Are you feeling overwhelmed by furniture purchase debt? You're not aloneâmany people find themselves in a tough spot when it comes to managing the costs of their home furnishings. Luckily, there are ways to negotiate your debt and find a manageable solution. Read on to discover effective tips and strategies for negotiating your furniture purchase debt like a pro!

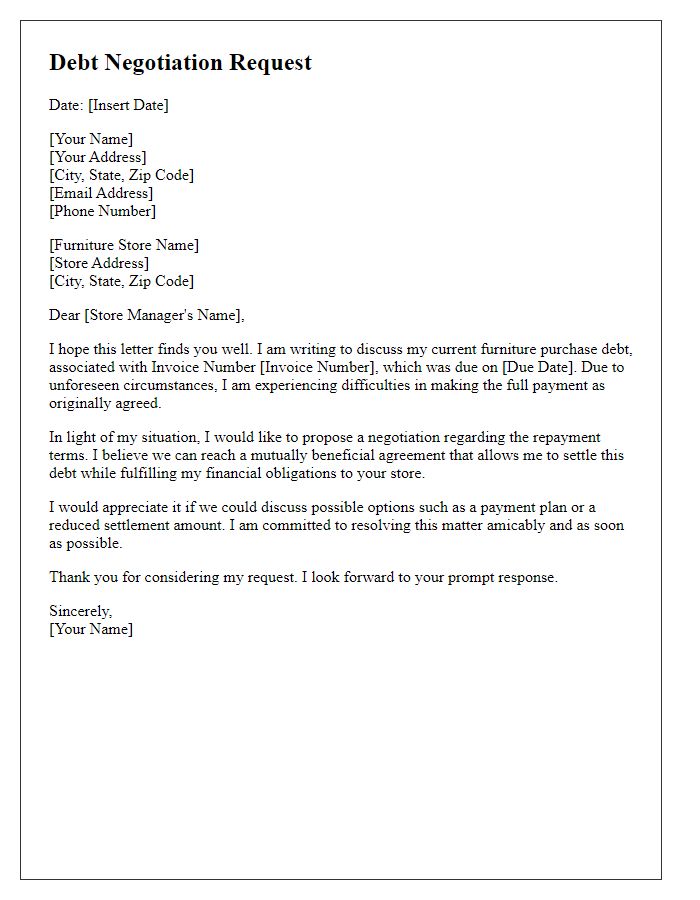

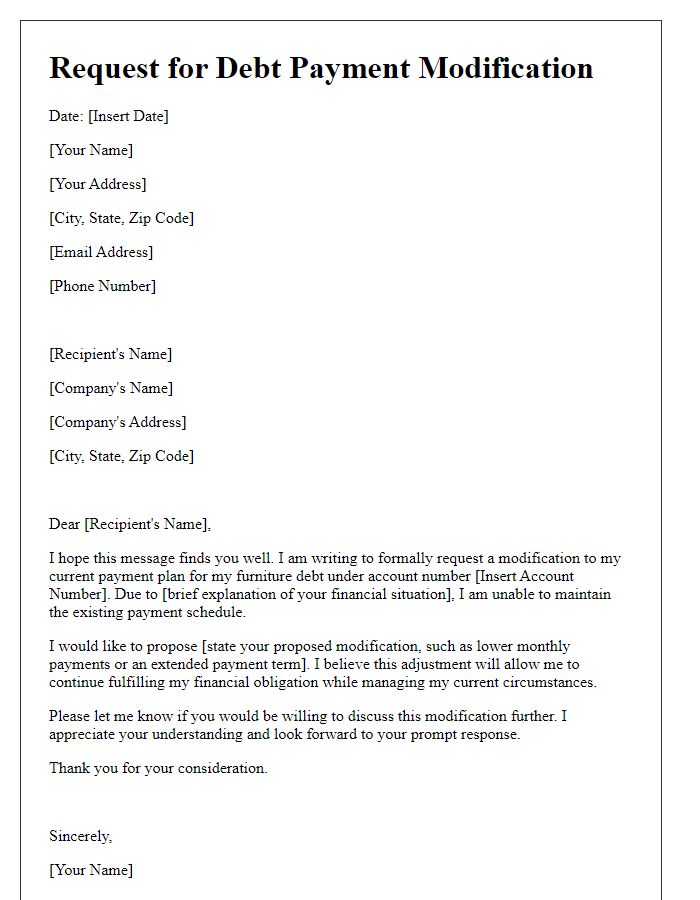

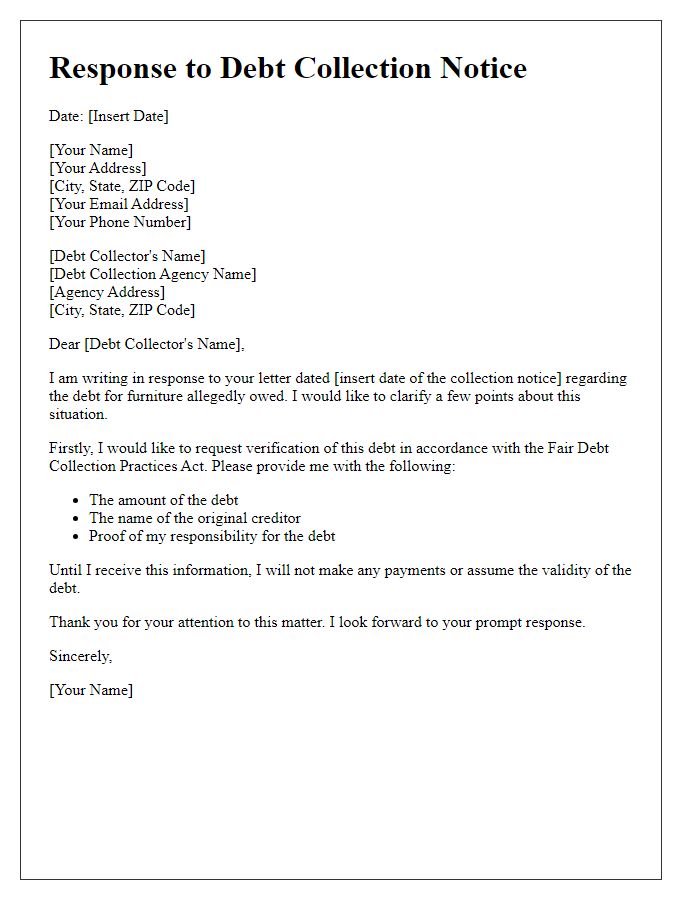

Personal Information Accuracy

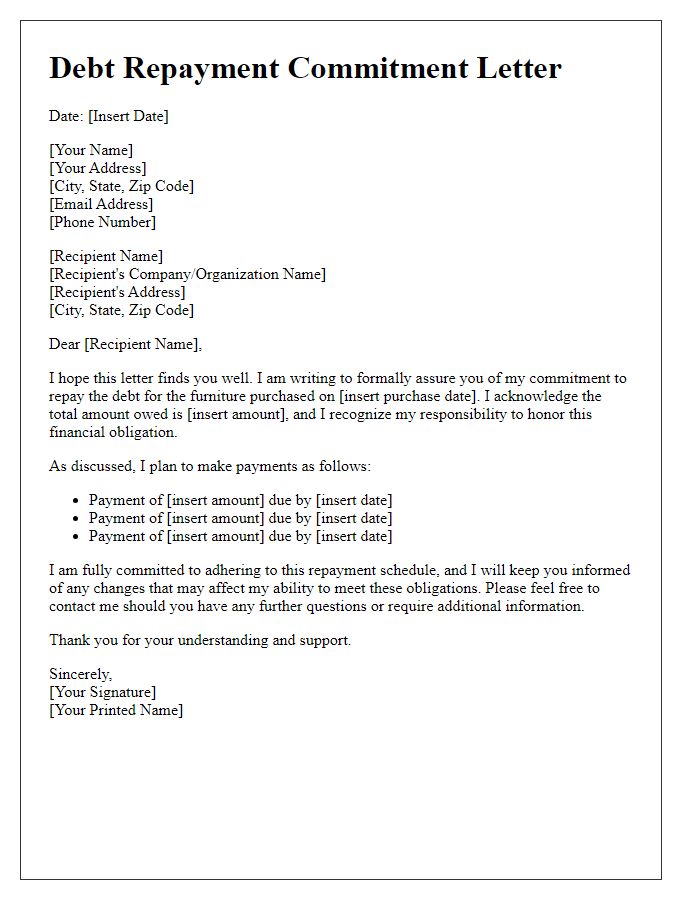

A successful furniture purchase debt negotiation requires precise personal information for optimal impact. Key elements include full name, such as John Smith, address details like 123 Elm Street, Apartment 4B, Springfield, ZIP code 62704, and contact number (555) 123-4567. Accurate account numbers associated with the furniture retailer, for instance, Account# 789456123, ensure clarity in discussions. Additionally, relevant information regarding the purchase, such as invoice number A12345 and purchase date May 15, 2022, bolsters your negotiation position. Presenting detailed financial data, including monthly payments of $150 due on the 1st of each month, can also illustrate the payment difficulties faced, potentially leading to more favorable negotiation outcomes.

