Are you feeling the pressure of overdue interest rates? You're not aloneâmany individuals and businesses are navigating the complexities of financial obligations and deadlines. Understanding how to manage these rates effectively can be a game changer in regaining control of your finances. Dive into our article to uncover tips and strategies that can help alleviate your concerns and lead you toward a more secure financial future.

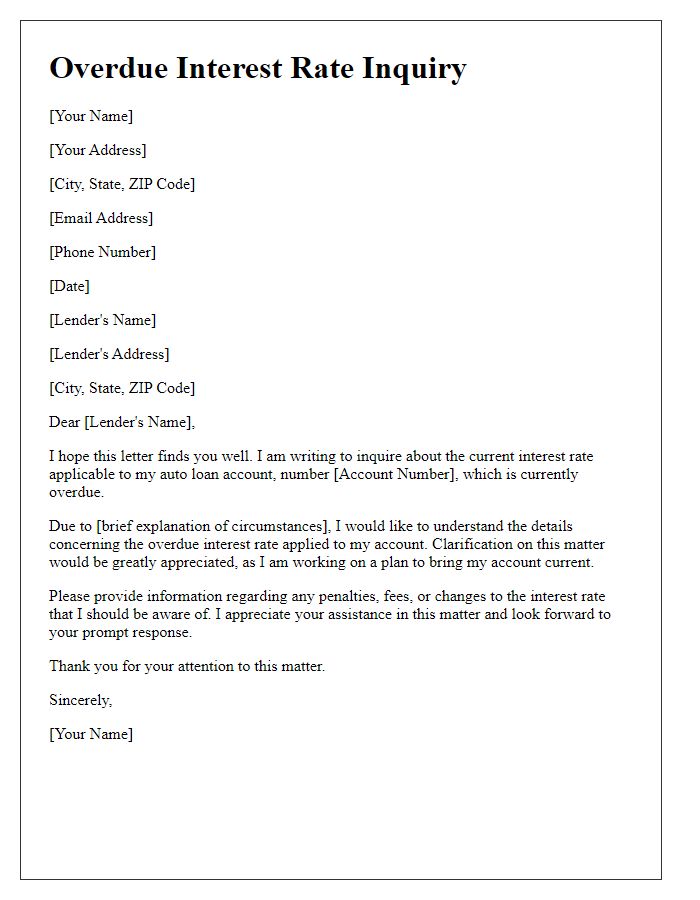

Recipient Information

An overdue interest rate application is crucial for financial institutions, detailing essential recipient information. This includes the name of the borrowing individual or organization, ensuring accurate identification. The address must pinpoint the precise location for proper correspondence, often including street number, city, state, and ZIP code. Contact numbers can facilitate immediate communication, while email addresses offer a digital correspondence channel. Additionally, specific account numbers related to the loan or mortgage play an imperative role, linking the application to the appropriate financial records. Distributing this information clearly aids in expediting the processing of overdue interest applications.

