Have you ever felt overwhelmed by the complexities of debt communication? Navigating the regulations surrounding monitored debt communication can be daunting, but understanding these guidelines is crucial for both creditors and consumers. This article will break down the essentials, ensuring you're equipped with the knowledge to handle debt communications effectively. Read on to explore practical insights and tips that can help simplify this process!

Clear identification of the creditor and debtor.

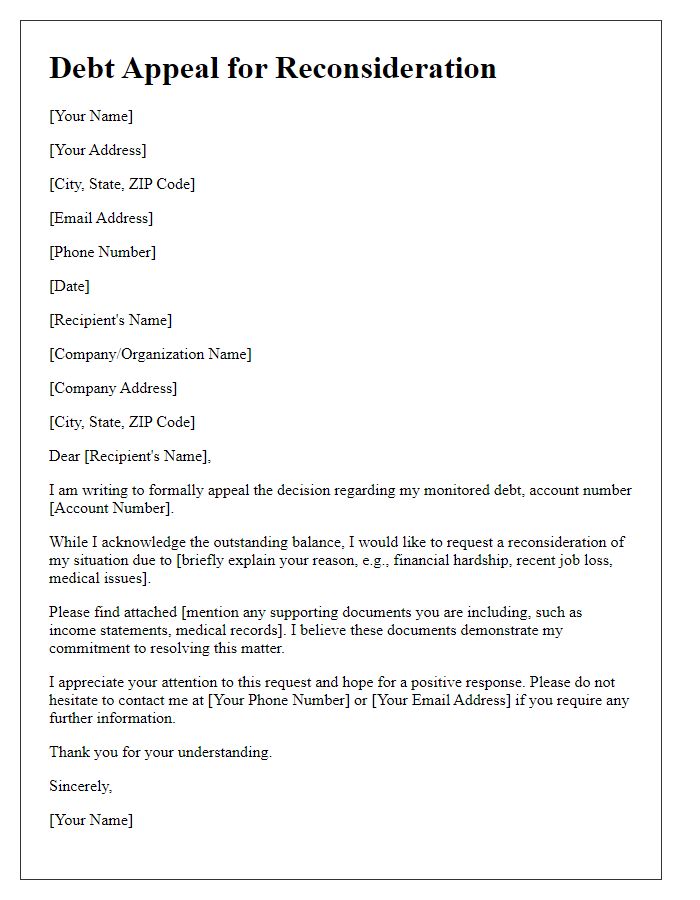

In the regulated communication of monitored debt, precise identification of both the creditor (the financial institution or individual owed money, such as XYZ Bank, based in New York City, holding a debt account number 123456) and the debtor (the person or entity who owes the money, for instance, John Doe residing at 456 Elm Street, Springfield, Illinois) is crucial. Legal documentation mandates that the debtor's contact information, including phone number (555-123-4567) and email (johndoe@email.com), be clearly stated for effective communication. Additionally, the total outstanding balance, payment due date, and any applicable interest rates (for example, 5% APR) must accompany the identification to ensure transparency and clarity in the debt communication process, aligning with Fair Debt Collection Practices Act guidelines put in place to protect consumer rights.

Detailed summary of the debt obligation.

The monitored debt communication regulation requires a detailed summary of the debt obligation, emphasizing key components such as outstanding balance, total amount due, and payment schedule. For instance, an outstanding balance of $5,000 may accrue interest charges based on a specified annual percentage rate (APR) of 15%. Payment obligations typically include monthly payments of $200 due on the 15th of each month. Furthermore, this summary should detail any late fees, which may reach $50 per occurrence, and consequences of non-payment, including potential collections or legal actions. Accurate records of transactions, including payment history, also contribute to clear communication, ensuring debtors understand their responsibilities under this regulation.

