If you're navigating the tricky waters of debt collection, crafting an effective notification letter can make all the difference. A well-structured letter not only conveys your intent but also ensures that your message is clear and professional. It's important to strike the right balance between being firm and respectful, as this can significantly improve your chances of a positive response. Ready to dive deeper into the essentials of writing a legal debt collection notification? Let's explore!

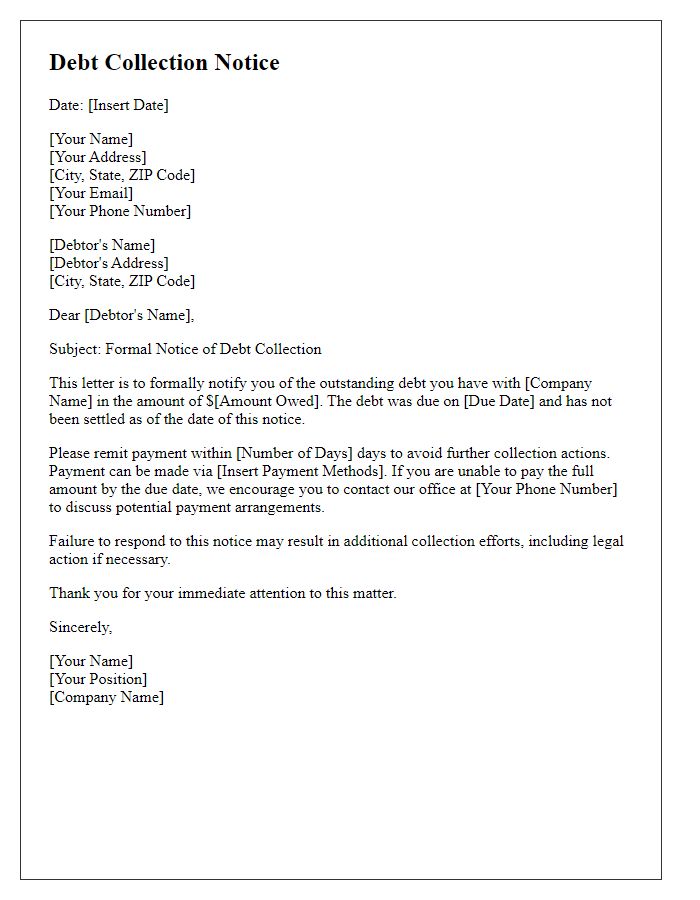

Creditor and Debtor Information

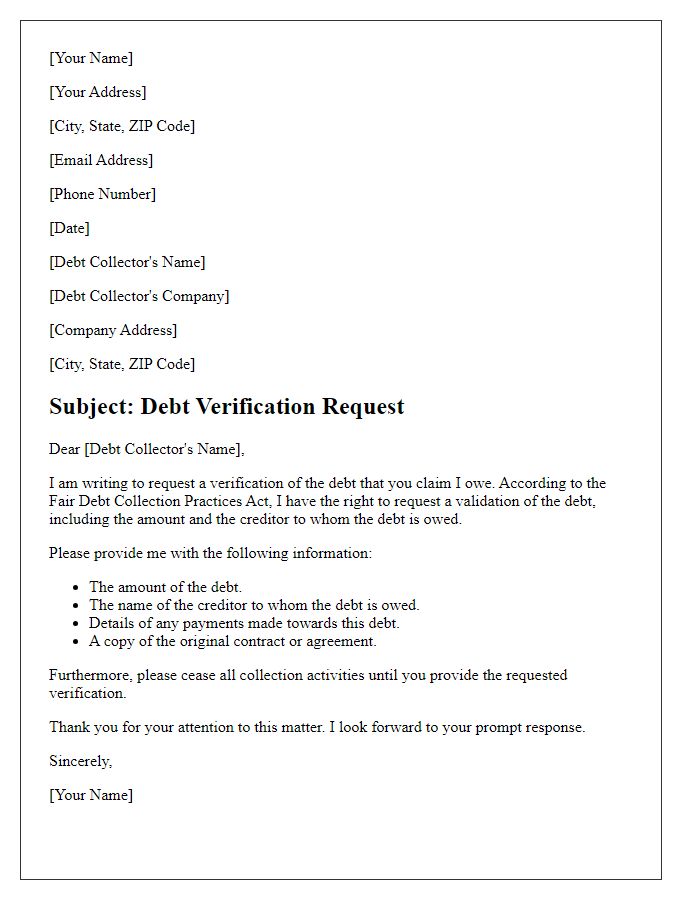

The legal debt collection notification must include essential information about both the creditor and debtor. For the creditor, include the full name or business name, mailing address, and contact information such as a phone number or email. Specify the creditor's account number related to the debt for easier identification. For the debtor, provide the full name, mailing address, and any additional identification information such as Social Security number or account number with the creditor. Highlight any relevant details surrounding the debt, including the original amount owed, interest rates applied, and any payment history, along with the outstanding balance owing as of the date of notification. This comprehensive approach ensures clarity and assists in resolving the financial obligation effectively.

