Are you looking for a straightforward way to update your income verification document? We understand that keeping your financial records accurate is crucial for everything from loan applications to rental agreements. In this article, we'll guide you through the essential elements of a letter template that ensures your updated information is communicated clearly and professionally. Stick around to learn more about crafting the perfect income verification letter that meets all your needs!

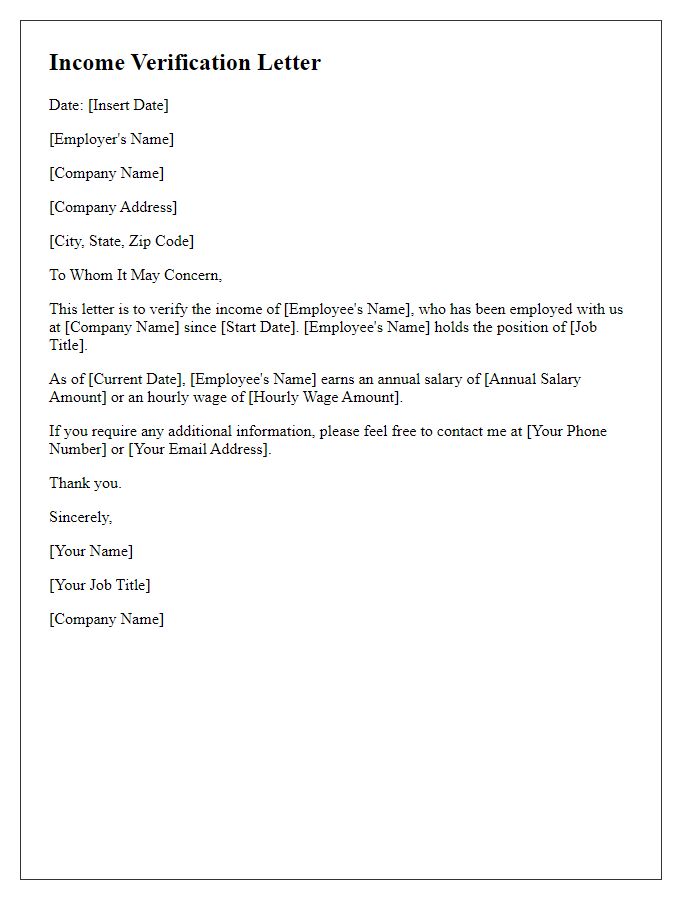

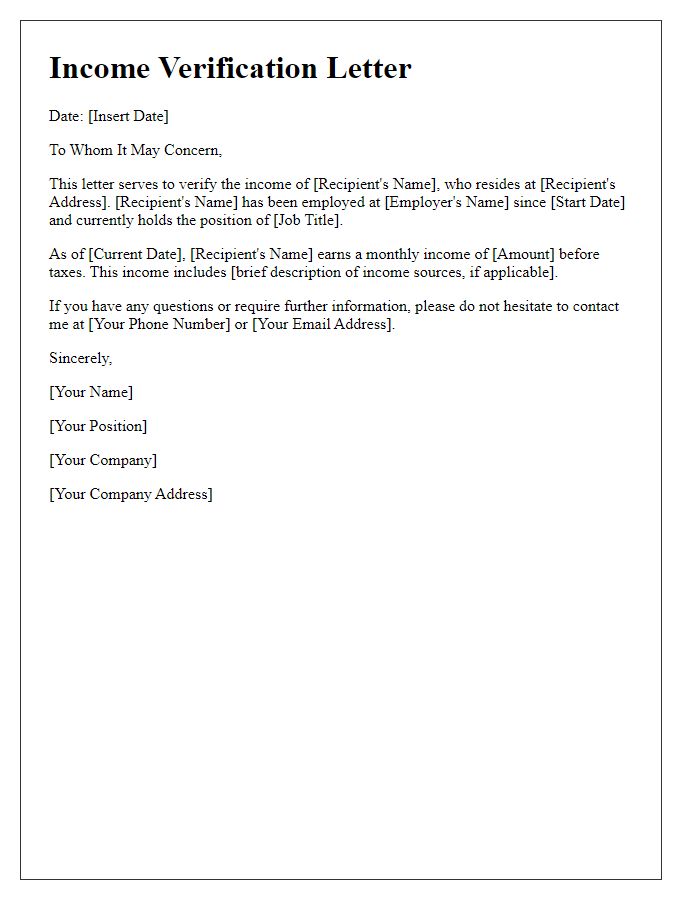

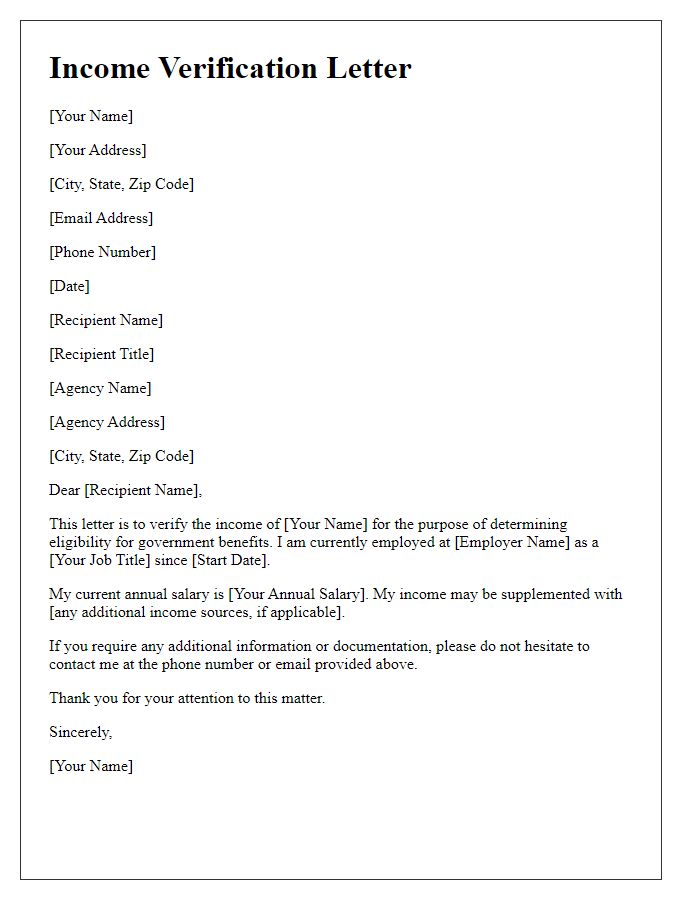

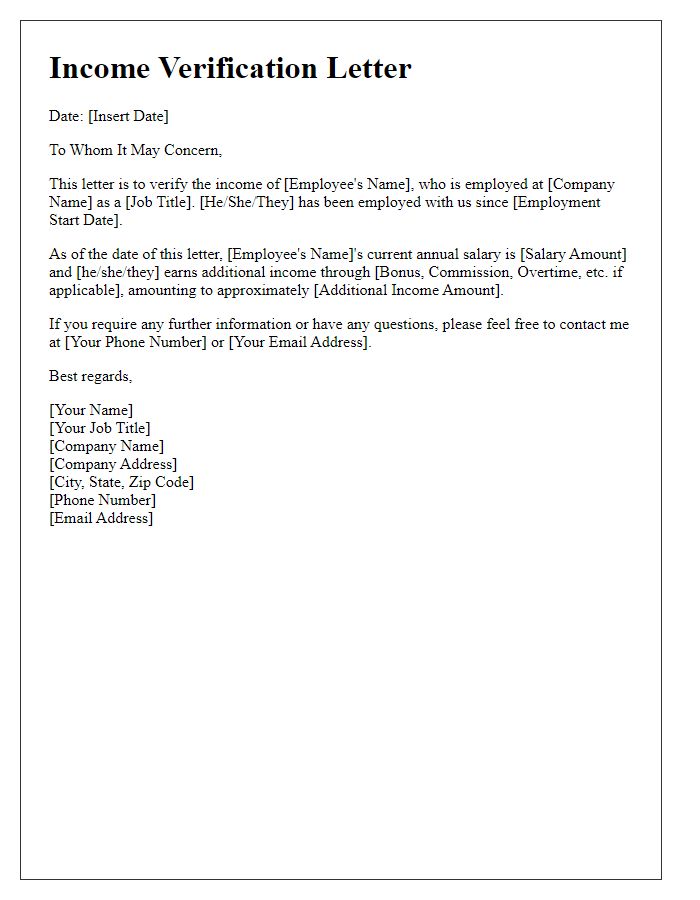

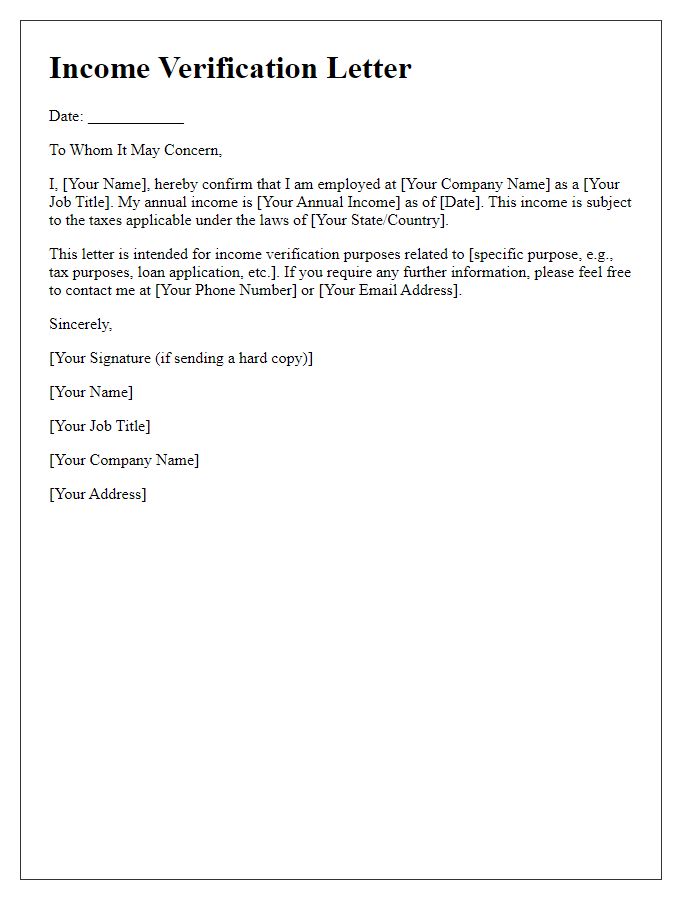

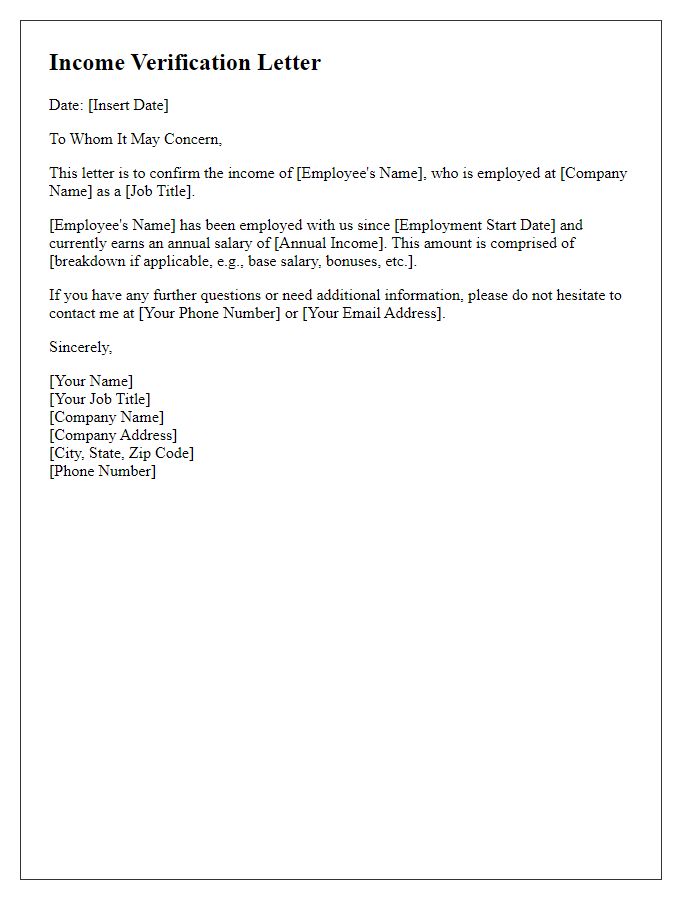

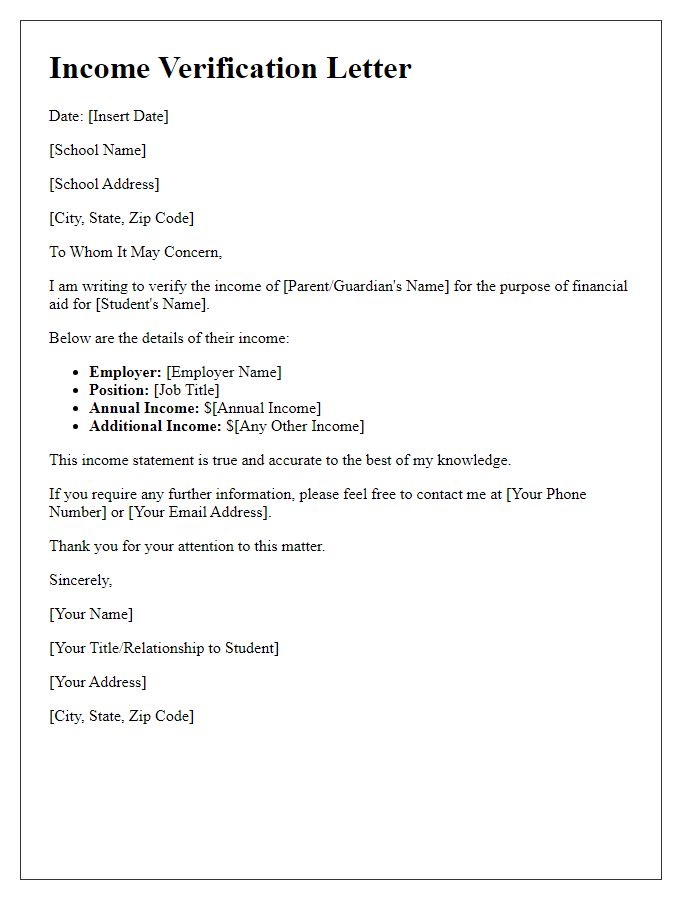

