Are you facing financial challenges and need to propose a repayment plan? Crafting the right letter can make all the difference in communicating your intentions clearly and professionally. A well-structured repayment plan proposal can not only demonstrate your commitment to meeting obligations but also help maintain positive relationships with creditors. Let's explore how you can create a compelling repayment letter that sets you on the right path â read on to find out more!

Clear subject line

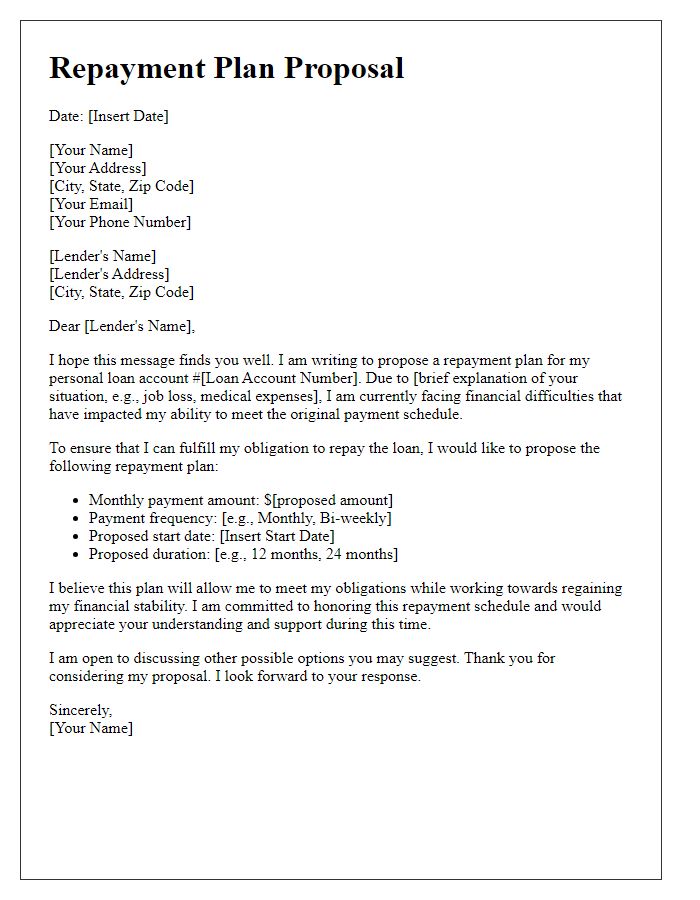

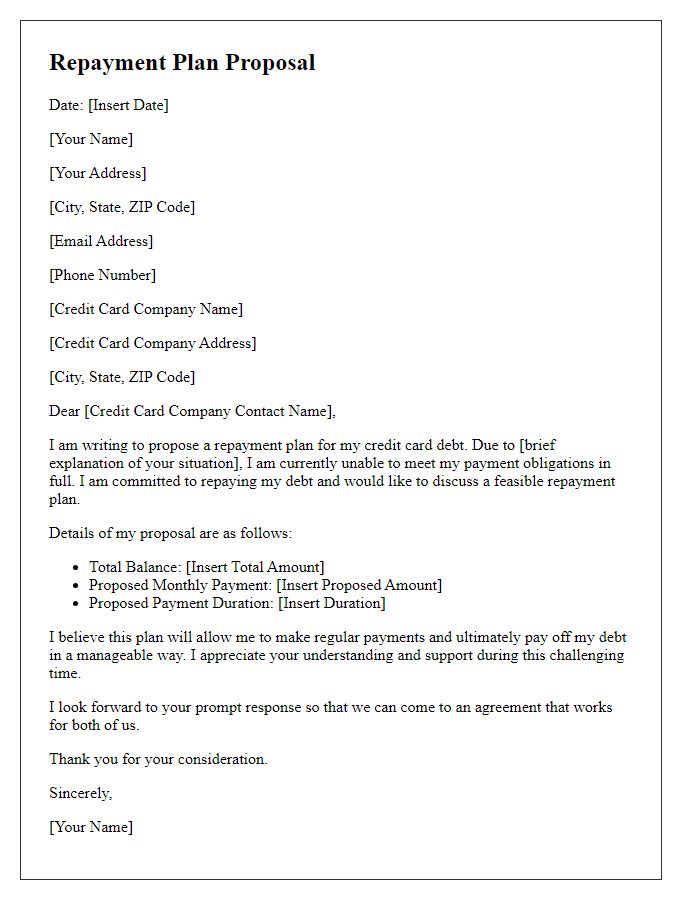

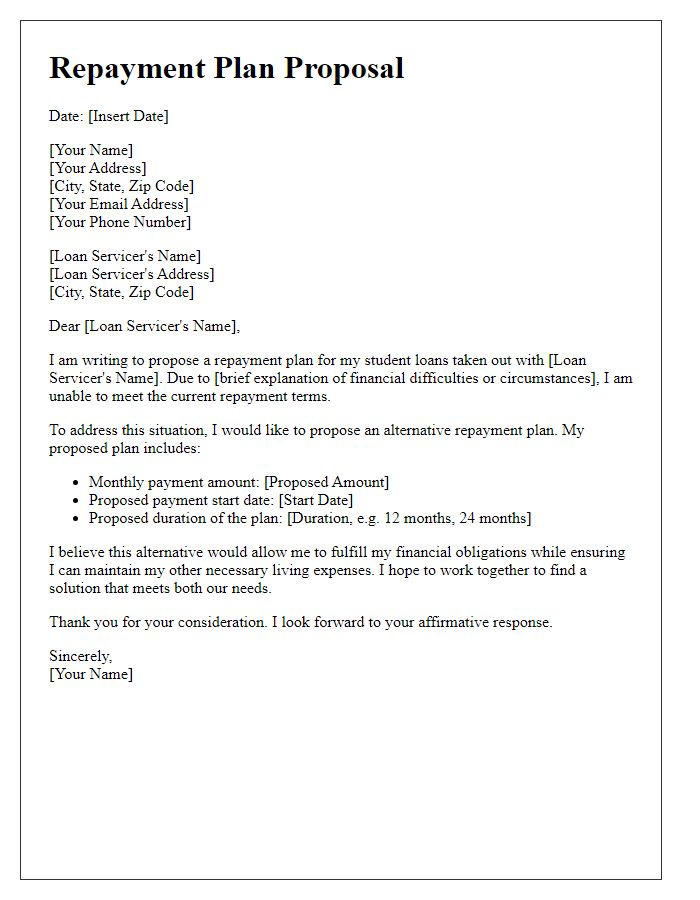

