Are you considering buying your dream home? Securing a mortgage pre-approval can streamline the process and give you a competitive edge in the housing market. In this article, we'll walk you through a simple letter template that you can use to request your mortgage pre-approval, ensuring you communicate clearly with lenders. Dive in to discover the essential details that will set you on the path to homeownership!

Personal and Financial Information

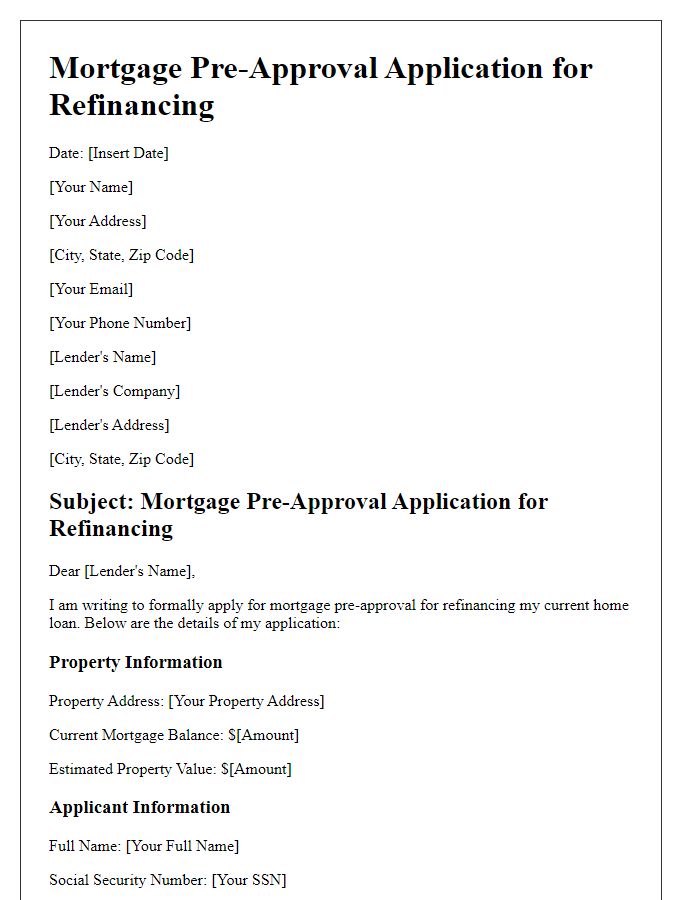

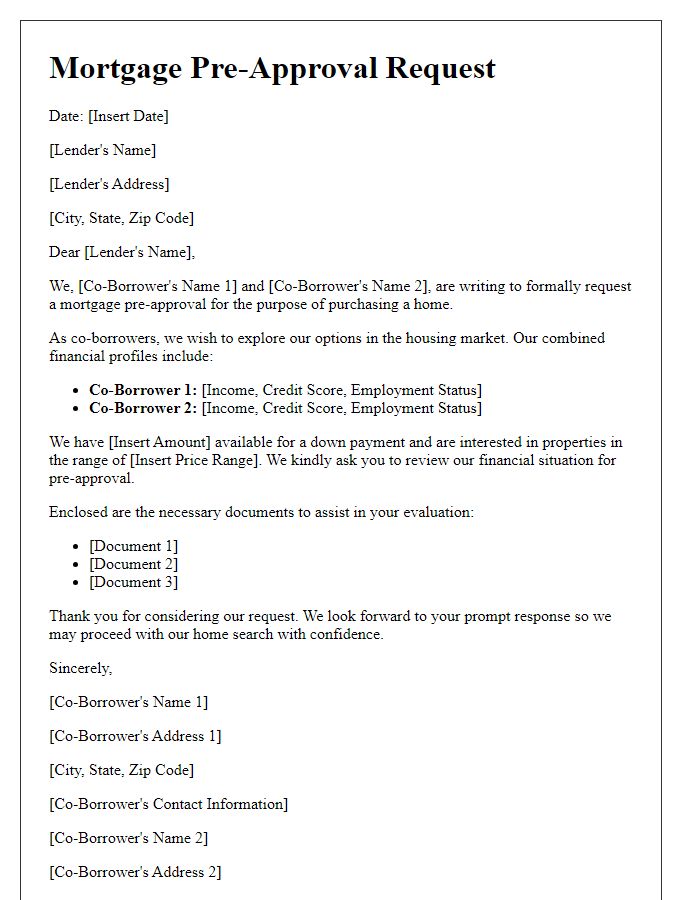

Mortgage pre-approval is a crucial step for potential homebuyers in their journey to owning property. Providing accurate personal details, such as full name, social security number, and current address, is essential for lenders to assess creditworthiness. Financial information includes income sources (wages, bonuses, rentals), monthly debts (credit cards, student loans, car payments), and liquid assets (savings accounts, retirement funds), which help determine your debt-to-income ratio, an important factor in loan assessment. Documenting employment history, including positions held and length of employment (often two years), can strengthen the application. Additionally, disclosing any additional financial obligations, such as alimony or child support, can influence mortgage terms, ensuring that lenders can make informed decisions regarding loan approval amounts.

