Have you ever found yourself tangled in a complicated credit agreement that no longer fits your financial situation? It's a common scenario many of us face, whether due to unexpected changes in our income or shifts in the market. Reassessing your prior credit agreement can lead to more favorable terms and peace of mind. Interested in learning how to navigate this process and enhance your financial well-being? Keep reading for insights and tips!

Clear Subject Line

Improper reassessment of prior credit agreements can lead to financial complications for borrowers seeking modifications. Credit agreements, often comprising interest rates and repayment terms, necessitate thorough evaluation, especially during economic fluctuations impacting individuals. Miscommunication with credit institutions can result in delayed responses, exacerbating stress for borrowers. Regulations imposed by agencies such as the Consumer Financial Protection Bureau (CFPB) may dictate the timeframe for reassessment, typically requiring action within 30 days. Understanding these guidelines can empower borrowers to effectively navigate the reassessment process and advocate for their financial well-being.

Account Identification Details

Prior credit agreements often undergo reassessment to evaluate changes in account identification details. Factors such as account number variations, credit limits adjustments, and borrower employment status can contribute to this process. Financial institutions may review credit reports from bureaus like Experian or TransUnion, assessing metrics such as credit score (usually ranging from 300 to 850) to determine risk. Recent economic events, including interest rate fluctuations by central banks and policy changes affecting lending criteria, also influence the reassessment of these credit agreements. It is essential to maintain updated contact information to facilitate communication throughout this process and ensure correct documentation.

Reason for Reassessment Request

In recent years, several financial institutions have reassessed credit agreements to ensure alignment with current market conditions and borrower capabilities. During this evaluation period, a significant fluctuation in interest rates (e.g., the Federal Reserve adjusted rates from near zero in 2020 to over 5% by late 2023) has resulted in varying repayment abilities for many borrowers. Economic changes, including job loss or reduced income, particularly amid events like the COVID-19 pandemic, can impact debt management significantly. Additionally, evolving financial profiles, such as improvements in credit scores or changes in personal circumstances, warrant reconsideration of existing terms. A reassessment could lead to more manageable payment plans and foster enduring relationships between borrowers and creditors, promoting financial stability and preventing defaults.

