Are you feeling the pressure of managing debts and seeking a bit more time to catch your breath? You're not aloneâmany people find themselves in similar situations and are looking for ways to navigate their financial challenges. In this article, we'll discuss a simple yet effective letter template for requesting a debt extension, ensuring you communicate your needs clearly and professionally. So, if you're ready to take the next step towards financial relief, keep reading!

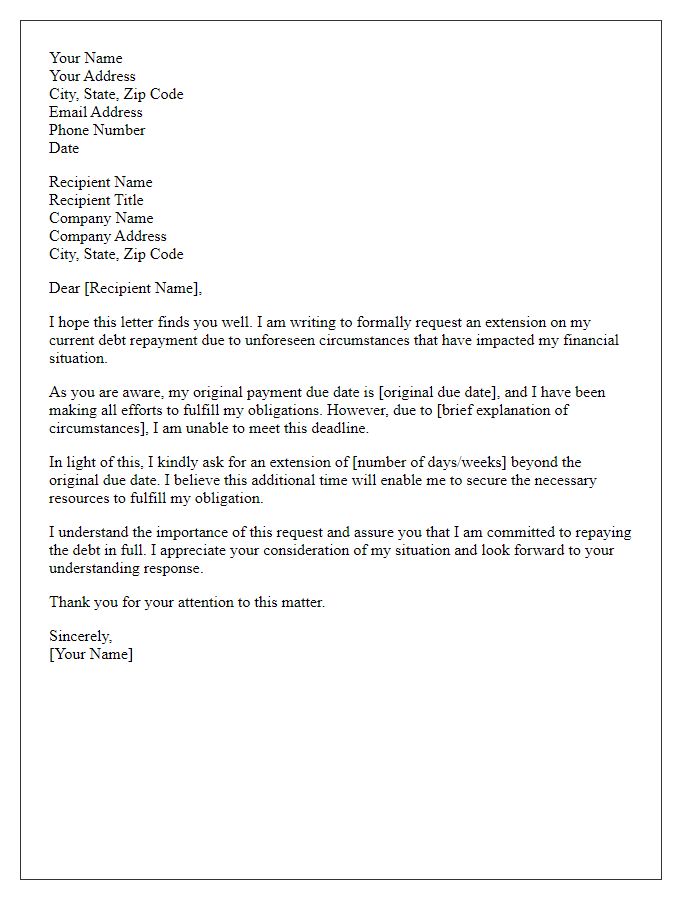

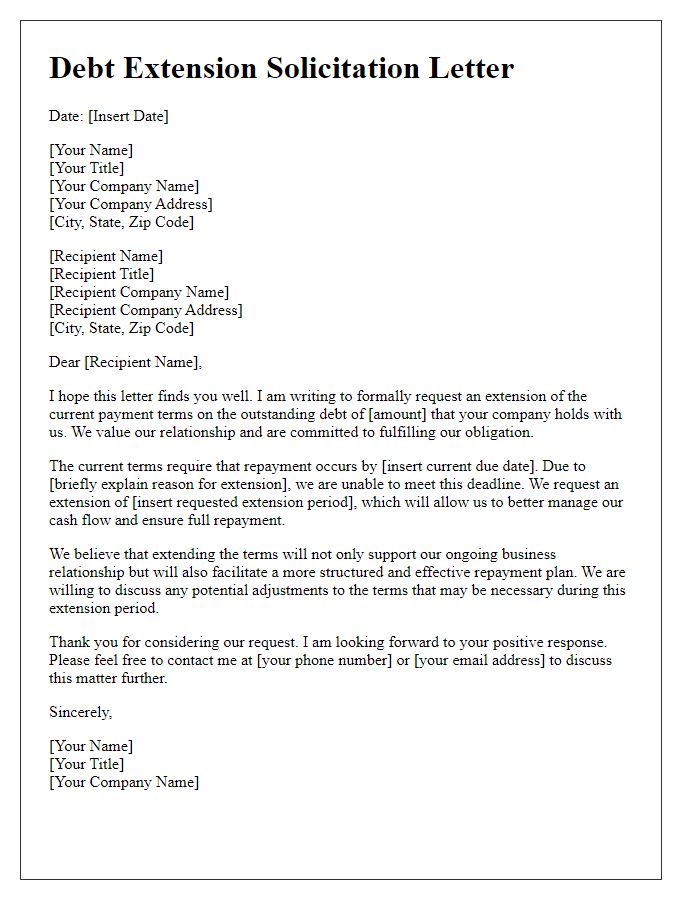

Formal salutations

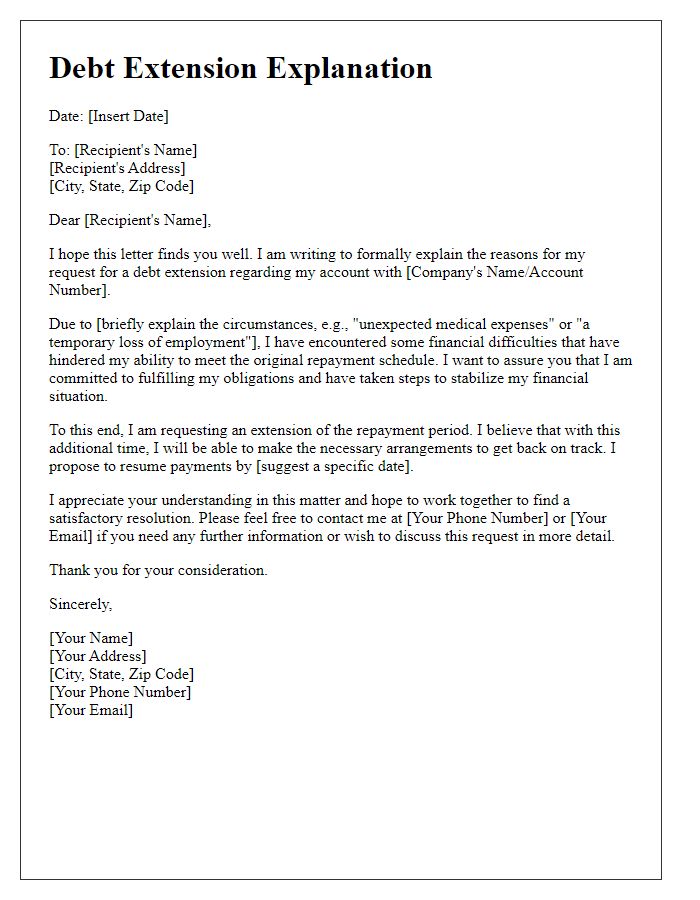

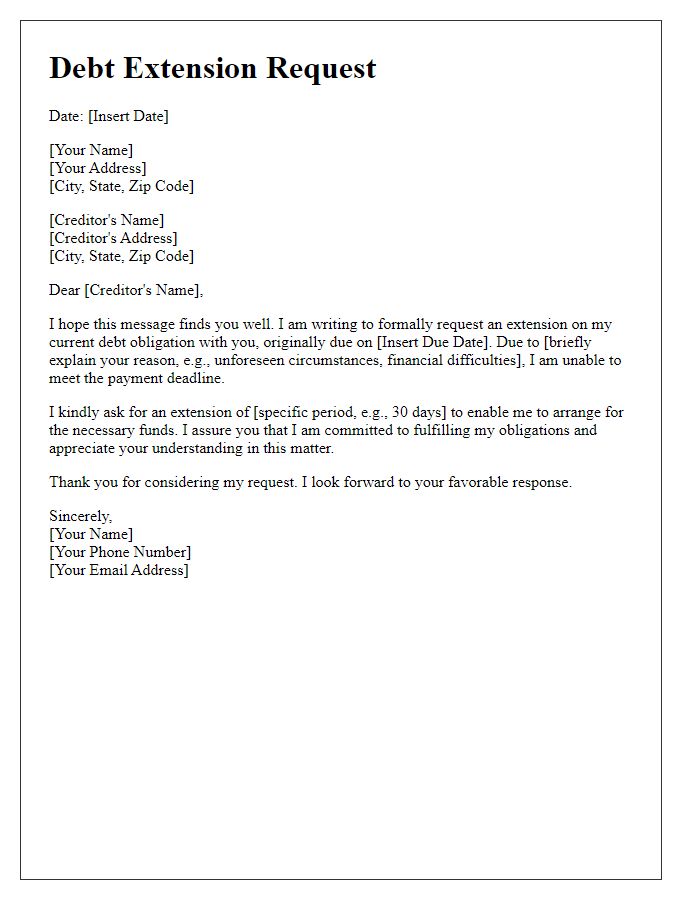

Drafting a letter for requesting a debt extension requires careful attention to detail and clarity. Begin with a formal