Employment and Income Verification

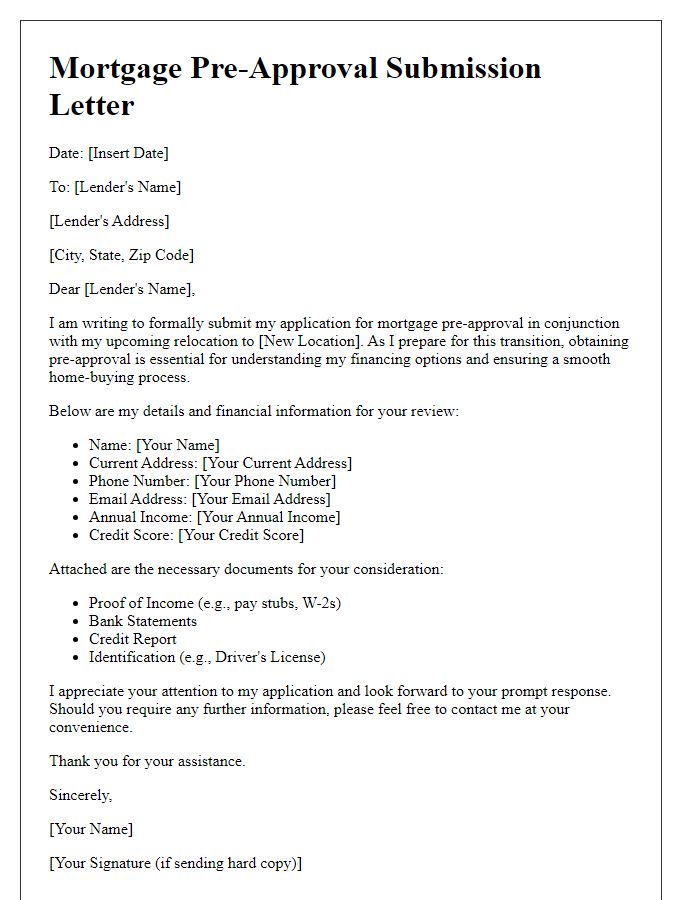

A mortgage pre-approval request emphasizes the importance of employment and income verification in securing financing for a home purchase. Lenders typically require documentation such as recent pay stubs, W-2 forms, and tax returns to assess an applicant's financial stability. Employment verification often involves contacting the human resources department or direct supervisors to confirm job titles, length of employment, and salary. Accurate income declaration, including bonuses and overtime, plays a critical role in determining the eligibility for loan amounts. Submitting these documents promptly can expedite the pre-approval process, helping potential homeowners navigate the competitive real estate market efficiently.