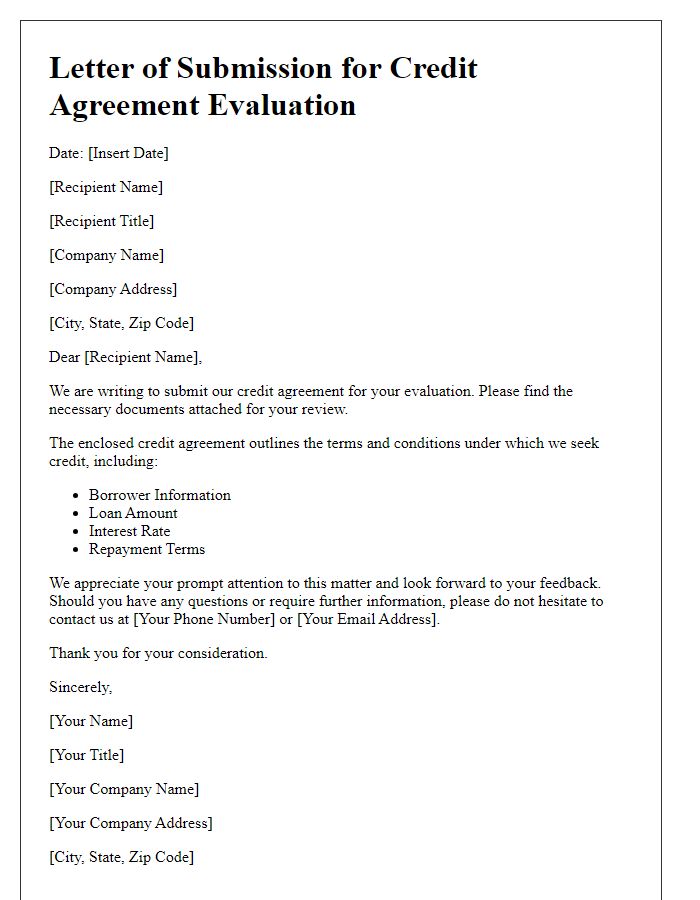

Supporting Documentation

Prior credit agreement reassessment requires comprehensive documentation to ensure transparency and accurate evaluation. Essential documents include historical financial statements (income statement, balance sheet, cash flow statement), which provide insights into revenue trends and liquidity ratios. Additional items such as tax returns (federal, state) from the previous three years demonstrate consistent income levels and tax compliance. Current credit reports from agencies like Experian or TransUnion reveal credit scores and any outstanding debt obligations. Detailed records of existing loans and obligations, including monthly payment schedules and balances, showcase the borrower's current financial responsibilities. Furthermore, a business plan (if applicable) outlining future revenue projections and market analysis can highlight growth potential and support the case for reassessment. Finally, any correspondence with financial institutions regarding past agreements or modifications strengthens the credibility of the reassessment request.

Contact Information for Further Communication

Reassessing prior credit agreements requires clear communication of contact information for effective resolution. Essential details to provide include full name, phone number, and email address, ensuring accessibility for follow-up discussions. Specify the relevant department handles the credit agreement reassessment, such as the Customer Service or Credit Specialist division. A dedicated office address may also be included for written correspondence, emphasizing the importance of timely responses and efficient communication channels. Providing accurate information accelerates the reassessment process, helping both parties reach satisfactory outcomes.

