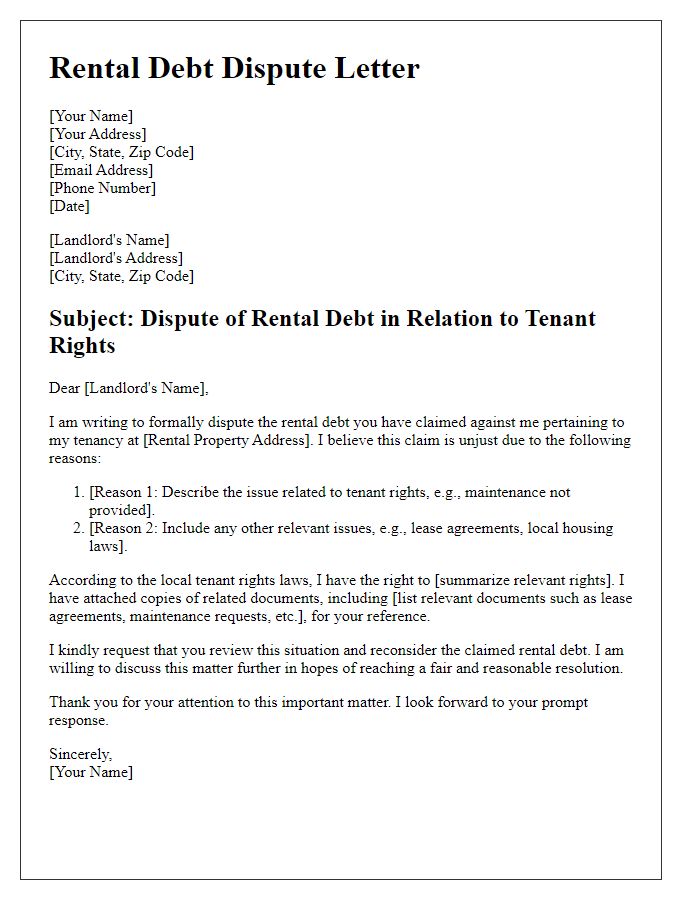

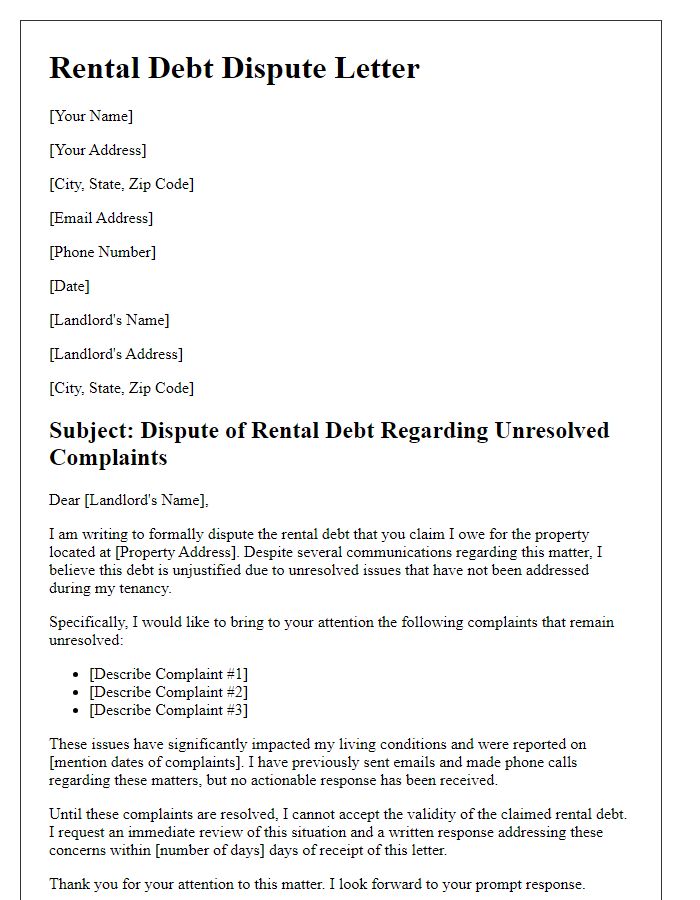

Are you facing a rental debt dispute and unsure how to address it? Navigating these tricky waters can be overwhelming, but having the right letter template can make all the difference. In this article, we'll guide you through the essential components of a letter that clearly communicates your position and seeks resolution. So, grab a cup of coffee and let's dive into the detailsâyou won't want to miss this!

