Are you looking for a way to formally request payment proofs in a professional manner? Writing a letter can be an effective way to communicate your needs clearly and respectfully. In this article, we'll provide you with a sample letter template that you can customize to fit your unique situation. So, if you're ready to streamline your payment confirmation process, keep reading to discover how to craft the perfect request!

Clear subject line

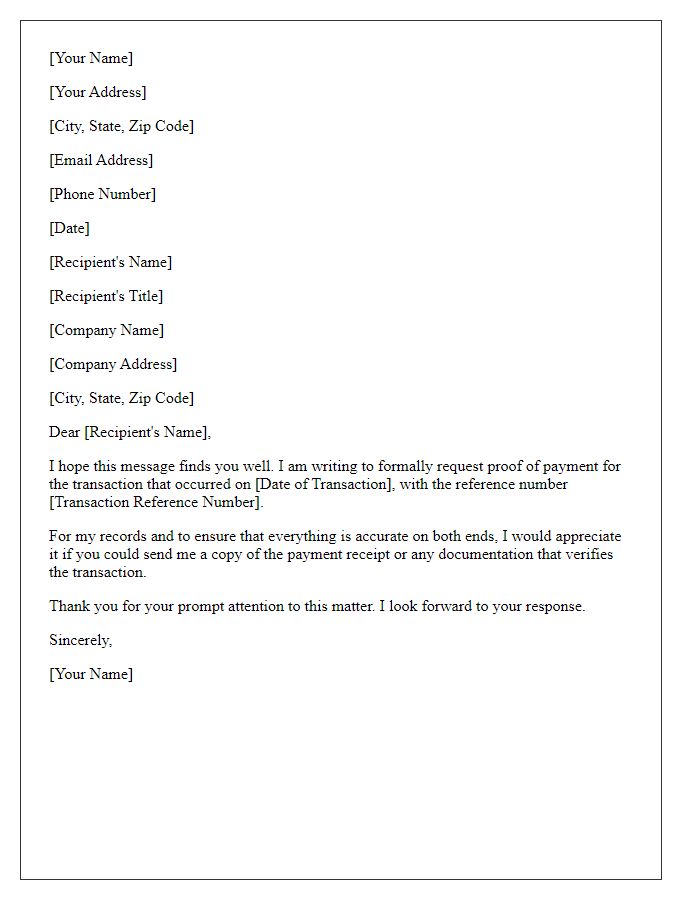

Request for Payment Proofs: Urgent Requirement for Reconciliation In the context of financial transactions, accurate payment records are essential for maintaining transparency. Payment proofs include documents such as receipts, bank statements, and transaction confirmations. These documents serve as verification of completed payments and are critical for audit processes. Timely submission of payment proofs, particularly related to invoices dated between January and March 2023, enables effective reconciliation of financial accounts. This request emphasizes the importance of accurate documentation in supporting the integrity of financial reporting and compliance with regulatory standards.

