Are you struggling with discrepancies in your mortgage payment history? It can be incredibly frustrating to see errors affecting your credit score and financial peace of mind. Addressing these inaccuracies promptly is crucial, and knowing how to communicate your concerns effectively can make all the difference. Join us as we explore a sample letter template designed to help you correct your mortgage payment historyâread more to get started!

Accurate Borrower Information

Accurate borrower information is critical for maintaining a clean mortgage payment history. In a mortgage account, details such as name, address, and Social Security Number are essential for proper identification. Any discrepancies can result in incorrect reporting to credit bureaus, impacting credit scores. Loan servicers, such as those governed by the Consumer Financial Protection Bureau, must uphold accuracy in these records to ensure compliance with federal regulations. A simple clerical error can lead to delayed payments or even foreclosure proceedings, making prompt correction vital for all parties involved. Updated records should include confirmed identity verification documents and are best sent via certified mail for traceability.

Loan Account Details

Mortgage payment histories can significantly impact credit scores and loan management. Inaccurate records may stem from various issues, such as clerical errors or miscommunication between financial institutions. For instance, a specific loan account (like a 30-year fixed-rate mortgage from a major bank) may show discrepancies in payment dates or amounts, leading to potential financial setbacks for homeowners. Requesting corrections typically involves providing documentation, such as bank statements or payment receipts, to support claims of inaccuracies. Attention to detail in numbers, such as actual payment dates or amounts (e.g., monthly payments of $1,500), will bolster the request for a accurate reflection of mortgage payment history.