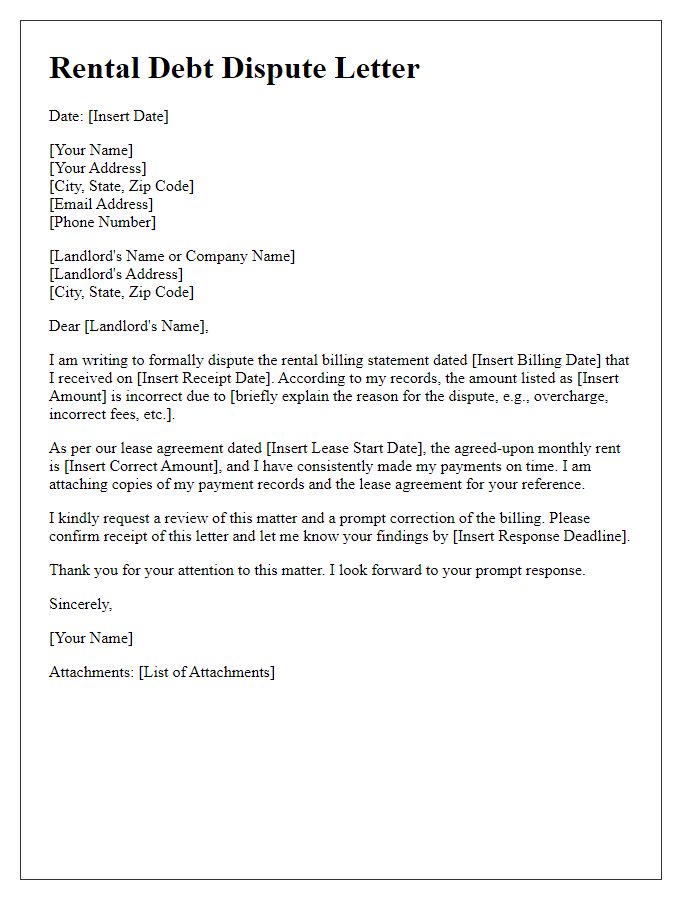

Clear Identification of Parties

In rental debt disputes, clear identification of parties plays a crucial role. The tenant, often delineated by a full name, current address, and any associated identification numbers, such as driver's license or social security number, ensures accuracy in documentation. The landlord or property management company must also be distinctly identified, including their business name, address, and contact information. Providing a specific rental property address, often including unit numbers, helps locals in legal proceedings. Any relevant lease agreement references, like start and end dates, should be attached to provide context. This thorough identification reduces ambiguity, aiding resolution in potential disputes.