Polite salutation

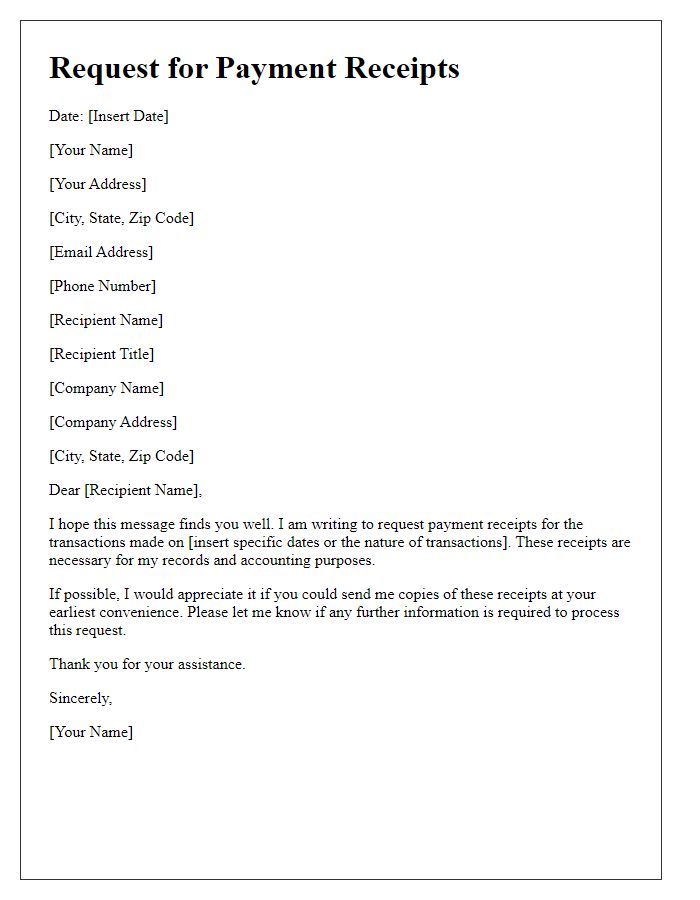

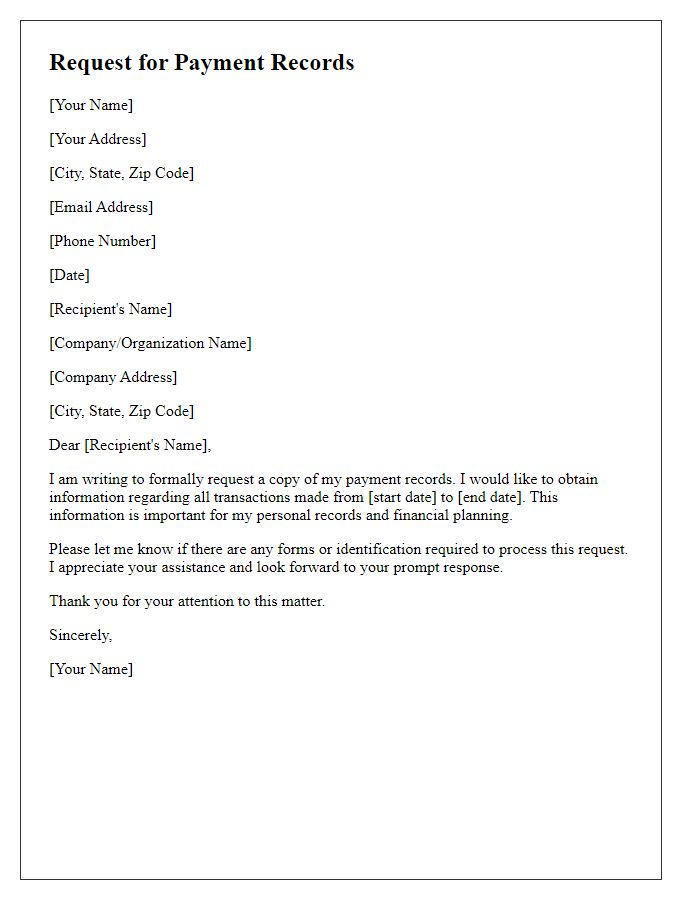

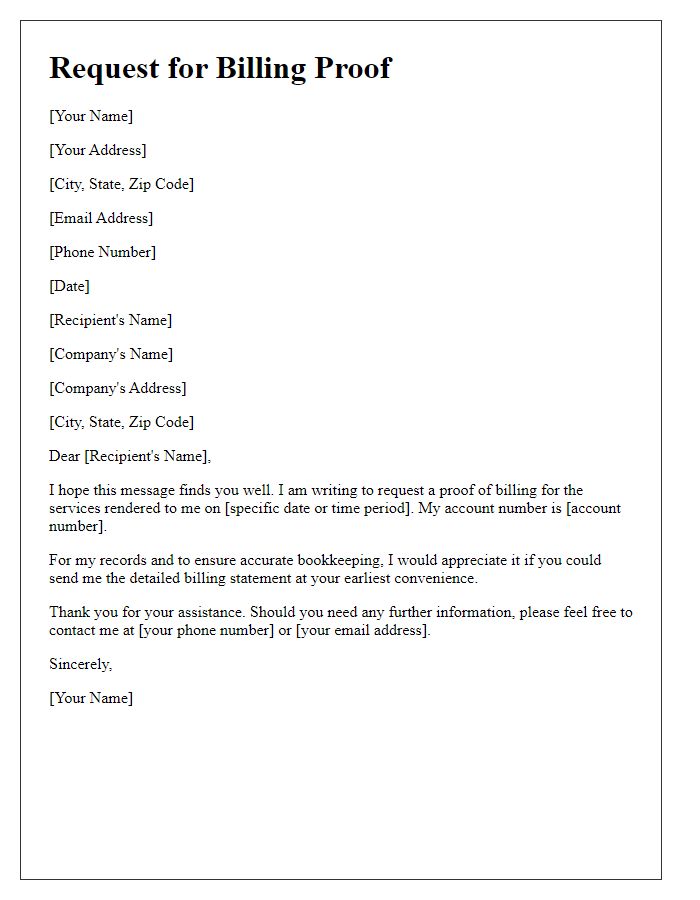

Timely payment proofs play a crucial role in maintaining clear financial records for businesses and individuals alike. Requesting such documentation can be vital after transactions involving significant amounts, for instance, contract payments of over $10,000 or service fees for quarterly projects. Specific details like invoice numbers, transaction dates, and payment methods (such as wire transfers or credit card transactions) help ensure accuracy in accounting. Recipients should also be informed about the preferred format for these proofs--whether digital copies, such as PDFs or JPEG files, or physical documents via postal mail--catering to personal or organizational preferences while streamlining record-keeping practices.

