Losing a loved one is never easy, and when it comes to managing their affairs, it can feel overwhelming. In situations where you need to report a deceased consumer, having a clear and compassionate letter template can be incredibly helpful. This guide will walk you through the necessary steps, ensuring your message is respectful and straightforward. Join us as we explore the best practices for writing this sensitive letter and how you can approach it with care.

Identification Details

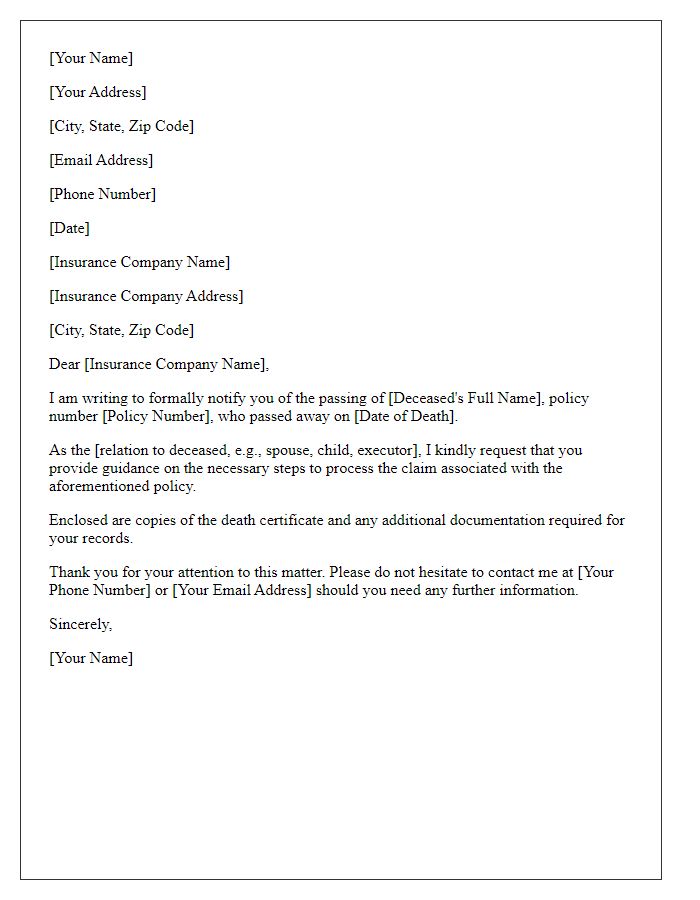

Reporting a deceased consumer involves providing specific identification details to ensure accurate records and sensitive handling of the situation. Important identifiers include the full name of the deceased individual, date of birth (for example, January 15, 1985), date of death (for instance, October 1, 2023), and social security number (often a nine-digit identifier) if applicable. The address of residence at the time of passing (such as 123 Main Street, Springfield, IL 62701) should also be documented. Additionally, contact information for the executor or next of kin (name, phone number, email) may be included to facilitate communication regarding any necessary actions or inquiries.

