Have you ever wondered what goes into a debt release confirmation letter? It's a crucial document that not only signifies the end of a financial obligation but also brings peace of mind to both the borrower and the lender. Understanding the key components of such a letter can help you navigate your financial journey more smoothly. So, if you're ready to learn more about crafting the perfect debt release confirmation, keep reading!

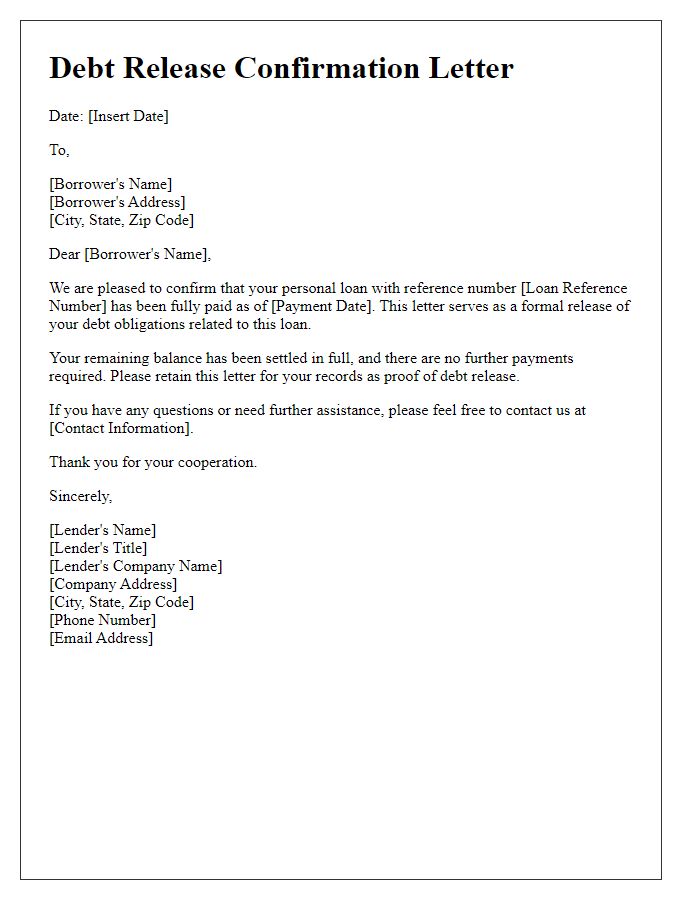

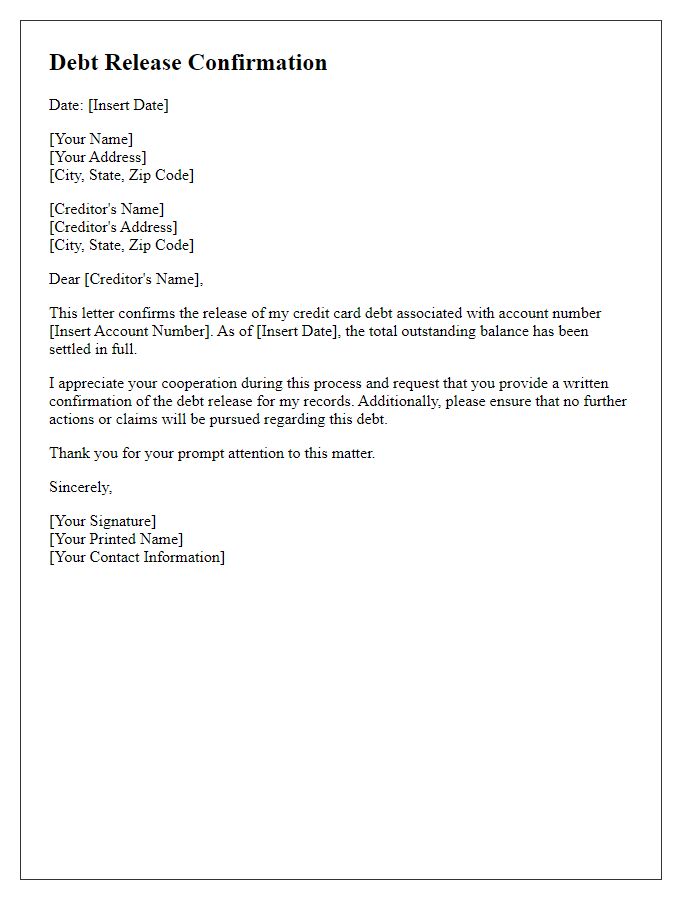

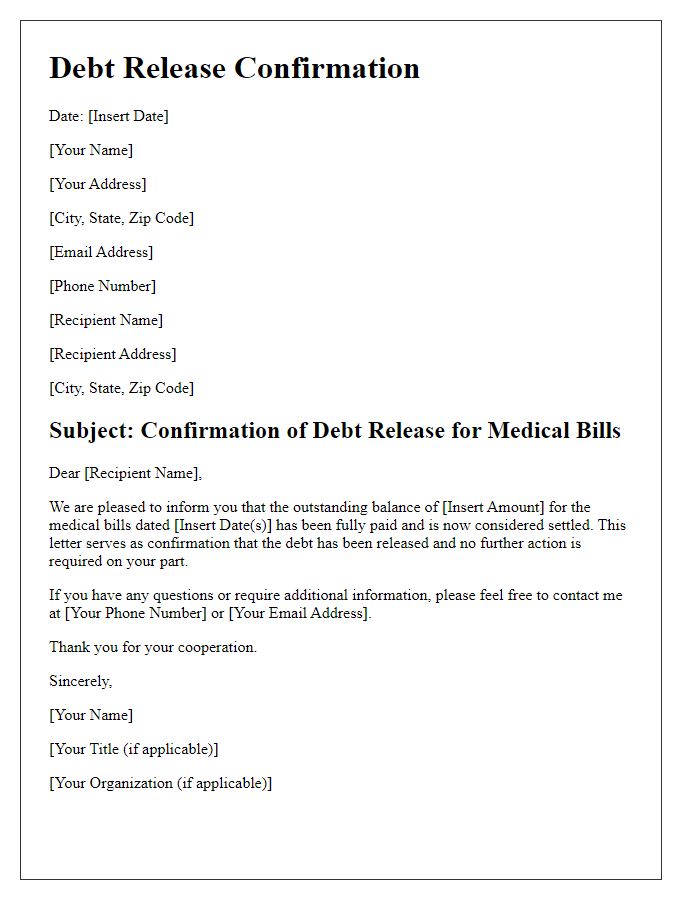

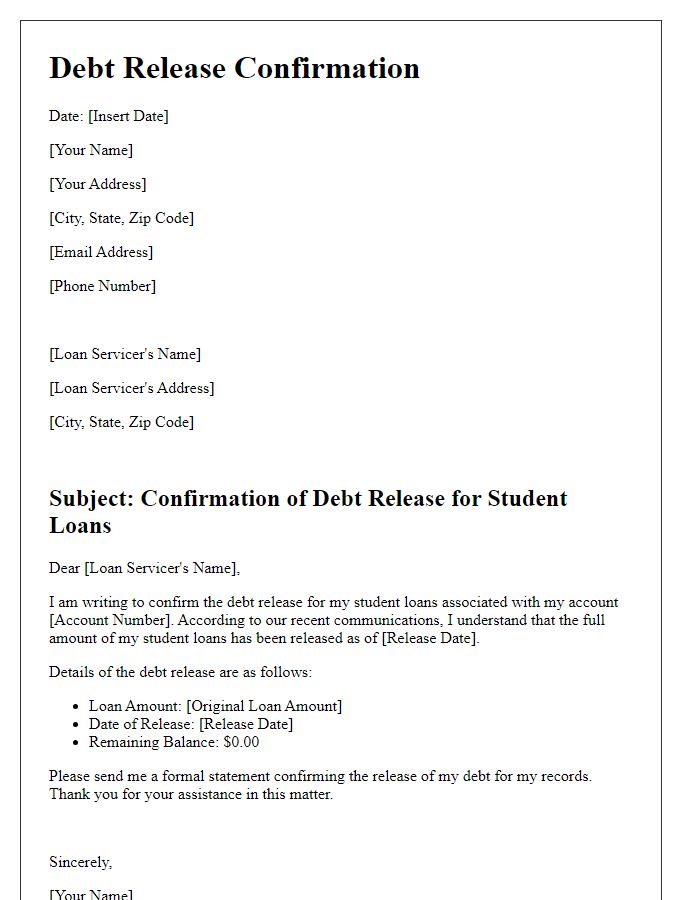

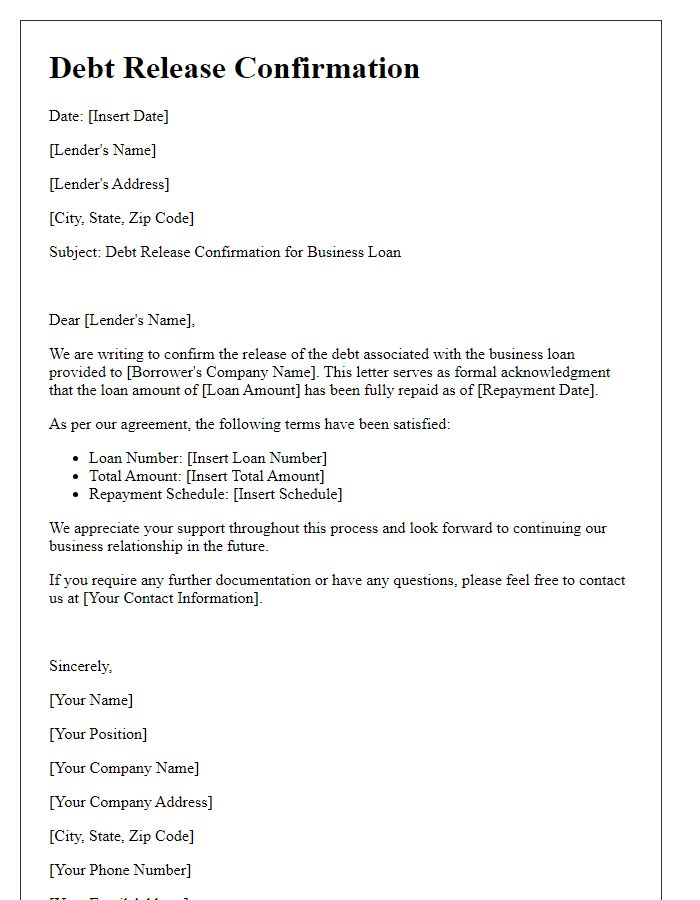

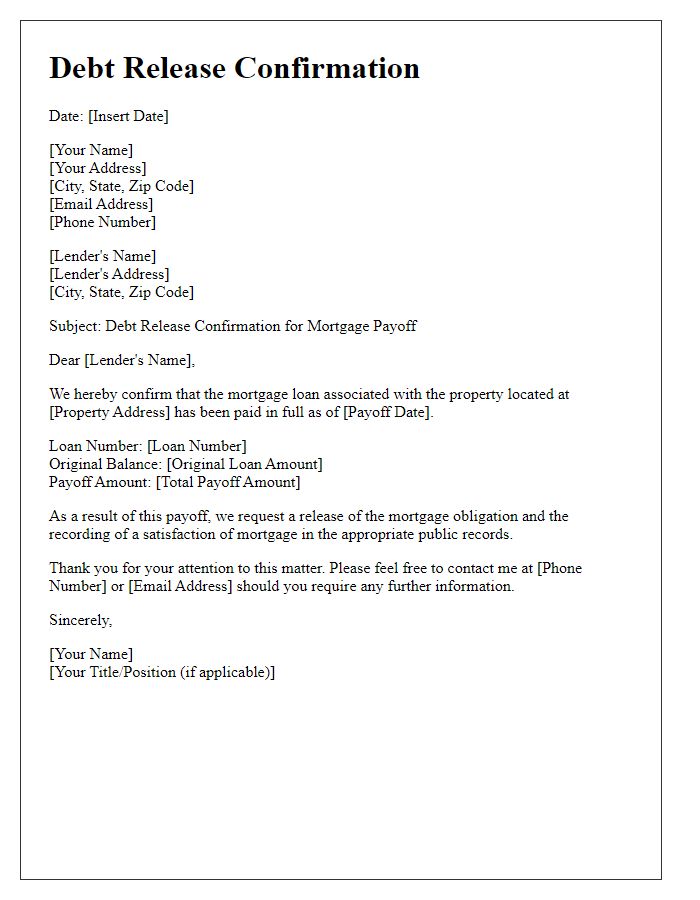

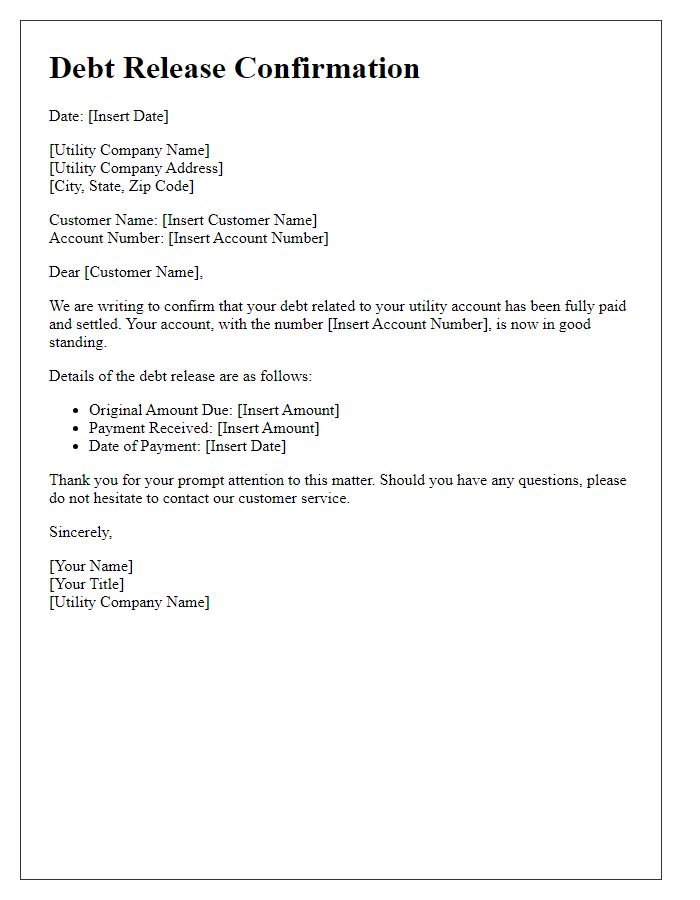

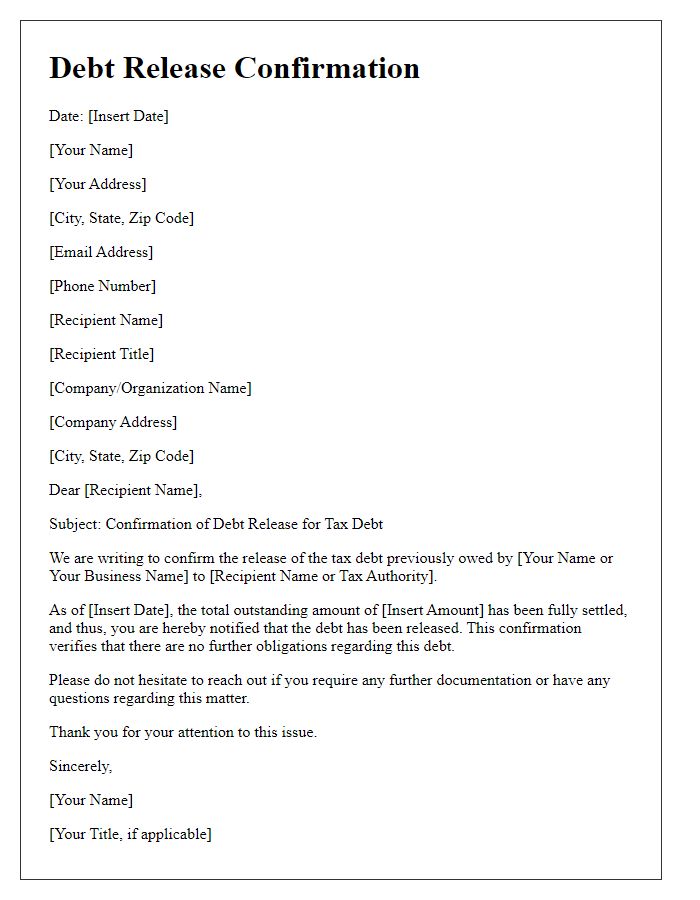

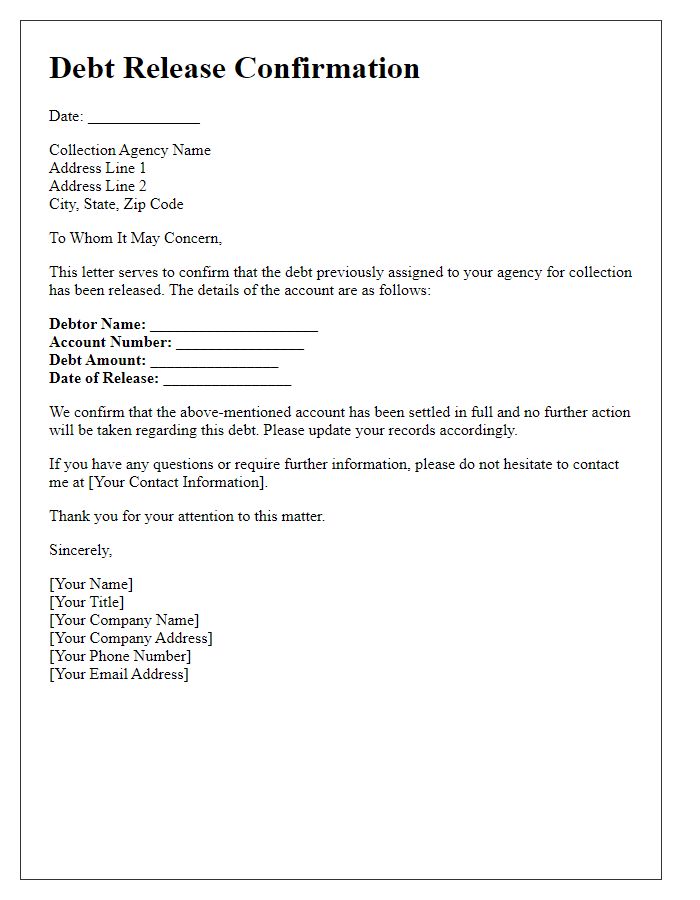

