When it comes to managing your finances, understanding your payment history with clients is key to maintaining a healthy cash flow. This letter template can help streamline the communication process, ensuring that both you and your clients are on the same page regarding outstanding invoices. By outlining important details such as payment due dates and amounts, you can foster transparency and strengthen your professional relationships. Ready to dive deeper into optimizing your client communication? Keep reading!

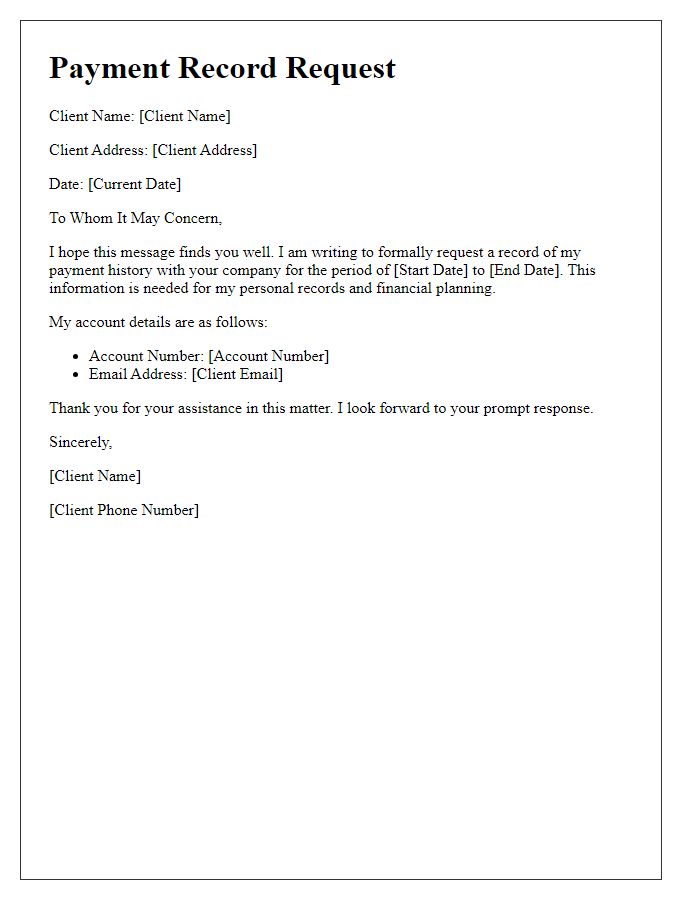

Client Name and Contact Information

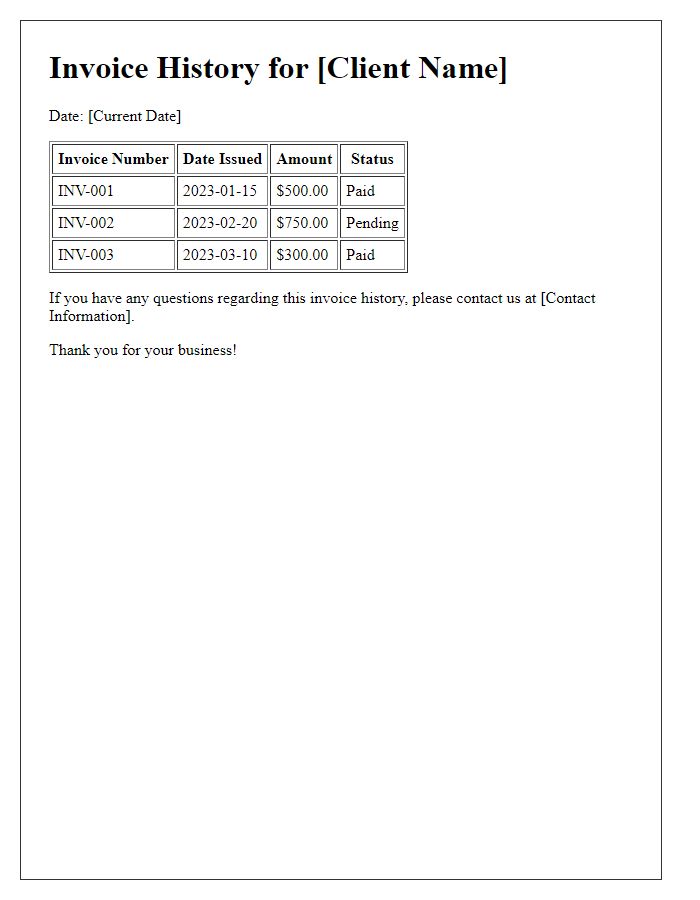

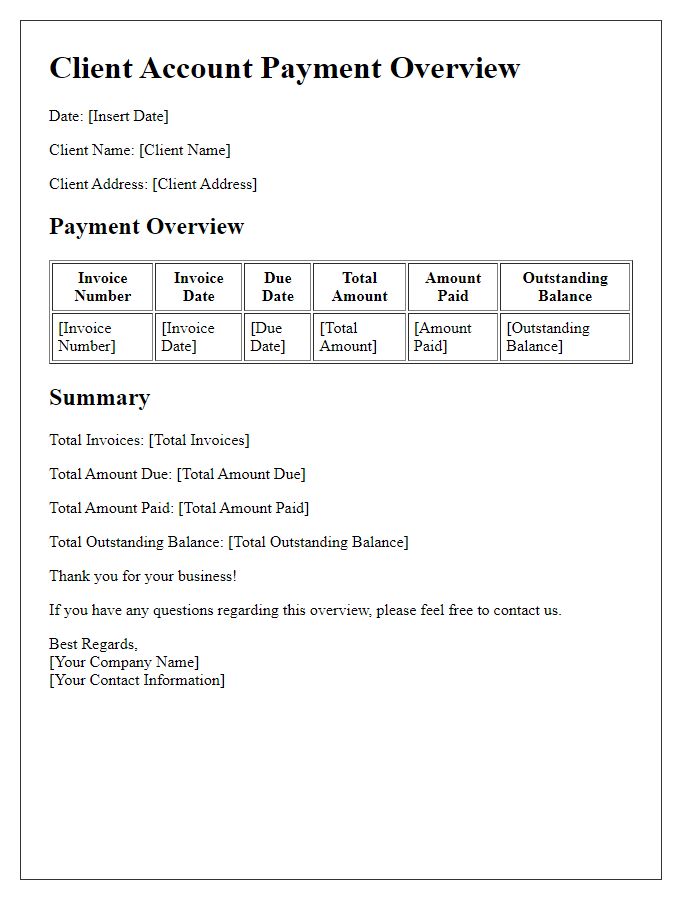

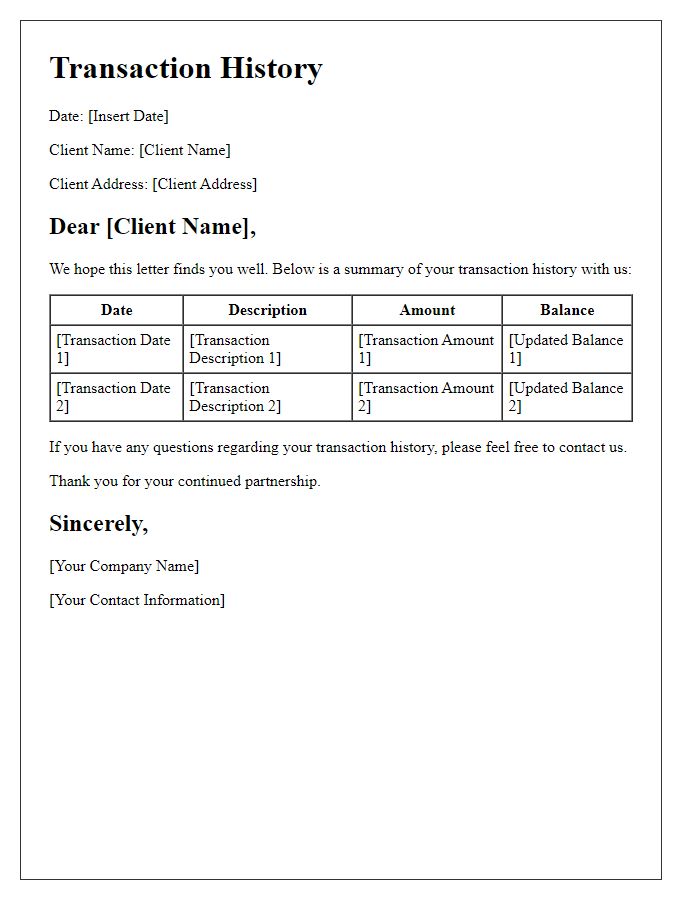

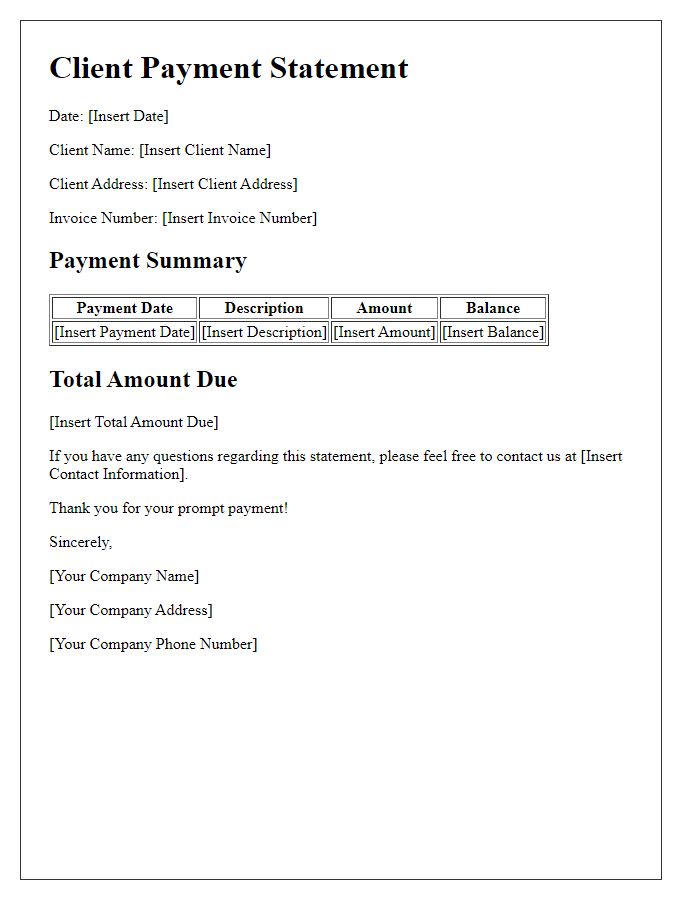

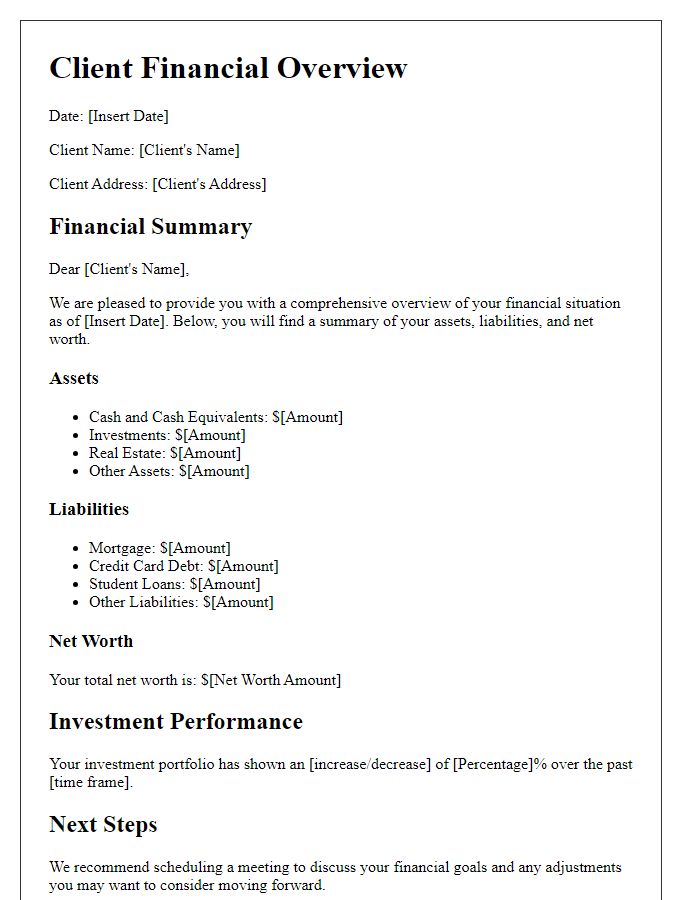

Client payment history often reflects financial behavior and account stability. Each transaction, including dates, amounts, and payment methods, contributes to a comprehensive overview of payment patterns. For example, consistent monthly payments of $1,500 from March 2022 to February 2023 provide insight into predictable cash flow. Significant variations may indicate financial distress or an evolving business relationship. Invoices, receipts, and account summaries serve as essential records, crucial for transparency and reconciliation. Maintaining accurate records enhances communication and fosters trust between clients and service providers.