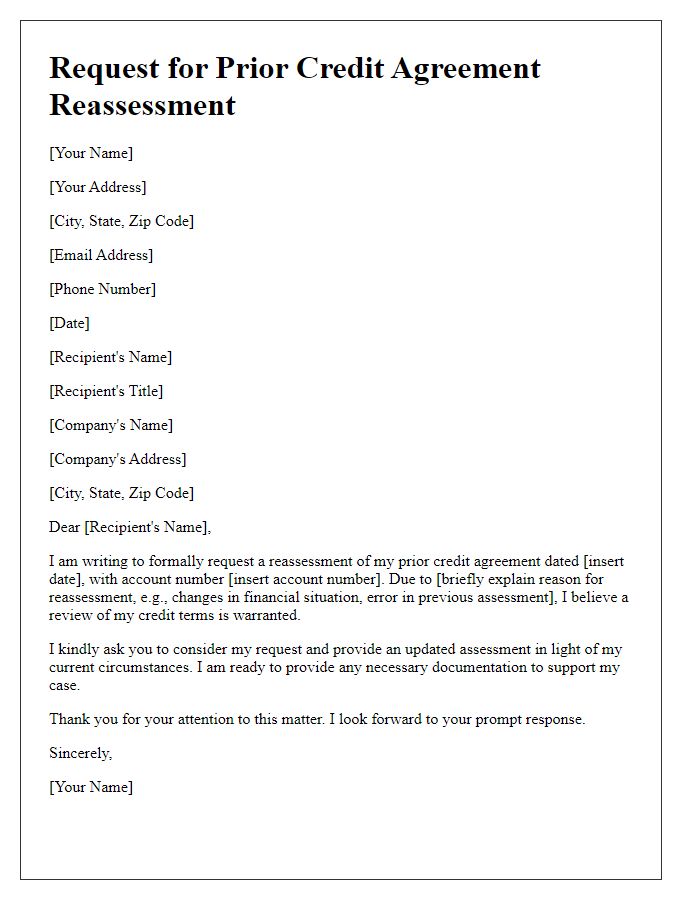

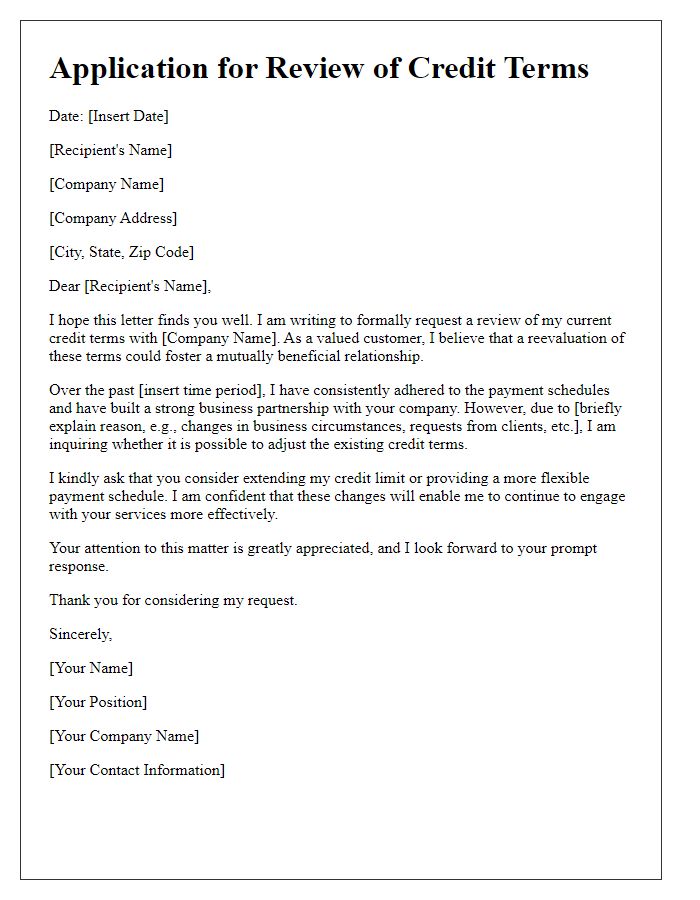

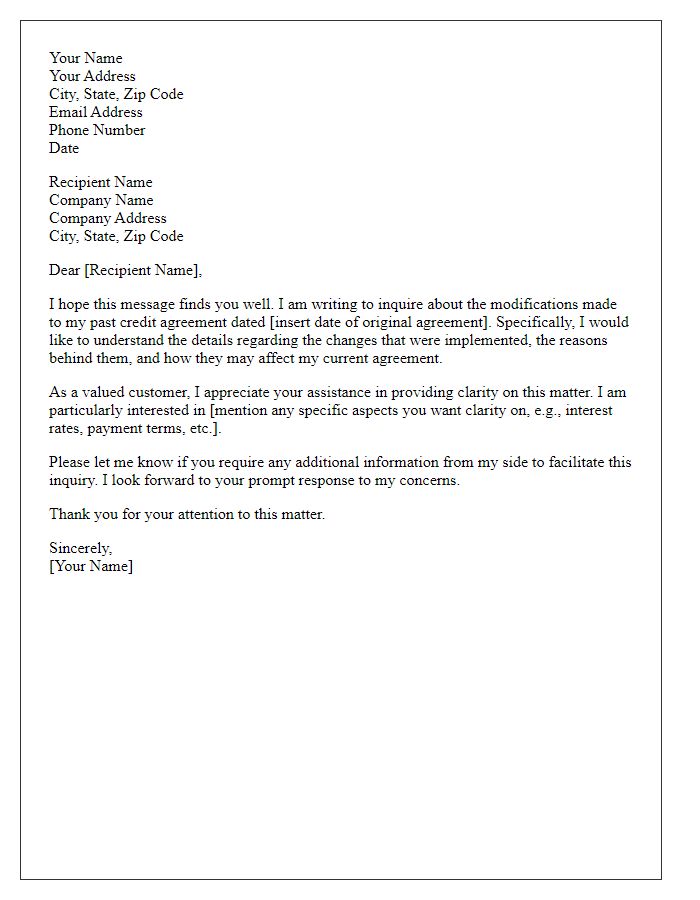