Specific request details

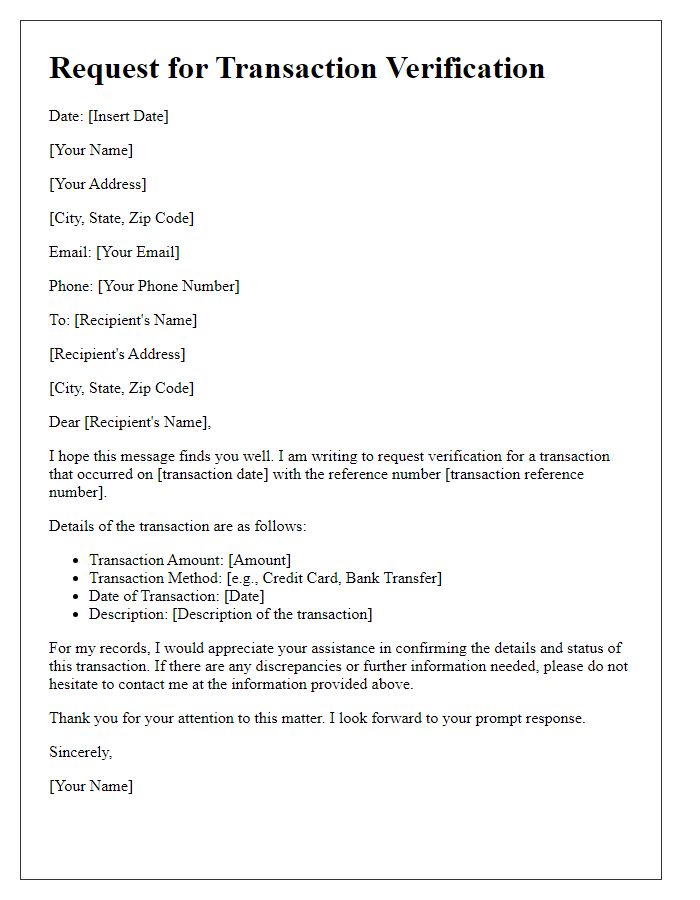

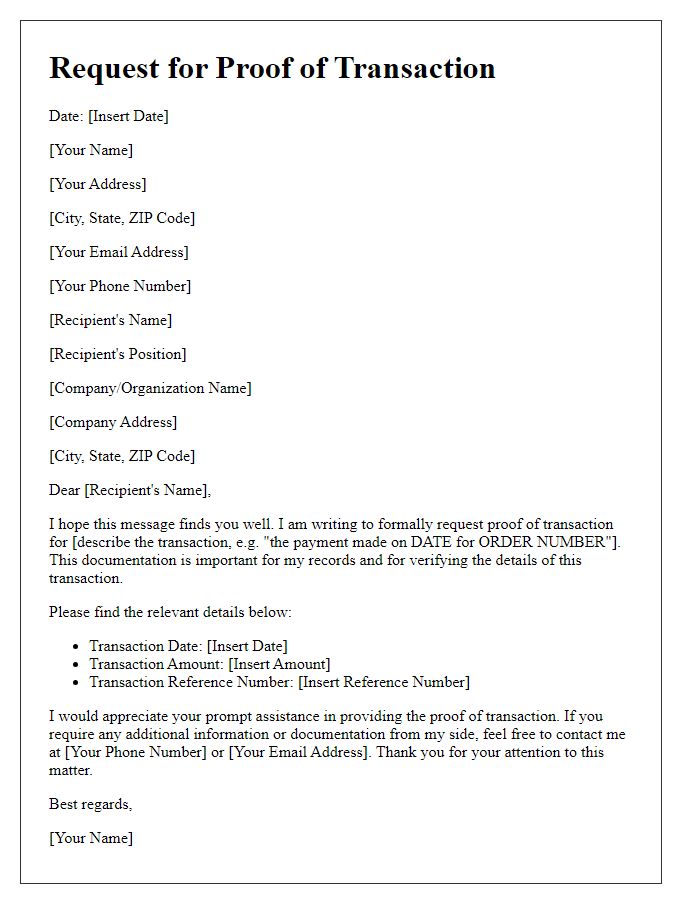

To obtain payment proof documents, a formal request may include essential details such as invoice numbers (specific identifiers ranging from 1001 to 1050), payment dates (for example, the period from January 1, 2023, to October 31, 2023), payment methods (specifying credit card, bank transfer, or PayPal), and the amounts involved (including total sums exceeding $1,000). Such proof provides confirmation of completed transactions, ensuring clarity and transparency in financial interactions. Additionally, referencing relevant parties (like the finance department at XYZ Corporation or the named recipient's email) enhances processing efficiency and accuracy.