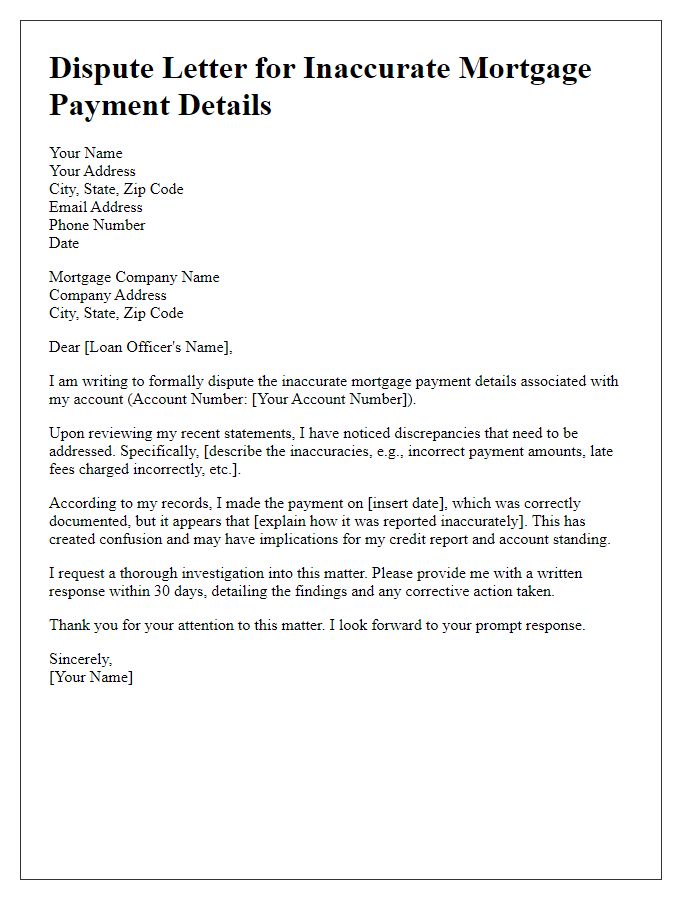

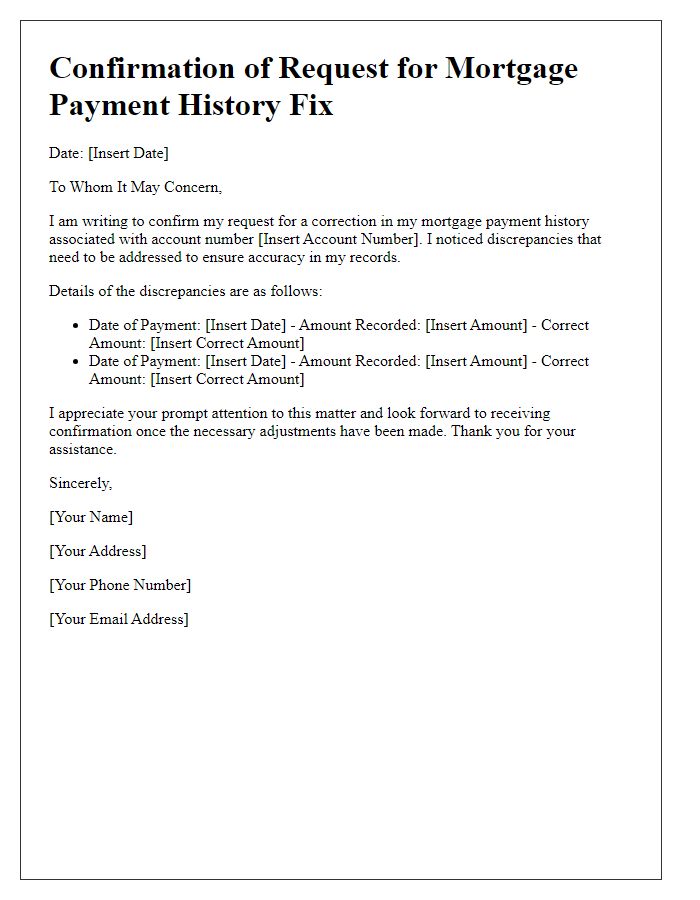

Specific Payment Discrepancies

Inaccuracies in mortgage payment history can significantly impact credit scores and loan management. Documentation errors resulting in missed payments may arise from miscommunication with financial institutions or inadequate record-keeping practices. For instance, discrepancies involving specific payments made on July 15, 2022, and December 1, 2022, can stem from delays in processing by lenders such as Wells Fargo or Bank of America. Additionally, payment systems may fail to update timely due to technical glitches or human error, exacerbating confusion surrounding account status. Resolving these issues often requires submitting a formal request for investigation to the mortgage servicer, referencing account numbers, payment confirmation receipts, and detailed timelines of the transactions to aid in accurate reconciliation.