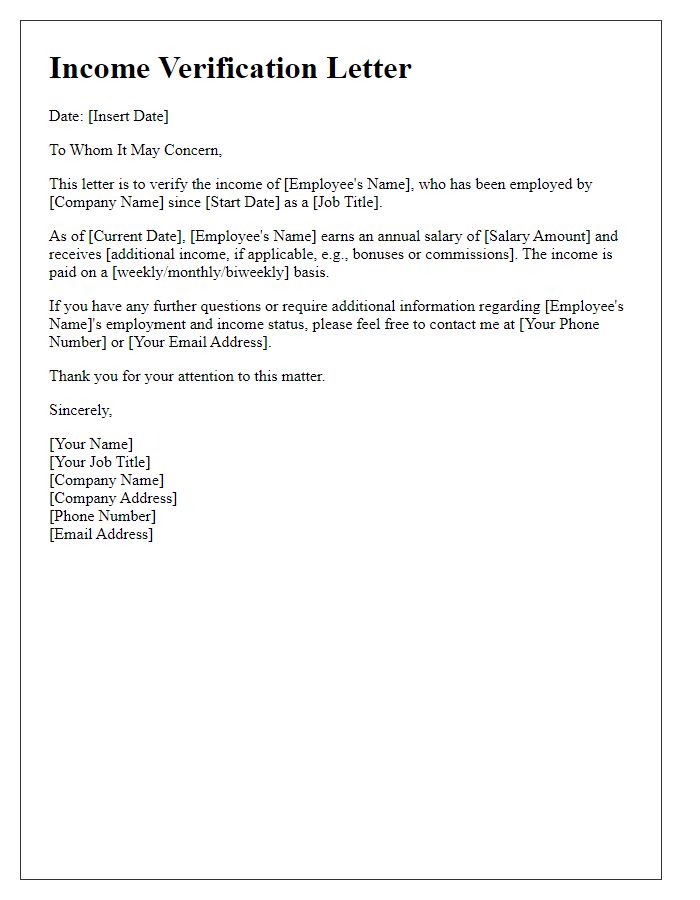

Professional Header

Income verification documents play a crucial role in determining an individual's financial standing, particularly for applications regarding loans or housing. These documents typically reflect employment status, gross annual income details, and specific employment dates, often required by financial institutions or landlords. For instance, a paycheck stub may detail bi-weekly earnings, while a tax return can illustrate total income status over a yearly period. Additionally, updated documents should clearly state the employer's name, address, and contact information to ensure authenticity and verify the individual's income source, enhancing credibility in the assessment process.