Deadline for response

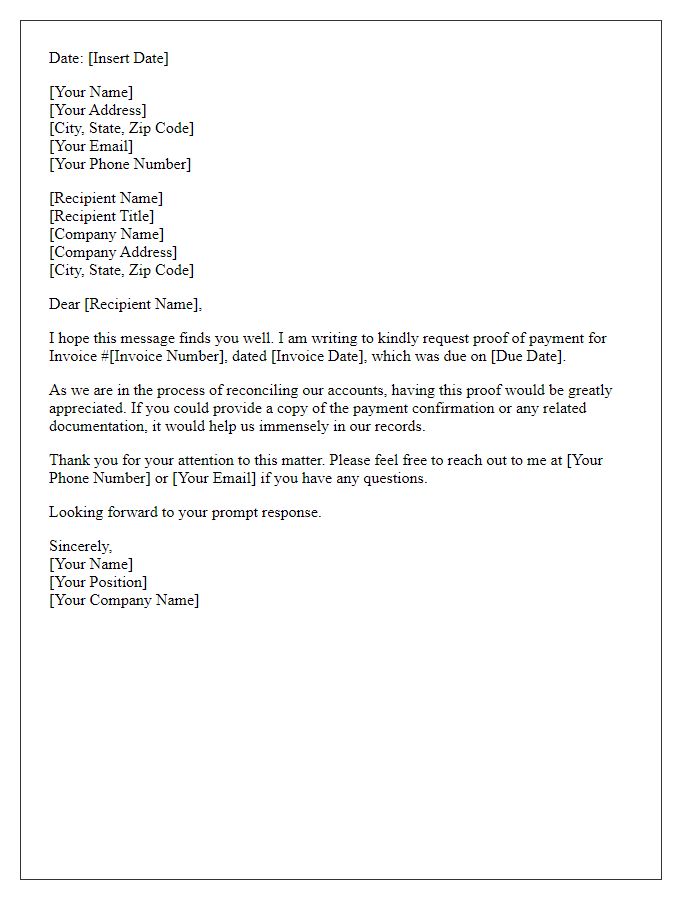

Many businesses require verified payment proofs to maintain accurate financial records. Payment proofs typically include transaction receipts, bank transfer confirmations, or invoices. For companies, especially in sectors like retail or services, having these documents is crucial for auditing and compliance purposes. In the United States, organizations often set deadlines for submitting such documents, commonly ranging from 7 to 30 days after a payment is made. This ensures timely processing of accounts and minimizes discrepancies in financial reporting. Keeping comprehensive records facilitates smoother operations and fosters trust between vendors and clients.

