Receiving a letter about a mail fraud debt claim can be overwhelming, but you don't have to face it alone. It's crucial to understand your rights and the steps you can take to dispute the claim effectively. Whether you believe the debt is invalid or you've been targeted by a scam, knowing how to respond is key to protecting yourself. Ready to learn more about how to navigate this challenging situation? Let's dive in!

Creditor's contact information

Mail fraud in debt claims often involves deceptive practices aimed at misleading individuals into believing they owe a debt. For instance, a fraudulent creditor may provide contact information that appears legitimate but redirects individuals to a false address or unmonitored phone line. Actual creditors, such as banks or credit card companies, typically have formalized contact information visible on their official websites, ensuring transparency. Investigating any unsolicited communication for inconsistencies, such as unusual phone numbers (which can be traced back to multiple sources), and validating creditor identities through public financial records or regulatory bodies are essential steps in protecting oneself against fraudulent claims. Always document interactions with creditors for future reference and potential legal recourse.

Account details and reference number

Mail fraud can significantly impact consumers, often leading to disputes over unauthorized debt claims. An individual facing such a situation should prepare documentation that includes critical details like account information, such as the account number assigned by the creditor, and reference numbers that uniquely identify the disputed claim. This reference number often indicates the specific transaction or account in question and can be vital for tracking communication with financial institutions. In disputes, clarity and specific details are essential; attaching copies of any relevant correspondence or proof of identity can aid in resolving the issue efficiently.

Detailed explanation of dispute

Mail fraud schemes can lead to significant financial distress, particularly in debt claims. Individuals often receive fake debt notices that list inaccurate amounts owed or even non-existent debts. These fraudulent communications can originate from various sources, including scammers or illegitimate collection agencies, targeting vulnerable individuals across the United States. A common tactic involves using official-looking letters and stamps to gain legitimacy, misusing familiar company names for added deception. Victims frequently face aggressive follow-up calls or further written correspondence, which can create confusion and anxiety regarding their true financial obligations. Documenting these communications becomes crucial; keeping copies of all correspondence can provide essential evidence when disputing the legitimacy of a debt claim. Reporting these issues to relevant authorities, such as the Federal Trade Commission (FTC) or local consumer protection agencies, also serves as an important step in combating mail fraud and recovering any lost funds.

Supporting evidence and documentation

In a mail fraud debt claim dispute, providing supporting evidence and documentation is crucial to validating the case against fraudulent activities. Essential documentation includes detailed records of communication with creditors, such as dates, times, and content of phone calls or correspondence, which can reveal inconsistencies or misrepresentations in the creditor's claims. Moreover, bank statements showing unauthorized transactions, along with copies of any fraudulent agreements or contracts, serve as vital evidence. Additionally, including police reports or identity theft affidavits can strengthen the case, demonstrating proactive measures taken by the victim. Relevant laws and regulations, such as the Fair Debt Collection Practices Act (FDCPA), can also provide a legal framework justifying the dispute, illustrating violations by the creditor. Furthermore, all evidence should be organized and clearly labeled to facilitate the review process for investigators or legal representatives.

Request for investigation or resolution actions

Mail fraud instances can significantly impact individuals, especially when related to debt claims, such as those from collection agencies. Victims often encounter unexpected correspondence, frequently labeled as 'Urgent', claiming outstanding debts that do not exist. Documents may contain misleading information, including inflated amounts and fictitious creditor names. As a result, individuals residing in areas with high fraud activity, like the metropolitan regions, should promptly report these cases. Engaging with local consumer protection agencies or the Federal Trade Commission (FTC) is essential for initiating investigations. Collecting evidence, such as records of communication and fraudulent documents, aids in thorough investigations, fostering consumer rights protection against fraudulent practices.