Loan Amount and Purpose

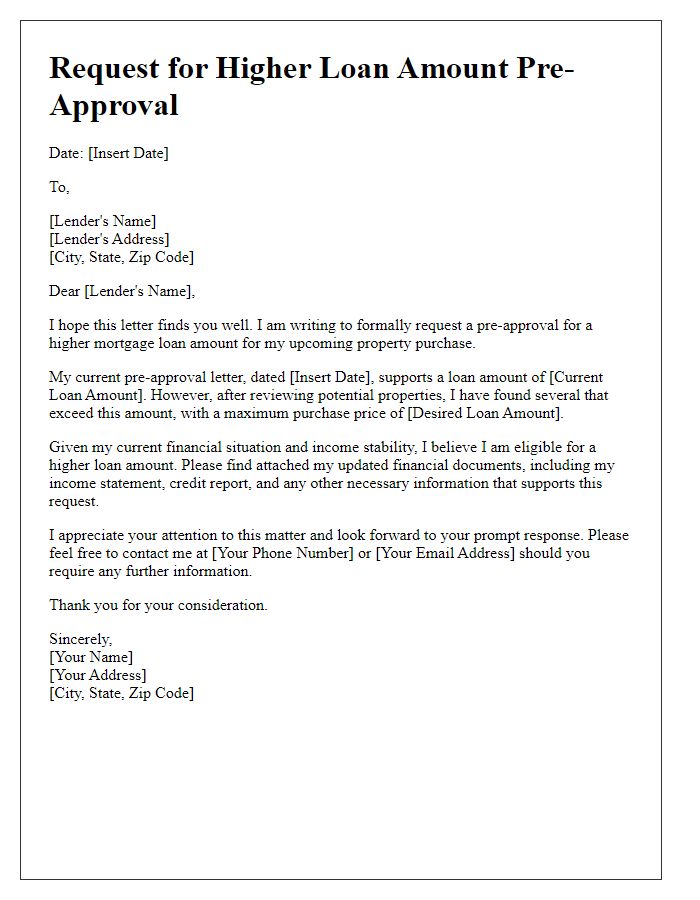

Homebuyers seeking mortgage pre-approval often need to specify the loan amount and purpose clearly. For instance, a loan amount of $250,000 may be requested for purchasing a primary residence located in suburban Chicago, Illinois. This property, a four-bedroom single-family house built in 2015, offers a spacious layout suitable for families. The buyer aims to secure financing to take advantage of current interest rates, which are around 3.5% as of October 2023, making homeownership more attainable. Proper documentation, including income verification and credit history, is essential to streamline the pre-approval process and ensure a smooth transaction when competing in a competitive housing market.

Property Details and Description

The mortgage pre-approval request outlines essential property details and a comprehensive description to ensure clarity and facilitate the approval process. Located in the picturesque neighborhood of Maplewood, this charming three-bedroom single-family home, built in 2015, boasts 2,200 square feet of living space. The property features a spacious open-concept kitchen equipped with stainless steel appliances and granite countertops, perfect for family gatherings. The backyard, approximately 0.25 acres, includes a landscaped garden and patio area, ideal for outdoor entertainment. Additionally, the home's proximity to local schools such as Maplewood High (ranked among the top 10% in state) and community amenities like the Maplewood Community Center enhances its appeal. Recent comparable sales in the area indicate strong market activity, with similar properties selling for an average of $450,000, positioning this home at a competitive price of $475,000.

Contact and Reference Information

When seeking mortgage pre-approval, it is essential to provide comprehensive contact and reference information to facilitate the process. Include full name, current mailing address, and phone number for primary communication. Additionally, specify an email address for prompt correspondence. References should consist of at least two professional contacts, such as a real estate agent with a proven track record in your area, or a financial advisor familiar with your financial history. Include the reference's full name, title, contact number, and email address, highlighting their relevance to your mortgage application. This organized approach aids lenders in assessing creditworthiness efficiently and may expedite approval timelines.