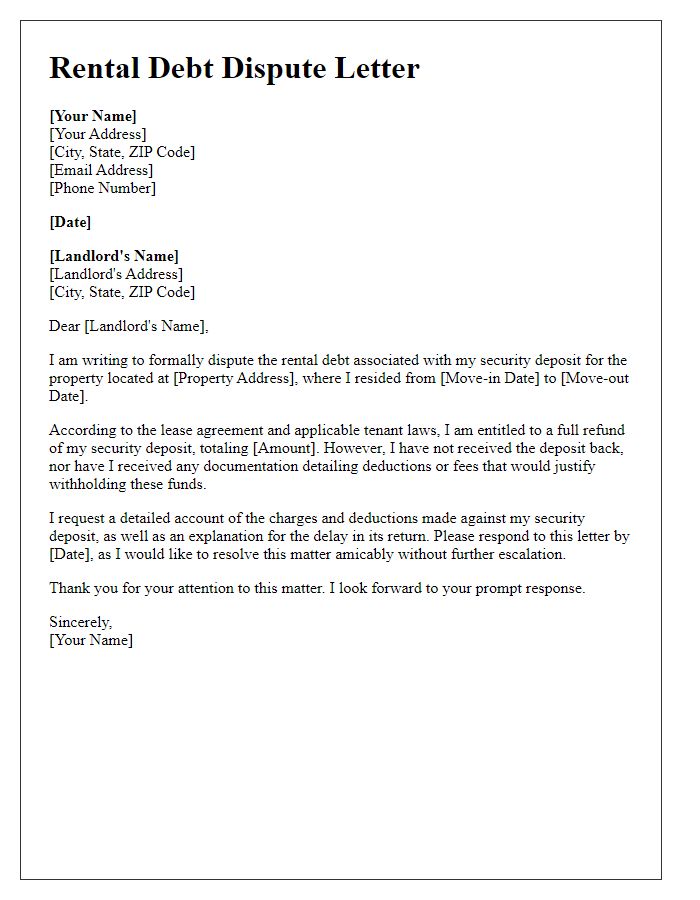

Detailed Account Summary

A rental debt dispute can often arise in situations involving missed payments, lease agreements, or property management discrepancies. In a specific case regarding an apartment located in Seattle, Washington, the tenant reported an outstanding rental balance of $2,500 dating back to March 2023. The tenant claimed that rent payments made on the 5th of every month were misapplied by the management company, XYZ Property Management. Correspondence dated from April to August 2023 revealed multiple requests for clarification on account statements which went unanswered, leading to confusion over the actual amount owed. Additionally, the tenant expressed concerns regarding maintenance issues, including plumbing repairs, that were promised by the management but not completed. This unresolved situation culminated in a demand for payment that allegedly included late fees of $300, raising the total claimed balance to $2,800. Accurate documentation from bank statements and communication will be crucial in resolving this dispute effectively.