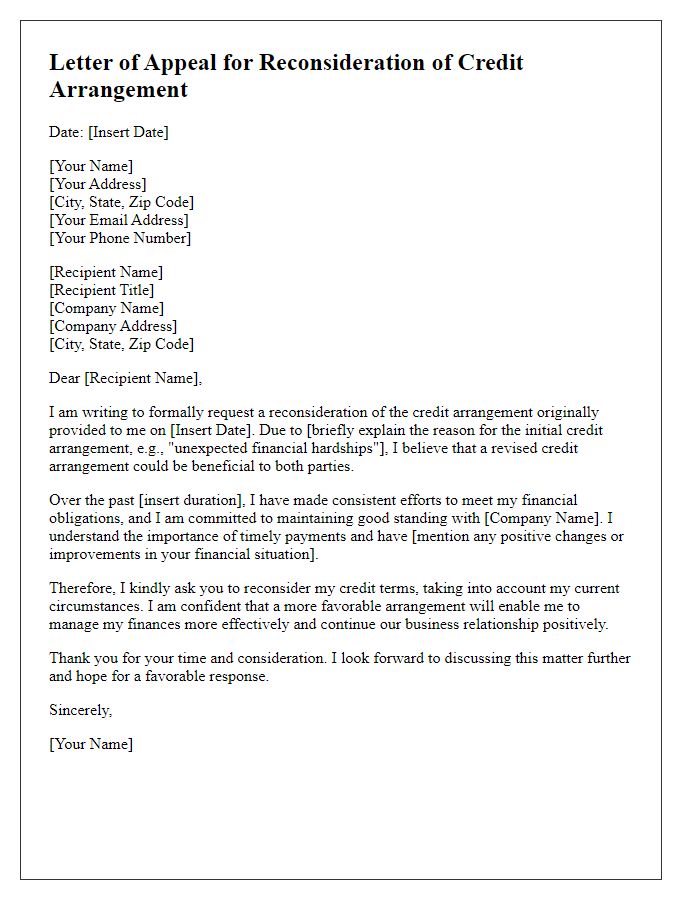

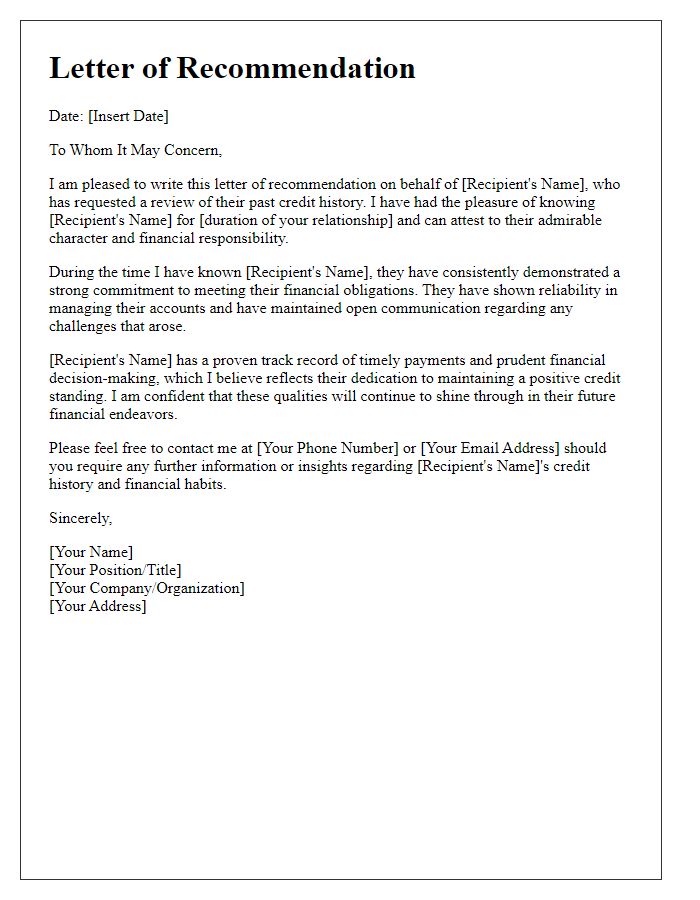

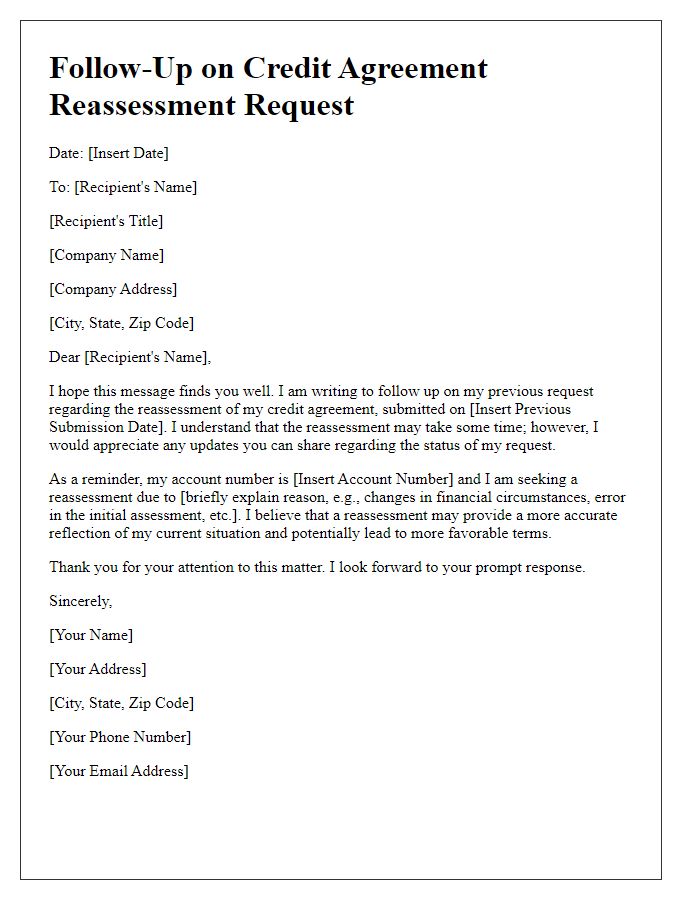