salutation, addressing the recipient politely, such as "Dear [Recipient's Name or Title]." This conveys respect and creates a professional tone. Mention specific overdue amounts and the original due date, providing necessary context for the request. Clearly articulate the reason for the extension, be it financial hardship or unexpected circumstances. Emphasizing your intention to meet obligations and proposing a new timeline for payment can strengthen your case. Conclude with expressions of gratitude and a professional closing, maintaining the formal nature throughout.

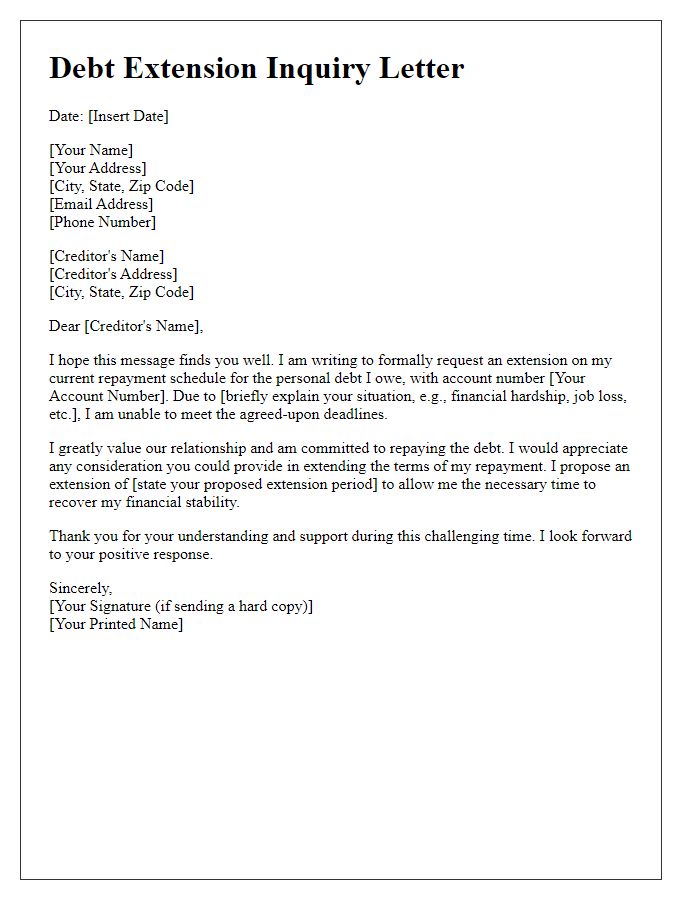

Account details and debt information

A debt extension request typically includes relevant account details and comprehensive debt information to provide clarity on the current financial situation. This includes the account number, indicating the specific loan or credit account, and the total outstanding balance owed, specifying the monetary figure that requires attention. The request should also mention the due date of the current payment, allowing the recipient to understand the urgency of the situation. Furthermore, it may include payment history, highlighting prior payments made on time versus any missed payments, which could influence the decision maker's response. Including contact details for direct communication might facilitate a quicker resolution. Providing a clear and transparent overview of these details enhances the effectiveness of the request, reflecting the seriousness of the financial circumstances while seeking assistance.

