Hello there! Are you looking to streamline your insurance payment process and ensure everything is well documented? Adding a record of your insurance payments is crucial for maintaining clarity and avoiding future misunderstandings. In this article, we'll walk you through a simple letter template that you can use to request the addition of your payment records. So, let's dive in and simplify your insurance management journey!

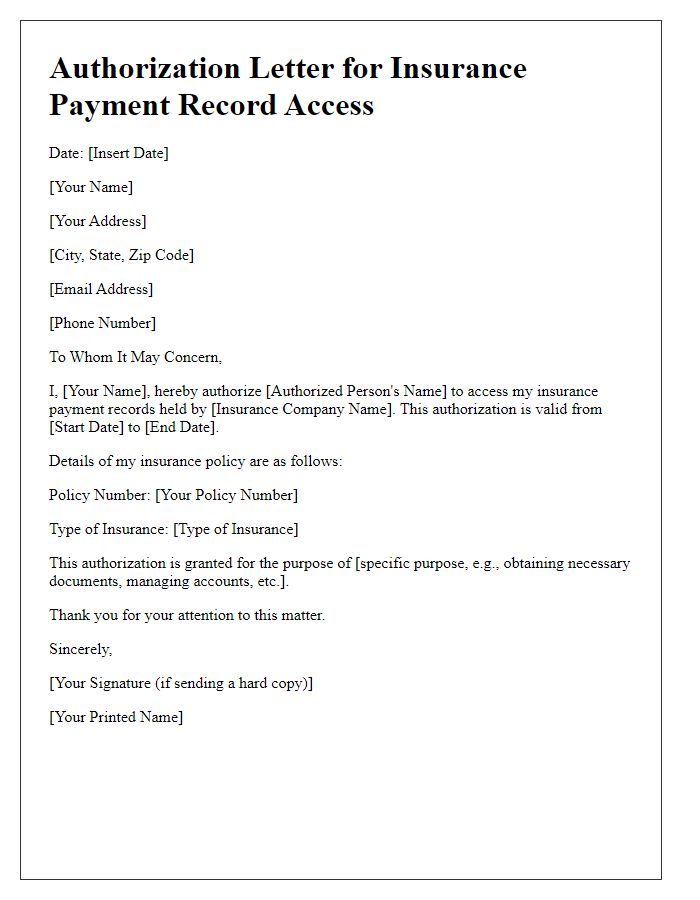

Policyholder Information

Policyholder information includes crucial details for managing insurance contracts effectively. Essential components encompass the full name, policy number (e.g., 123456789), date of birth (e.g., January 1, 1980), contact phone number (e.g., +1-800-555-0199), email address (e.g., policyholder@example.com), and mailing address (e.g., 123 Main Street, Springfield, IL, 62701). Furthermore, additional identifiers such as social security number (e.g., 123-45-6789) may be required for verification purposes. Accurately documenting these elements ensures seamless processing and communication regarding inquiries, claims, and payment records within the insurance database. This comprehensive record helps maintain transparency and efficiency in client relations.