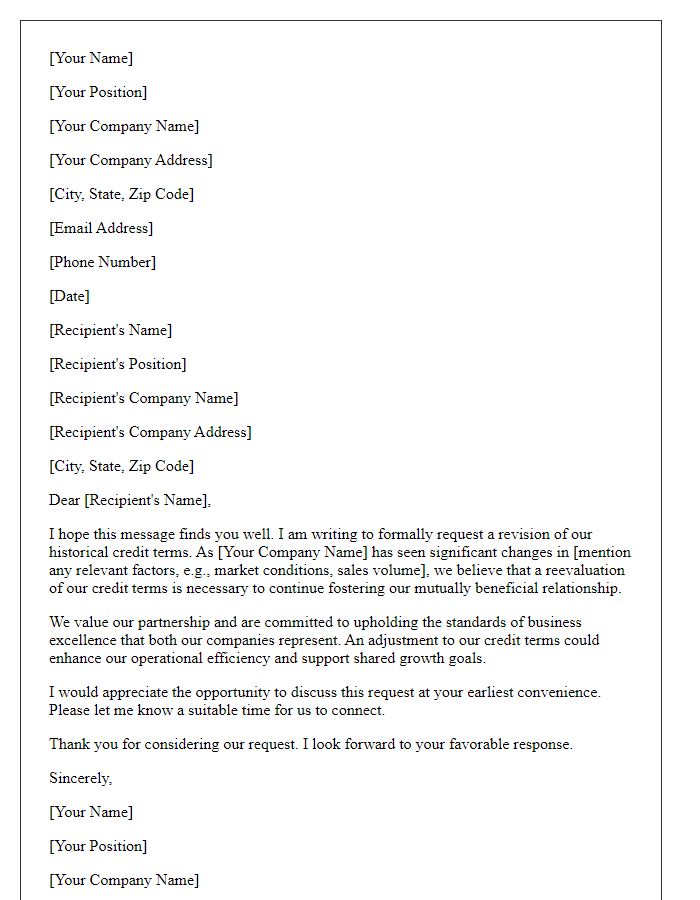

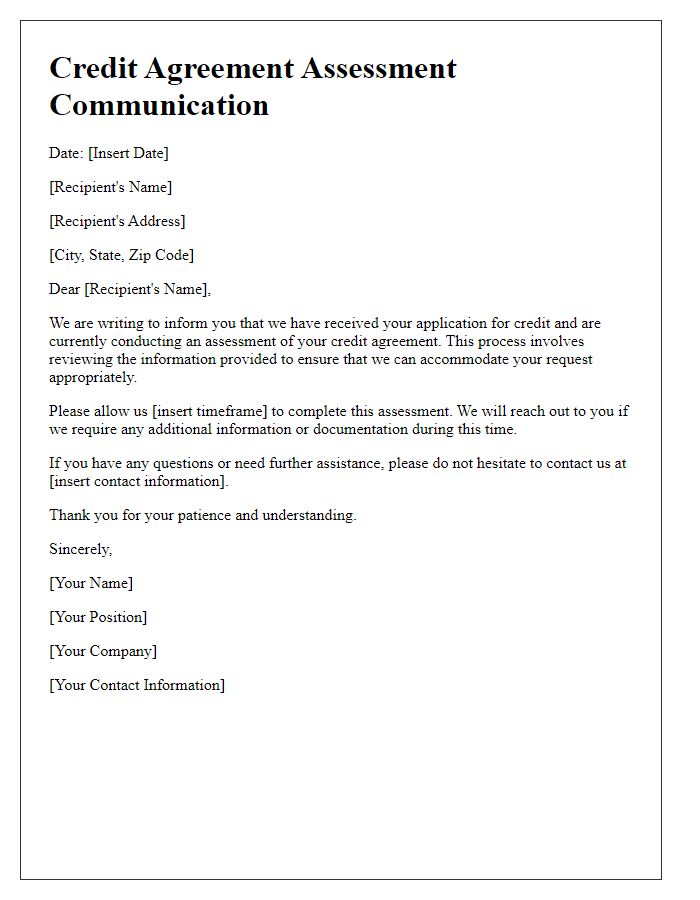

Letter Template For Prior Credit Agreement Reassessment Samples