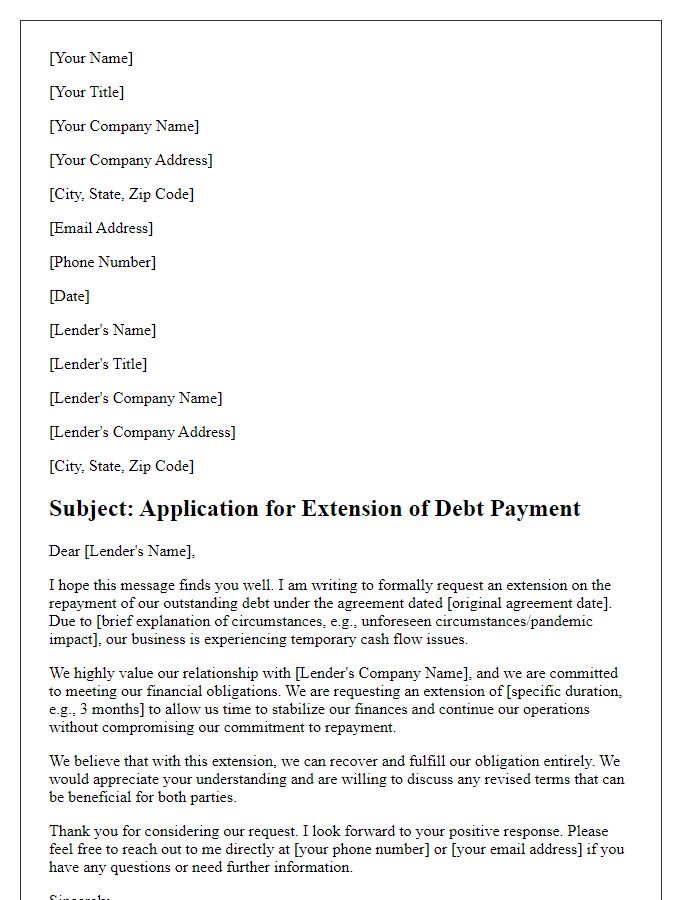

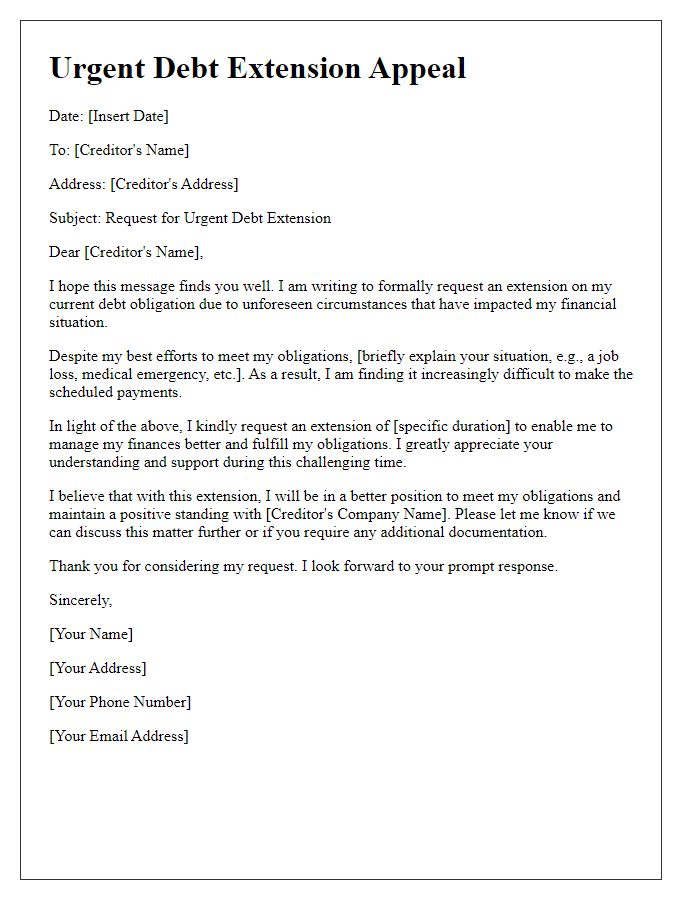

Reason for extension request

A debt extension request typically arises from unexpected financial difficulties impacting timely repayment. These challenges may include job loss, medical expenses, or significant life changes like a divorce. Detailed documentation supporting the reason for the extension, such as termination letters from previous employers or medical bills, can enhance the credibility of the request. The request should specify a new proposed payment plan, outlining manageable monthly payments. Timely communication with creditors is essential to maintain transparency, as it fosters goodwill and strengthens the likelihood of approval for the requested extension.