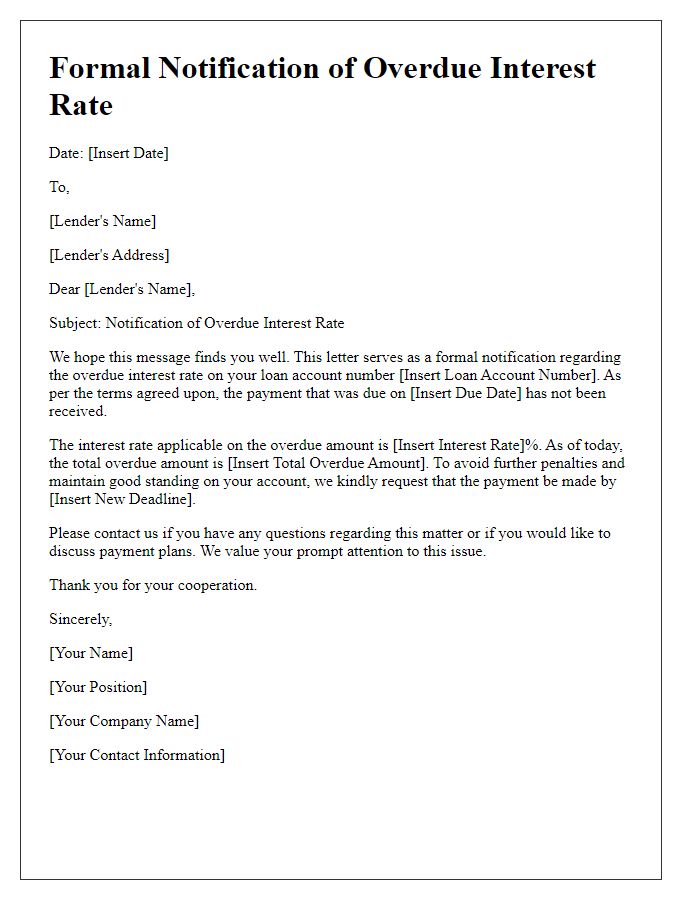

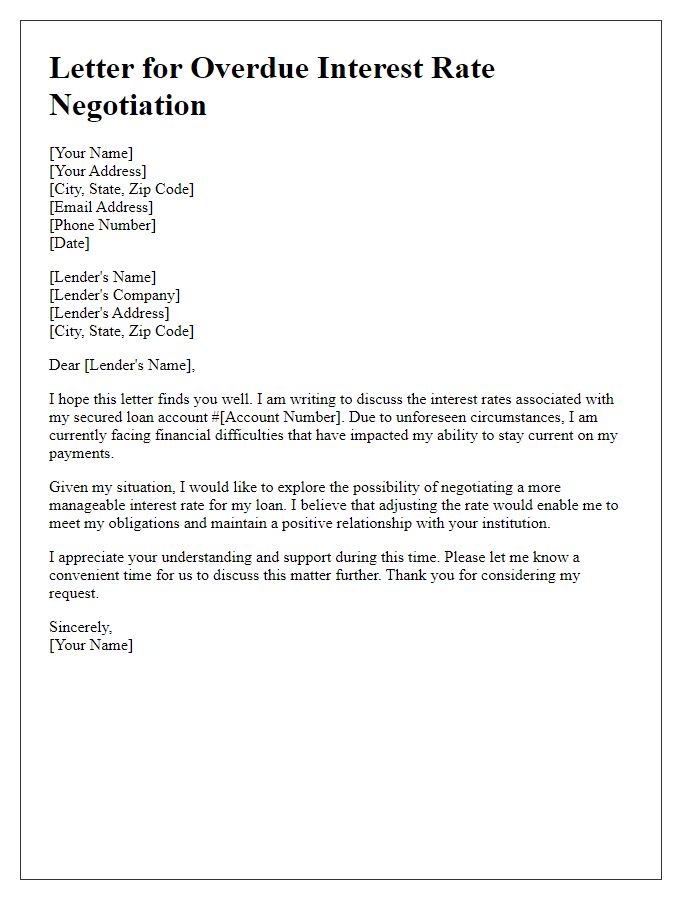

Sender Information

A letter template for an overdue interest rate application typically includes the sender's information at the top. This information comprises the sender's name (e.g., John Smith), address (including street number, city, state, and postal code), email address (e.g., john.smith@email.com), and phone number (with area code, like (123) 456-7890). Date of drafting must be included to document the correspondence time (e.g., October 20, 2023). Lastly, in the context of a formal application, including details like account number or reference number related to the interest rate would enhance clarity and facilitate processing by the intended recipient.

Subject Line

The subject line for an overdue interest rate application should clearly indicate the purpose and urgency of the communication. For instance, "Application for Overdue Interest Rate Adjustment: Account #123456 - Immediate Attention Required" effectively captures key details, including the nature of the request (interest rate adjustment), the specific account identifier (123456), and the necessity for urgent attention.