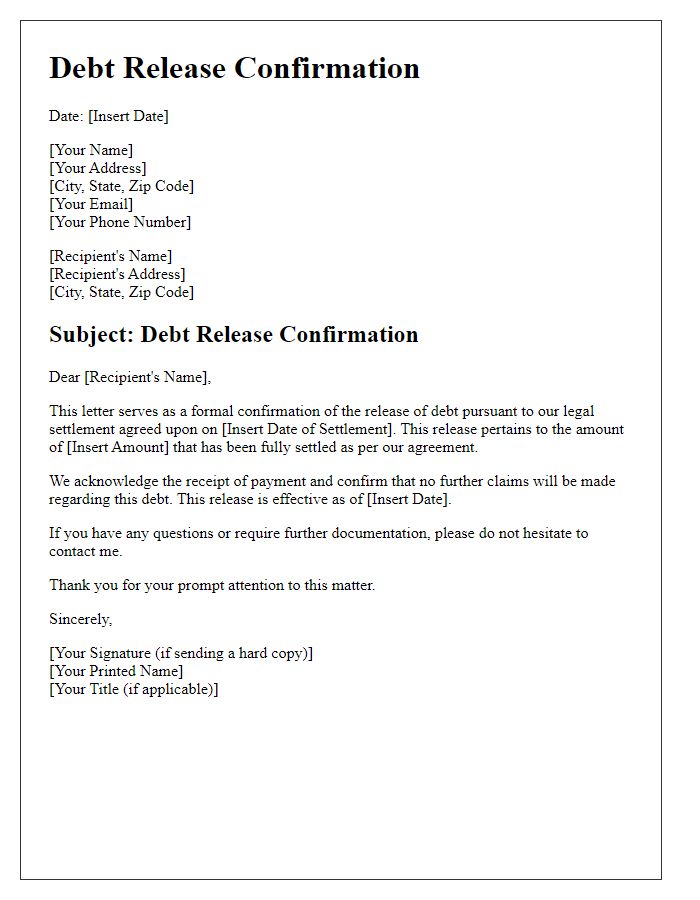

Creditor and debtor information

Debt release confirmation signifies the formal acknowledgment that a debt has been settled. This document includes crucial information such as the creditor's name, address, and contact details, often featuring a unique creditor identification number for identification purposes. The debtor's name, address, and identification details, such as a Social Security Number or Tax ID, must also be included to ensure clarity. The document details the original amount of the debt, the date of the agreement, and the method of payment, whether it was a lump sum or installment payments. A confirmation statement explicitly declaring that the debt is considered paid in full and the effective date of the release should also