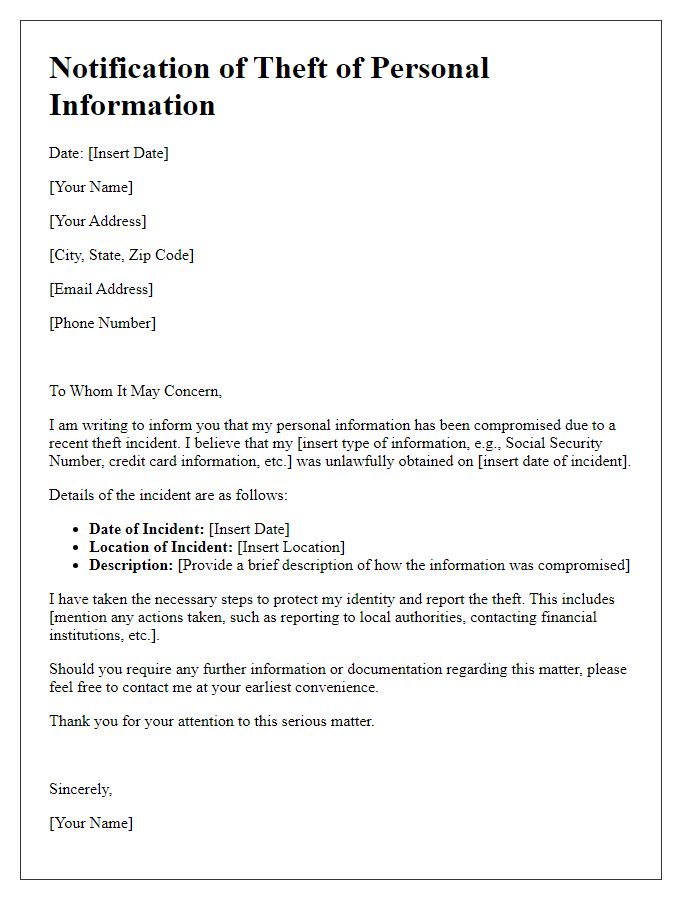

If you've ever found yourself in the frightening situation of dealing with identity theft, you know how overwhelming it can be. Crafting a clear and concise letter to report this theft is a crucial step in reclaiming your identity and protecting your financial future. In this article, we'll walk you through an easy-to-follow letter template designed specifically for submitting your identity theft report. Ready to take charge of your situation? Let's dive in!