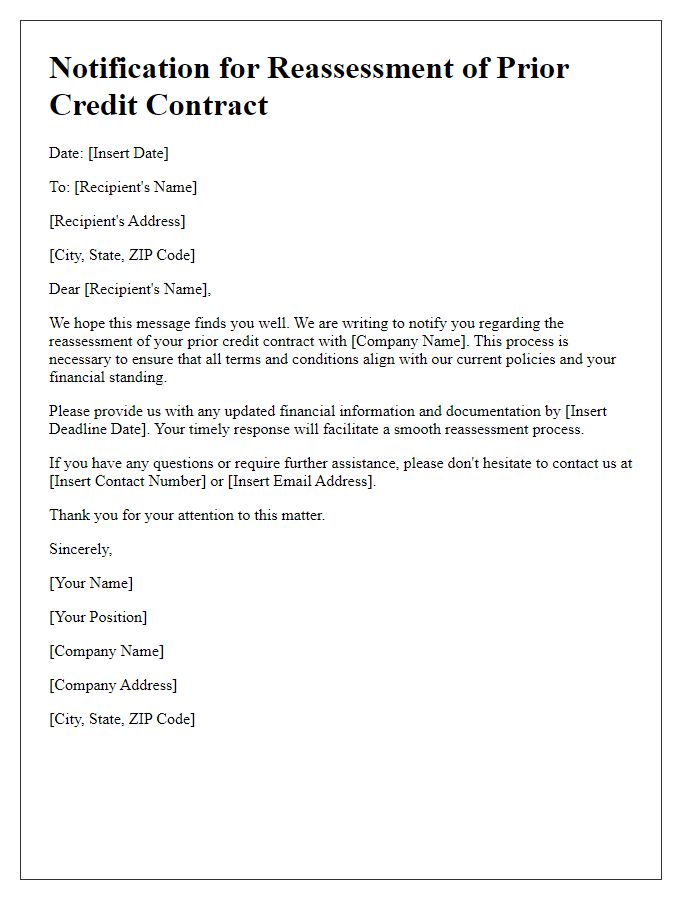

Letter template of notification for reassessment of prior credit contract

Comments