be part of the document. Finally, it may include signatures from both the creditor and debtor, validating the agreement and providing legal protection for both parties.

Debt amount and description

Debt release confirmation officially acknowledges the clearance of an outstanding financial obligation, such as loans or credit. This confirmation highlights key details, including the total debt amount, often expressed in a specific currency (USD, EUR), and the nature of the debt, possibly identifying it as a personal loan, credit card balance, or medical bill. The confirmation serves as a formal document, providing assurance that the debtor, typically an individual or organization, has fulfilled all terms of repayment. It may also include the date of release, reflecting the completion of the repayment process and relieving the debtor from financial responsibility associated with that particular obligation.

Confirmation of full payment

A debt release confirmation document serves as official proof that an individual or organization has completed their payment obligations. It typically includes essential details such as the debtor's name, the creditor's name, transaction amount (specifying currency, e.g., USD), payment date, and the account or invoice number associated with the debt. This confirmation signifies that the creditor, which may be a financial institution or a private lender, acknowledges receipt of full payment for the outstanding balance. Additionally, it may note any terms of agreement or conditions pertinent to the release, underscoring the resolution of the debt situation. Such documentation is vital in protecting the debtor from future claims regarding the settled debt and is often retained for personal records or potential future financial transactions.

Legal release statement

Debt release confirmation documents serve to officially indicate that a debtor has fully satisfied their financial obligations to a creditor, effectively releasing them from any further liabilities. A legally binding statement typically includes essential details such as the creditor's name, debtor's name, total debt amount, payment date, and any related account numbers. Additionally, it should be signed by a representative of the creditor, providing reassurance of legitimate release from the obligation. The document may also reference applicable laws or regulations to ensure compliance, protecting both parties' interests. Such confirmation is crucial for maintaining accurate financial records and ensuring peace of mind for debtors.

Contact details for further inquiries

For debt release confirmation, providing comprehensive contact details is vital for effective communication. Key information includes a designated phone number, allowing direct inquiries regarding the debt release status, and an email address for written correspondence. Mailing address should also be included, ensuring recipients can send any necessary documents or formal requests. Furthermore, including a specific point of contact, such as a customer service representative's name, enhances accountability and expedites the inquiry process, particularly for complex cases or high-value debts.

Comments