Navigating the complex world of debt can feel overwhelming, especially when you're in need of expert guidance without the added burden of costs. If you find yourself struggling financially, seeking pro bono debt representation might just be the lifeline you need. Many legal aid organizations are eager to help those facing financial hardship, offering their services at no charge. Read on to discover how you can take the first steps towards reclaiming your financial stability and find the assistance you deserve!

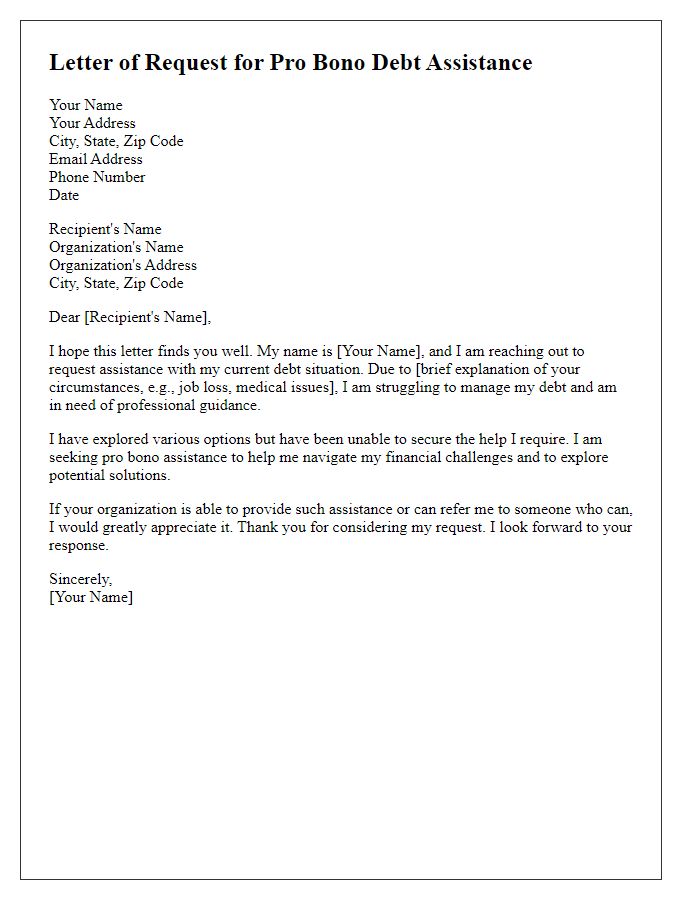

Personal Information.

Pro bono debt representation can provide essential legal assistance for individuals facing financial challenges. Clients often seek help when dealing with overwhelming financial obligations, such as student loans and credit card debt. Organizations like Legal Aid Society in New York City or Volunteer Lawyers Project in Boston offer free services to those meeting income eligibility requirements. These services typically include legal advice, assistance in negotiating with creditors, and representation in court, aiming to alleviate the burdens of debt. The importance of accurate personal information, such as income level, family size, and existing debt amounts, plays a pivotal role in securing pro bono assistance. Factors like housing situation and employment status also influence the urgency and type of legal support provided.

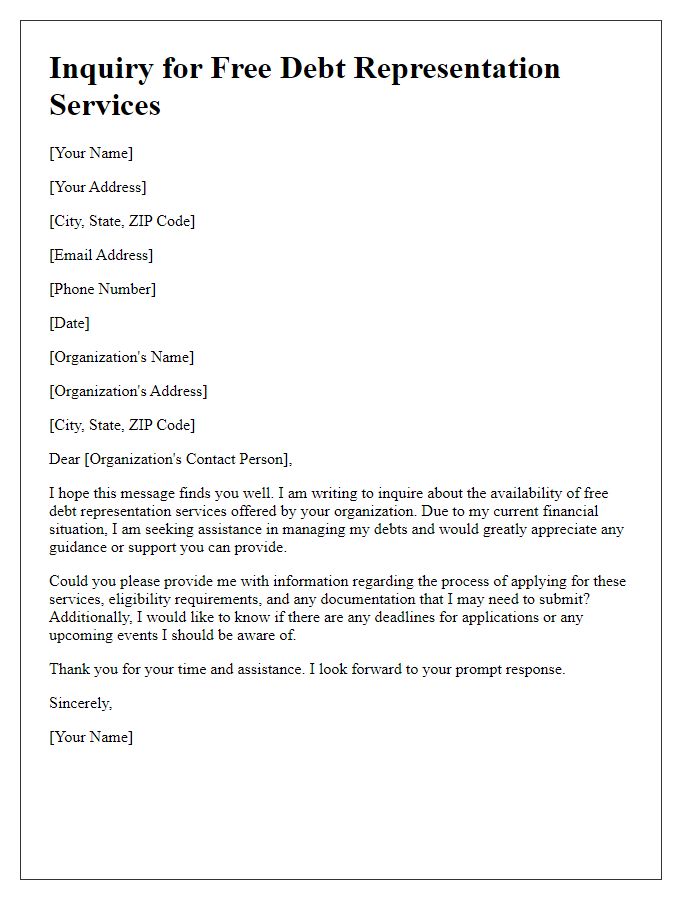

Financial Situation Summary.