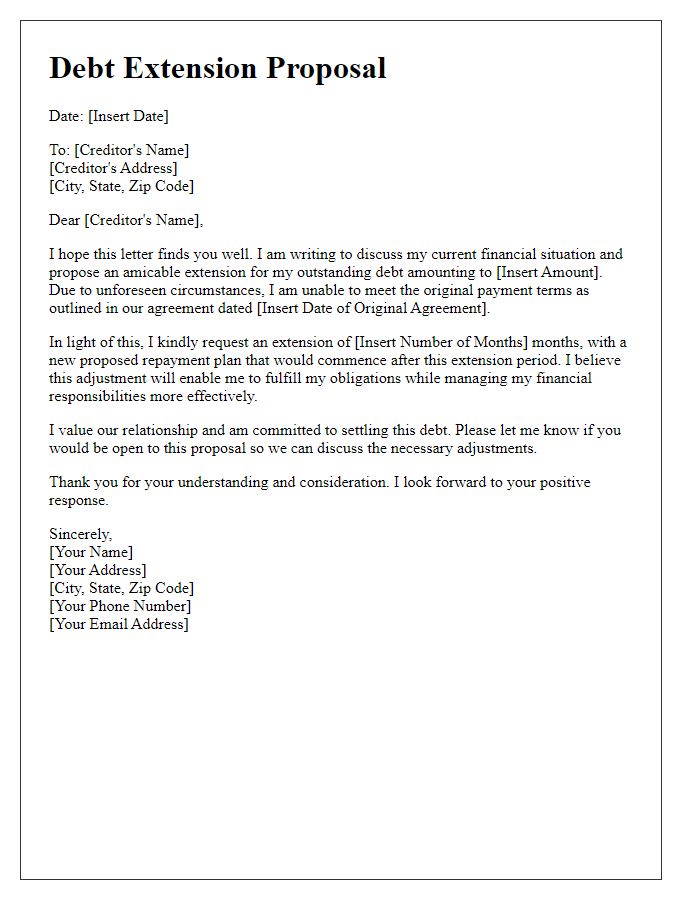

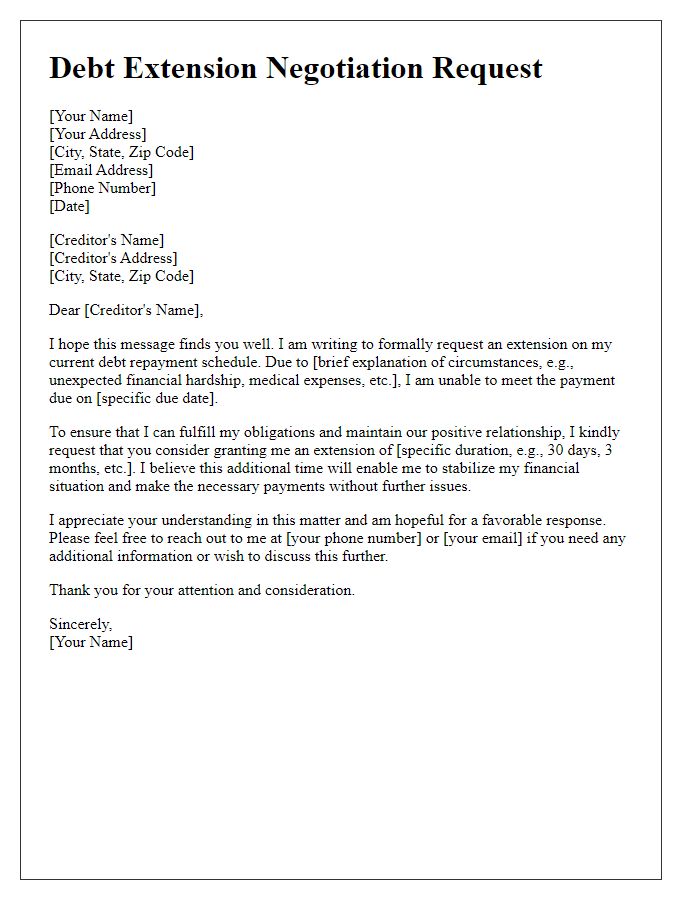

Proposed new terms or timeline

Debt extension requests often require a clear outline of proposed new terms or a revised timeline. In a typical scenario, a debtor might seek to extend the repayment period (for instance, from 12 months to 24 months) due to unforeseen financial circumstances. The request may include a detailed payment schedule, specifying revised monthly payment amounts, such as reducing payments from $500 to $250 over the new extended term. Additionally, it is crucial to mention any potential changes in interest rates, like proposing a fixed rate of 5% instead of a variable rate, ensuring long-term affordability. Furthermore, the request should emphasize commitment to meet the new obligations and provide a clear