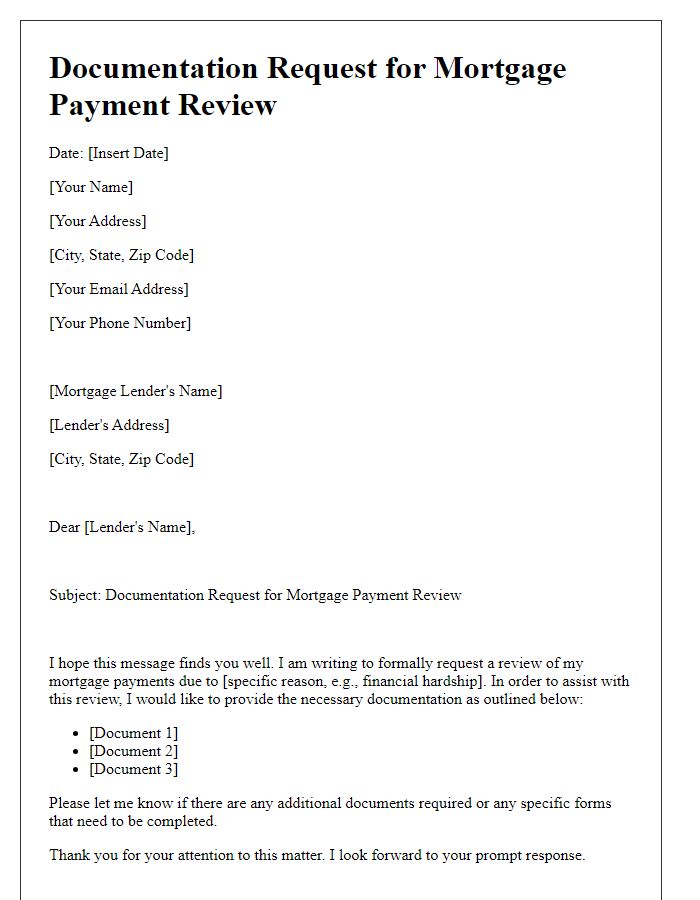

Supporting Documentation

Inaccurate mortgage payment history can significantly impact credit scores and loan eligibility. Lenders often require detailed documentation to assess payment history accurately. Key records include bank statements (usually spanning the last 12 months), payment receipts showcasing dates and amounts, and account statements from mortgage servicers detailing any discrepancies. Documentation must clearly indicate any missed or late payments (defined as payments over 30 days past due) alongside correction requests, usually submitted to the mortgage servicer or credit bureaus like Experian, TransUnion, and Equifax. Timely resolution of these issues is essential for maintaining financial health in a competitive housing market.

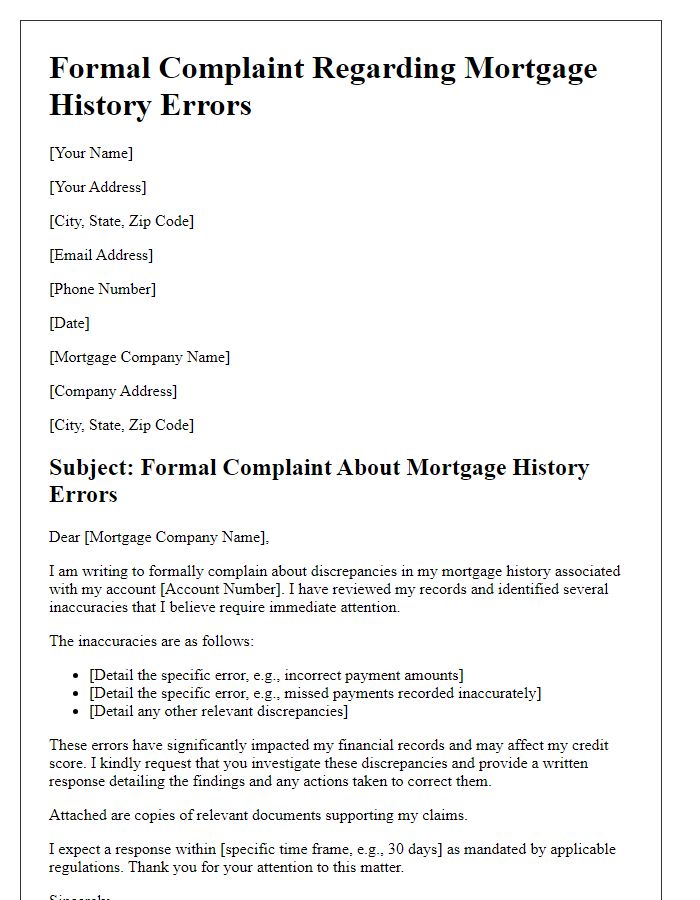

Desired Resolution

Mortgage payment history corrections are crucial for maintaining accurate financial records, particularly for loan accounts like fixed-rate mortgages and adjustable-rate mortgages. Discrepancies in payment history may arise from various sources, including errors by lenders and delays in processing payments. Such inaccuracies can severely impact credit scores, ultimately affecting eligibility for future loans. A desired resolution typically aims for the prompt correction of these discrepancies and the provision of an updated payment history report reflecting accurate transaction dates and amounts. Additionally, ensuring that any penalties or late fees applied due to these inaccuracies are reversed is often sought by homeowners striving to maintain financial health and creditworthiness.