Letter Template For Mail Fraud Debt Claim Dispute Samples

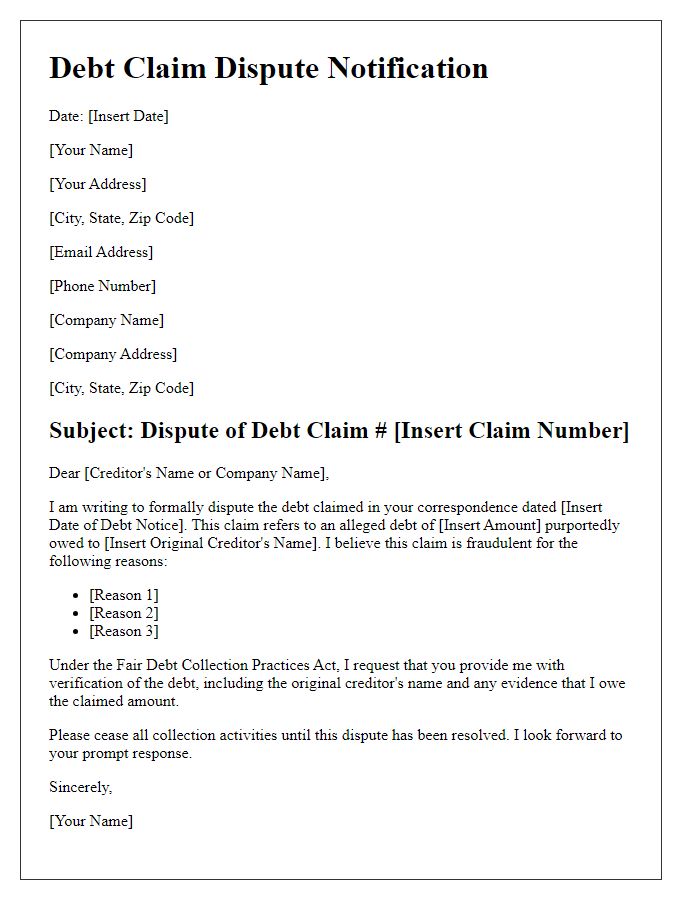

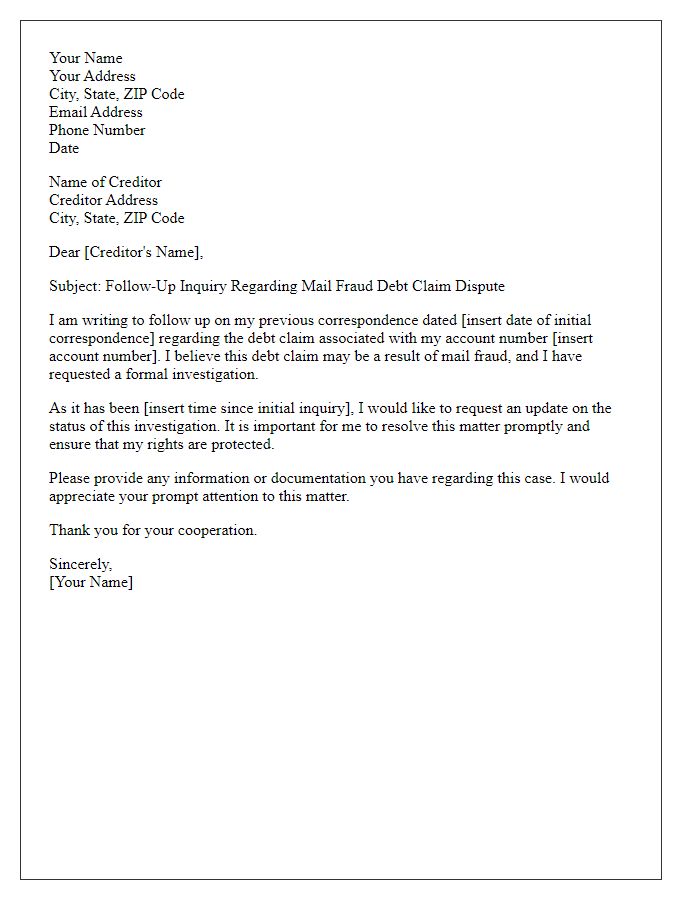

Letter template of mail fraud debt claim dispute for initial communication.