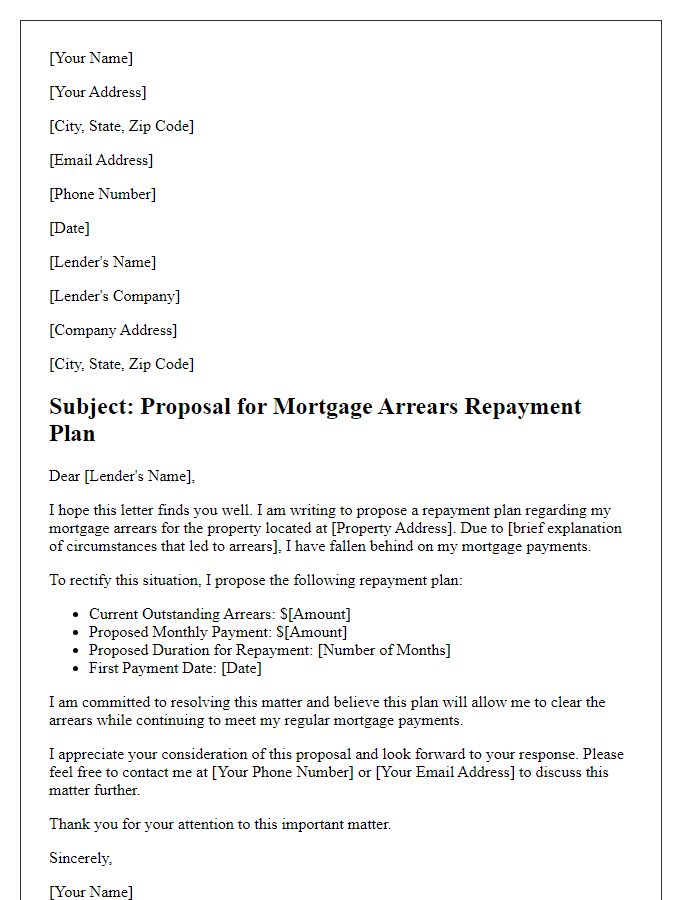

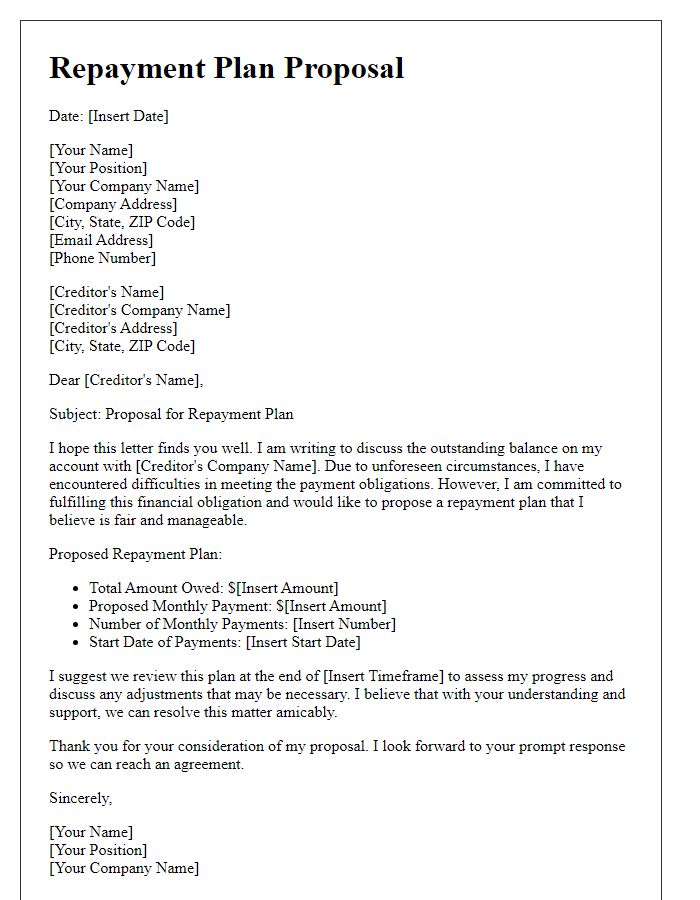

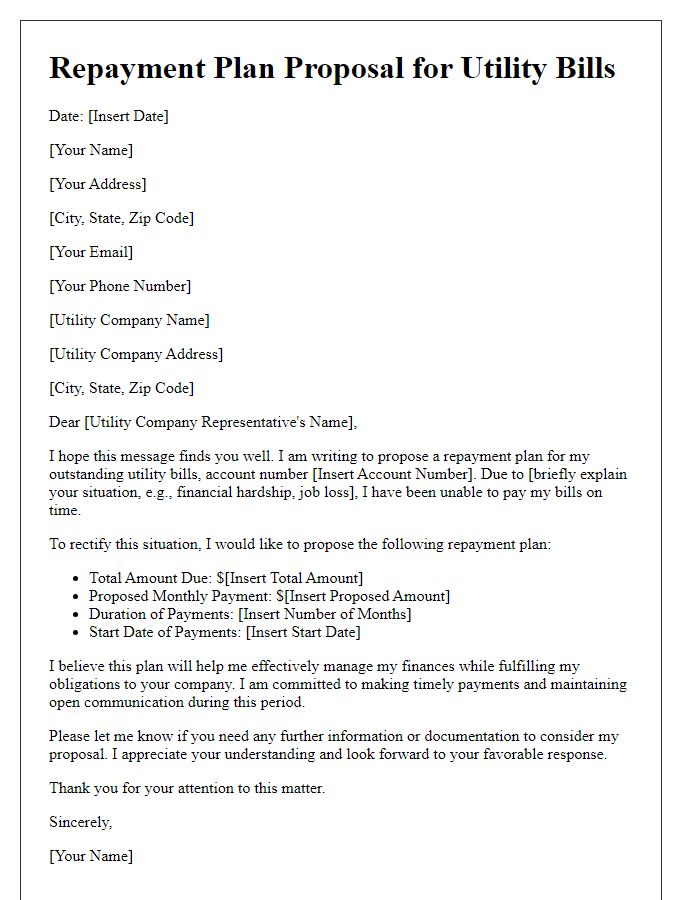

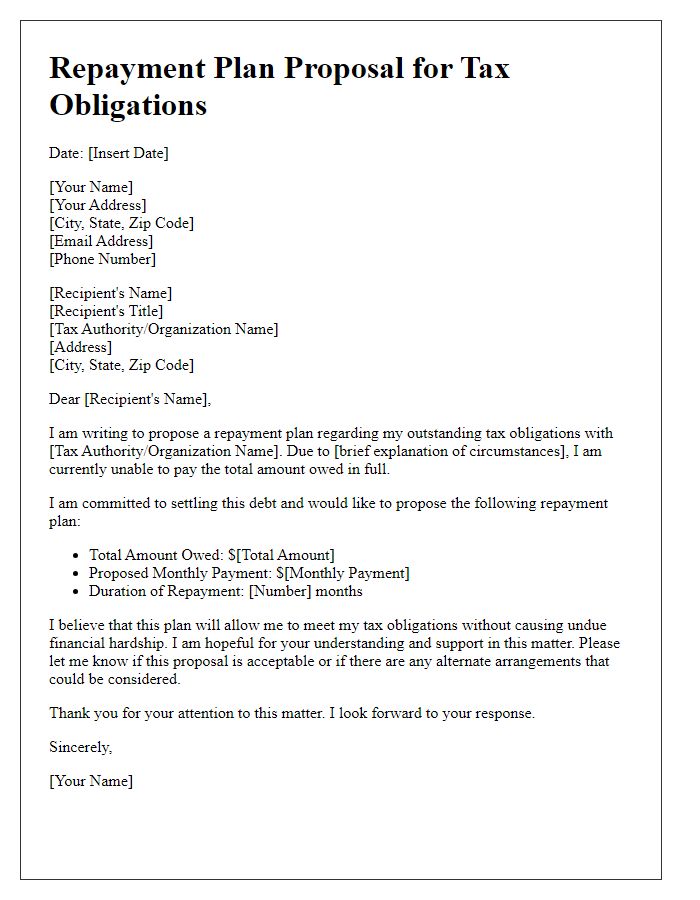

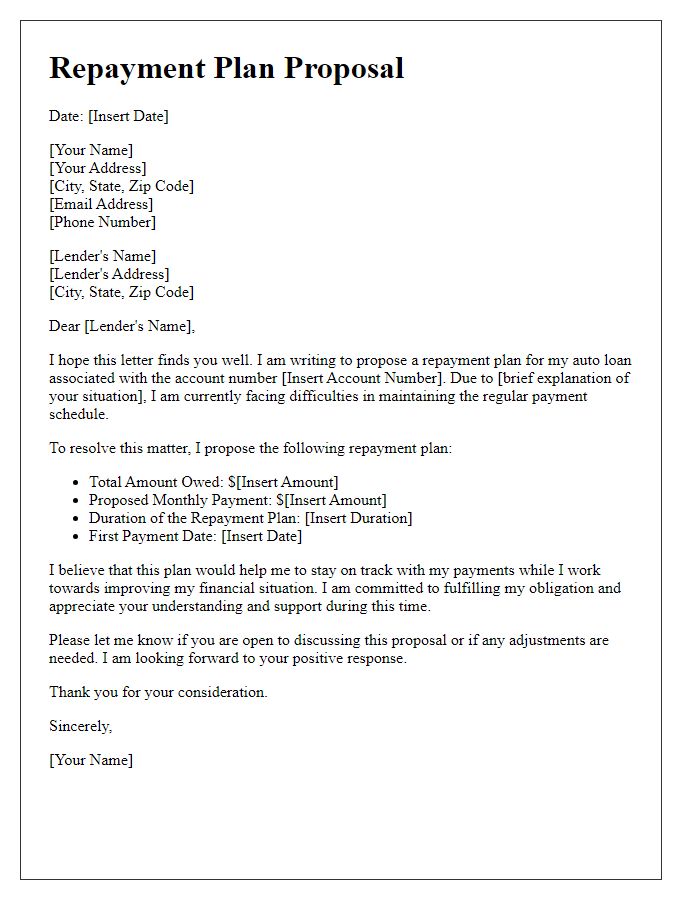

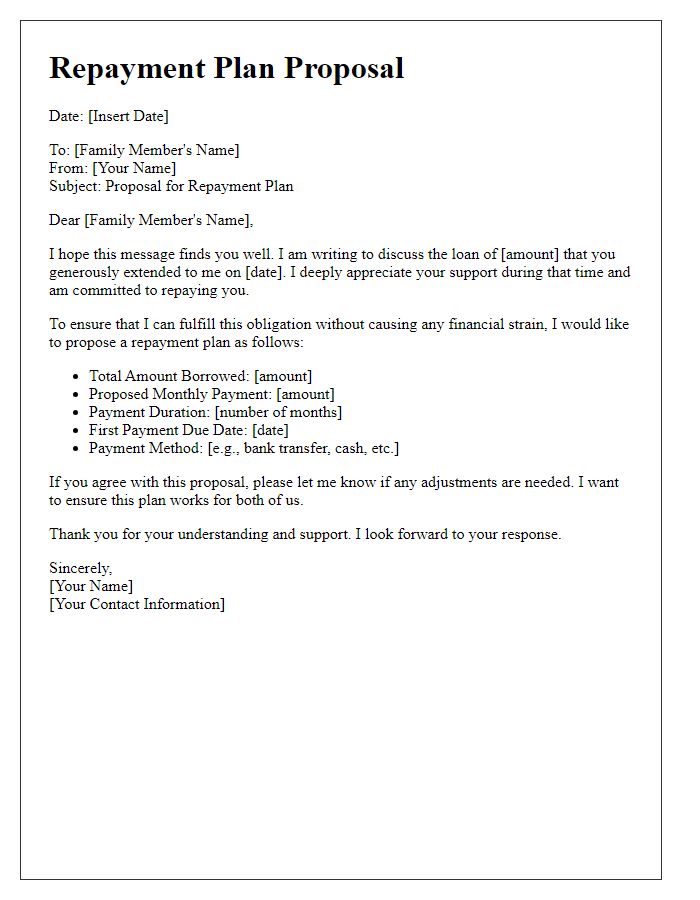

A well-structured repayment plan proposal is essential for financial negotiations. The subject line should be direct and informative, such as "Proposal for Repayment Plan Regarding Outstanding Balance." This clarity helps the recipient quickly identify the email's purpose. In the body, include key details like the specific amount owed, proposed payment schedule (weekly, bi-weekly, monthly), and any relevant dates (e.g., starting date for payments). Be sure to mention any past payments made and express a willingness to communicate openly throughout the process. Ending with a respectful closing statement reinforces a positive approach to resolving the financial obligation.