rationale for the extension, such as job loss or unexpected medical expenses, to enhance the chances of approval from creditors.

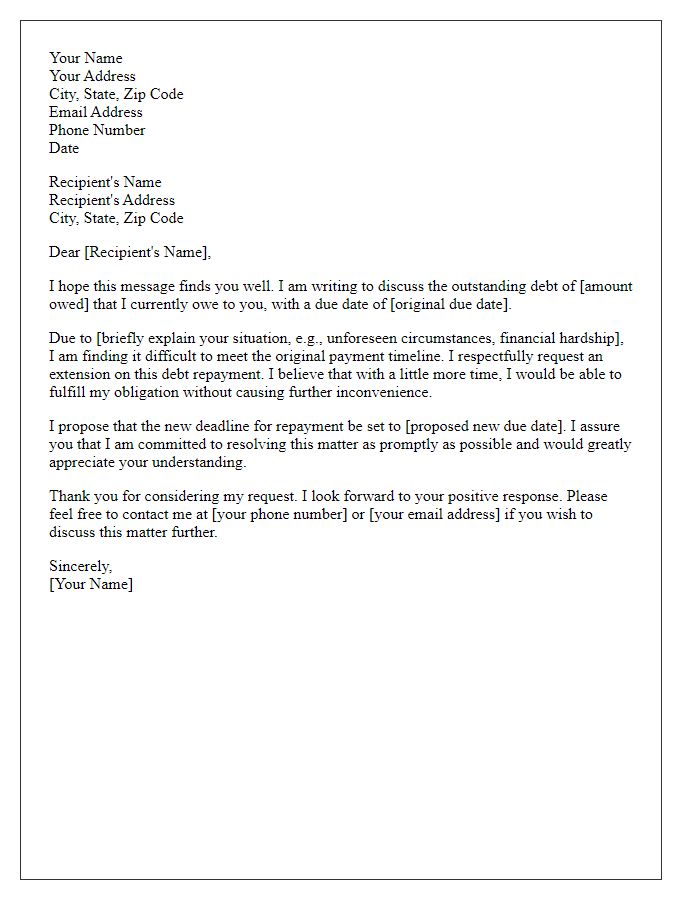

Appreciation and contact information

An effective debt extension request highlights the importance of maintaining open communication with the creditor. Expressing appreciation for past support reassures the lender of the relationship's value. Contact information should be clearly listed, ensuring the creditor can easily reach out for further discussions. This demonstrates professionalism and willingness to cooperate. A well-crafted request might also include specific reasons for the extension, such as financial difficulties due to unforeseen circumstances, emphasizing the need for understanding and flexibility in repayment terms.

Comments