Have you ever found yourself puzzled by an error on your credit report? It can be frustrating to see misinformation potentially impacting your financial health. Thankfully, correcting this information is a straightforward process that anyone can navigate. If you want to learn how to effectively draft a letter for correcting inaccurate credit details, keep reading!

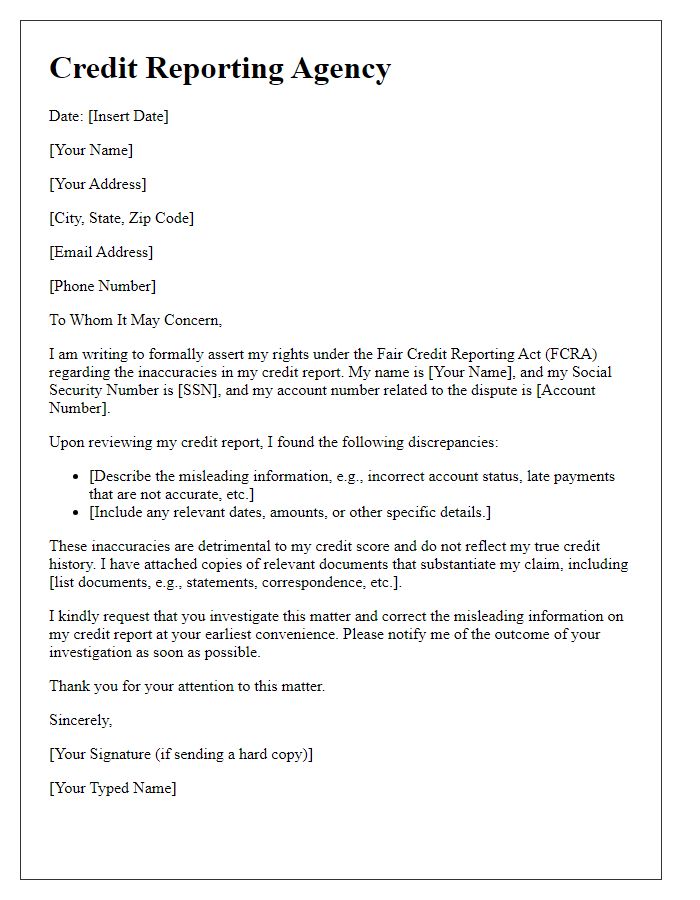

Personal identification details

Inaccurate credit information can significantly affect an individual's credit score, impacting future financial opportunities, such as loan approvals and interest rates. For instance, errors such as incorrect account balances or misreported payment histories can lead to unfavorable evaluations from lenders. Providing personal identification details, including the name, address, Social Security number (last four digits) and date of birth, is essential in identifying the account owner within credit reporting agency databases. Additionally, specific examples of inaccuracies, such as the name of the creditor and account number, enable quicker resolution and corrections. Ensuring that credit reports maintain accurate information promotes financial well-being and enhances the credibility of personal finance management.

