Writing a letter for a goodwill adjustment can feel daunting, but it's easier than you might think! Start by clearly stating your reasons for the request, as this helps establish your case right away. Remember to keep your tone friendly and respectful, as building rapport is key in these situations. If you're curious about how to craft the perfect goodwill adjustment letter, keep reading for helpful tips and a ready-to-use template!

Greeting and Recipient Information

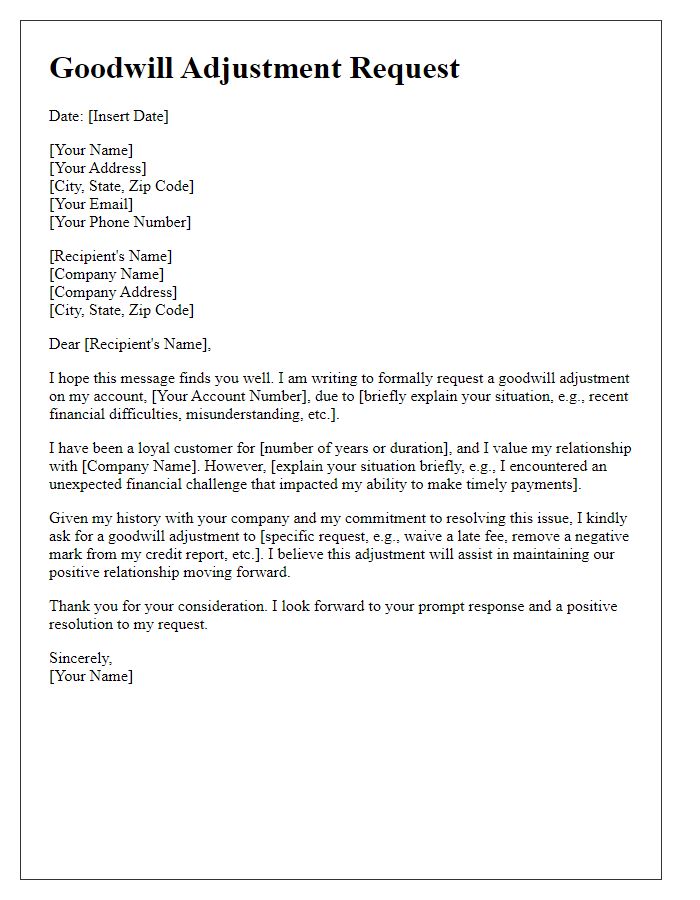

Goodwill adjustment requests often require a polite introduction and clear recipient details for effective communication. Proper greetings set a respectful tone, while recipient information ensures the request reaches the correct department. Greeting examples include "Dear Customer Service Team," followed by the date and the specific address or contact information for the relevant financial institution or service provider. Including a concise subject line such as "Request for Goodwill Adjustment on Account #123456" enhances clarity. Addressing the recipient accurately, with titles if applicable, may also impact the response positively, establishing a professional relationship.

Account Details and Description

A goodwill adjustment request can be effective for individuals seeking resolution and leniency from financial institutions. Specific account details, including account number (e.g., 123456789), type of account (e.g., credit card, mortgage), and the history of payment, are crucial in establishing context. Highlighting events such as missed payments (e.g., those occurring in March 2023 due to unexpected job loss) or unusual circumstances (medical emergencies or natural disasters) can provide a compelling narrative. Clearly outlining the positive payment history prior to the incident, maintaining a good standing for over three years, emphasizes reliability. Specific details, like the request for the removal of a late fee (e.g., an $85 late fee incurred in April 2023), can clarify the intent for adjustment. A personal touch, expressing commitment to uphold future payment responsibilities, reinforces sincerity in the request.

