Have you ever found yourself grappling with the daunting task of correcting your Social Security number? It's a common issue that many people face, and the process doesn't have to be overwhelming. In this article, we'll walk you through a simple letter template that will make correcting your Social Security number a breeze. So, grab a cup of coffee and let's dive into the details to ensure you get it right!

Recipient's Address

The importance of correcting a Social Security Number (SSN) cannot be overstated, as it plays a crucial role in an individual's identity verification for various services, including employment, healthcare, and credit applications. An incorrect SSN, whether due to typographical errors or changes in personal status, can hinder access to essential benefits administered by the Social Security Administration (SSA). Prompt action is necessary to ensure accurate record-keeping and to avoid potential implications such as delayed processing of claims or errors in tax reporting, emphasizing the need for accurate correspondence with the SSA.

Proper Salutation

Correcting errors in a Social Security Number (SSN) requires meticulous attention to detail. Individuals seeking to rectify inaccuracies must contact the Social Security Administration (SSA) directly. A proper salutation in correspondence should reflect the recipient's designation, such as "Dear Social Security Administration Representative" or "To Whom It May Concern." This ensures the communication is respectful and directed to the appropriate authority handling SSN corrections. The letter must include personal information like name, date of birth, and current address to facilitate processing. Additional documentation, such as proof of identity--birth certificate or government-issued ID--should accompany the request for an efficient correction process.

Clear Explanation of Error

Mistakes in Social Security numbers (SSNs) can have significant consequences for individuals, affecting their ability to access government services, employment opportunities, and credit. An incorrect SSN may arise from clerical errors, transcription mistakes, or identity theft incidents. When addressing an SSN error, it is crucial to provide a concise and clear explanation of the mistake, detailing both the incorrect number (for instance, 123-45-6789) and the correct number (for instance, 987-65-4321) required for accurate record-keeping. Supporting documentation, such as a birth certificate or government-issued ID, can help validate the correction process, ensuring the Social Security Administration can promptly rectify the error and prevent future discrepancies.

Correct Social Security Number

A correctly recorded Social Security Number (SSN) is crucial for accurate identification and benefits administration within the United States Social Security Administration (SSA). An incorrect SSN can lead to issues such as delayed or denied benefits, identification problems, and complications during tax filings. For instance, an SSN is a unique 9-digit number assigned to every U.S. citizen and eligible resident. Errors in this number can arise from typographical mistakes in forms or discrepancies during data entry at financial institutions. Swift correction of an SSN ensures compliance with federal regulations and helps maintain an individual's record accuracy, thereby preventing potential disruptions in social security benefits or services.

Request for Confirmation and Correction

A social security number (SSN) is a crucial identification element for individuals in the United States, used for tracking earnings and benefits. Incorrect SSN entries can lead to complications in various processes, such as tax filings and benefit applications. A formal request for confirmation and correction of an SSN is typically directed to the Social Security Administration (SSA) office situated in Baltimore, Maryland. This request may reference specific documentation, such as birth certificates or passports, to verify identity and support the correction. Providing accurate information ensures the integrity of personal records, vital for accessing social security benefits and maintaining an individual's financial security throughout their life.