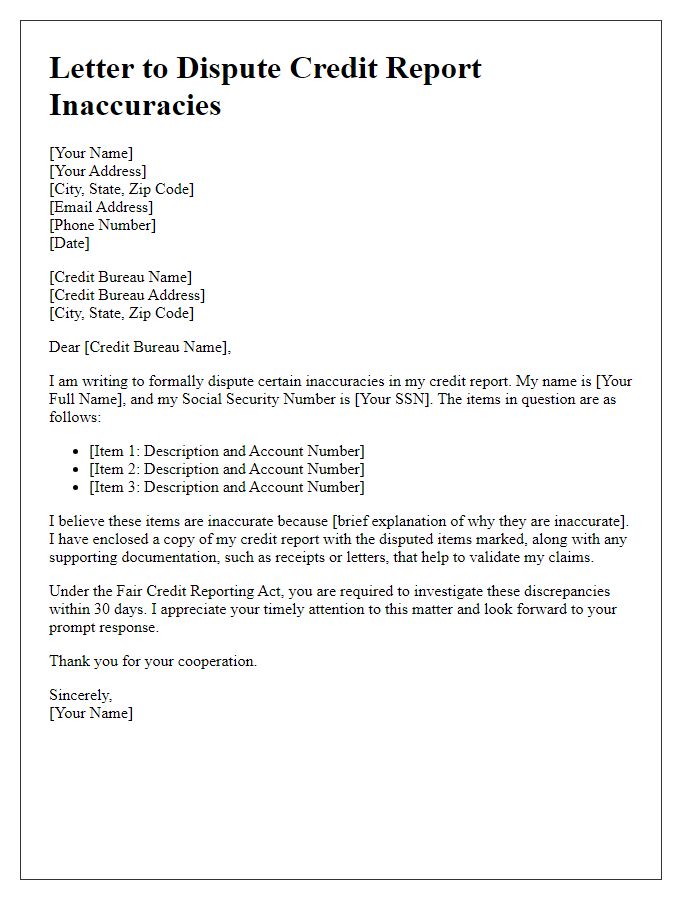

Clear statement of disputed information

Disputed credit information can severely impact an individual's financial health and borrowing capacity. Credit reports from agencies like Experian, Equifax, and TransUnion can contain inaccuracies such as incorrect account details, wrong payment history, or erroneous late payments. These discrepancies can lower a credit score, potentially leading to higher interest rates on loans and mortgages. Timely reporting of disputed information, with a clear record of inconsistencies, is crucial for consumers to maintain an accurate financial profile. A systematic approach to addressing these issues involves gathering supporting documents, submitting a dispute to credit bureaus, and following up to ensure resolution within the 30-day investigation period mandated by the Fair Credit Reporting Act (FCRA).

Supporting documentation

Inaccurate credit information can significantly impact an individual's financial health and credit score. Credit reports from major bureaus, like Experian or Equifax, may contain errors such as incorrect account balances or misreported payment statuses. Supporting documentation, including bank statements or payment confirmation emails, is crucial in disputing these inaccuracies. The Fair Credit Reporting Act provides consumers rights to request corrections, which can enhance their creditworthiness. Addressing these inaccuracies promptly can lead to improved credit scores that facilitate future loan approvals or better interest rates on financial products.

Request for correction or deletion

Inaccurate credit information can significantly impact credit scores and loan approvals, causing financial distress for consumers. The Fair Credit Reporting Act (FCRA) mandates that credit reporting agencies, such as Experian, TransUnion, and Equifax, ensure the accuracy and integrity of the data they report. For instance, a single erroneous late payment reported from a creditor like Bank of America can lower a credit score by several points, potentially preventing individuals from qualifying for preferred interest rates on mortgages. Filing a dispute online or through certified mail, while including supporting documentation, can initiate the correction process. A timely response, usually within 30 days from the credit bureau, is expected per regulatory standards, emphasizing the importance of maintaining accurate credit profiles for all consumers in the financial landscape.