Explanation and Justification

A goodwill adjustment request seeks to address customer service issues, typically involving disputes over charges or account management. Customers often provide a detailed explanation of their experiences, including specific events, dates, and interactions with company representatives that influenced their dissatisfaction. For example, a customer may describe a billing error that occurred on March 15, 2023, alongside a recent call to customer support where a promised solution did not materialize. Emphasizing loyalty toward the brand over a significant period, such as ten years, can highlight a positive relationship that justifies consideration for adjustments. Customers might also detail their financial hardships or unexpected circumstances, creating a case for a discretionary credit or waiver to alleviate the current financial burden.

Polite Request and Resolution Proposal

In a goodwill adjustment request, a customer seeks a favorable outcome regarding an issue they've encountered, often in relation to a product or service. Relevant context may include the specific incident that led to dissatisfaction, such as improper service at a prominent restaurant chain, or a defective item from a well-known electronics manufacturer. The request typically emphasizes prior positive experiences to establish rapport, while respectfully outlining the current issue, such as delays in delivery exceeding the promised time frame by two weeks. Moreover, the proposal for resolution, which could involve compensation in the form of a discount or replacement, should reflect a reasonable solution, ensuring the customer feels valued. The timeframe for follow-up can also enhance the likelihood of a positive response, indicating the customer's eagerness to resolve the matter amicably.

Closing and Contact Information

Goodwill adjustment requests aim to address concerns regarding billing errors or service issues. Key elements include clear identification of the account holder, account number (typically a unique identifier for customer accounts), and company information (name of service provider). Closing statements can reaffirm appreciation for the ongoing business relationship, expressing hope for resolution and continued support from the provider. Contact information is crucial, including phone numbers, email addresses, or customer service chat, enabling swift responses to any inquiries or clarifications regarding the request.

Letter Template For Goodwill Adjustment Request Samples

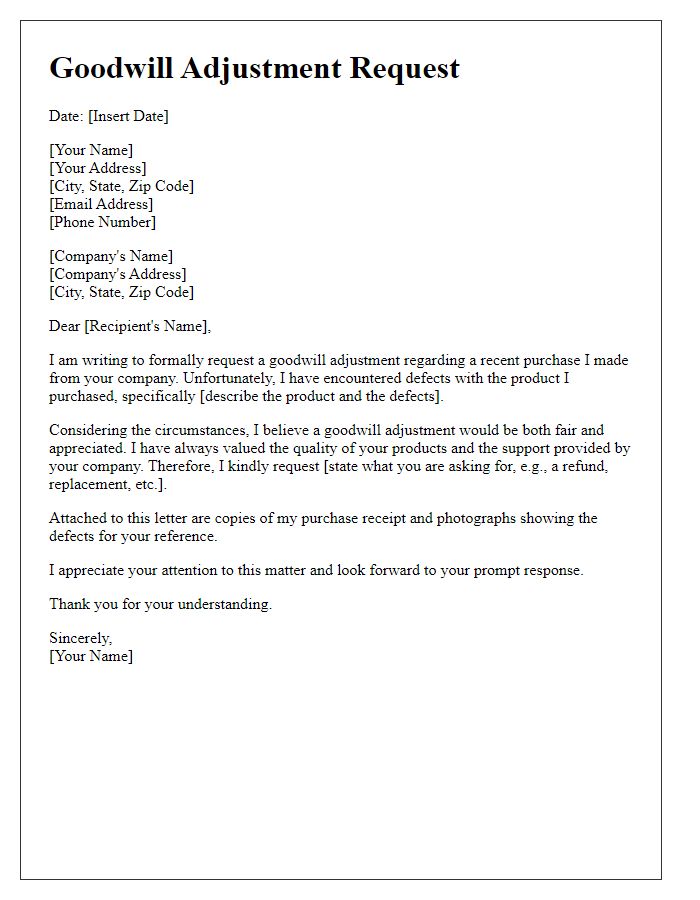

Letter template of goodwill adjustment request for unsatisfactory experience

Letter template of goodwill adjustment request following a recent complaint

Letter template of goodwill adjustment request for promotional discrepancies

Letter template of goodwill adjustment request as a gesture of appreciation

Letter template of goodwill adjustment request for travel inconveniences

Comments