Letter Template For Correcting Social Security Number Samples

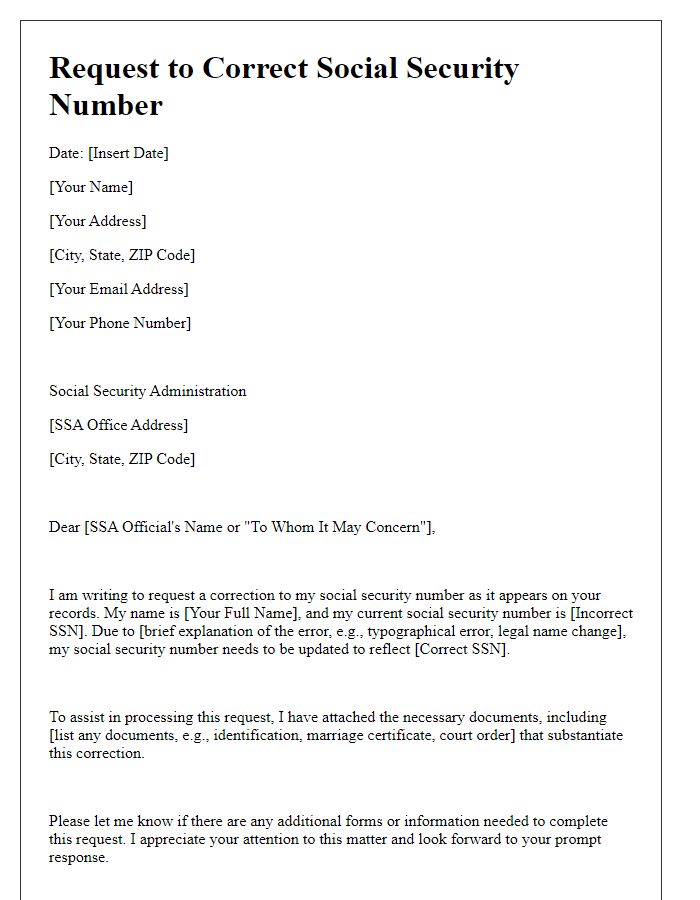

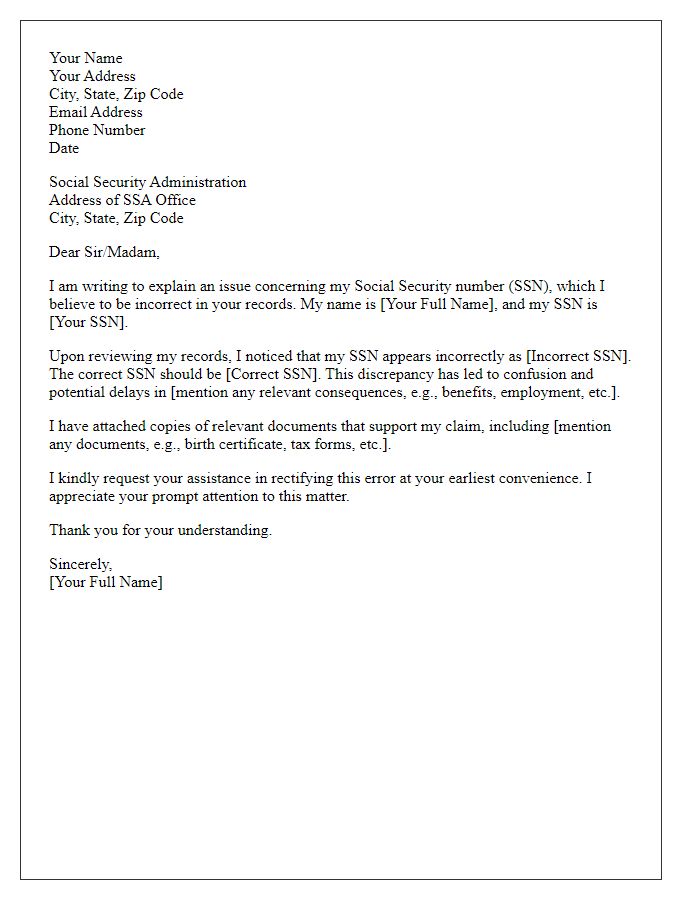

Letter template of request to correct social security number on official records.