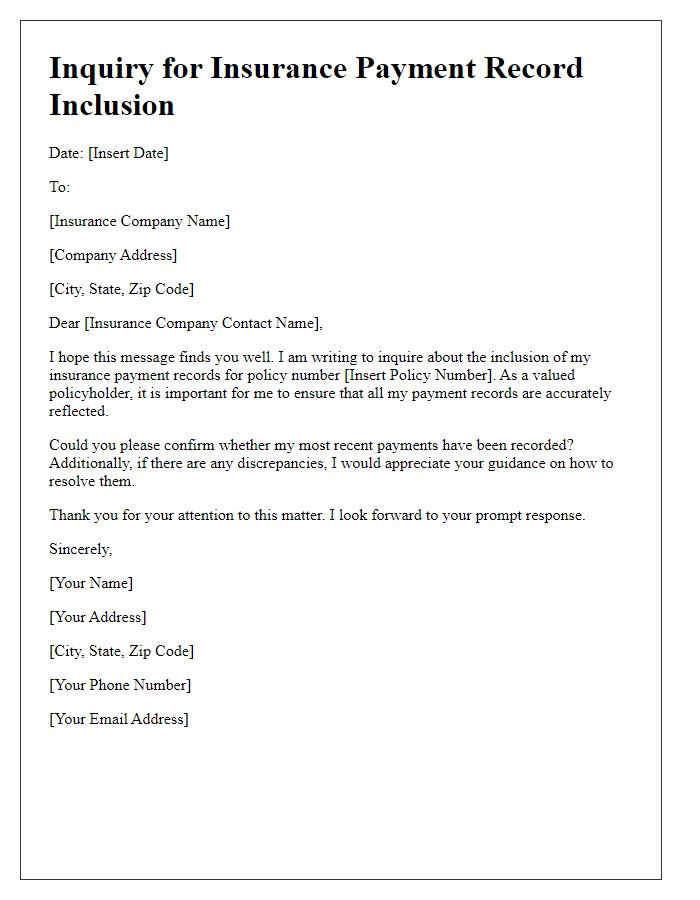

Policy Number

The insurance payment record addition process involves critical details such as policy number (often a unique alphanumeric identifier assigned to an insurance policy), payment date (exact date when the payment was made), paid amount (specific monetary value for the premium payment), and service provider name (insurance company responsible for the coverage). Accurate documentation of these elements is essential for ensuring seamless record-keeping and maintaining the validity of the insurance policy. This information must be submitted to the appropriate department within the insurance company, often the billing or claims department, to ensure timely updates. Regular updates to payment records can prevent lapses in coverage and facilitate easier claims processing.