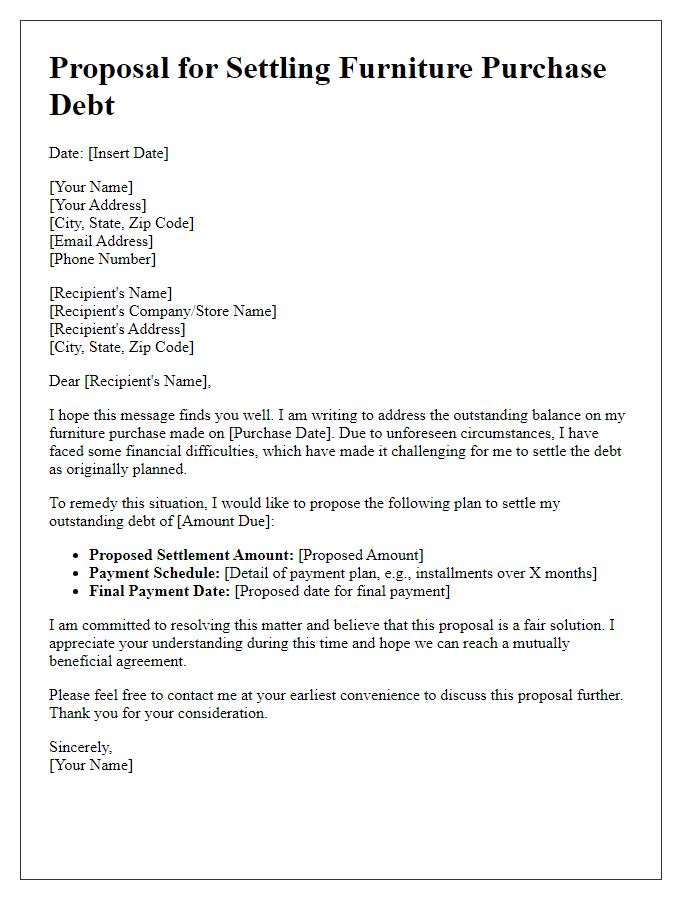

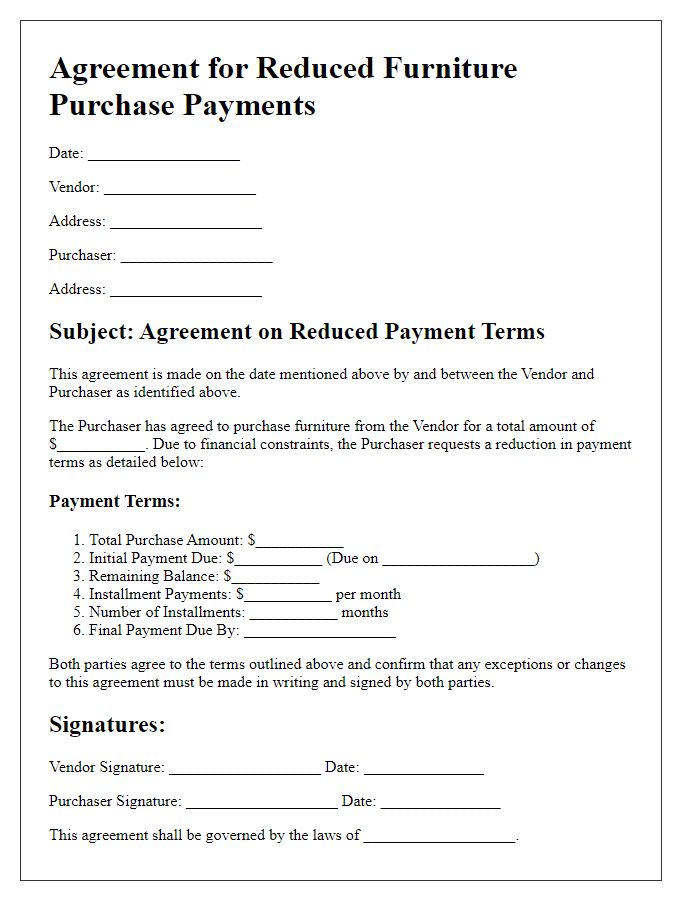

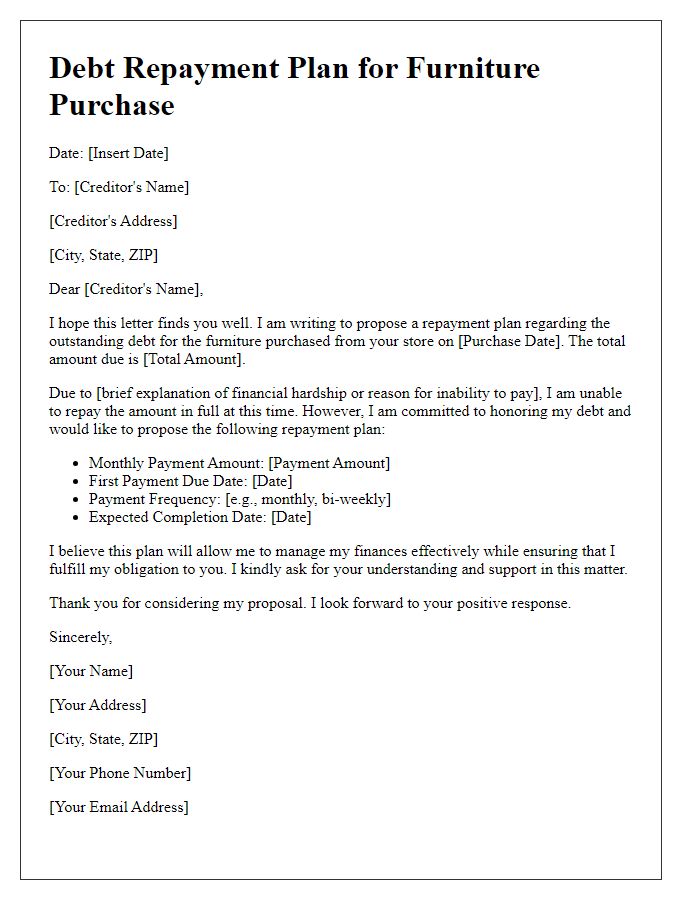

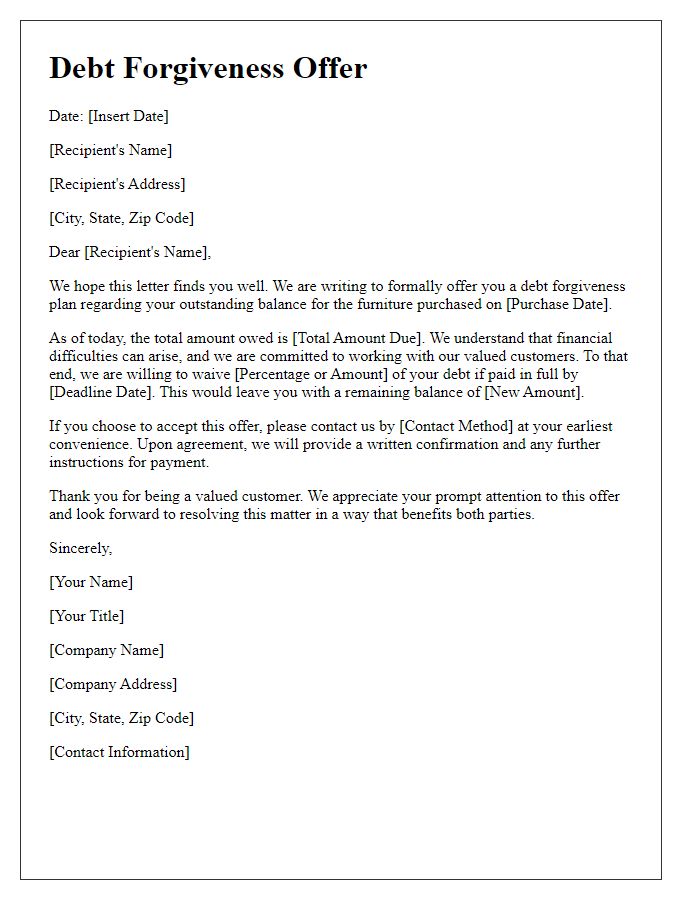

Clear Payment Proposal

Purchasing furniture often involves significant financial commitments, leading to potential debt accumulation. A clear payment proposal outlines an effective strategy for negotiating the repayment of this debt. A structured plan, typically involving the original purchase amount, interest rate detailed in the sales agreement, and the remaining balance, is essential. The proposal may include specifics such as a timeline for repayment, suggested monthly amounts, and potential discounts for early payment. Accurate identification of the retail store's location, transaction dates, and customer service contact information can enhance the proposal's credibility. Preparing documentation of the initial purchase, payment history, and financial circumstances provides additional context, aiding in effective communication with the furniture retailer.