Personal Information Verification

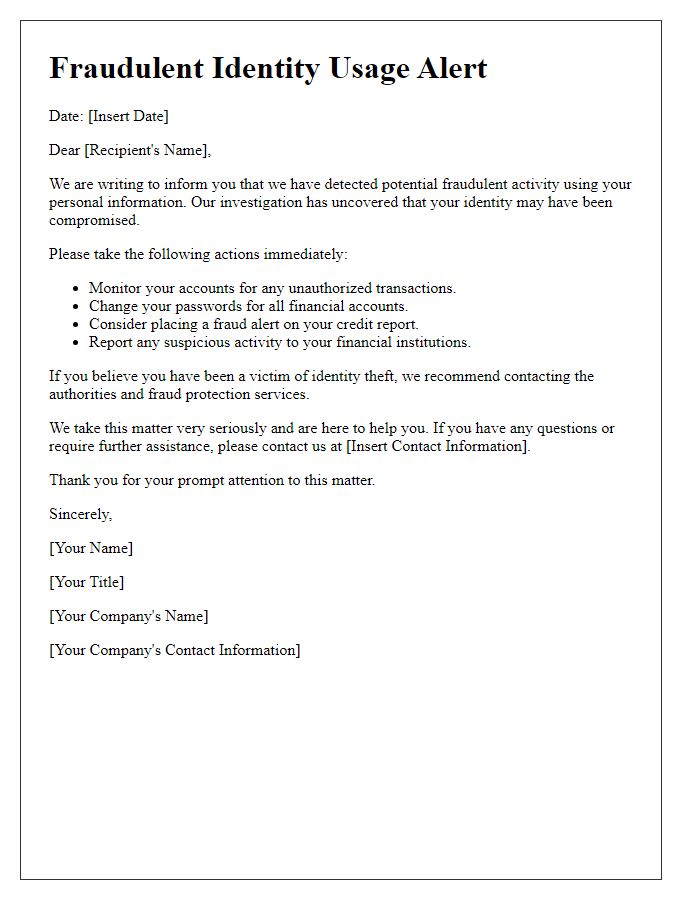

Identity theft can lead to significant financial and emotional distress, impacting victims on various levels, including credit scores and financial accounts. Victims, such as those affected by fraudulent credit card activities or unauthorized loans, must report incidents to agencies like the Federal Trade Commission (FTC). Timely reporting is essential, often within 30 days of discovering the theft to mitigate further damage. Crucial documents include detailed personal information, such as social security numbers (which consist of nine digits), and evidence of unauthorized transactions. Relevant organizations, including local law enforcement and credit bureaus like Experian, Equifax, or TransUnion, play critical roles in resolving issues, reinstating identities, and securing financial futures.

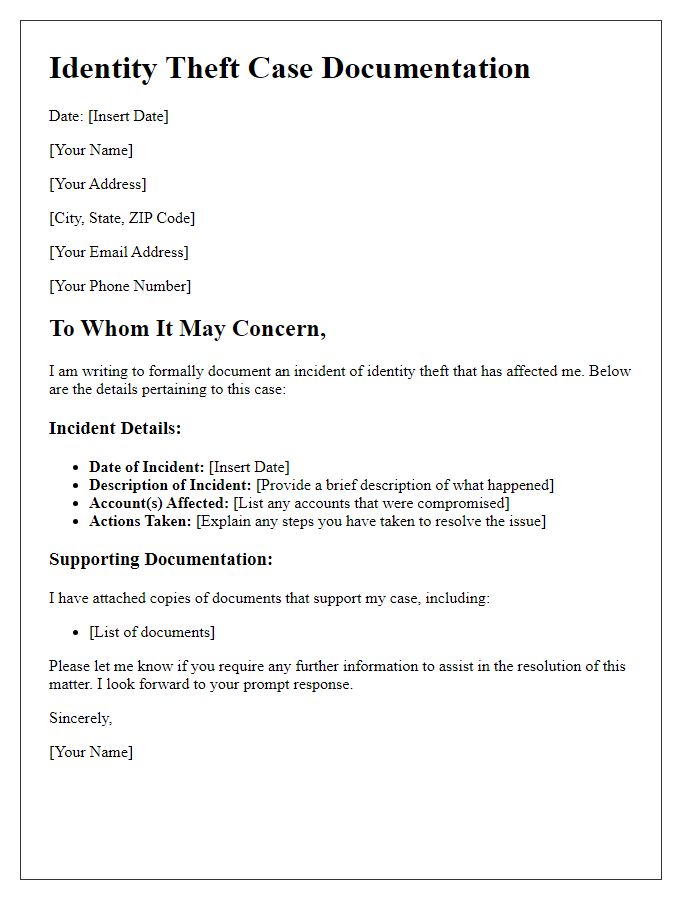

Detailed Incident Description

Identity theft incidents can involve various factors, such as unauthorized use of personal information like Social Security numbers, credit card details, or bank account information. Recent reports show that over 1.4 million cases of identity theft occurred in 2022 alone, highlighting a significant increase in these crimes. Victims may experience financial losses, damaging credit scores, and emotional distress. Common methods of identity theft include phishing attacks, data breaches at major corporations, and physical theft of documents. Locations often targeted include urban areas with higher populations and larger economic activities, where anonymity is easier to maintain for criminals. Law enforcement agencies, such as the Federal Trade Commission (FTC), recommend immediate reporting of theft incidents for faster resolution and prevention of further misuse of personal information.