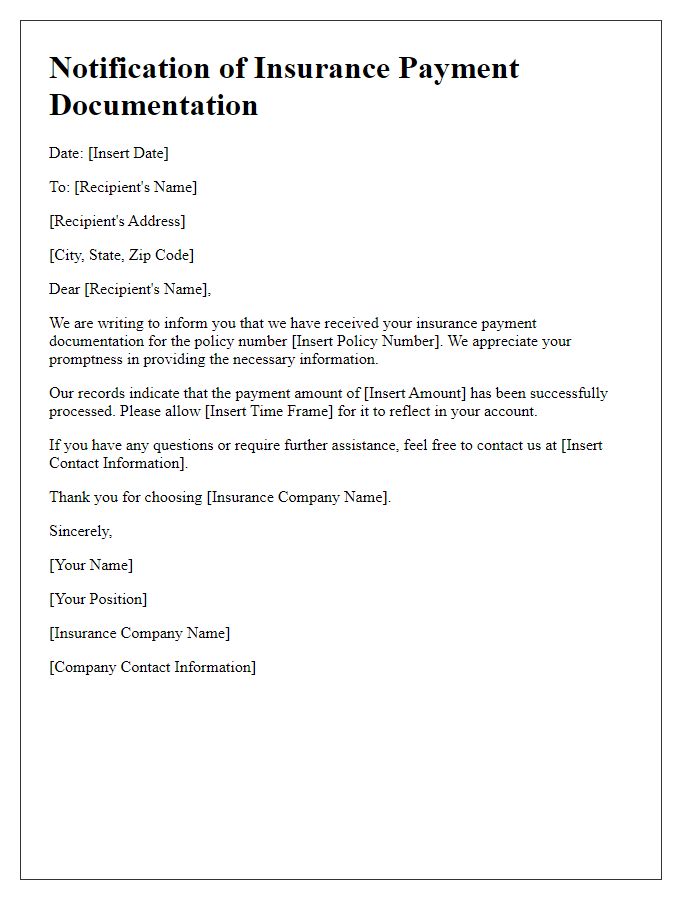

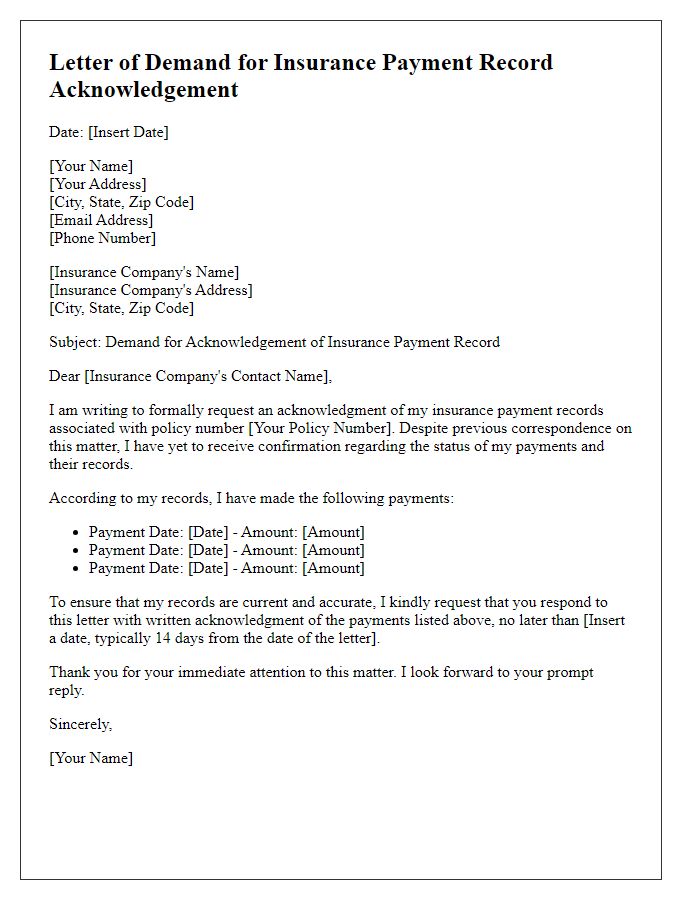

Payment Details

Maintaining accurate insurance payment records is crucial for policyholders and insurers alike. Documenting payment details, such as transaction dates, amounts, and reference numbers, provides transparency and aids in future claims processing. For instance, a policyholder might document a premium payment of $1,200 made on March 15, 2023, using reference number 123456789 for their auto insurance with XYZ Insurance Company, based in New York. Furthermore, ensuring these records are stored securely enhances accountability and simplifies audits, should they arise. Regularly updating these payment records also helps track any discrepancies, allowing for timely resolution and maintaining good standing with the insurer.