Contact information

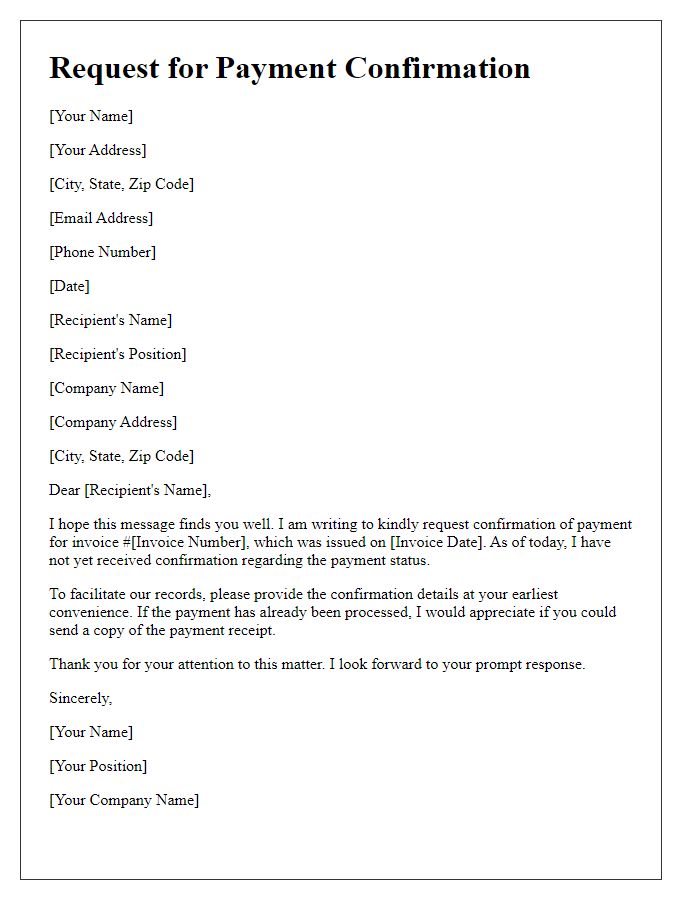

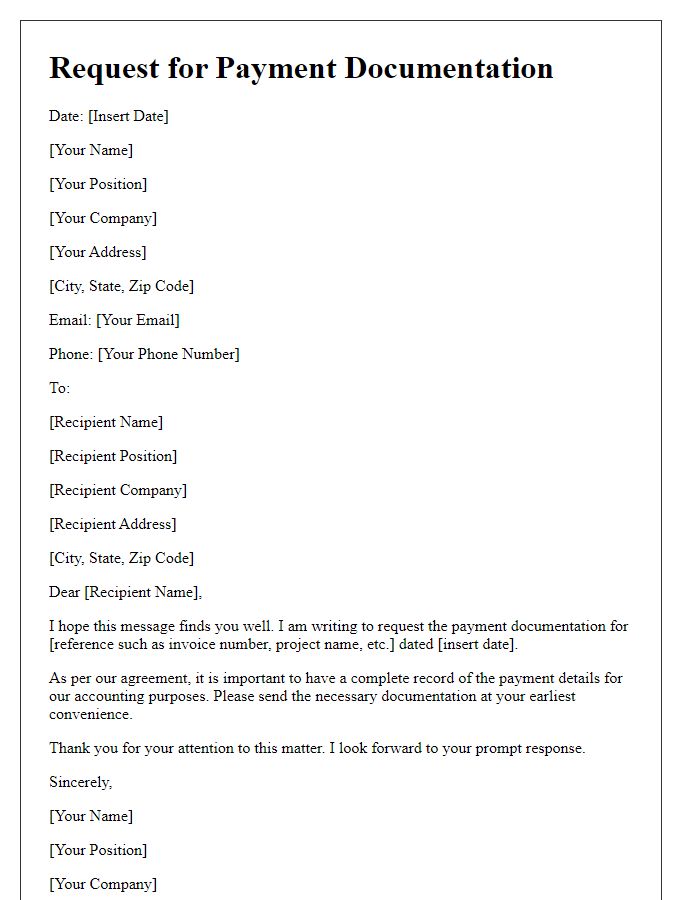

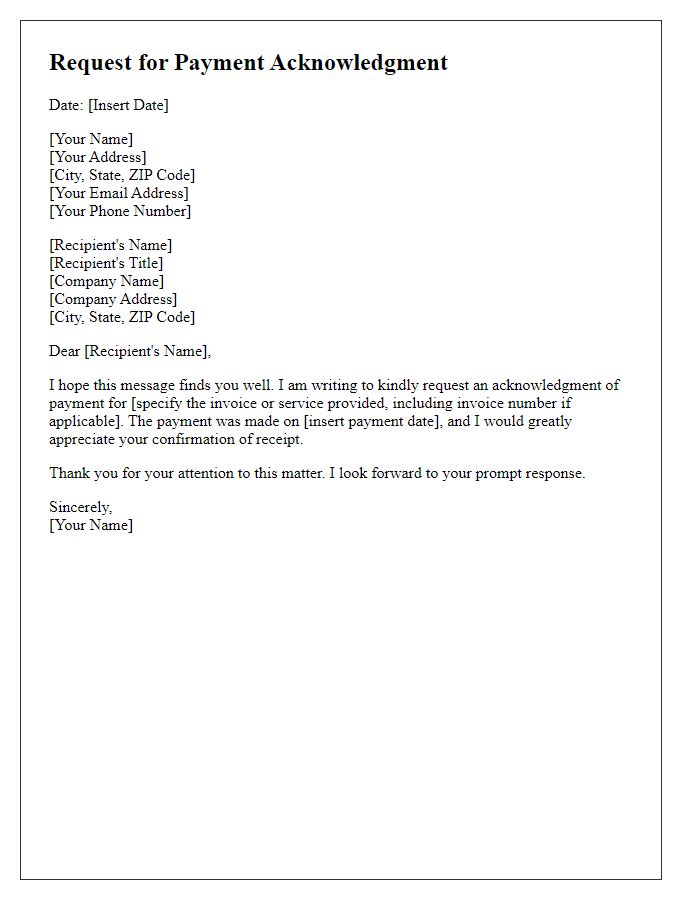

A request for payment proofs serves as a formal communication to verify financial transactions. Essential details such as the sender's contact information, including the full name, email address, and phone number, should be clearly outlined. The recipient's information, including their name, company name, and address, is equally important to establish context. Specifying the payment details, like transaction dates, amounts, and reference numbers, enhances the clarity of the request, fostering prompt and accurate responses. Utilizing a professional tone while clearly stating the purpose of the request will facilitate effective communication and ensure all necessary documentation is provided.

Comments