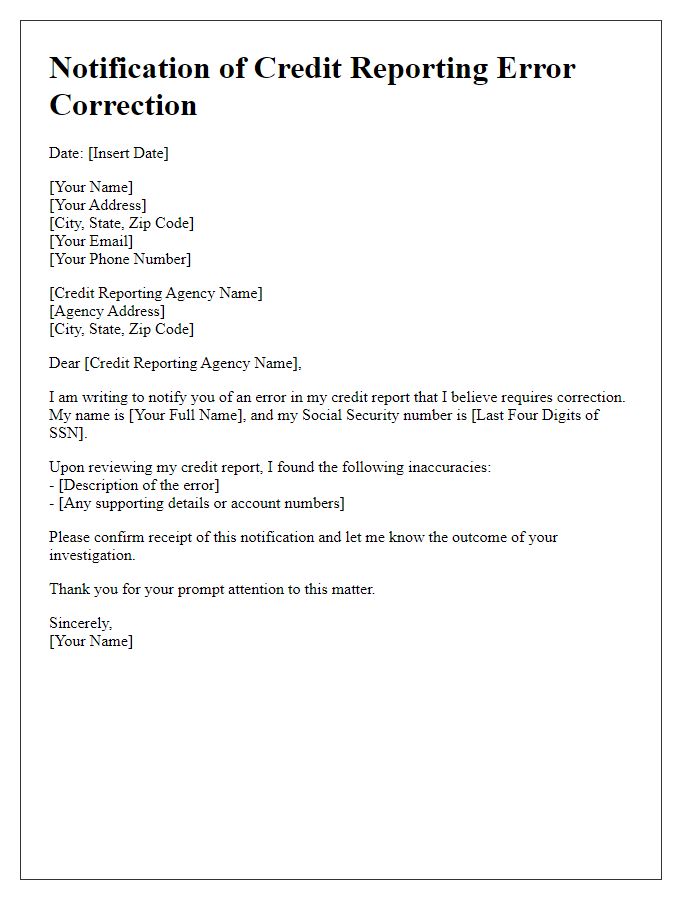

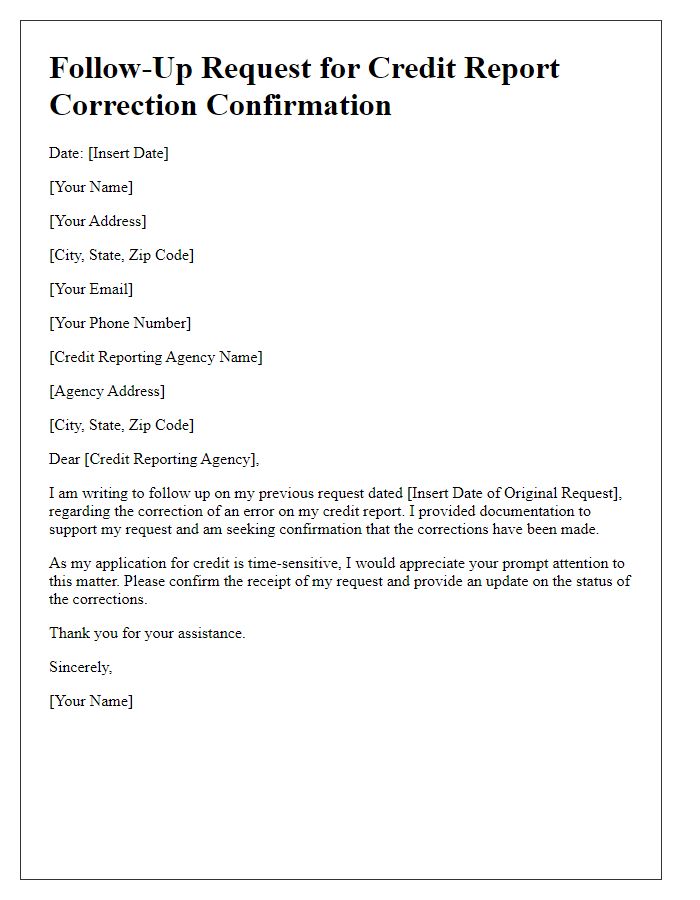

Contact information for follow-up

Inaccurate credit information can significantly impact one's credit score, creating challenges when applying for loans or credit cards. To address this issue, it is crucial to gather documents that support the claim, such as the credit report from agencies like Experian or TransUnion, which often offers free access to reports annually. Adding specific details like account numbers and dates of disputed entries is essential for clarity. Providing accurate contact information, including phone numbers and email addresses, facilitates communication with credit bureaus and ensures prompt resolution of inaccuracies. Continuous follow-up can help ensure that changes are reflected in future reports, maintaining a healthy financial profile.