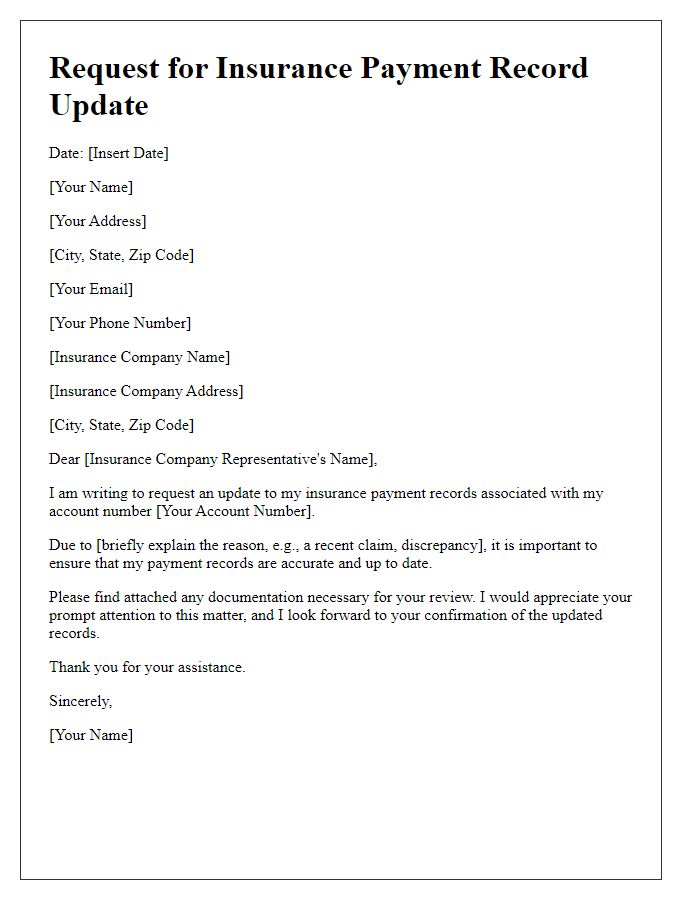

Request for Record Update

An insurance payment record update request serves to ensure accurate financial information in policyholder accounts. Such requests can include important details like policy numbers, payment amounts, and transaction dates. Standard procedures typically require submission to the insurance company's billing department, where records encompass monthly premium payments, claims reimbursements, and any adjustments or penalties. Keeping these records accurate helps avoid complications during future claims processing and ensures compliance with company policies. Prompt attention to these updates contributes to maintaining a positive relationship between the policyholder and the insurance provider.

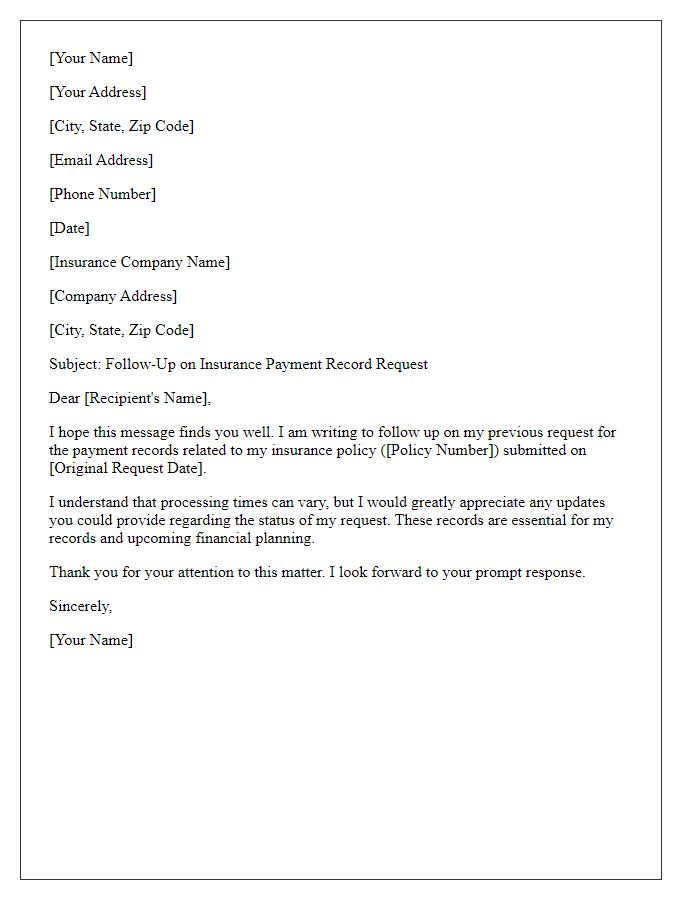

Contact Information for Follow-up

Maintaining accurate insurance payment records is crucial for both policyholders and insurance providers. Having comprehensive contact information ensures seamless follow-ups during inquiries. Essential details include the policyholder's full name, policy number, and date of payment. Additionally, the provider's contact number (often a toll-free line) and email address should be clearly documented. For timely responses, documenting the date of communication is vital. This information aids in tracking payment status and resolving any discrepancies efficiently. Proper organization and easy access to this data enhance communication flow and customer satisfaction within the insurance process.

Comments