Introduction Paragraph

Applying for overdue interest rates can significantly impact financial agreements, particularly in lending scenarios. Specific regulations, such as the Truth in Lending Act, govern these rates across the United States, ensuring transparency and fairness. Understanding the importance of deadlines, financial institutions typically impose overdue interest rates on late payments, which can vary based on the loan type and lender policies. For example, a missed mortgage payment could incur an added fee of around 5% of the overdue amount, emphasizing the necessity of timely payments. Proper documentation is crucial in maintaining accountability and assisting during disputes when these rates are applied.

Account Details

Applying for an overdue interest rate adjustment requires a detailed understanding of account specifics, including elements like account numbers, overdue amounts, and specific due dates. An account with a unique number, for example, 123456789, may carry an overdue balance of $500 accumulated since January 15, 2023. This amount may accrue interest at a specified rate of 12% per annum, based on the lender's policies. Providing accurate details about the account holder's previous payment history and any communication with customer service between accounts, like reference numbers for calls, establishes context and supports the argument for a revised interest rate.

Letter Template For Overdue Interest Rate Application Samples

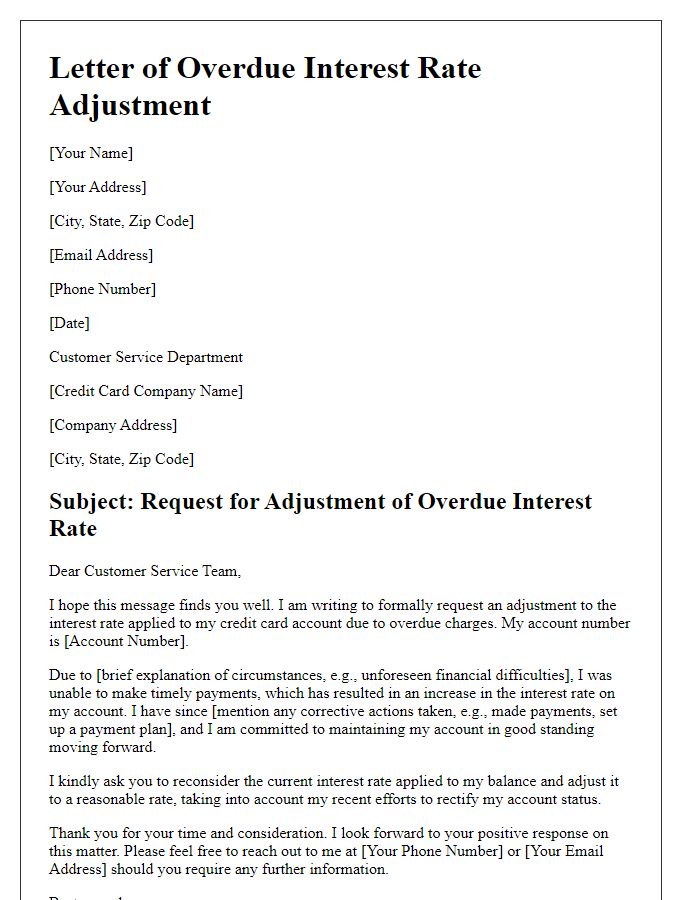

Letter template of overdue interest rate adjustment for credit card debt

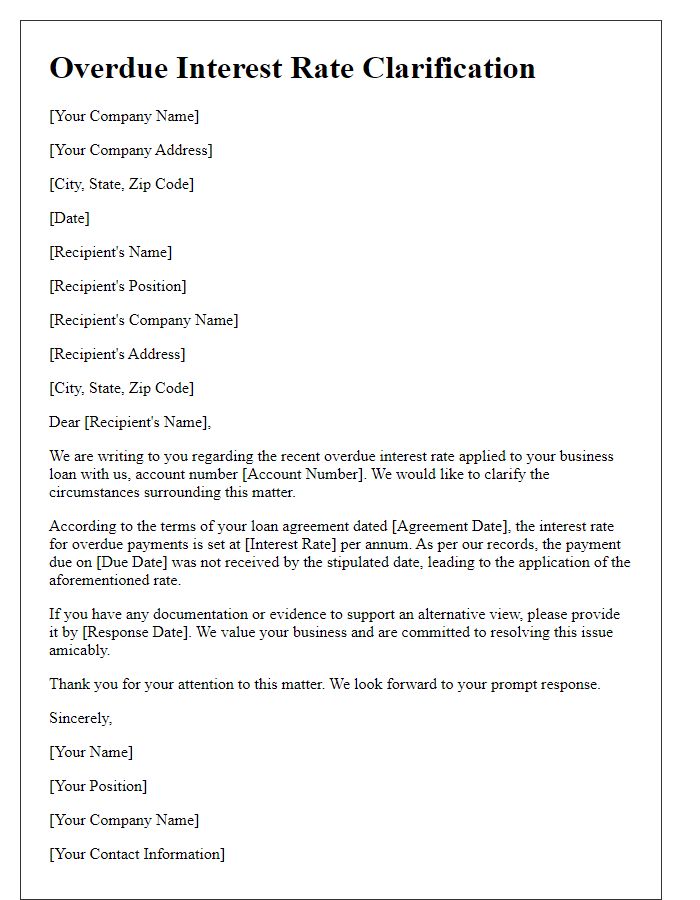

Letter template of overdue interest rate clarification for business loans

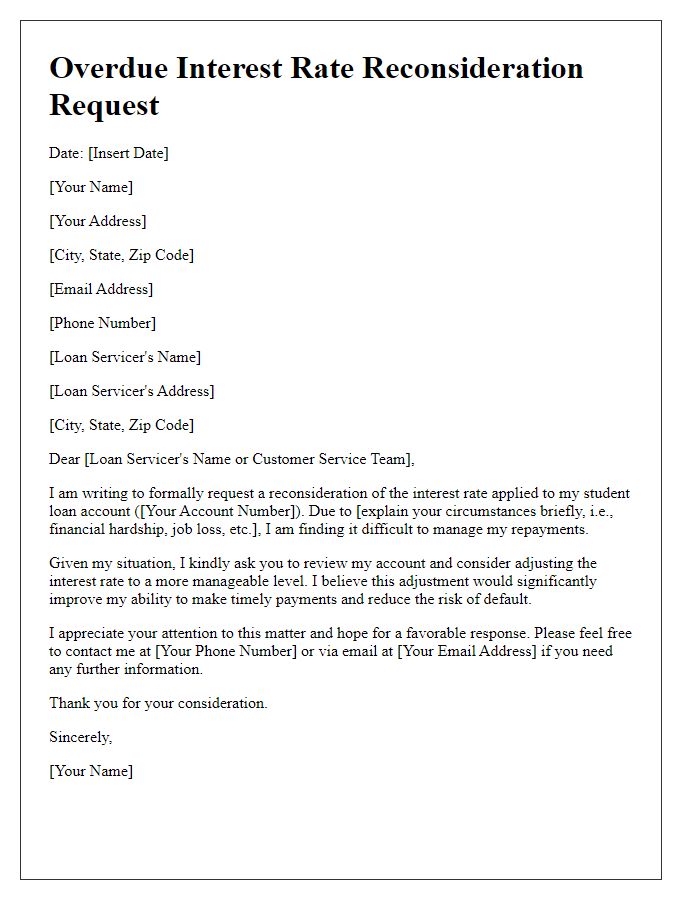

Letter template of overdue interest rate reconsideration for student loans

Letter template of overdue interest rate dispute with financial institution

Letter template of overdue interest rate remediation request for installment loans

Comments