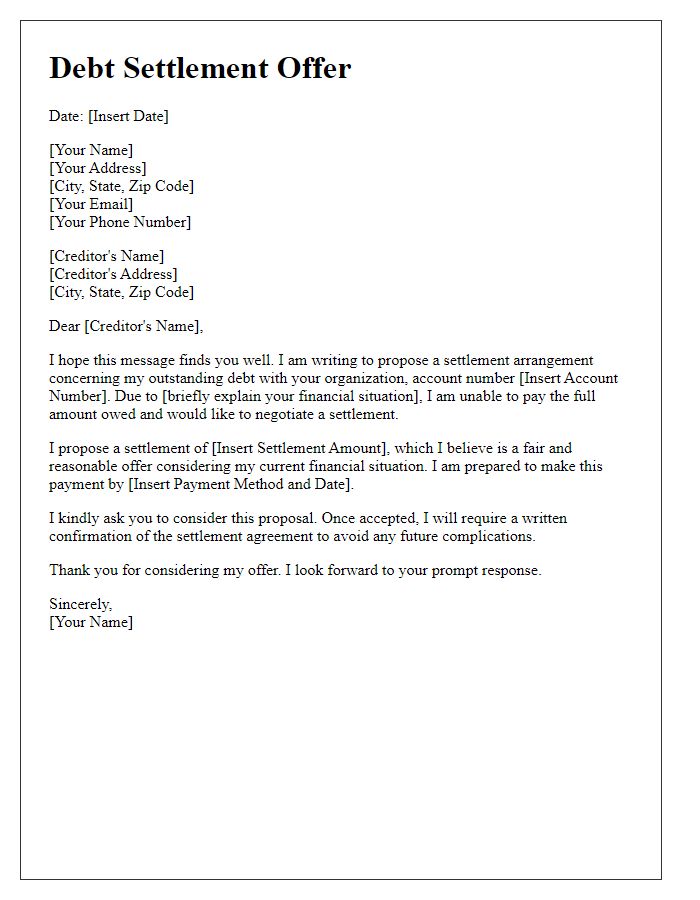

Outstanding Debt Amount

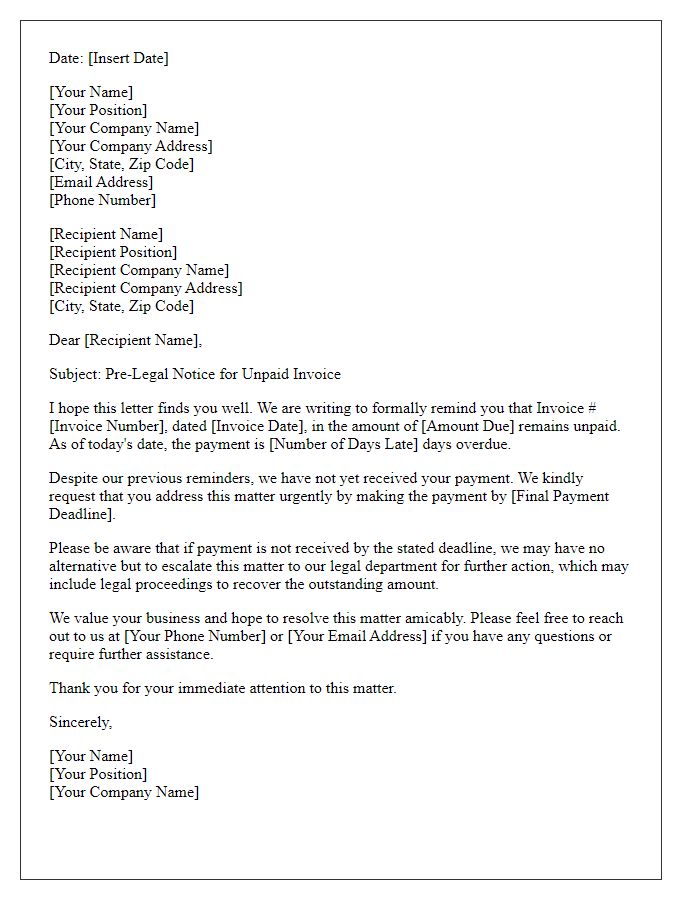

A legal debt collection notification outlines the outstanding debt amount owed by a borrower to a lender or creditor. This notification usually specifies the exact debt figure, which may include principal, accrued interest, and any applicable fees or charges. For instance, a borrower in New York with an outstanding debt amount of $5,000 could receive a notification detailing the obligation, payment due dates, and consequences of non-payment, such as potential legal action or negative credit reporting. The letter often references previous communications dated within the last six months, establishes the collection agency representing the creditor, and provides contact information for further inquiries to facilitate resolution before escalating the matter legally.