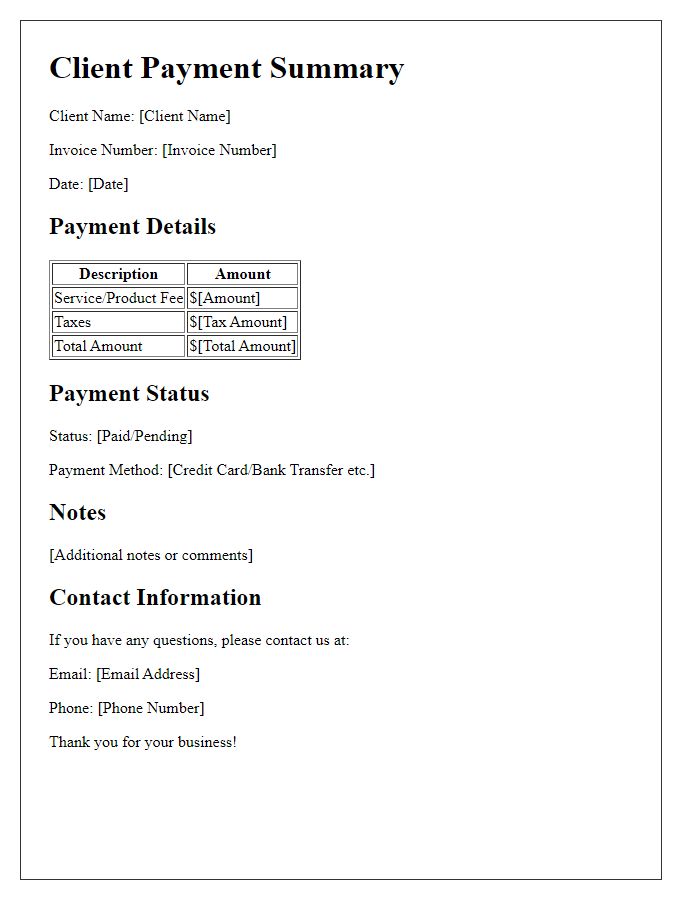

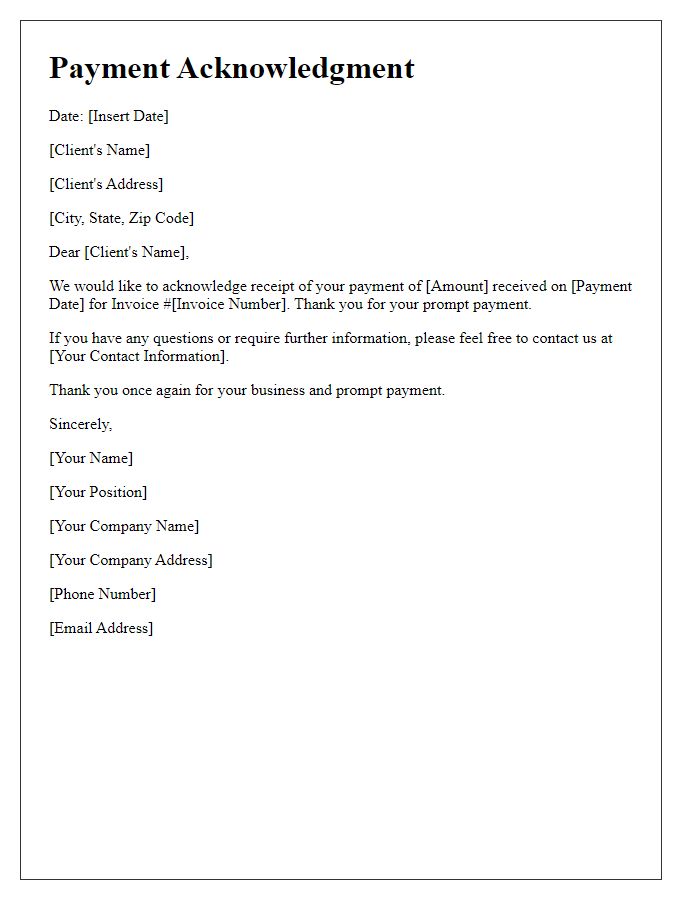

Payment Dates and Amounts

An organized payment history is essential for maintaining transparency between a service provider and clients. The payment history illustrates all relevant transaction dates, such as January 15, 2023, and amounts, for instance, $1,200 for services rendered. Each transaction entry should include a brief description of the services provided, enhancing clarity and accuracy. For example, the payment received on February 10, 2023, might represent a deposit for ongoing project work, amounting to $800. Summarizing total payments over a specified period, such as the last fiscal year ending December 31, 2023, displays comprehensive financial engagement and accountability between both parties.