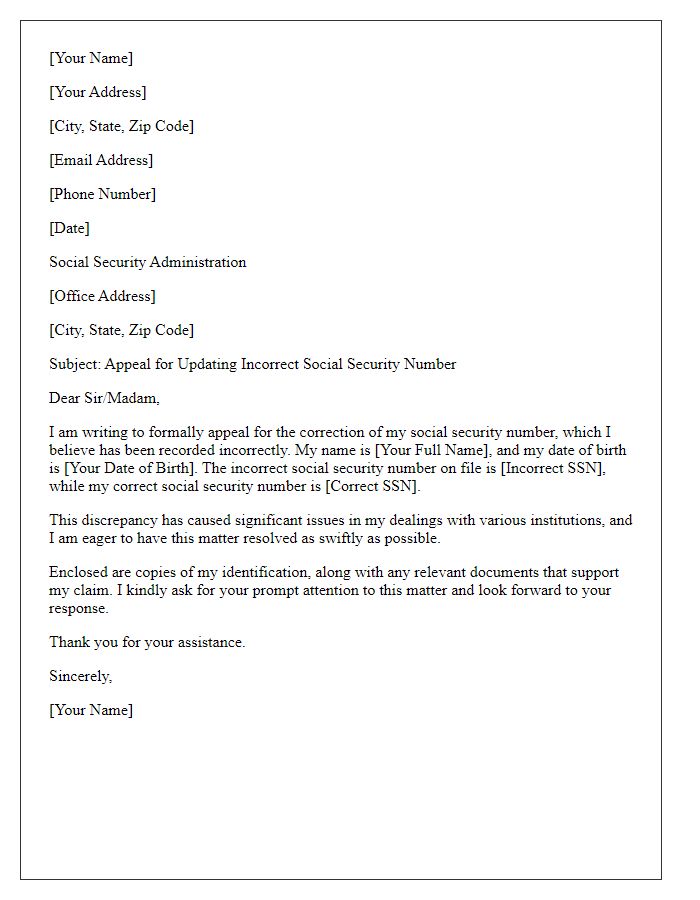

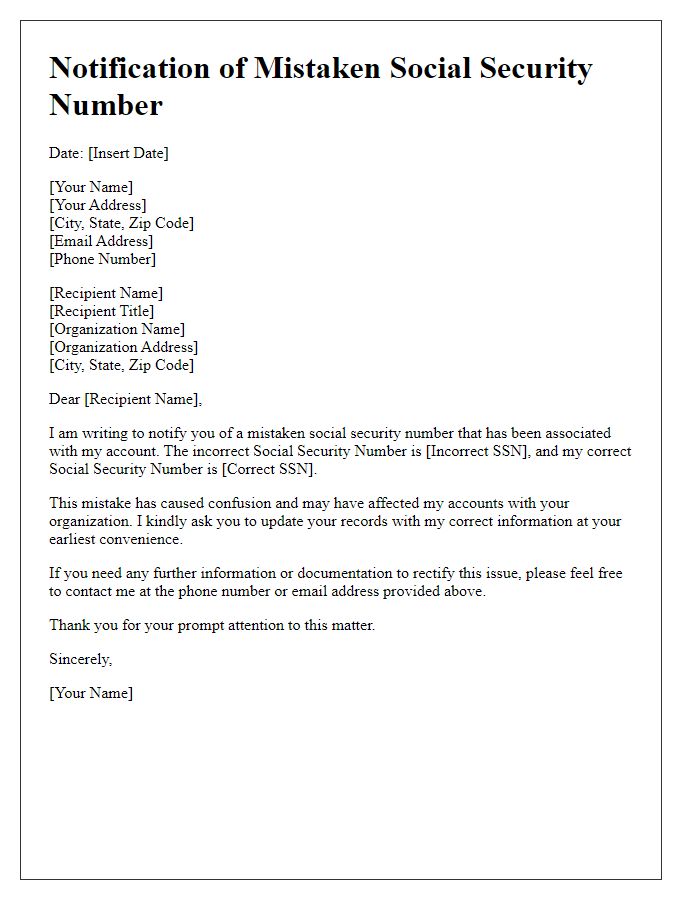

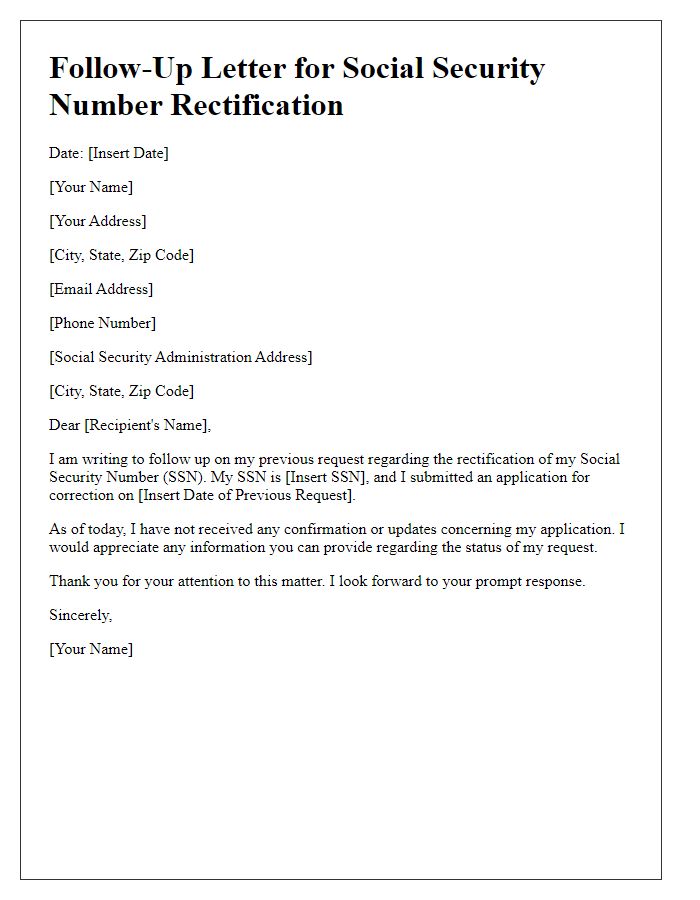

Letter template of appeal for updating incorrect social security number.