Contact Information

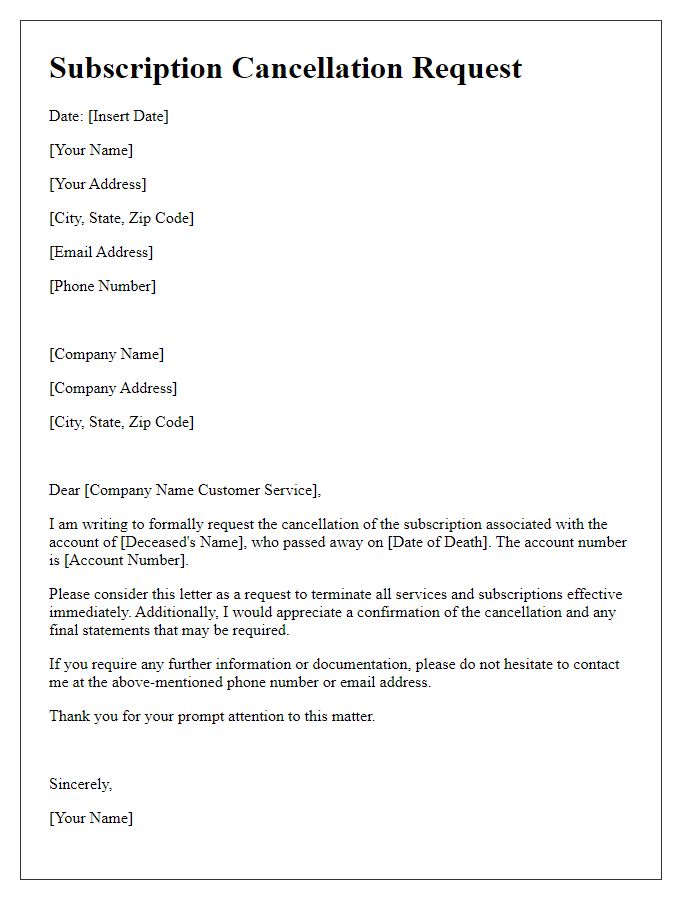

Reporting a deceased consumer requires careful attention to detail and sensitivity to personal circumstances. Accurate identification of the deceased individual, alongside their account number, is essential for processing. The contact information should include the deceased person's full name, date of birth, and last known address, ensuring the accurate matching of records. Furthermore, documentation such as a death certificate may be necessary to validate the report. If applicable, including the name and contact details of the reporting individual, such as their relationship to the deceased, provides clarity and facilitates communication with the concerned organizations. Maintaining confidentiality throughout this process is paramount, as it involves personal and sensitive information pertaining to the deceased.