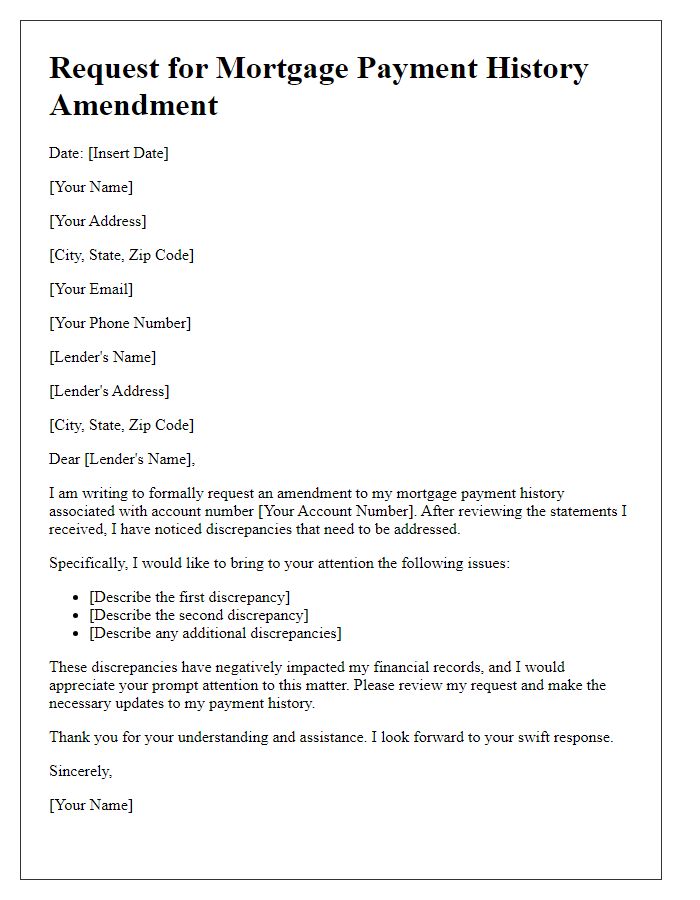

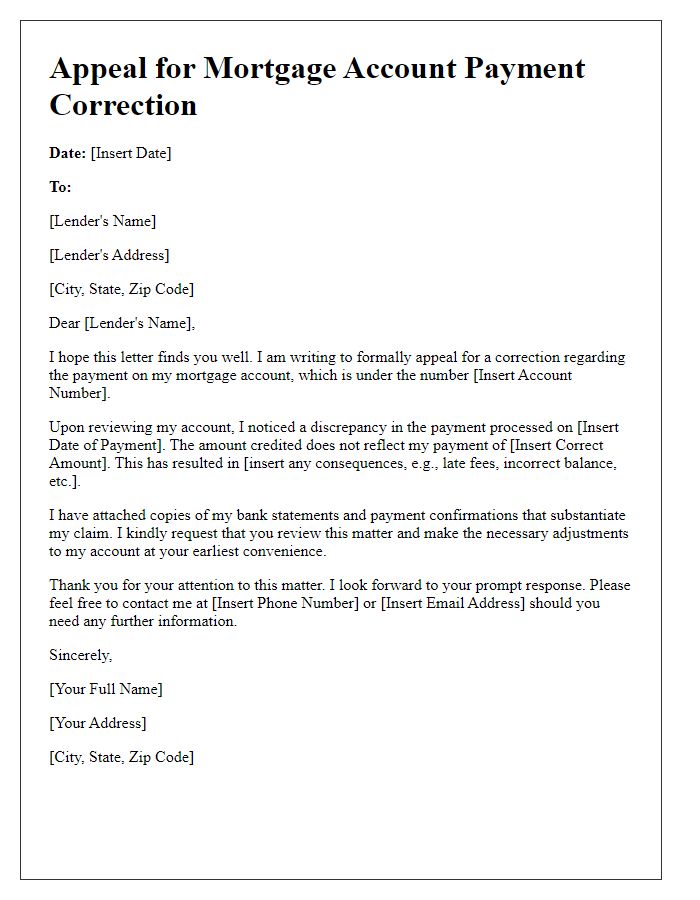

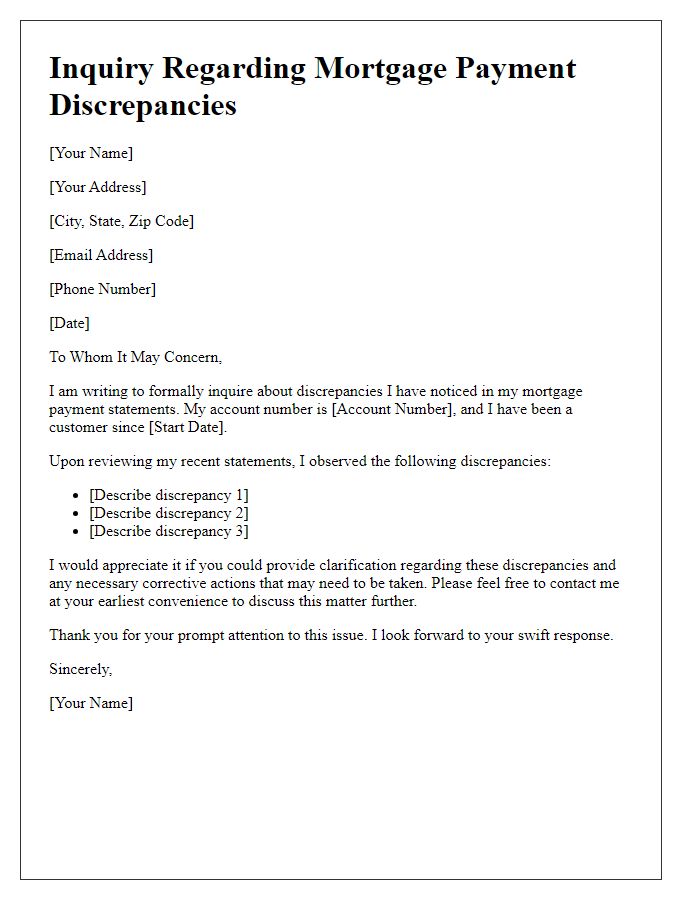