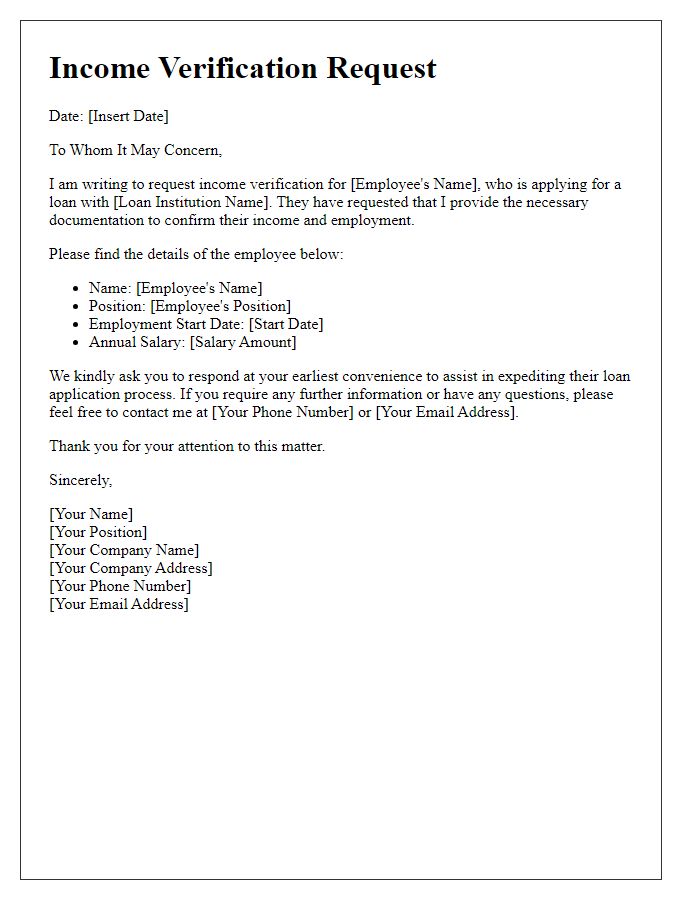

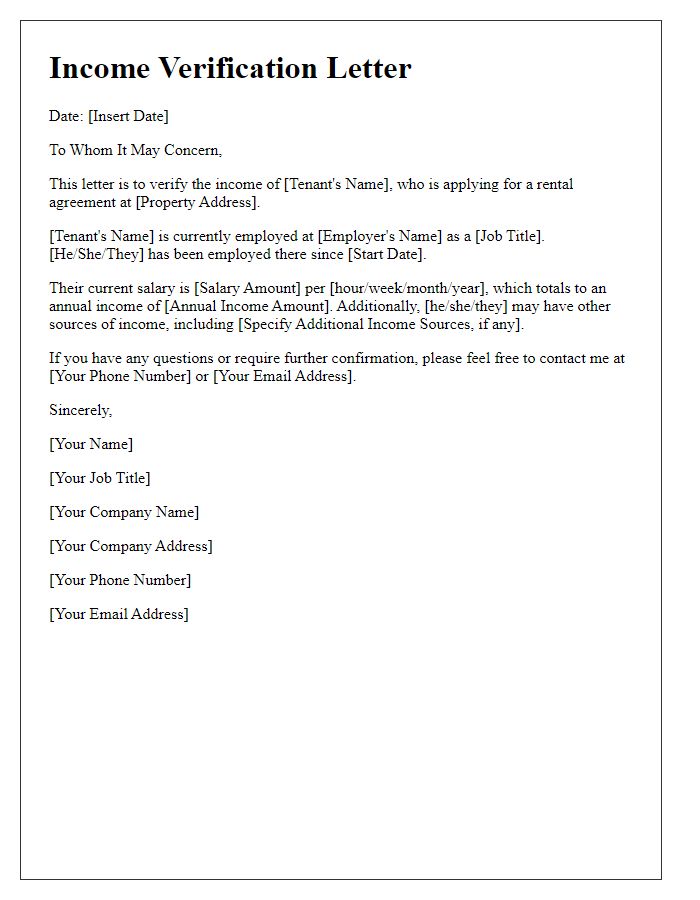

Recipient Information

Recipient information is critical in income verification documents, ensuring proper identification and communication. Essential details include the recipient's full name, such as John Smith, and mailing address, which might be 123 Main Street, New York, NY 10001. Additional identifiers, like phone number (555-123-4567) and email address (john.smith@email.com), enhance reliability. Date of document creation, for example, January 1, 2024, provides a timeline reference, crucial for record-keeping. Accurate recipient information fosters efficient processing and prevents delays in verification procedures, maintaining the integrity of financial assessments.

Purpose of the Letter

An income verification document serves as an official statement, confirming an individual's earnings from various sources, such as employment, self-employment, or rental income. This document is often required by financial institutions, landlords, or government agencies to assess financial eligibility for loans, housing applications, or assistance programs. Updates to this document may occur due to changes in employment status, salary adjustments, or new sources of income. Accurate figures, such as the current annual salary or net income, are crucial for establishing an individual's financial position. Timely and precise updates ensure compliance with application requirements and foster transparency in financial dealings.

Details of Income Verification

Income verification documents are essential for financial processes involving loans, mortgages, and rental applications. These documents typically detail an individual's financial status, including salary, bonuses, and other income sources. Essential elements include the applicant's name, employer's name, and contact information, as well as employment start date and income figures, which may be presented as gross income for tax purposes. For example, annual salary figures over $50,000 can indicate a stable financial status. The verified income must also reflect consistent payment history over the last three months, providing lenders or landlords assurance of reliability in meeting financial obligations. Additionally, any discrepancies in reported income should be documented and explained to maintain transparency during verification processes.

Request for Confirmation or Further Action

An income verification document update is essential for financial transactions, especially when applying for loans or rental agreements. This document typically includes details such as employment status, annual salary figures, and the duration of employment, often verified through employer letters or automated systems. Accurate income verification is crucial in high-stakes locations like New York City, where average rents exceed $3,000 and lenders require precise financial assessments. Prompt updates to these submissions ensure compliance with financial regulations and improve decision-making processes for both lenders and leasing agents.

Comments