Are you facing the challenging situation of filing for bankruptcy and unsure how to communicate with your creditors? Sending a bankruptcy notification letter can be a crucial step in managing your financial affairs and maintaining transparency with those you owe. This letter acts not only as a formal notification but also as a way to lay out your current circumstances and intentions moving forward. If you want to learn more about how to draft an effective bankruptcy notification letter, keep reading!

Accurate Debtor Information

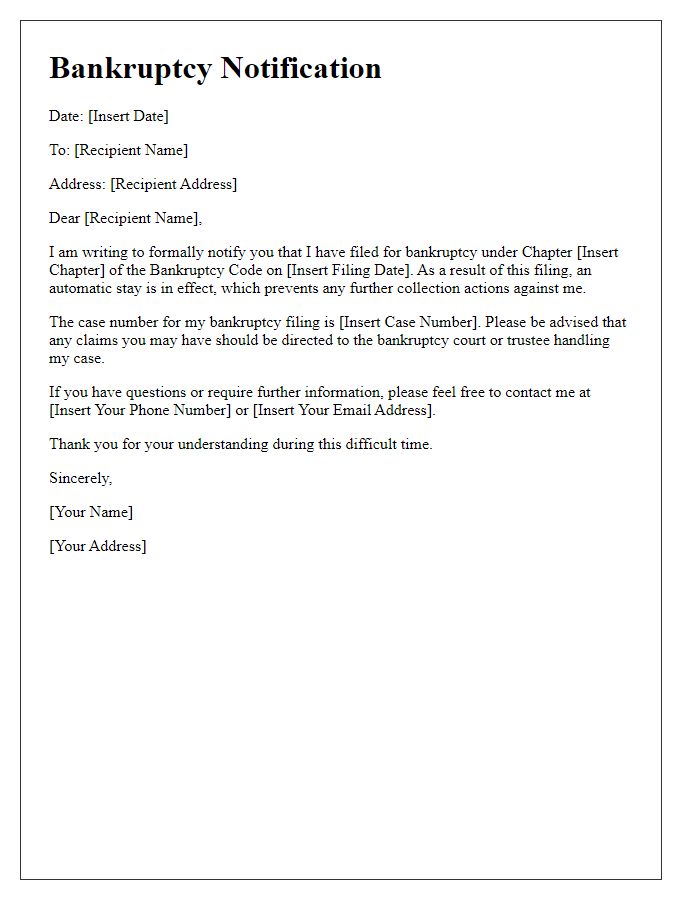

The bankruptcy notification process requires accurate debtor information to ensure seamless communication with creditors involved. Essential details include the debtor's full legal name, often followed by any aliases or trade names used in business operations. Including the debtor's permanent address is vital, as it serves as the primary point of contact, facilitating the delivery of important legal documents. The debtor's Social Security number (for individuals) or Employer Identification Number (EIN for businesses) identifies the debtor uniquely, essential for procedural accuracy in the bankruptcy process. Additionally, communicating the specific type of bankruptcy (Chapter 7, 11, or 13) and the corresponding case number assigned by the bankruptcy court provides clarity regarding the proceedings, ultimately aiding creditors in understanding the situation comprehensively.

Clear Bankruptcy Type and Chapter

A bankruptcy notification, such as a Chapter 7 bankruptcy (liquidation), formally communicates to creditors about an individual's financial status. In this instance, the debtor lists all outstanding debts, including credit card balances, loans, and other financial obligations. The notification must include specific details such as the debtor's name, filing date, and case number, which is essential for creditors to identify the case in the bankruptcy court system. Additionally, it should inform creditors about the automatic stay, a legal provision that halts most collection actions, giving the debtor relief during the bankruptcy process. This notification is crucial, ensuring transparency and clarity about the debtor's intent to reorganize or eliminate debts under federal law.