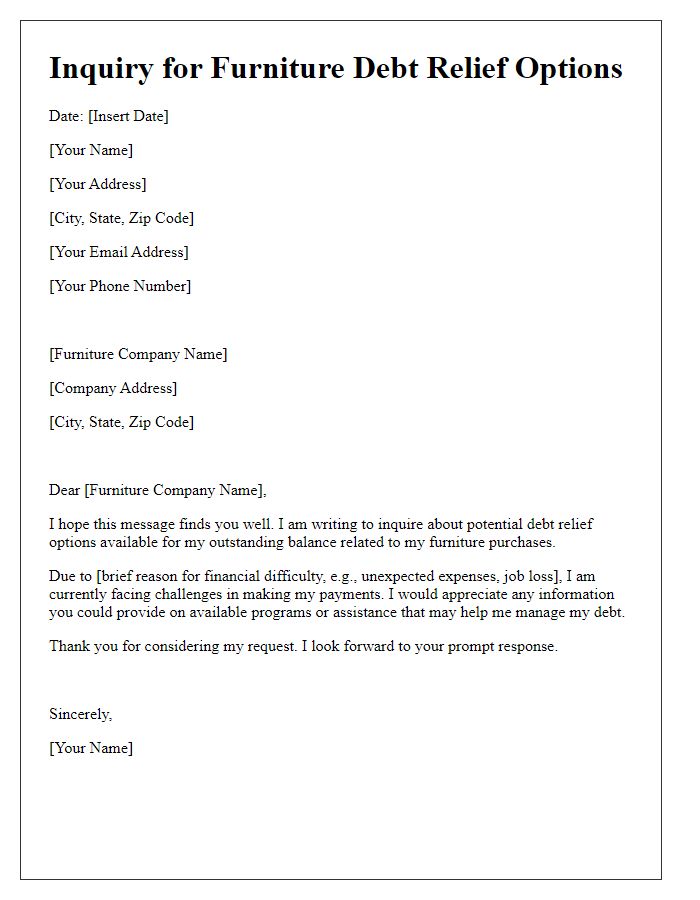

Financial Hardship Explanation

Many individuals face financial hardships that impact their ability to manage furniture purchase debts. Factors such as job loss, medical expenses, or unexpected emergencies may contribute to this situation. For instance, unemployment rates for certain sectors, like hospitality (over 10% as of 2023), can exacerbate difficulties in meeting financial obligations. Medical bills may accumulate, with the average cost of a hospital stay exceeding $10,000, straining budgets. Additionally, a family's sudden move--perhaps due to a natural disaster like a hurricane--can lead to increased expenses in purchasing necessary furniture for a new living situation. These circumstances highlight the importance of open communication with creditors to negotiate manageable payment plans or settlements.

Polite and Professional Tone

Clear communication during furniture purchase debt negotiations is essential for achieving a favorable outcome. The process typically involves written correspondence outlining the debt details, including the amount owed, the specific furniture items purchased, and any relevant purchase dates. It is crucial to express a willingness to negotiate repayment terms and propose specific options, such as installment payments or settlement amounts. Additionally, maintaining a polite and professional tone throughout the negotiation, acknowledging the creditor's position, and showing appreciation for their consideration can foster a more cooperative relationship. Always include contact information for follow-up discussions.

Contact Information

Negotiating furniture purchase debt can be crucial for financial stability. Individuals seeking to address outstanding balances on items like sofas, dining sets, or bedroom furniture should include vital contact information in their communications. Essential elements comprise full name, residential address for documentation purposes, email address for efficient correspondence, and phone number for potential direct negotiations. It's important to specify the account number associated with the furniture purchase, enabling creditors to easily identify the relevant debt. A concise description of the purchased items, including brands and styles, can aid in the negotiation process by providing context. Noting the original purchase date and any payment history can enhance the negotiation stance by demonstrating efforts made to honor the debt obligations.

Comments