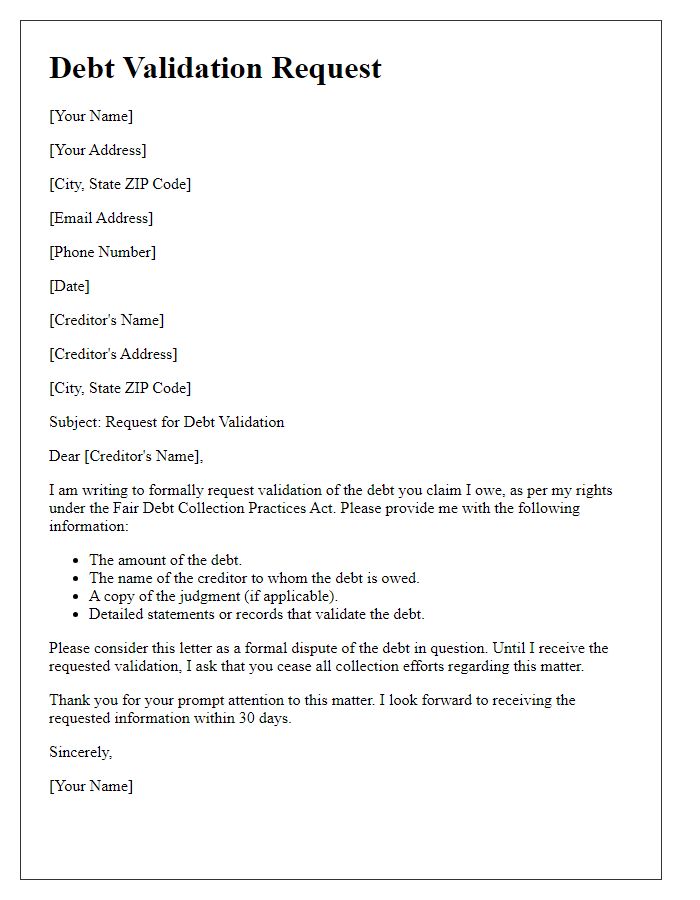

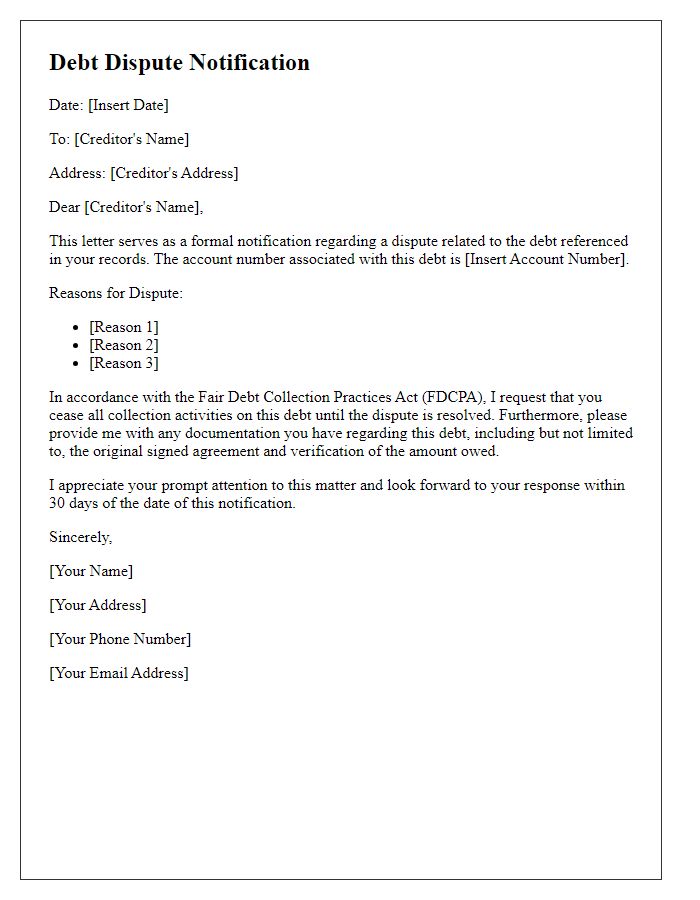

Compliance with legal disclosure requirements.

