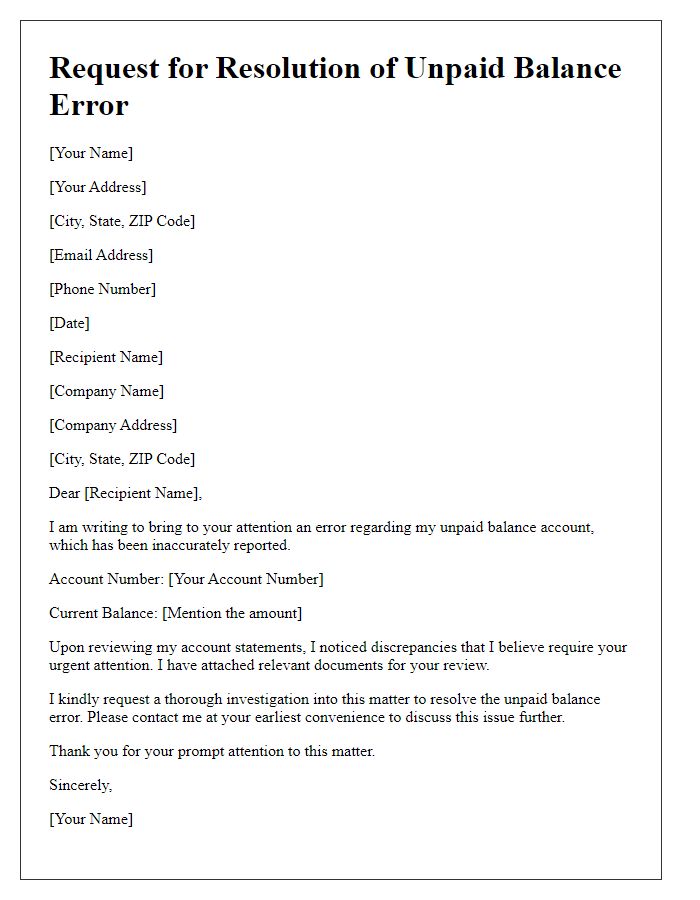

An unpaid balance error can greatly affect financial records and credit scores. A clear and concise subject line, like "Dispute of Unpaid Balance Account #12345," can immediately identify the purpose of the correspondence. Including specific recipient information such as the name of the account manager, company name, and address ensures proper handling of the dispute. Essential details include the date of the initial transaction, the amount in question, and any relevant account statements that support the claim. Providing a timeline of communication attempts, including dates and summary of discussions, strengthens the request for resolution. Documentation such as payment confirmations or receipts highlights the accuracy of presented facts and emphasizes the urgency of rectifying the error.

Account details and disputed amount.

Account details such as account number 123456789 reflect an unpaid balance error of $1,250. This discrepancy has been consistently noted since May 2023 on monthly statements from XYZ Financial Services, leading to confusion regarding payment obligations. Detailed invoices dated April 2023 and June 2023 exhibit differences in recorded transactions, indicating possible clerical errors. It is imperative to clarify this situation to avoid further implications such as credit score impacts or collection agency involvement, given that erroneous reports can adversely affect financial credibility.

Explanation of the error and supporting documents.

Unpaid balances can often arise from discrepancies in billing statements. An example of such an error might involve a credit card account balance reported by a financial institution like Chase Bank, which can incorrectly list a $500 charge from an unauthorized transaction. Supporting documents for this dispute may include previous billing statements from the last three months, showing no such charges, alongside a police report detailing the fraudulent use of the card. Relevant communication records, such as emails or letters sent to the bank disputing the charge, should also be included to substantiate the claim. Timely resolution is crucial, as disputes can affect credit scores if unresolved, further complicating financial situations.

Request for correction and updated balance.

Disputing unpaid balance errors requires clear communication and attention to specific details. In cases of inaccurate billing statements, individuals should reference account numbers, specific transaction dates, total amounts claimed as due, and the nature of the dispute, such as bill discrepancies or unauthorized charges. Financial institutions, such as banks or credit card companies, may be involved, often requiring a formal request for correction. It's essential to specify any supporting documentation attached, like copies of receipts or previous statements, to validate the claim. A prompt response is typically expected within certain time frames defined by consumer protection laws, which can vary by state or country. Maintaining records of all correspondence is important for follow-up and future reference.

Contact information and preferred response method.