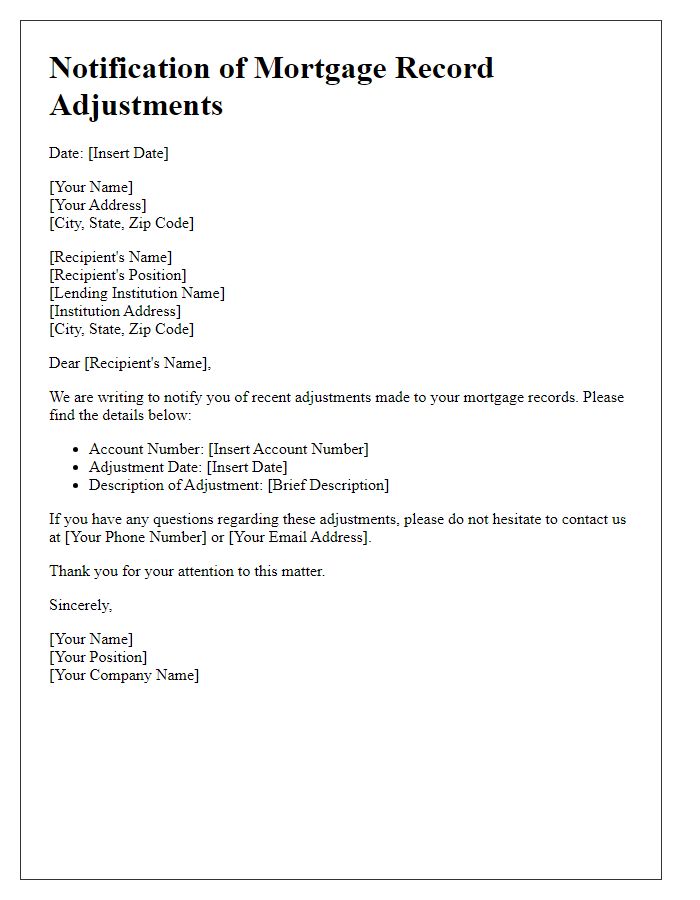

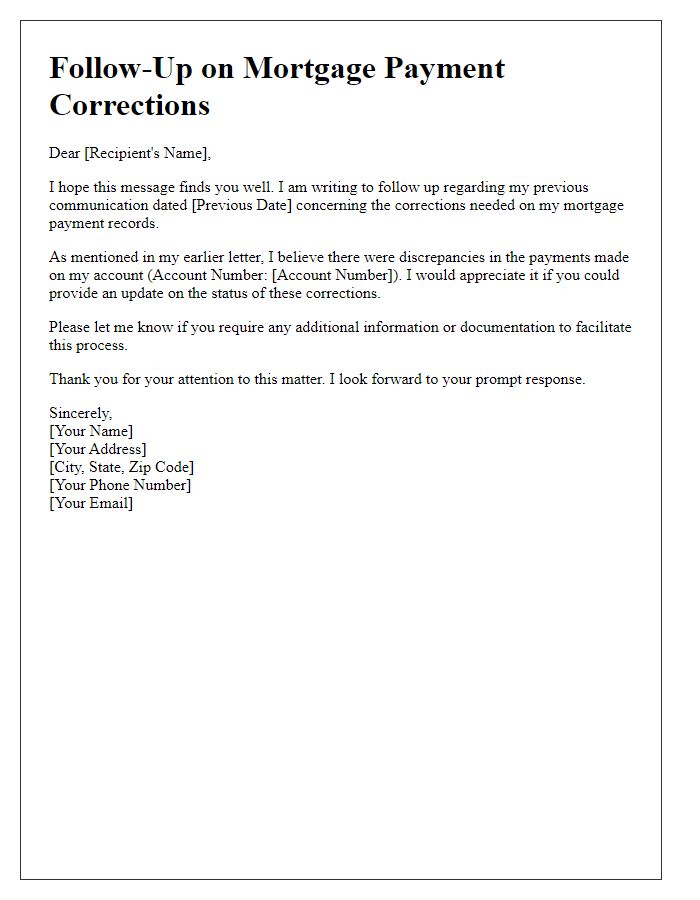

Letter Template For Mortgage Payment History Correction Samples