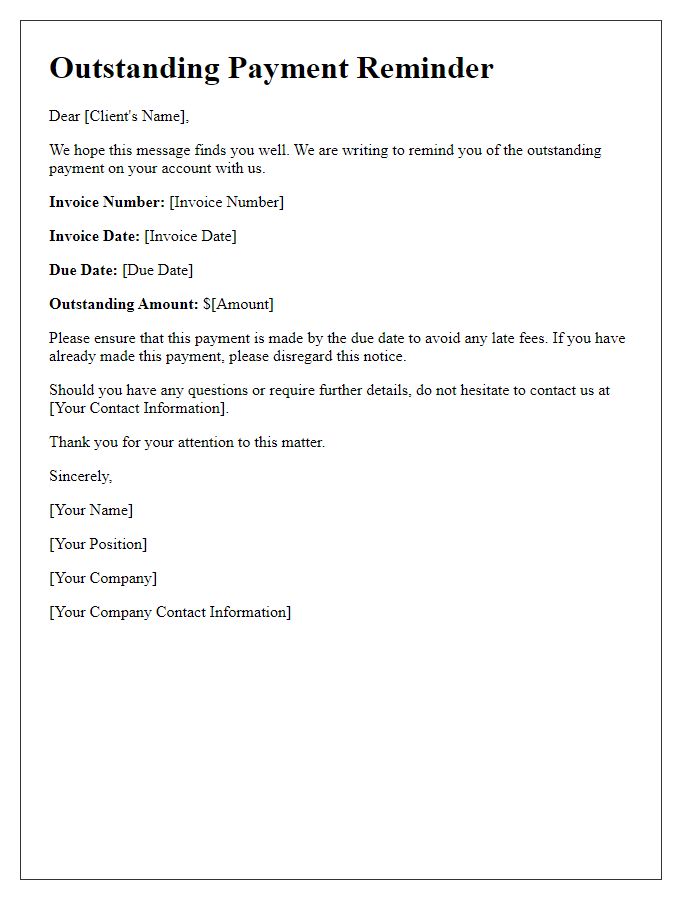

Outstanding Balance and Due Dates

An outstanding balance represents the remaining amount due from clients after previous payments have been applied, often detailed in billing statements. For businesses, keeping track of client payment history is essential for maintaining cash flow and identifying any delinquent accounts. Due dates, which specify when payments are expected, can vary widely based on the terms of service provided, typically ranging from 15 to 60 days after invoicing. Invoices issued in November 2023, for example, may indicate due dates often set for December 15, 2023, or January 1, 2024, depending on the agreed payment terms. Monitoring outstanding balances and their corresponding due dates ensures the financial health of the business and helps in forecasting future revenues.

Payment Methods Accepted

Clients can utilize various secure payment methods to manage their payment history efficiently. Credit cards, including Visa and MasterCard, provide immediate transaction verification. PayPal offers a widely recognized platform for online payments, ensuring protection for both parties. Bank wire transfers facilitate large transactions, typically suited for significant invoices, while digital wallets like Apple Pay and Google Pay simplify mobile payments. Bitcoin and other cryptocurrencies represent innovative options emerging in recent years, appealing to tech-savvy clients. Maintaining a clear and organized payment history through each method allows for streamlined financial tracking and accounting for both clients and service providers.

Contact Information for Queries

Maintain detailed records of client payment history to facilitate efficient tracking and resolution of financial queries. Document essential contact information such as email addresses and phone numbers for each client, ensuring prompt communication regarding payment statuses. Utilize software tools to categorize payments based on dates, amounts, and methods, enabling easy retrieval of transaction details. Highlight discrepancies in payments and outline procedures for clients to follow when seeking clarification on their payment histories. Establish a dedicated support line or email address for clients to resolve queries, thereby enhancing overall customer satisfaction and fostering trust.

Comments