Pro bono debt representation services play a crucial role in assisting individuals facing financial hardships, particularly those who cannot afford legal fees. Many individuals encounter overwhelming debt situations involving factors such as credit card balances, medical expenses, and mortgages, often amounting to thousands of dollars. These debts can lead to significant stress and uncertainty, affecting mental well-being and stability. Nonprofit organizations, such as the Legal Aid Society and debt counseling agencies, often provide free legal assistance, helping clients navigate bankruptcy filings or negotiate settlements with creditors. Individuals applying for such services typically need to provide detailed information about their income levels, expenses, and assets, enabling attorneys to assess eligibility and devise tailored legal strategies while minimizing costs and maximizing benefits.

Case Details and Background.

Individuals seeking pro bono debt representation often present compelling case details and background, illustrating their financial distress. For instance, a single parent residing in a metropolitan area, such as New York City, may be struggling with overwhelming credit card debt, totaling over $15,000, accumulated due to medical bills and unemployment for several months. The individual may also face eviction from their apartment located in the Bronx, where the cost of living has risen significantly, further exacerbating their financial strain. The need for legal assistance becomes urgent, especially when facing aggressive debt collectors invoking the Fair Debt Collection Practices Act (FDCPA) violations, necessitating expert advice and representation to navigate this complex legal landscape. Supporting this, documentation such as court summons, collection letters, and income statements provides further context to the dire circumstances, emphasizing the need for immediate legal intervention to mitigate potential threats to housing stability.

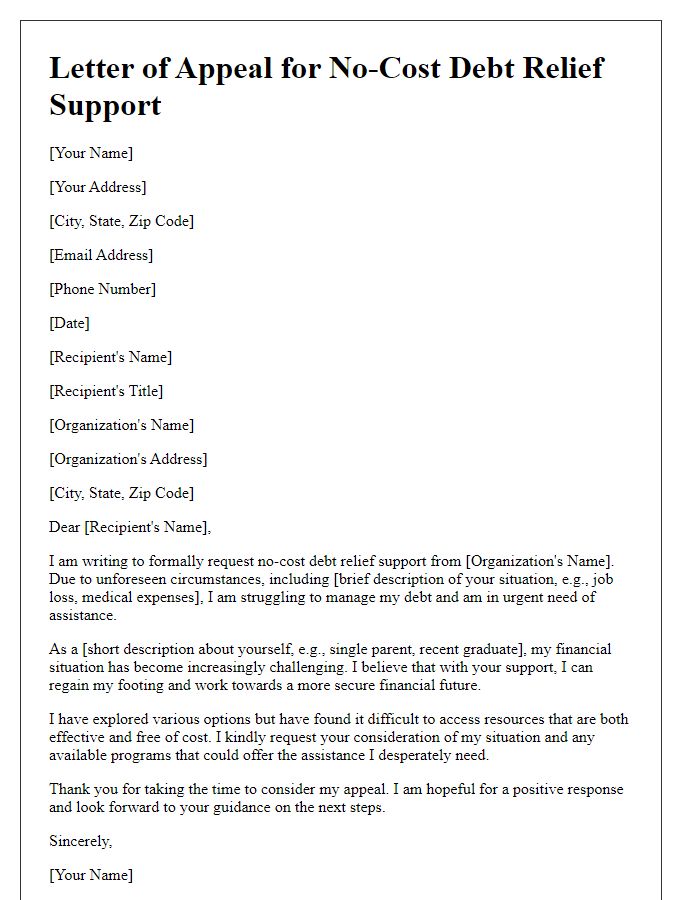

Reason for Seeking Pro Bono.

Seeking pro bono debt representation is crucial for individuals facing overwhelming financial burdens, particularly in circumstances of unexpected job loss or medical emergencies. Many people with annual incomes below $40,000 struggle to meet basic living expenses while managing multiple debts, including credit card obligations averaging $5,000 and student loans often exceeding $30,000. Legal assistance can provide invaluable support, allowing individuals to navigate complex bankruptcy processes or negotiate settlements with creditors without incurring additional costs. Organizations, such as the Legal Aid Society, greatly assist low-income individuals in understanding their rights and options, fostering fair outcomes and financial stability. Access to pro bono services becomes imperative when overwhelming debt threatens to disrupt daily life and hinder future opportunities for financial recovery.

Contact Information and Preferred Communication.

Seeking pro bono debt representation requires precise contact information for accessibility and effective communication. This includes full name (essential for identification), phone number (preferably a mobile number for immediate access), and email address (for formal correspondence). Preferred communication method plays a crucial role in ensuring understanding and prompt responses. Choosing between phone calls (which allow for immediate feedback) or email correspondence (which provides a written record) should align with individual comfort levels and urgency of the debt situation. Providing relevant personal experiences or specific debt issues can help representatives assess the situation quickly.

Comments