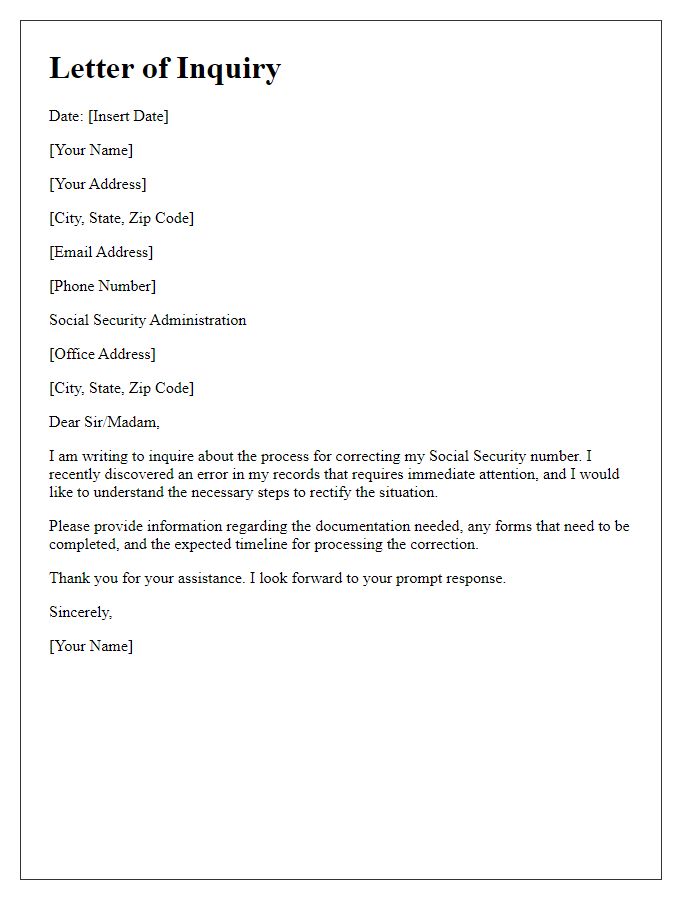

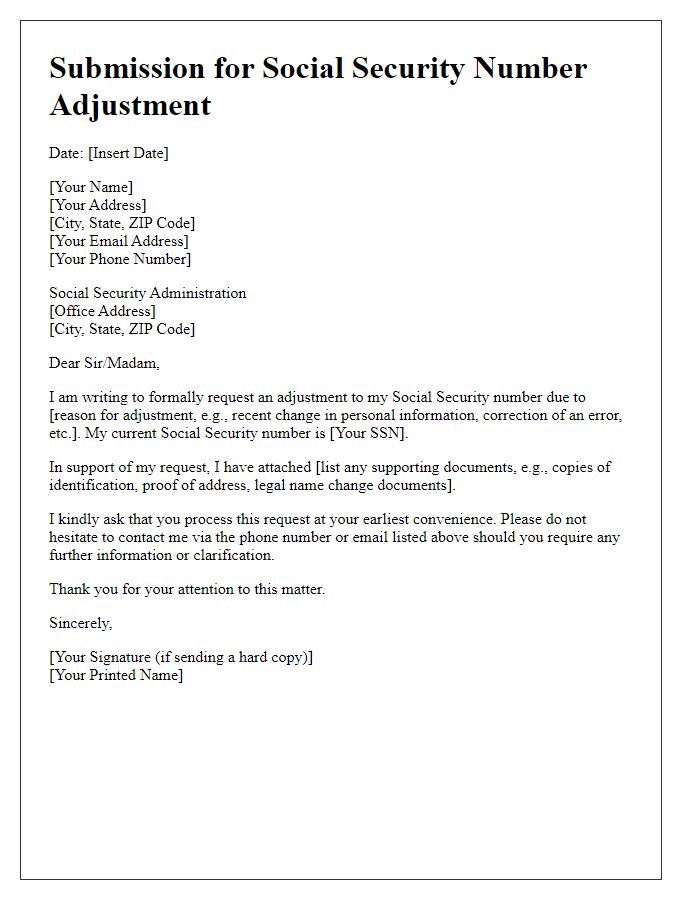

Letter template of inquiry regarding social security number