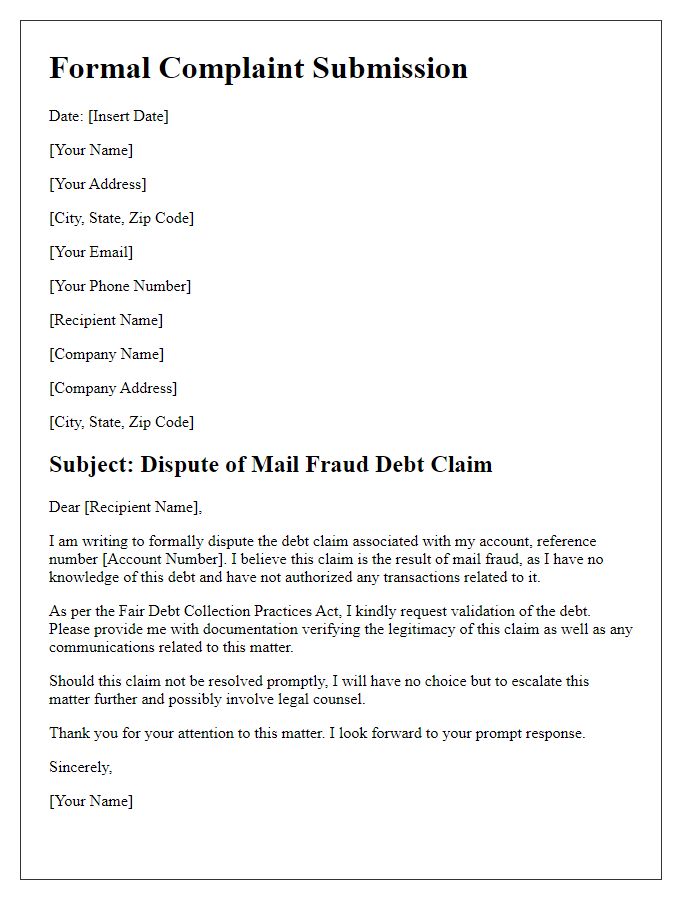

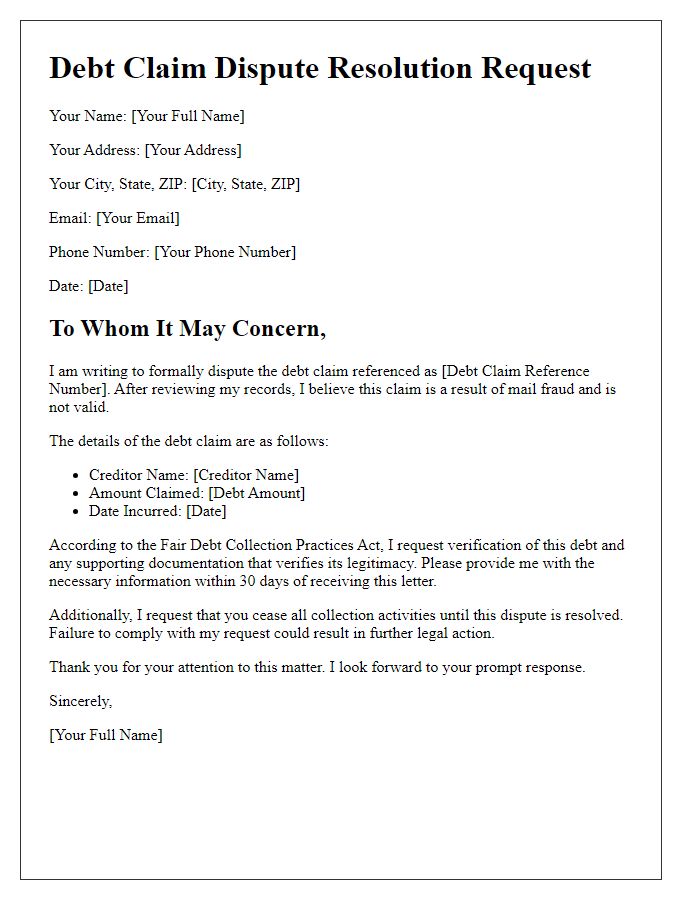

Letter template of mail fraud debt claim dispute for formal complaint submission.