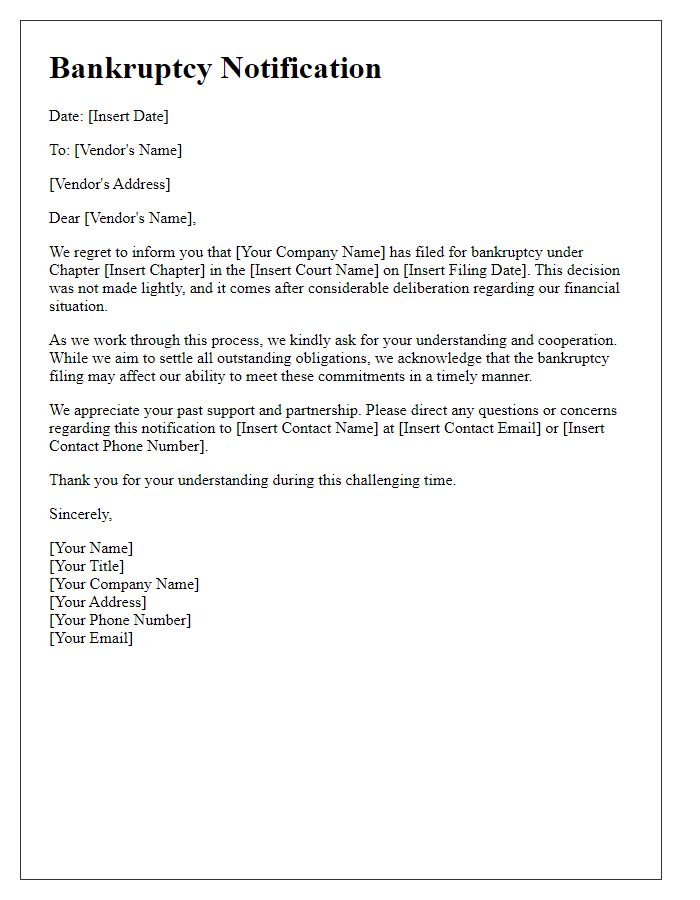

Detailed Creditor Information

A bankruptcy notification to creditors contains crucial elements, emphasizing the need for clarity and accuracy. Creditors, such as financial institutions, service providers, or suppliers, must be listed with specific identifiers like account numbers and addresses for effective communication. The notification must clearly state the type of bankruptcy filed, such as Chapter 7 or Chapter 11, indicating the legal implications for creditors. Dates of important events, like filing date and deadlines for claims submission, should be included to establish a timeline for the creditors. Detailed descriptions of secured and unsecured claims, along with any collateral attached to debts, enable creditors to assess their positions. It is essential to include contact information of the bankruptcy attorney or trustee managing the case, providing a reliable point of reference for creditors to address inquiries or concerns.