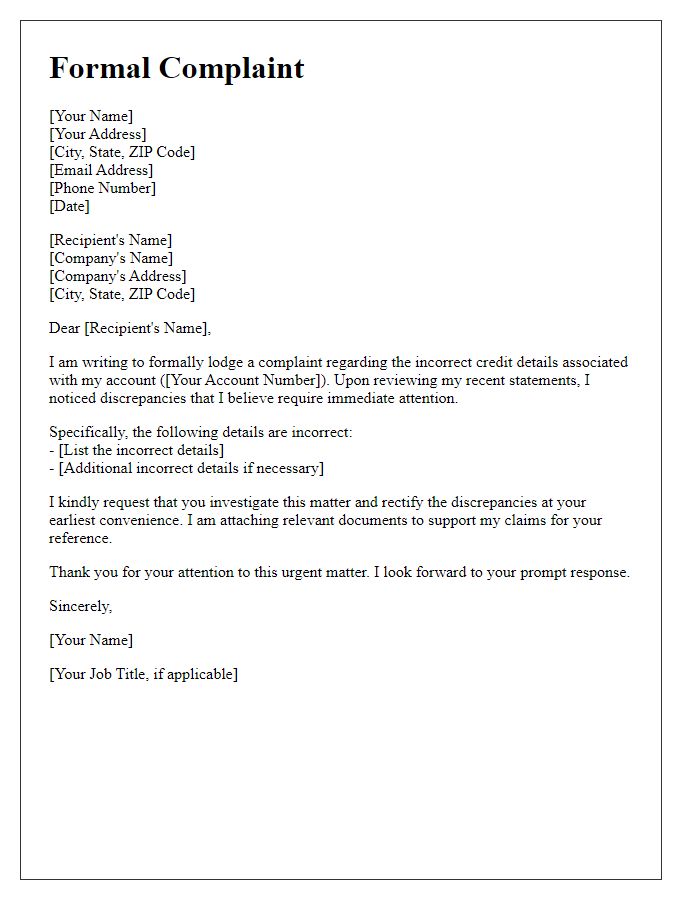

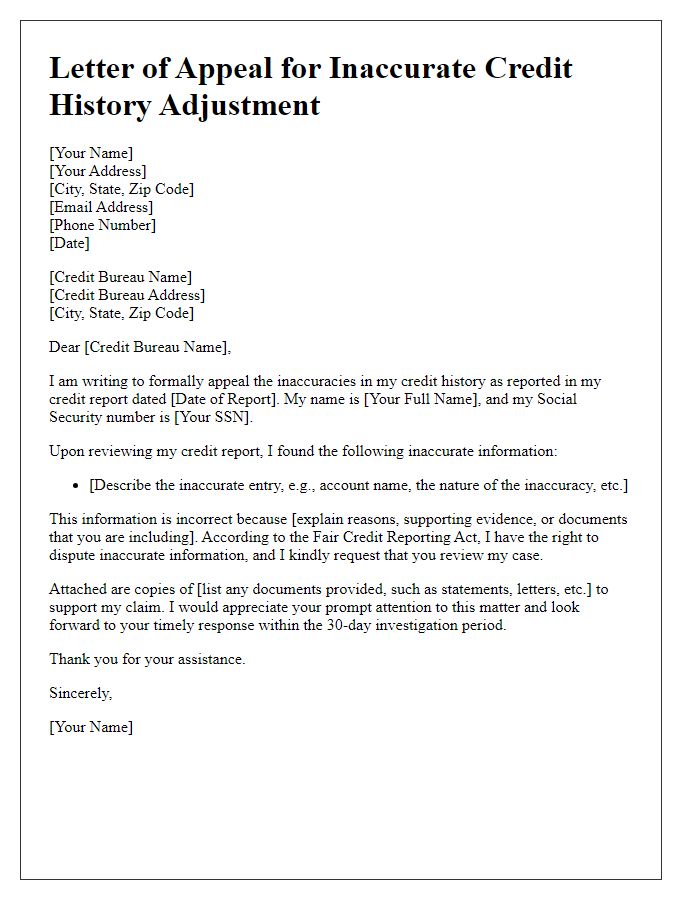

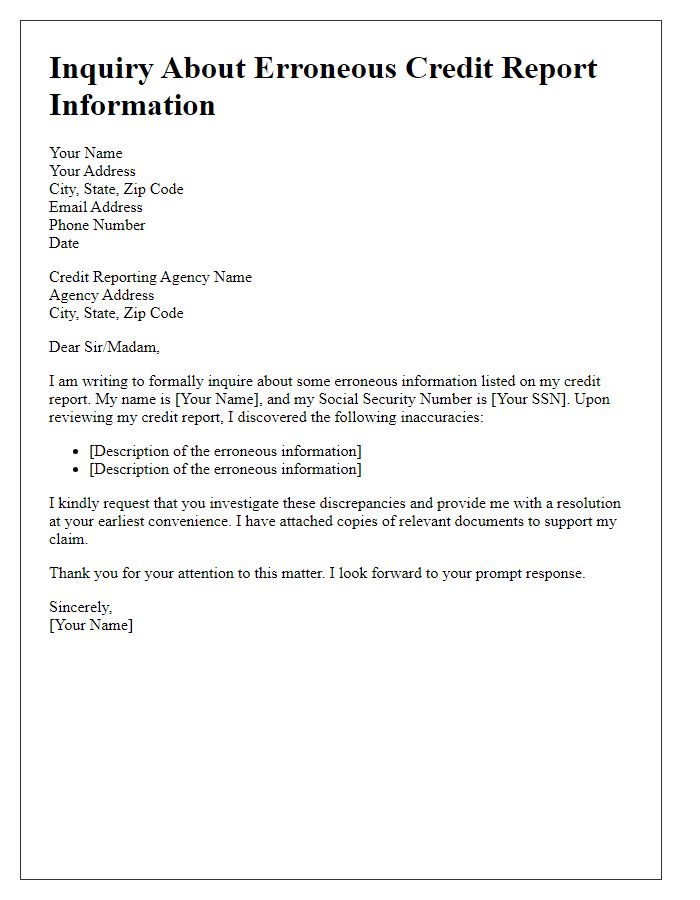

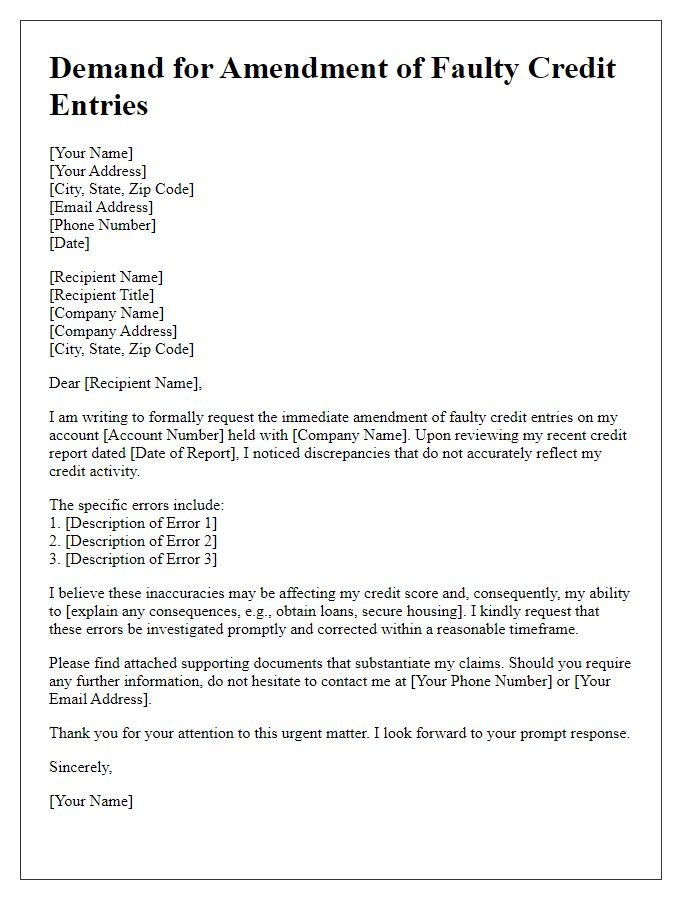