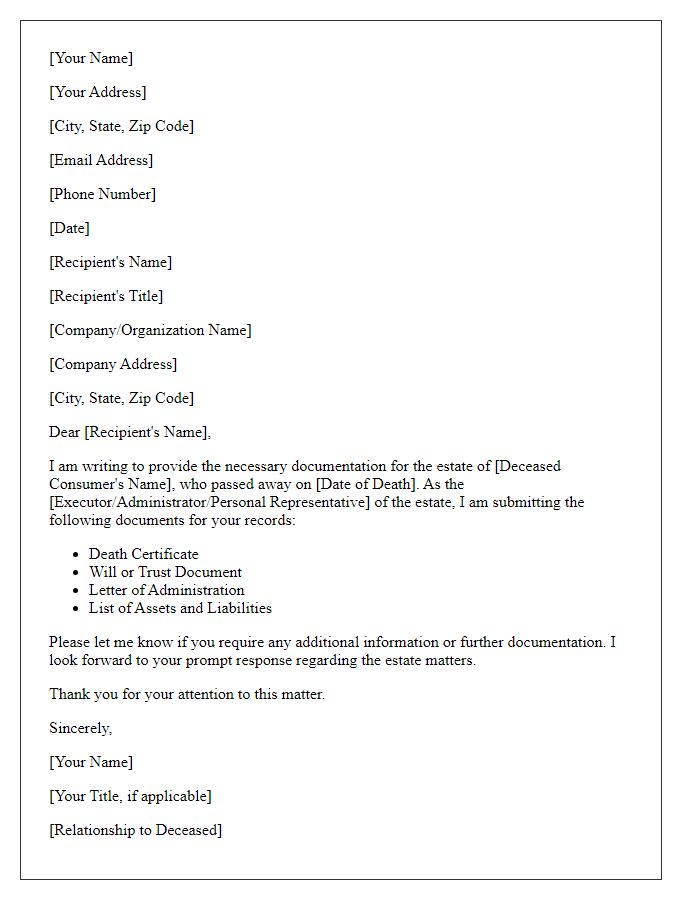

Authorized Representative

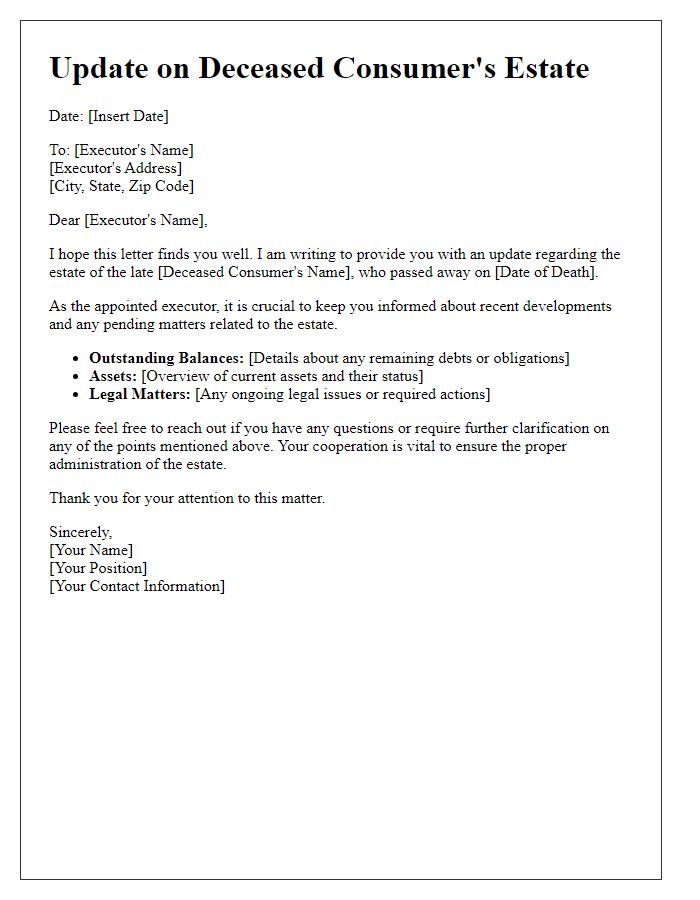

In cases of reporting a deceased consumer, authorized representatives must provide essential information to ensure a smooth process. Comprehensive details regarding the deceased individual's identity, including full name, date of birth, and social security number, should be collected. Additionally, documentation such as a death certificate or obituary notice from a recognized publication is crucial for verification. The representative's identity, along with proof of authorization--like a power of attorney or court document--is vital to establish legitimacy. Providing accurate information about outstanding accounts, including account numbers and service providers, aids in the closure process. Clear communication is key, as financial institutions or service providers may require specific procedures to handle the deceased's financial matters appropriately.