Financial institutions must adhere to monitored debt communication regulations, specifically the Fair Debt Collection Practices Act (FDCPA) in the United States. This law mandates clear disclosure of the debt's nature, including the original creditor's name and total amount owed, which can help consumers understand their financial obligations. The regulation also requires that consumers receive notification of their rights, specifically the right to dispute the debt within 30 days, which is crucial for transparency. Failure to comply with these legal disclosure requirements can result in significant penalties for collectors, including fines and legal action. Additionally, adherence to regulations ensures ethical communication, fostering trust in financial relationships.

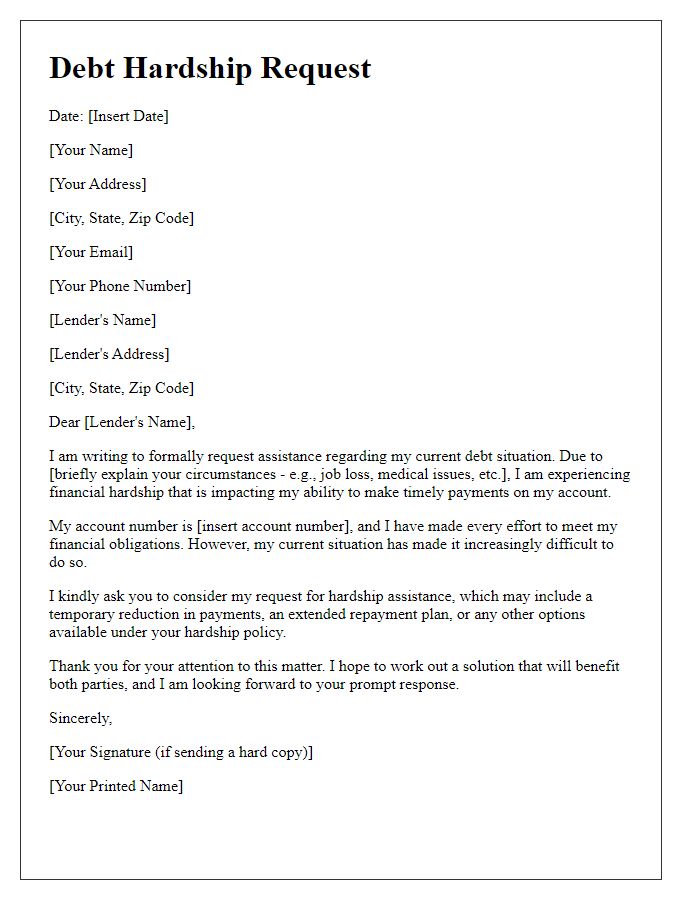

Options and methods for debt resolution.

Debt resolution options include negotiation processes, consolidation strategies, bankruptcy filings, and payment plans tailored to individual financial circumstances. Open communication with debtors can facilitate understanding of available methods such as debt settlement, which reduces the total amount owed, or credit counseling services that offer budgeting assistance and financial education. Legal avenues include Chapter 7 or Chapter 13 bankruptcy, each with distinct eligibility requirements and implications on credit reports, lasting up to ten years for bankruptcies. Additionally, regulatory frameworks set by the Consumer Financial Protection Bureau (CFPB) in the United States underscore protective measures aimed at ensuring fair treatment of consumers during debt recovery efforts. Organizations such as the National Foundation for Credit Counseling (NFCC) are instrumental in providing resources and support for individuals seeking viable debt resolutions.