correction process.

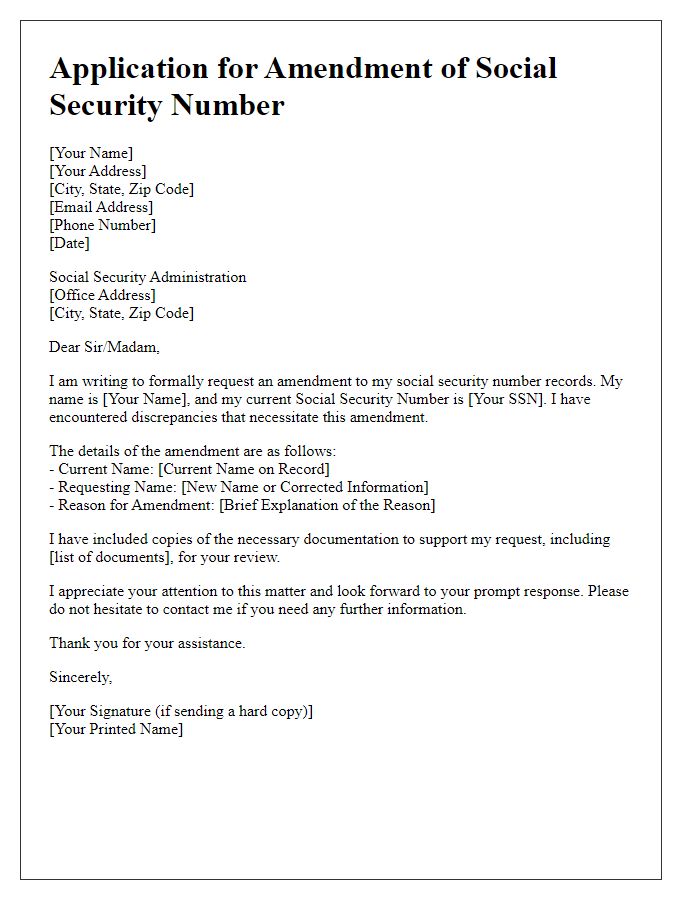

Letter template of formal application for social security number amendment.