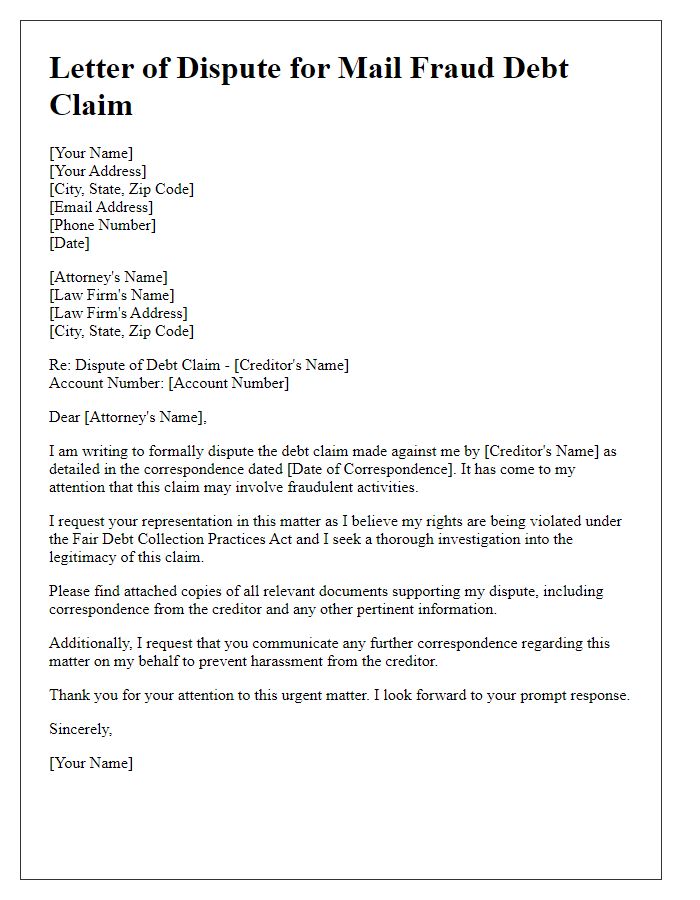

Letter template of mail fraud debt claim dispute for attorney representation.

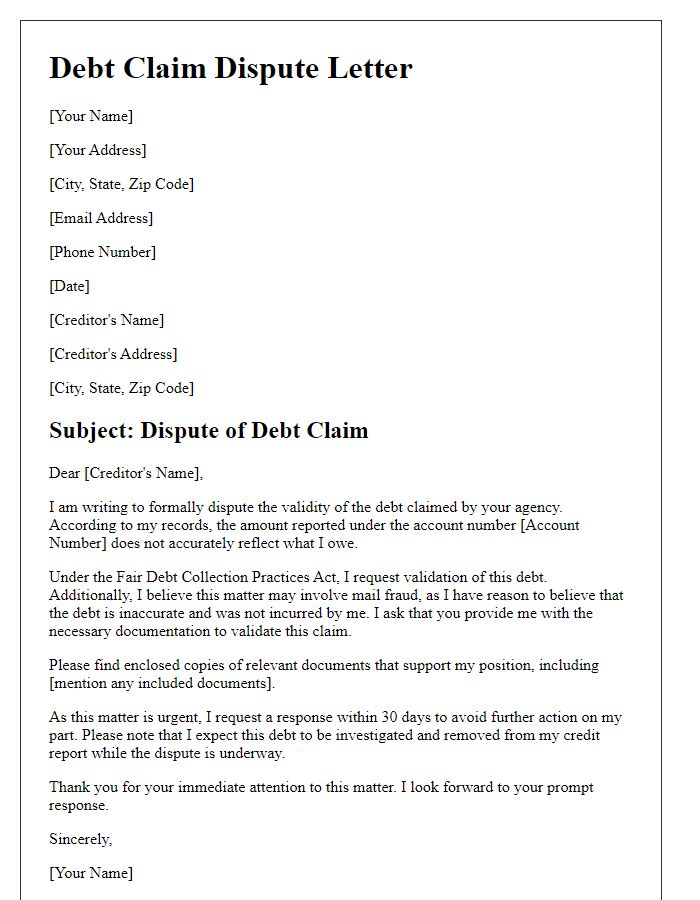

Letter template of mail fraud debt claim dispute for evidence submission.