Disputing an unpaid balance error requires clarity and organization. A well-structured document includes sender's contact information (name, address, phone number, email), which should be accurate and up-to-date to ensure effective communication. The preferred response method could involve specifying whether contact should occur via email or a phone call, outlining the best times for availability. Details of the disputed balance--such as account number, amount, and dates--should also be clearly presented to aid in the resolution process. Highlighting the preferred resolution outcome--such as correcting the account balance or receiving a written explanation--helps guide the response.

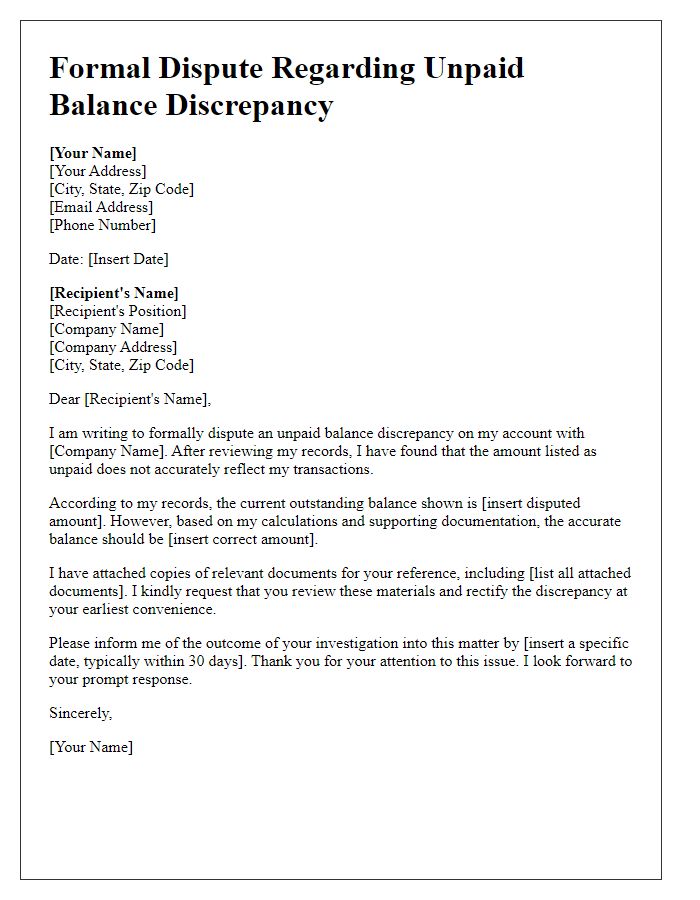

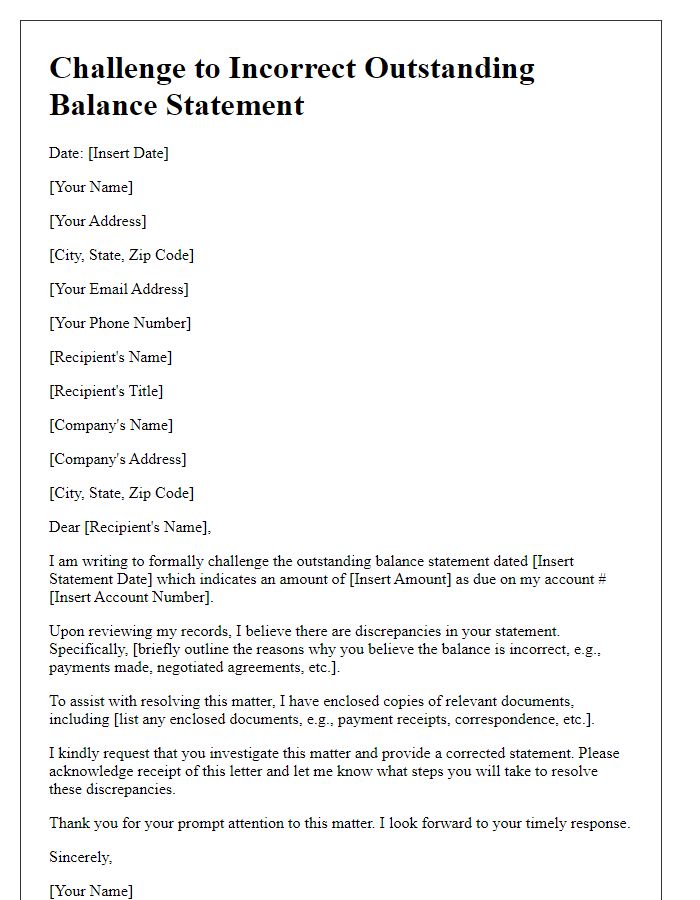

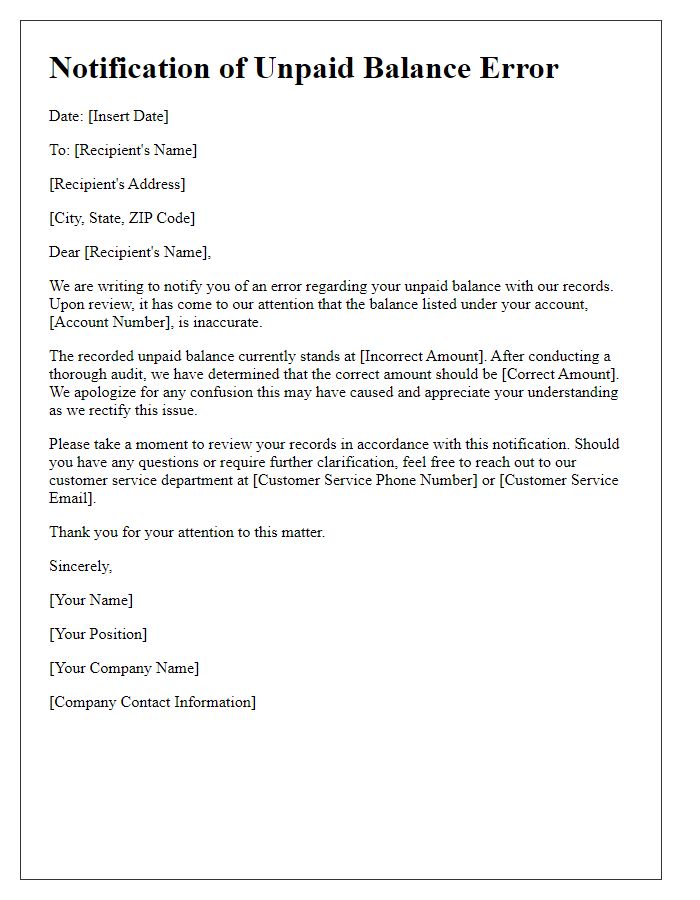

Letter Template For Disputing Unpaid Balance Error Samples

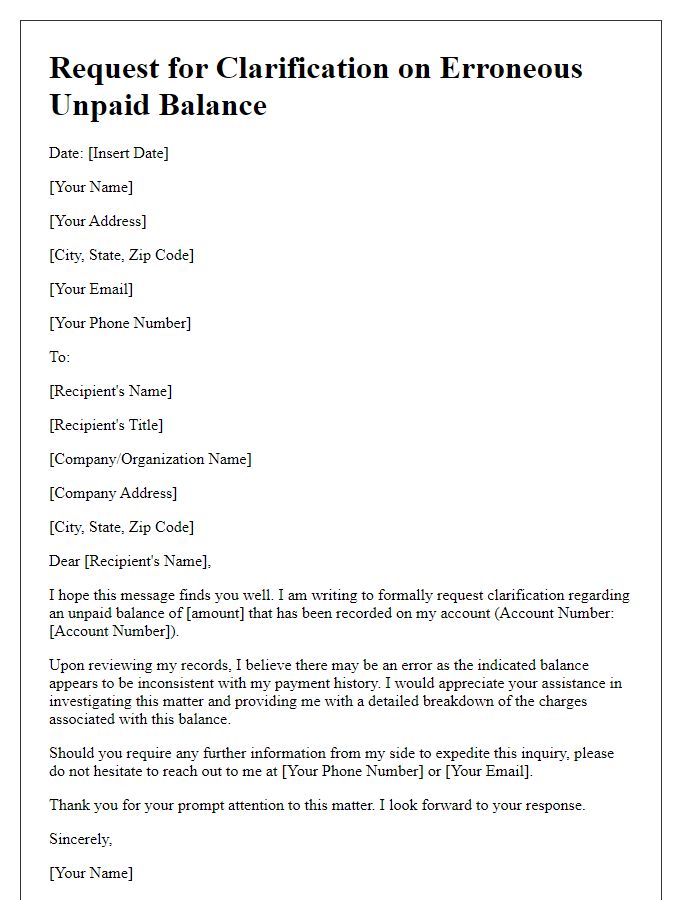

Letter template of request for clarification on erroneous unpaid balance

Comments