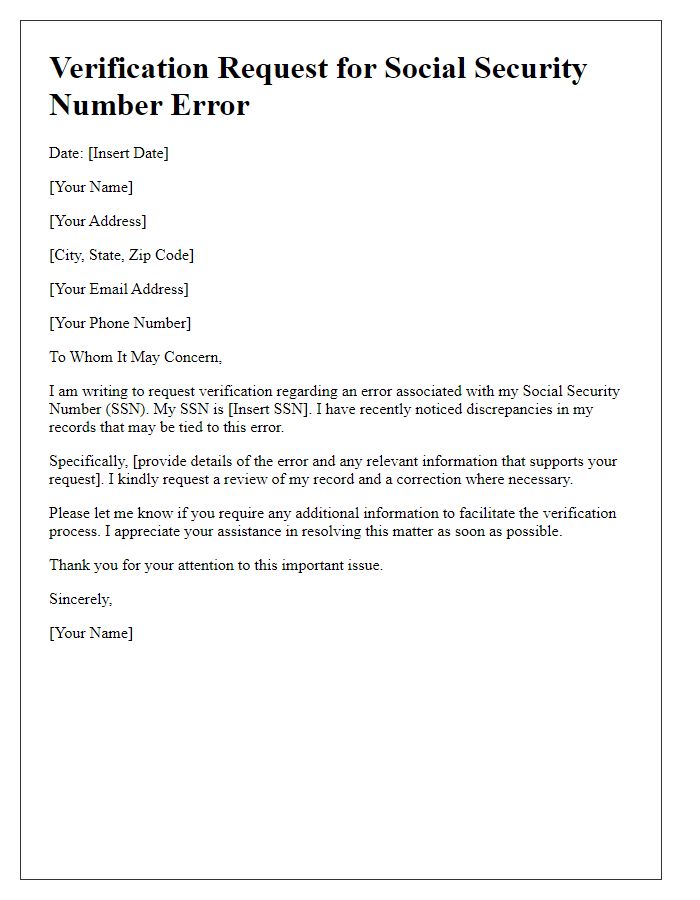

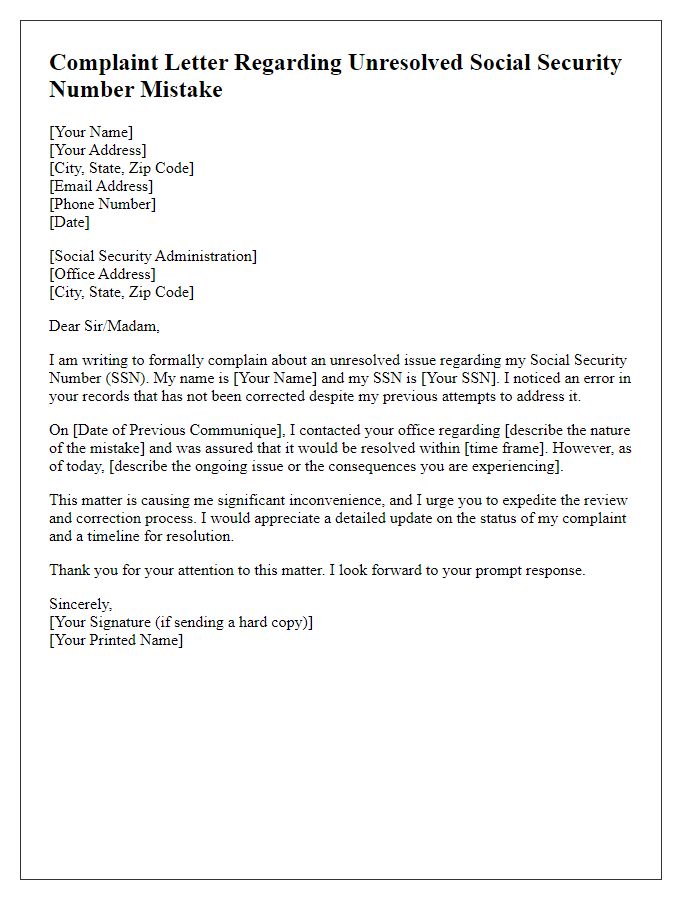

Letter template of verification request for social security number error.

Comments