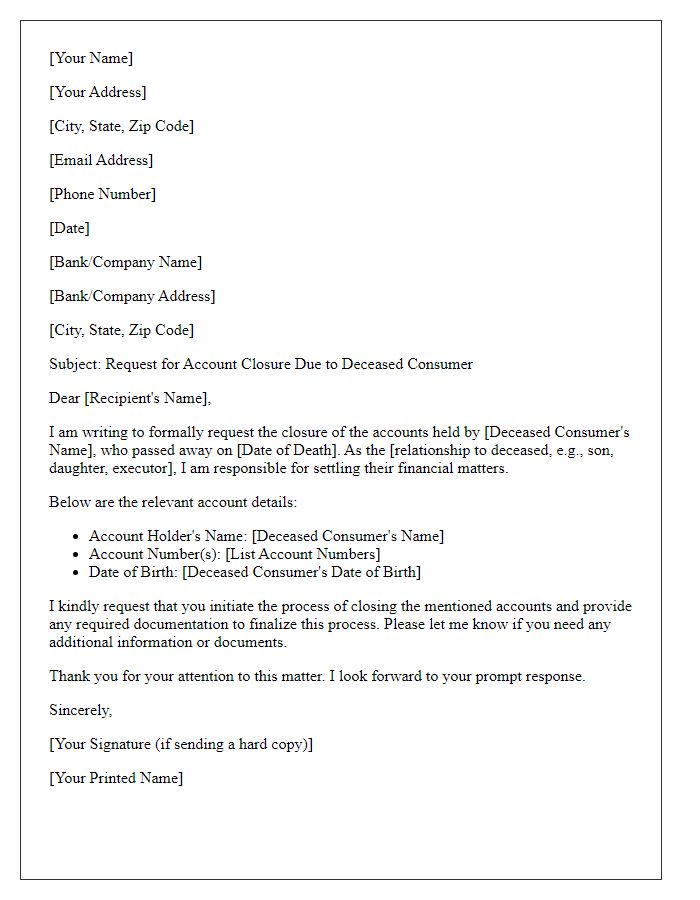

Relevant Account Information

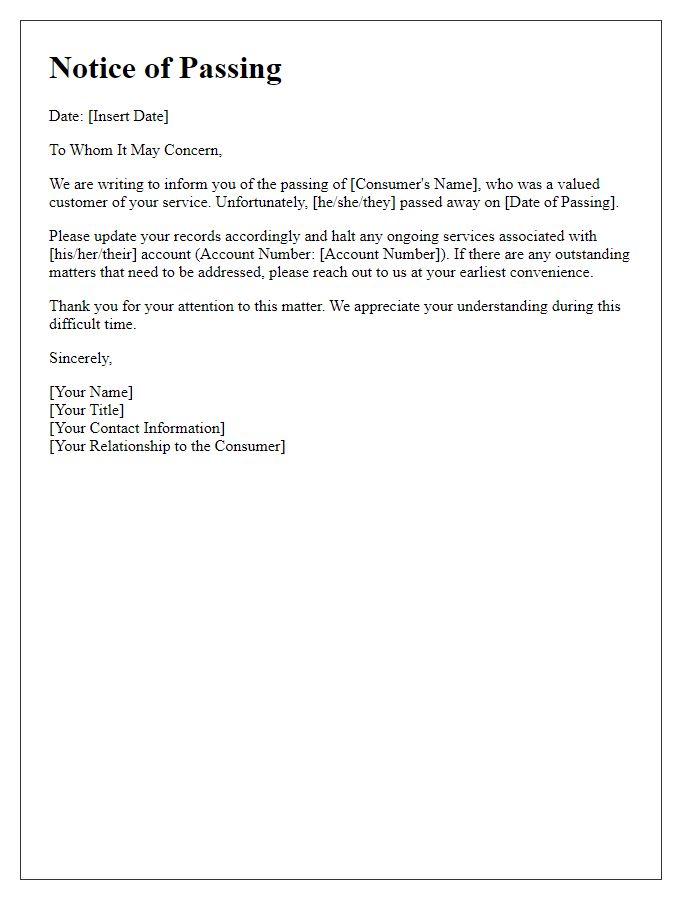

Reporting the passing of a consumer requires detailed and sensitive information to ensure proper handling. Account information must include the relevant account number, which uniquely identifies the consumer's connection with the service provider, alongside the full name of the deceased individual. Additionally, the date of birth (to confirm identity) is crucial, enabling clearer identification in records. The date of passing is essential for accurate processing and closure of the account. Documentation such as a death certificate may be required to substantiate the notice. Including contact information for the next of kin (if applicable) allows for smoother communication regarding any necessary follow-ups or obligations.