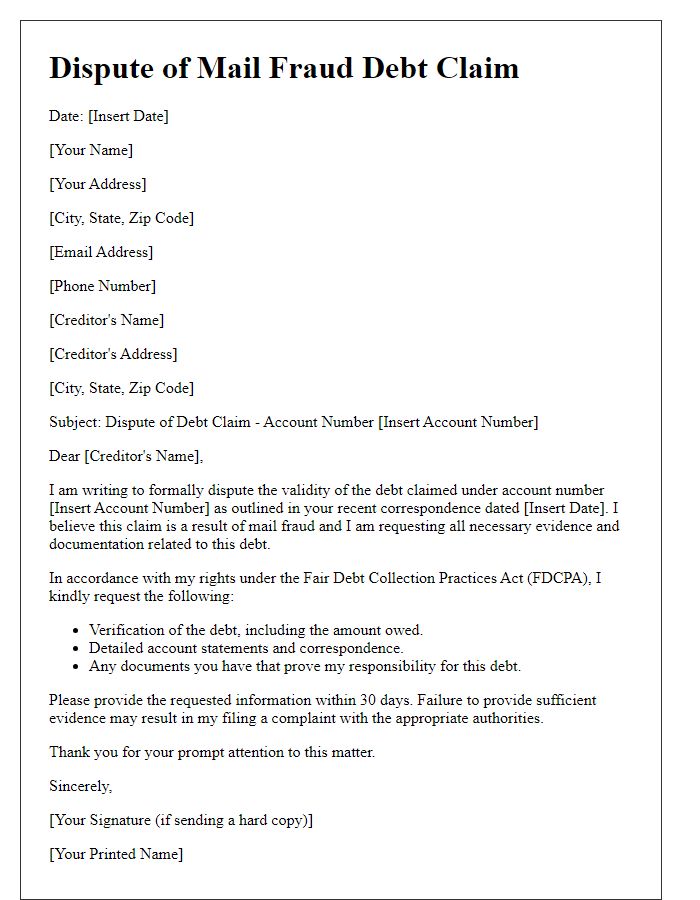

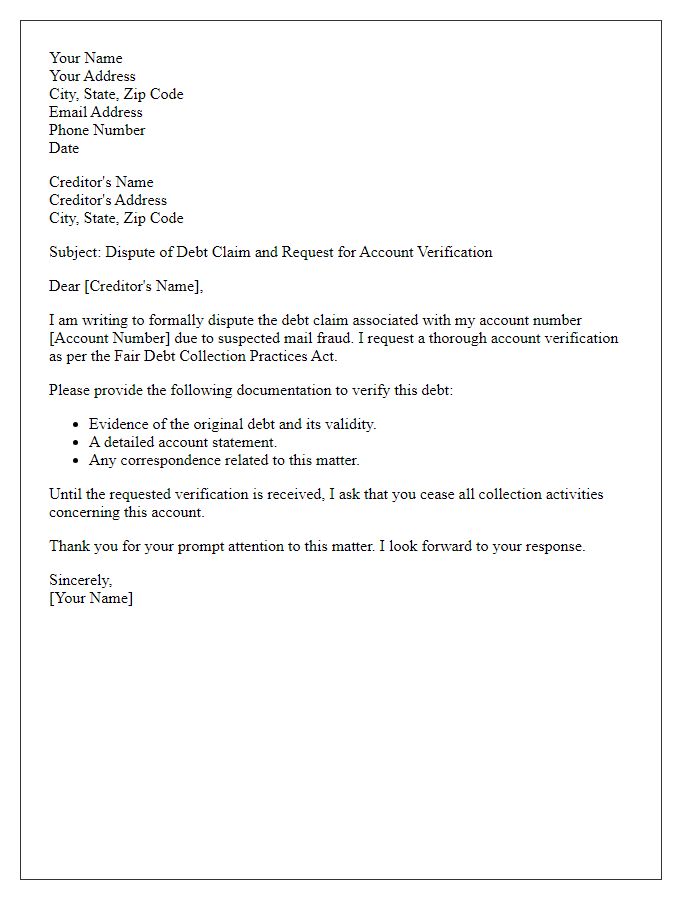

Letter template of mail fraud debt claim dispute for account verification request.