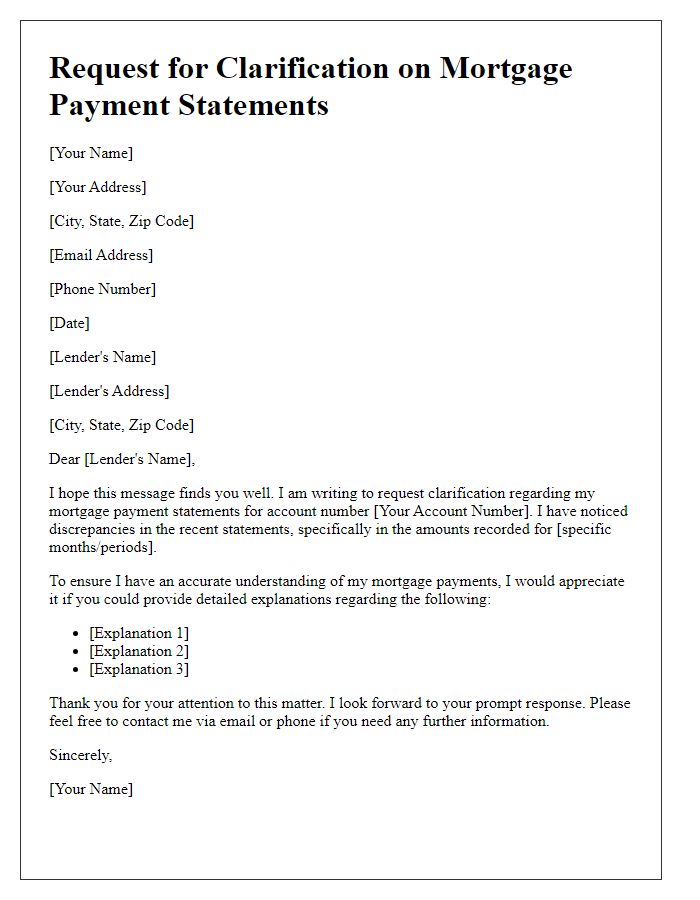

Letter template of clarification request for mortgage payment statements

Comments