Polite salutation

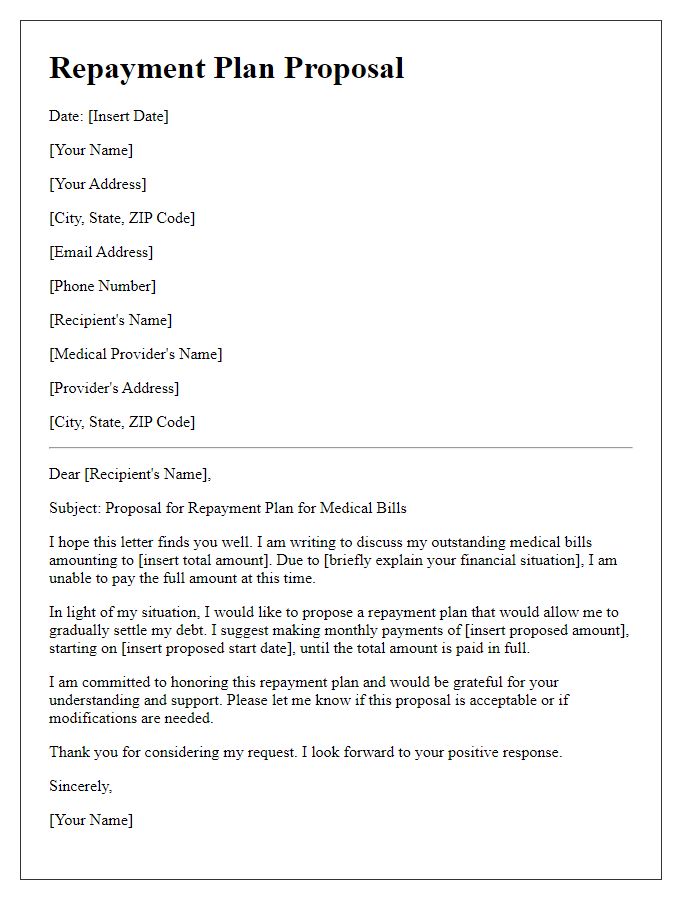

Repayment plans are financial arrangements established between lenders and borrowers to manage debt repayment over a specified time frame. These plans often involve structured timelines, specific amounts per installment, and interest rates. When a borrower lacks the means to fulfill their financial obligations, they can propose a repayment plan to their lender. A well-crafted proposal includes a respectful salutation, a clear outline of the repayment terms, and an explanation of the borrower's current financial situation. Notable aspects to address may include the total amount owed, proposed monthly payment amounts, and the desired time period for the repayment process, which allows for clarity in expectations and responsibilities.

Specific loan details

A repayment plan proposal for a personal loan, with a principal amount of $10,000 at a 5% annual interest rate, typically involves clear terms and timelines. The borrower may suggest a 24-month repayment period, resulting in monthly payments of approximately $438. This plan accounts for both principal and interest, ensuring full repayment by the end date. Additionally, timing plays a crucial role; the proposal could specify that payments commence on January 1, 2024, extending until December 1, 2025. Emphasizing the borrower's commitment to timely payments, the proposal may include a contingency for unforeseen circumstances, ensuring transparency and fostering trust between lender and borrower.

Proposed repayment terms

A repayment plan proposal outlines the terms for settling outstanding debts. A clear structure is essential, including an itemized list of total debt amount, interest rates, and monthly payment amounts. Specifying the duration of the payment period, typically ranging from six months to several years, aids in establishing expectations. Additionally, mentioning any upfront payments or collateral, such as property or assets, can strengthen the agreement. Timeliness of payments, including specific due dates, is crucial for maintaining accountability. Providing a point of contact for questions or concerns during the repayment period fosters open communication.

Closing statement with contact information

Creating a repayment plan proposal involves emphasizing commitment and transparency. The closing statement should express gratitude and availability for further discussion. A key aspect is the inclusion of contact information for easy communication if any questions or clarifications arise. Ensure to highlight your willingness to work together for a satisfactory resolution. The closing statement would typically end on a positive note, reinforcing the intention to meet obligations responsibly. Include your full name, preferred contact number, and a professional email address for comprehensive communication. This allows the other party to feel comfortable reaching out for additional dialogue or support.

Comments