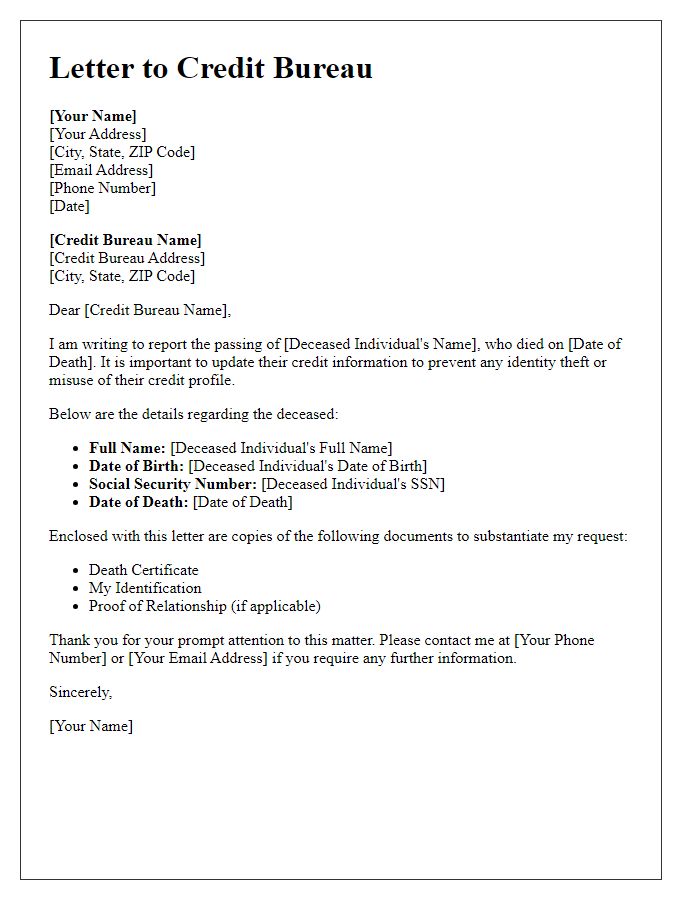

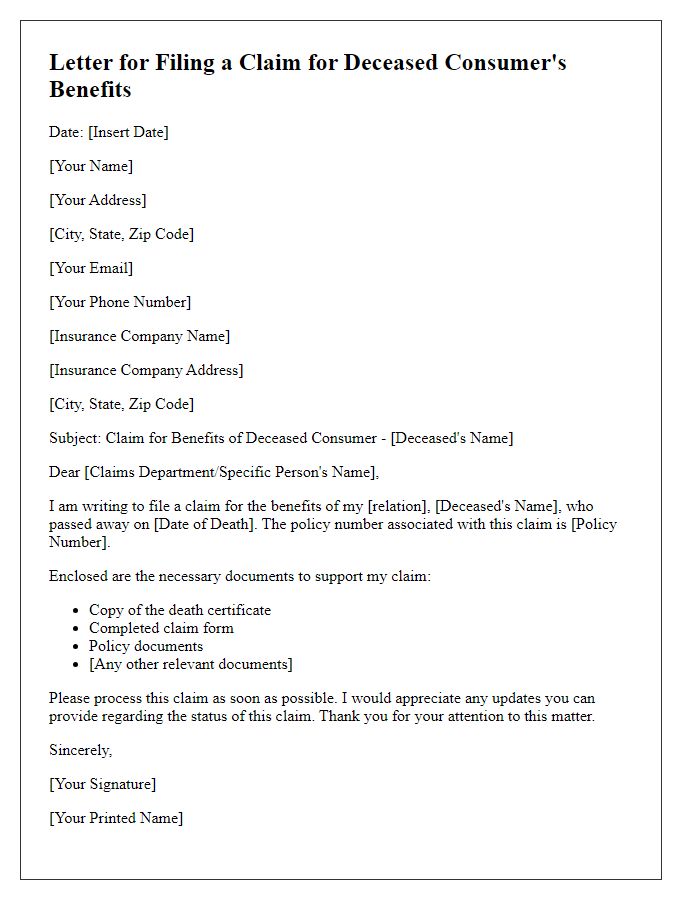

Documentation of Death

Reporting the death of a consumer requires precise documentation to ensure accuracy and compliance with regulations. The notice must include essential details such as the full name of the deceased individual, identification numbers (e.g., Social Security Number or account number), date of death (including the official declaration from a medical authority), and, if applicable, the documentation supporting the death, such as a death certificate or obituary. It is crucial to provide the contact information for the reporting individual, such as a family member or executor, as well as their relationship to the deceased. Documentation must also state any ongoing obligations or accounts connected to the deceased, such as credit accounts or subscriptions, to facilitate smooth processing of the report and address potential liabilities effectively.