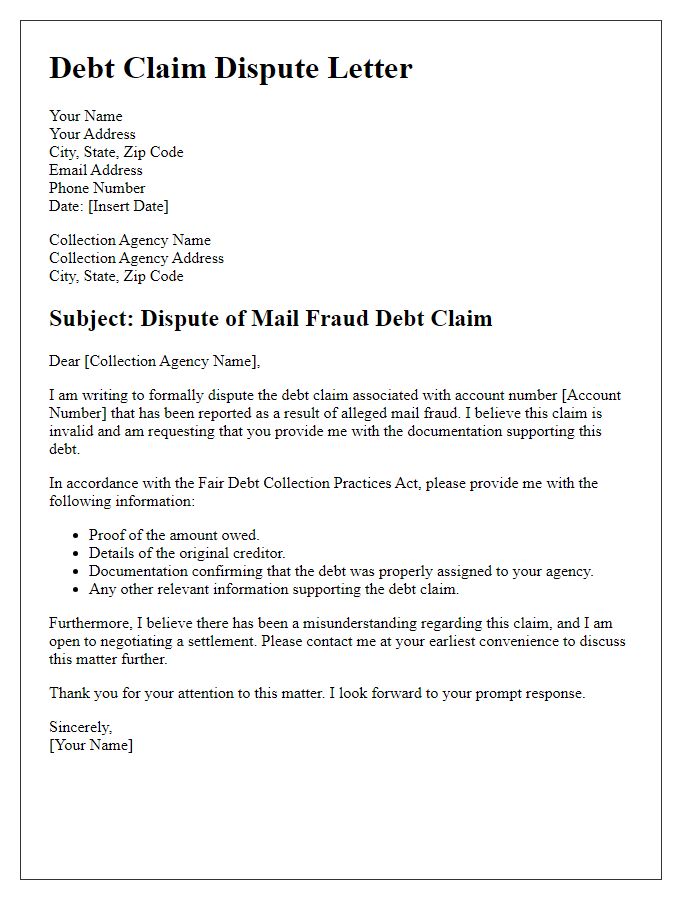

Letter template of mail fraud debt claim dispute for settlement negotiation.

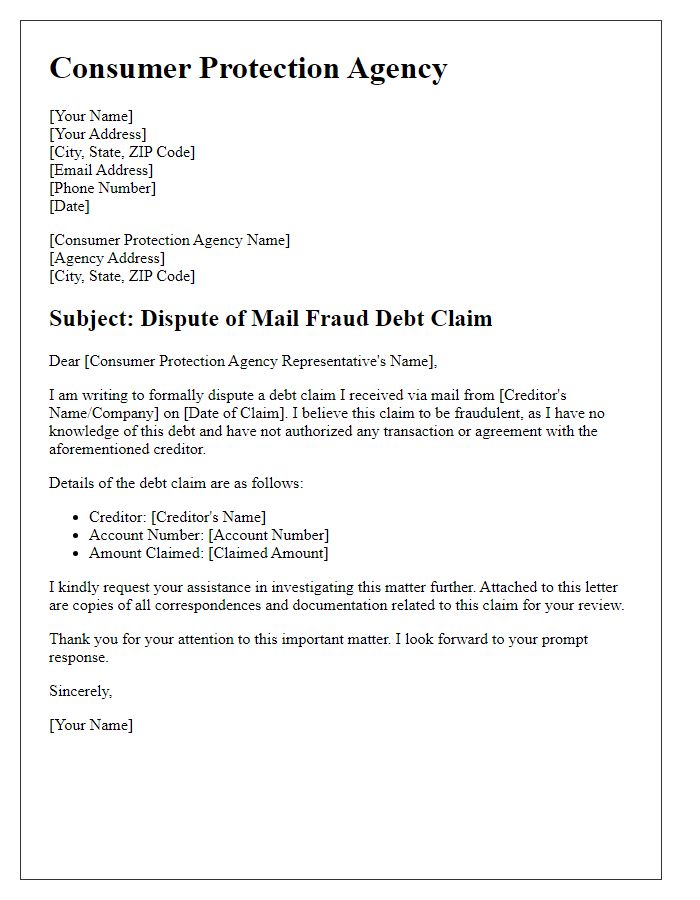

Letter template of mail fraud debt claim dispute for consumer protection agency.

Letter template of mail fraud debt claim dispute for credit reporting challenge.

Comments