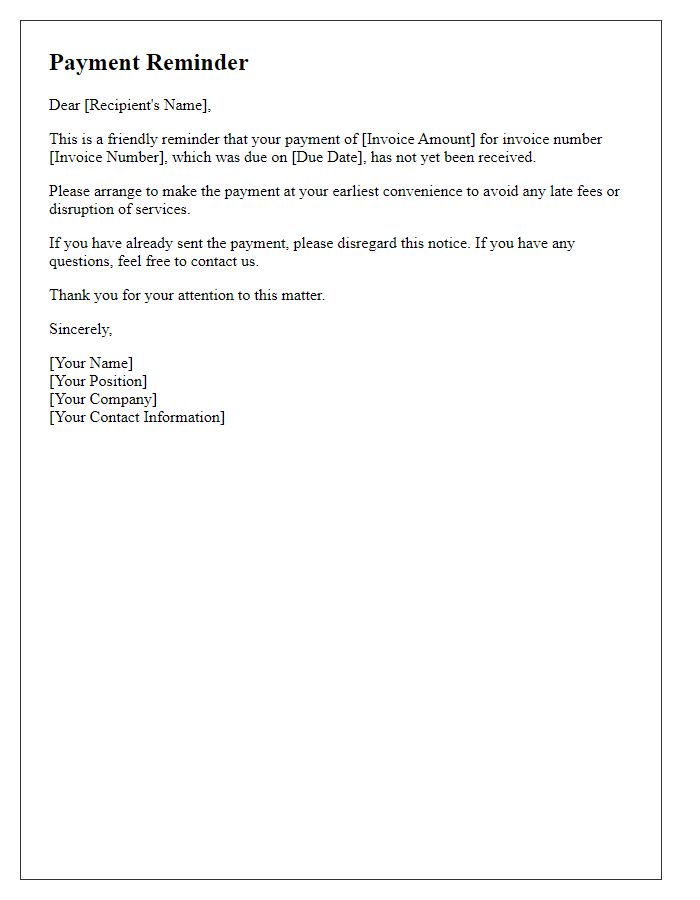

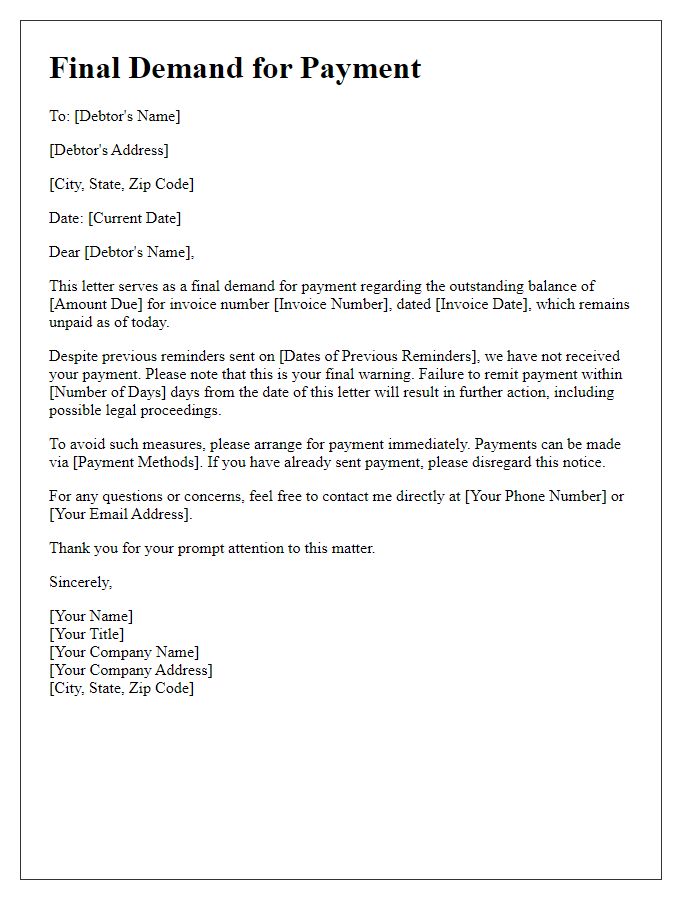

Due Date and Payment Instructions

In the context of a legal debt collection notification, clarity and specificity are essential for compliance and effectiveness. A detailed explanation should include a clear due date, usually specified as a calendar date, and instructions for payment methods, such as wire transfer or credit card, to ensure the debtor understands their obligations. The total amount due should be prominently displayed, including any potential late fees or interest accrued, along with a contact number for inquiries. Providing the debtor with options for payment plans or negotiation may also encourage resolution. Moreover, referencing specific legal statutes or terms may enhance the validity of the notification in the eyes of consumers. Understanding the implications under the Fair Debt Collection Practices Act (FDCPA) is critical for maintaining ethical standards in the debt collection process.

Legal Consequences and Actions

Businesses that deal with overdue accounts often face legal consequences if proper debt collection measures are not taken. A legal debt collection notification notifies the debtor of their outstanding amount, which may reach thousands of dollars, and the potential implications for failure to respond. In jurisdictions such as the United States, the Fair Debt Collection Practices Act (FDCPA) governs how debt collectors must conduct their communications, safeguarding consumers against harassment. Debtors are usually given a specific timeframe, often 30 days, to respond or settle the debt before further actions such as court proceedings can be initiated. Ignoring such notifications may also lead to additional costs, which can include attorney fees and court expenses that accumulate quickly, making the total amount due even larger.

Contact Information for Queries and Resolution

Proper communication is essential for resolving debt collection issues effectively. Clear and concise contact information facilitates easier interactions between the creditor and debtor. Include the creditor's name, which is the company or individual to whom the debt is owed, along with a dedicated phone number, such as a toll-free number for nationwide access or a local number for regional matters. An email address should also be provided, ensuring quick digital correspondence. Mailing addresses, especially for sending official documents or payments, must be accurate and up-to-date, with any office location mentioned clearly if applicable. Providing operation hours for inquiries is vital, allowing debtors to know the best times to reach out.

Comments