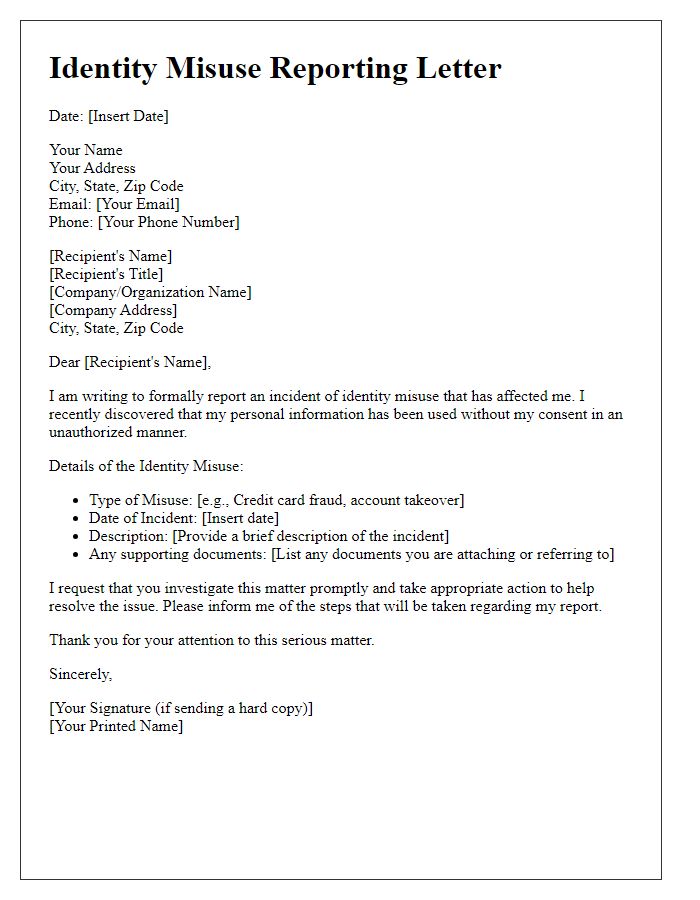

List of Unauthorized Accounts or Transactions

Unauthorized financial activities can significantly disrupt individuals' lives, particularly in cases of identity theft. Instances of fraudulent transactions may include unauthorized credit card charges totaling over $1,500, bank withdrawals from personal accounts at Wells Fargo, or activity on Amazon accounts exceeding $200. Each incident often requires detailed documentation, including transaction dates, amounts, and merchant names, such as the online retailer Target or sophisticated scams involving PayPal. Unauthorized accounts may include fraudulent credit lines reported by Experian or new bank accounts opened in the victim's name at Chase. The implications of such breaches necessitate immediate reports to financial institutions and law enforcement authorities, such as the Federal Trade Commission (FTC), as well as follow-up actions to mitigate financial liability and restore personal security.

Enclosed Evidence and Documentation

Identity theft cases can require careful documentation to provide proof of fraudulent activity. Enclosed evidence may include items such as copies of stolen identification (driver's license, social security card), bank statements showing unauthorized transactions (often from major banks like Chase or Bank of America), and credit report disputes to establish inaccuracies. Supporting documents can also consist of police reports from local law enforcement agencies (which may detail the date and nature of the theft), correspondence with creditors or lenders regarding fraudulent accounts, and affidavits affirming the victim's identity and the measures taken to resolve the issue. Such evidence is crucial for law enforcement and credit agencies to investigate and take corrective actions.

Request for Investigation and Resolution

Identity theft poses significant risks to individuals, affecting personal finances and reputations. Victims, such as those experiencing unauthorized use of credit cards, may face fraudulent charges amounting to thousands of dollars. Reporting such incidents to authorities, including the Federal Trade Commission (FTC) in the United States, is vital. Victims can file a report and receive an Identity Theft Report number for official records. Additionally, contacting credit reporting agencies (TransUnion, Experian, Equifax) to freeze or alert with alerts ensures protection against further fraudulent activities. Prompt action, including notifying affected financial institutions, is essential for recovering identity and mitigating damage.

Comments