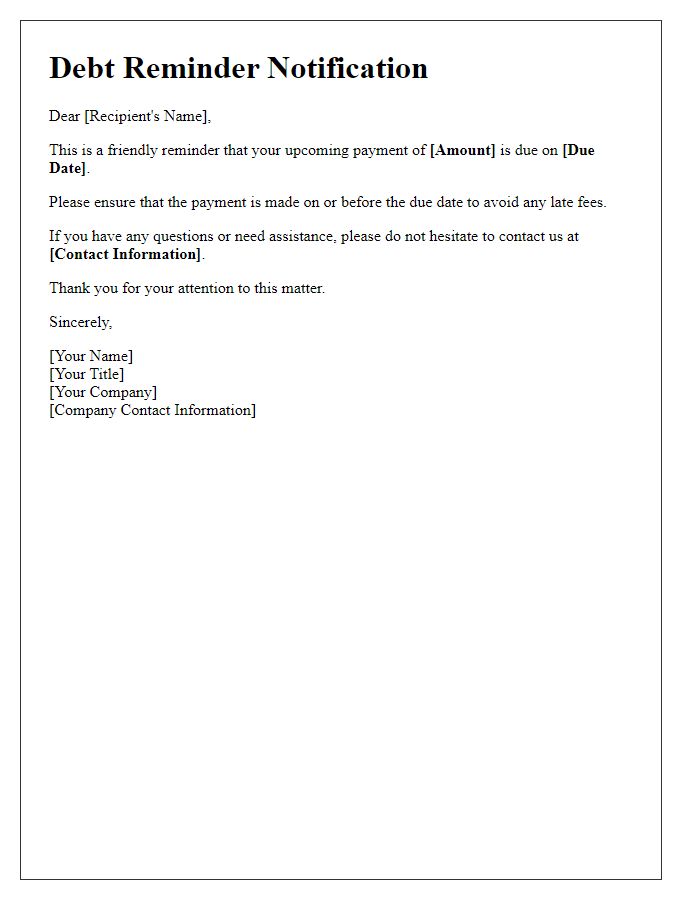

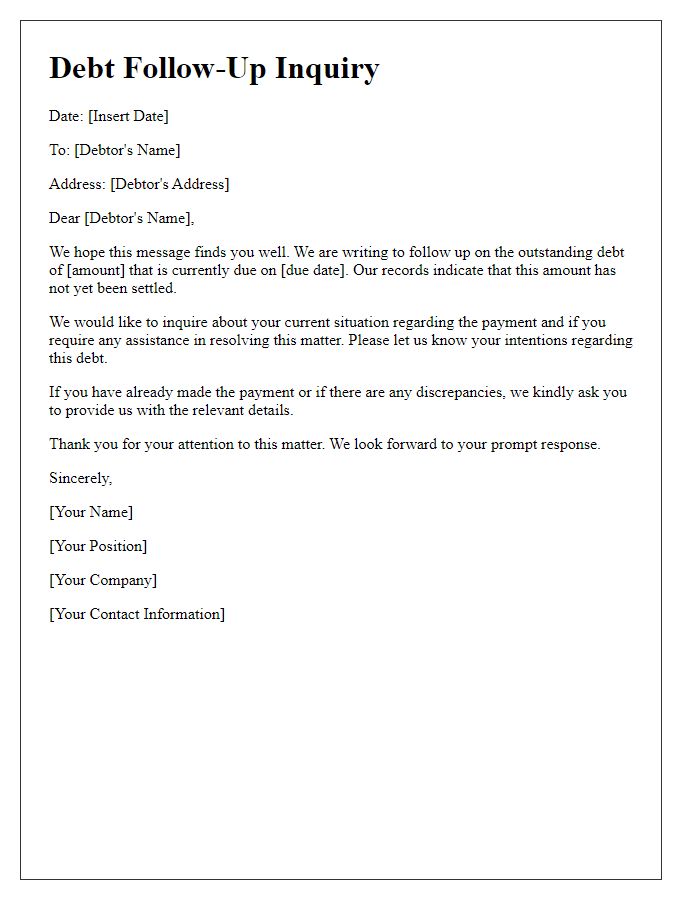

Timeline and deadlines for debtor response.

In monitored debt communication, specific timelines and deadlines play a crucial role in ensuring effective debtor response. A typical timeline may commence with the initial notification sent via certified mail, allowing a grace period of 30 days for the debtor to acknowledge the debt. Following this, a reminder notice issued at the 15-day mark serves to reinforce the urgency of the response. If no action occurs within a subsequent 15 days, a final notice offering a settlement option may be dispatched, clearly outlining the consequences of non-response, including potential collections or legal proceedings. The emphasis on compliance is significant, as regulatory bodies like the Consumer Financial Protection Bureau (CFPB) mandate strict adherence to these timelines to protect consumer rights while facilitating resolution.

Comments