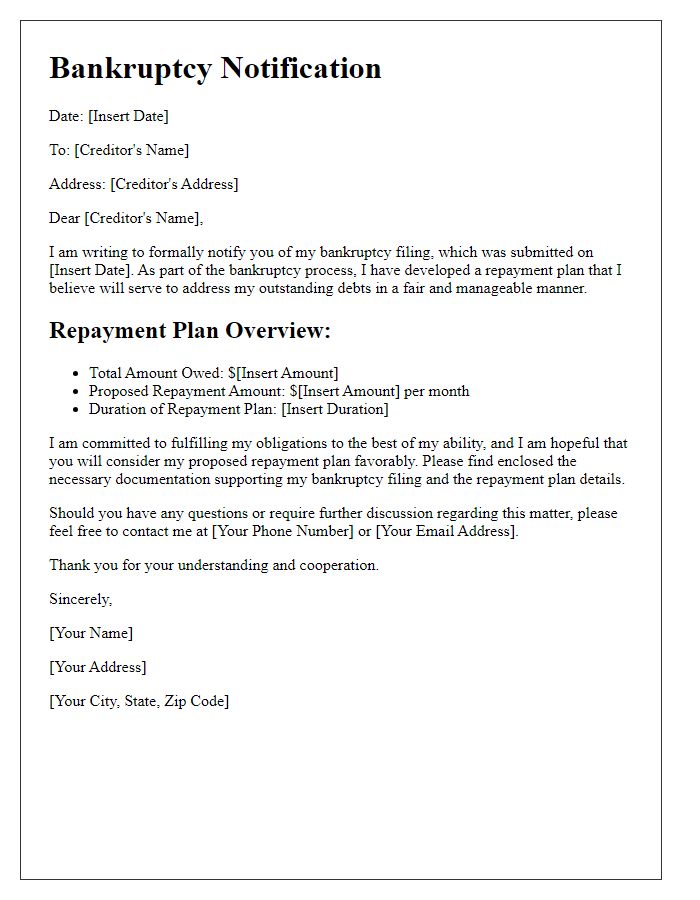

Specific Claim Details

Claim notifications issued during bankruptcy proceedings must clearly outline the specifics of the claim. The filing company, such as XYZ Corporation, is in bankruptcy court under case number 123-4567. Creditors should note their claim amount, detailing outstanding balances that may include invoices from dates like January 10, 2023, to March 15, 2023, totaling $50,000. Important information regarding secured and unsecured claims regarding property, like the office equipment valued at $20,000, must be specified. All creditors should provide supporting documents, including contracts, agreements, and previous communications, to validate their claims. The deadline for submitting claims is June 30, 2023, with submissions directed to the bankruptcy court located at 100 Main Street, Suite 200, Anytown, USA.

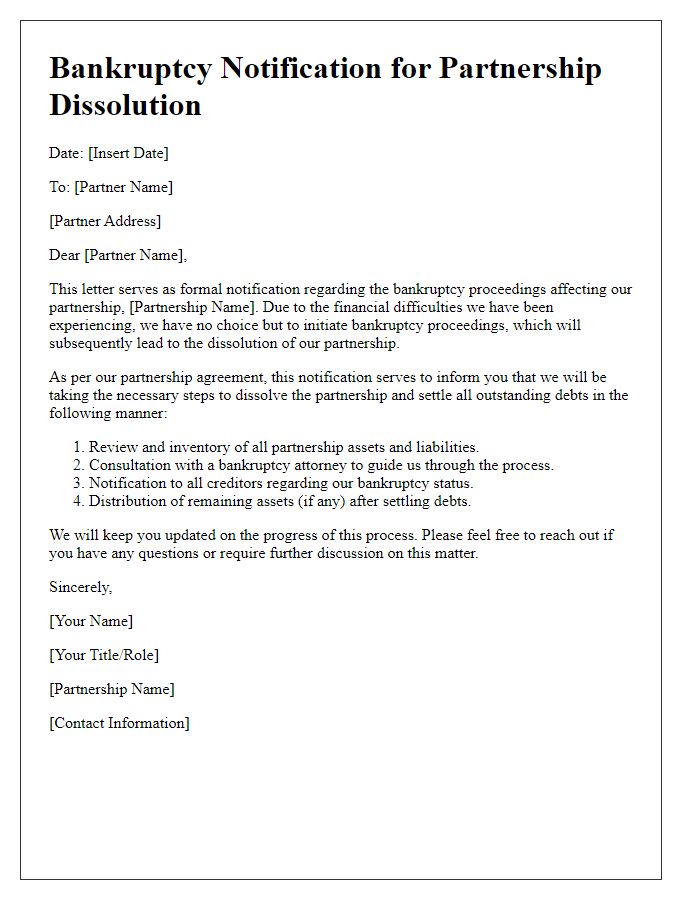

Professional and Formal Tone

Bankruptcy proceedings can have significant implications for businesses and individuals. When a company files for Chapter 11 bankruptcy protection, which allows for reorganization and continuation of operations, it's essential to officially notify creditors. A well-structured notification informs creditors about the filing, necessary actions required on their part, and relevant timelines. It outlines the bankruptcy case number, the court's jurisdiction, and highlights the importance of filing claims within stipulated deadlines to ensure possible recovery. Clear awareness of these parameters aids in managing expectations and provides a roadmap for creditors navigating this complex process.

Letter Template For Bankruptcy Notification To Creditors Samples

Letter template of bankruptcy notification with asset liquidation details

Comments