Letter Template For Correcting Inaccurate Credit Information Samples

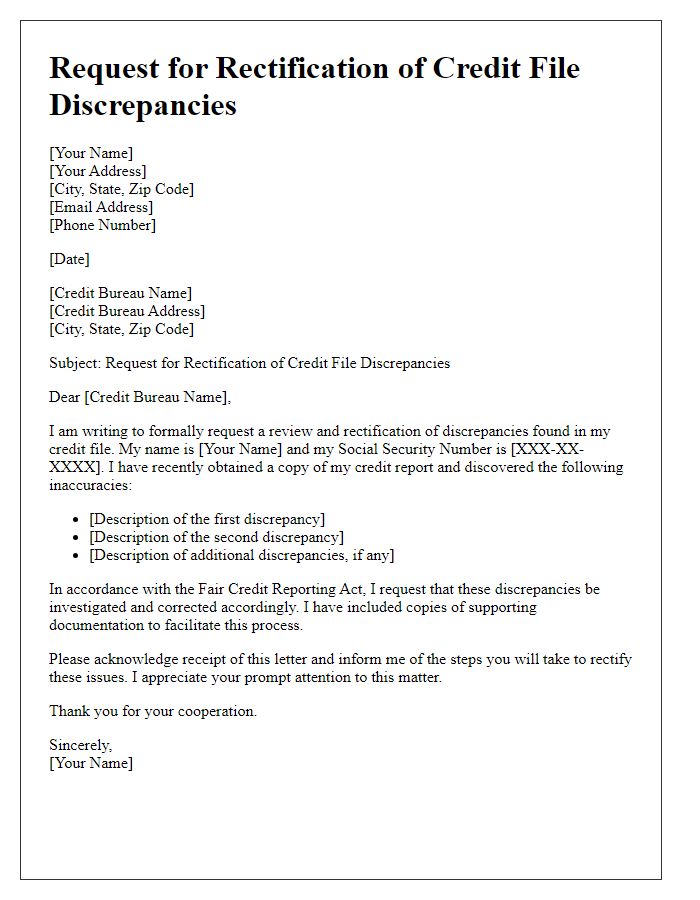

Letter template of request for rectification