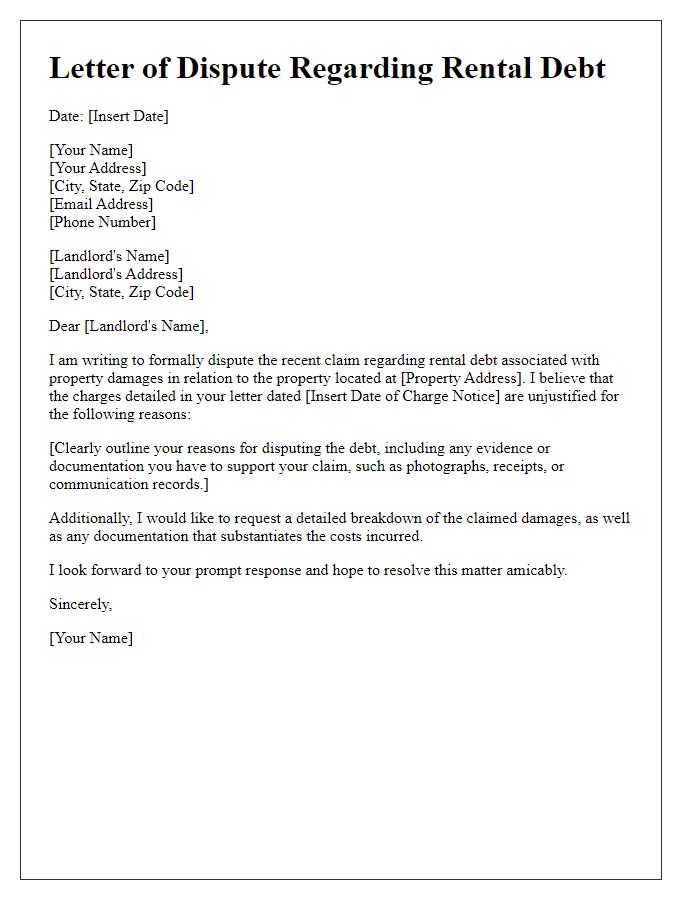

Legal Reference and Policy Explanation

Rental debt disputes can arise over discrepancies in charges, late fees, or eviction proceedings. Legal frameworks such as the Fair Debt Collection Practices Act (FDCPA) outline specific rights for tenants regarding debt collection practices. Landlords must adhere to state-specific eviction laws, which, for example, in California, require a written notice to the tenant stating unpaid amounts before proceeding with legal actions. Documentation such as rental agreements, payment receipts, and communication records play crucial roles in supporting a tenant's position. Local policies may also include landlord-tenant mediation services, which facilitate resolution without courtroom involvement. Understanding these regulations is essential for both parties involved.

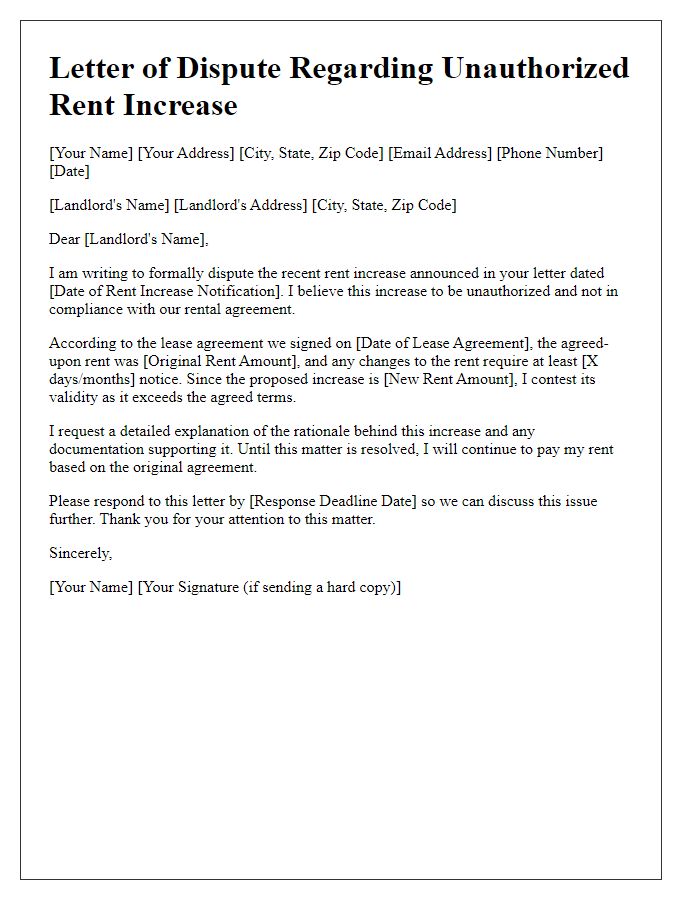

Request for Resolution

A rental debt dispute typically arises when tenants and landlords disagree on outstanding payments or terms of a lease. Such disputes often involve amounts totaling hundreds or thousands of dollars, depending on the duration of non-payment and local rental rates, which can vary widely by city or neighborhood. Legal entities, such as housing authorities or state mediation services, may become involved to help reach a resolution. Tenants who dispute rental debt often seek justification for any charges, requiring documentation such as lease agreements, rent payment records, and communication history, which can play a pivotal role in evaluating the legitimacy of the debt. Addressing these disputes promptly is crucial, as delays can lead to more significant legal consequences, including eviction processes or damage to credit ratings.

Contact Information for Follow-Up

In rental debt disputes, accurate contact information is critical for effective communication between landlords, tenants, and relevant legal representatives. Essential details include names, phone numbers, and email addresses of both parties involved in the dispute. Additionally, including the address of the rental property in question, such as 123 Maple Street, Springfield, ensures that all correspondence is clearly referenced. It is also important to note the date of the initial lease agreement signed on June 1, 2022, as this provides context for the timeline of debt accumulation. Providing an organized format for follow-up discussions can help facilitate resolution, including preferred methods of contact such as direct phone calls or scheduled meetings, often preferred by tenants who may experience anxiety during conflicts over financial obligations.

Comments