Letter Template For Reporting Deceased Consumer Samples

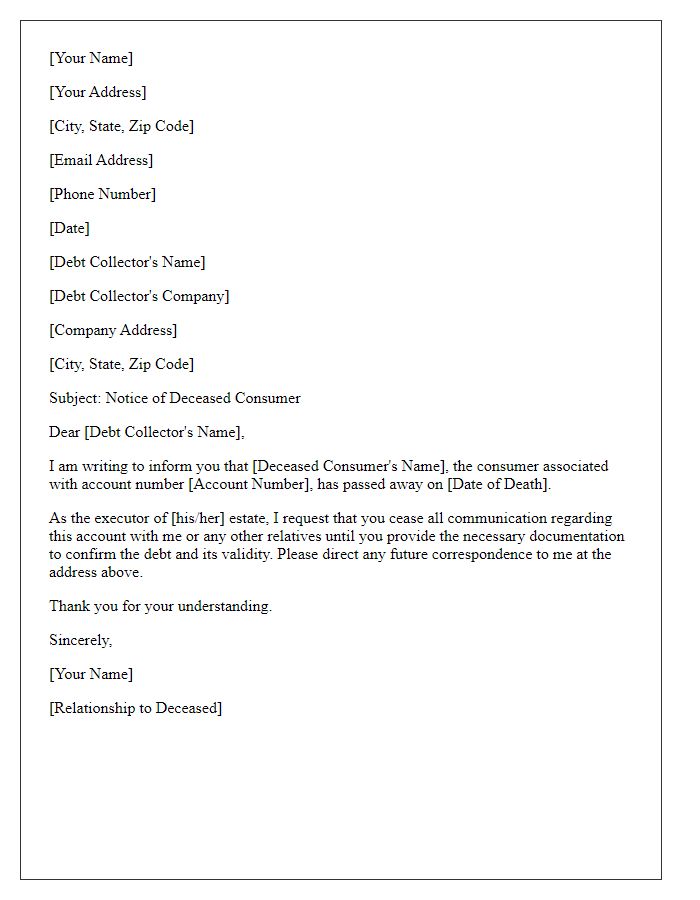

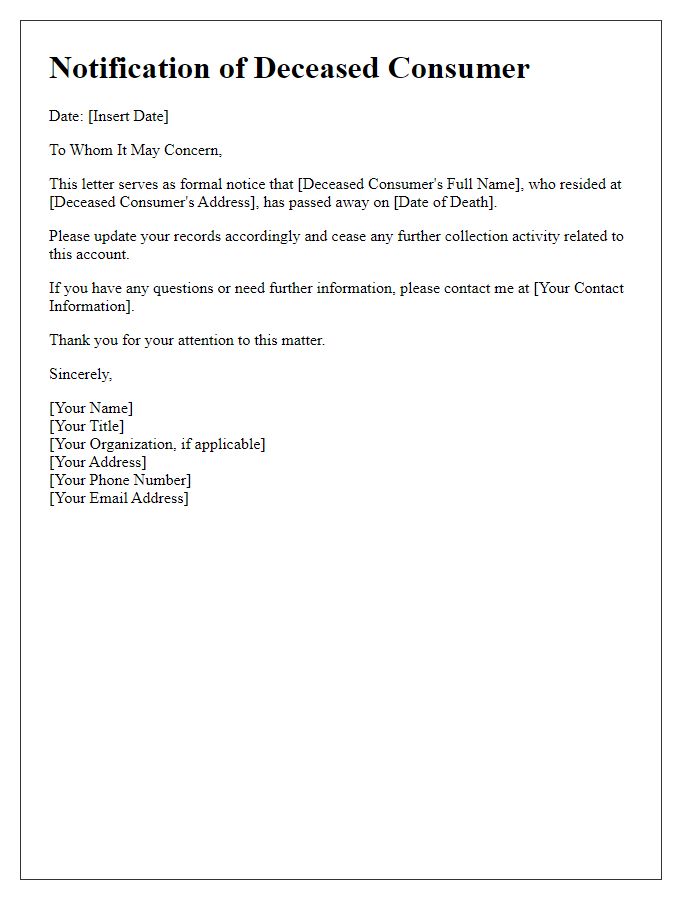

Letter template of communicating with debt collectors about deceased consumer

Comments