of credit file discrepancies

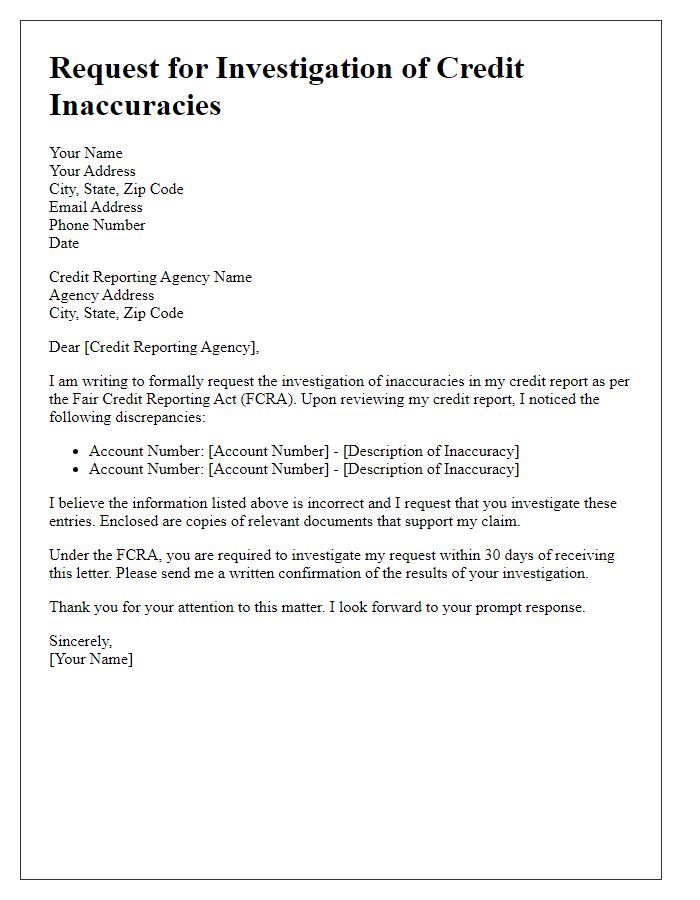

Letter template of solicitation for investigation of credit inaccuracies

Comments