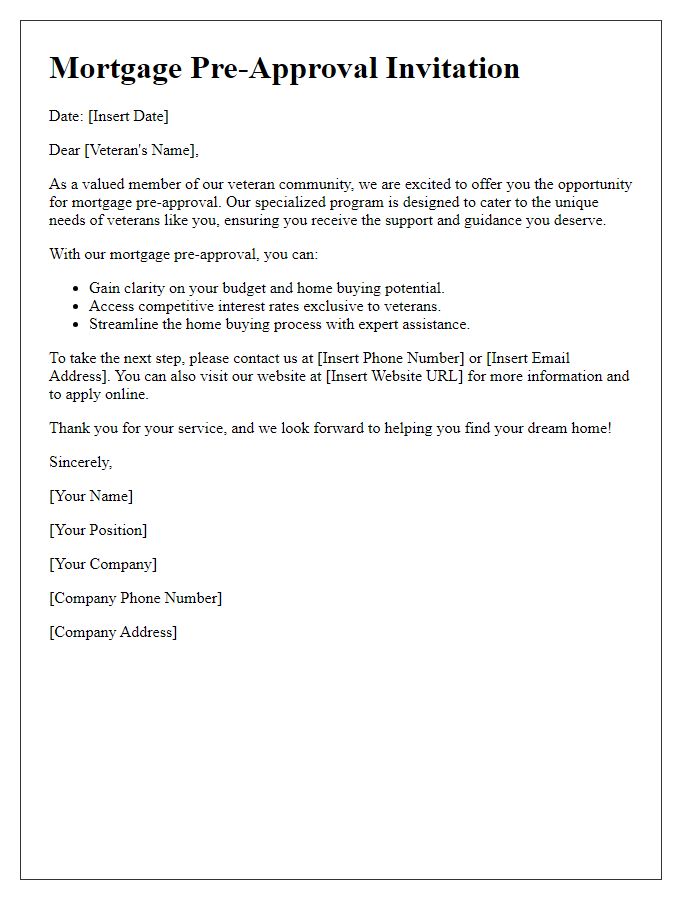

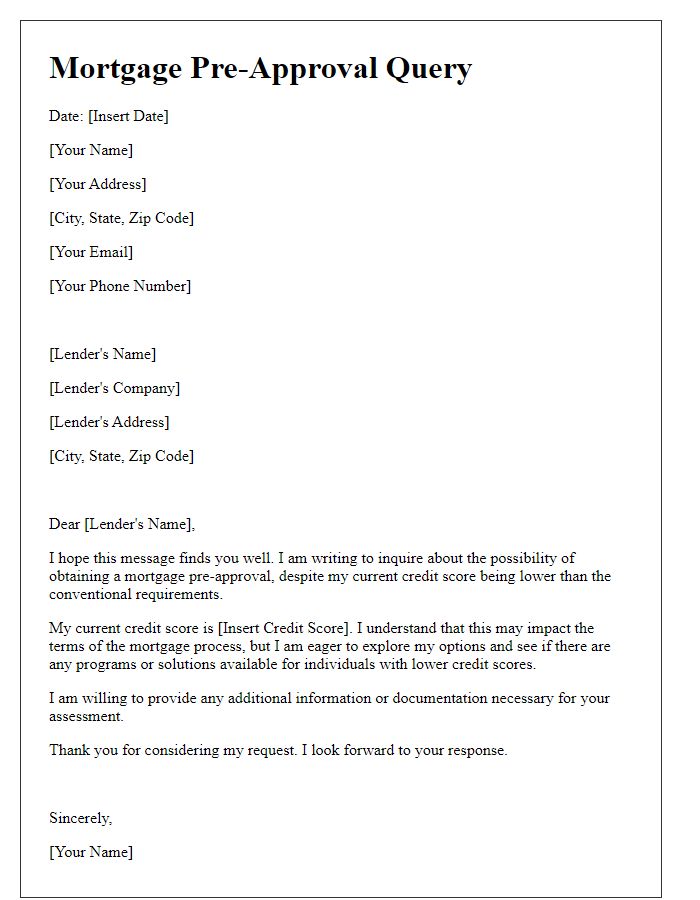

Letter Template For Mortgage Pre-Approval Request Samples

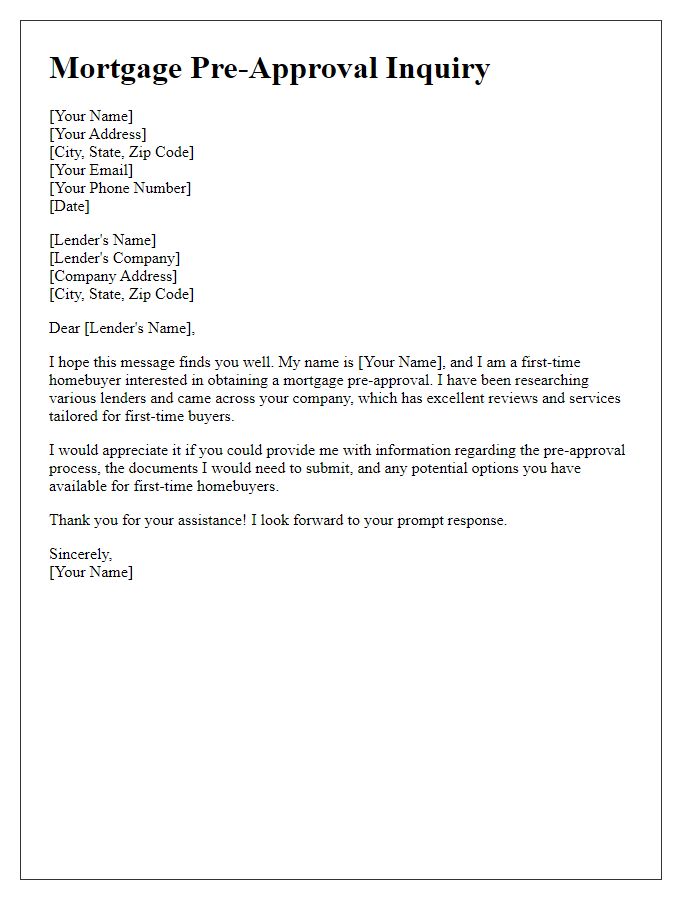

Letter template of mortgage pre-approval inquiry for first-time homebuyers

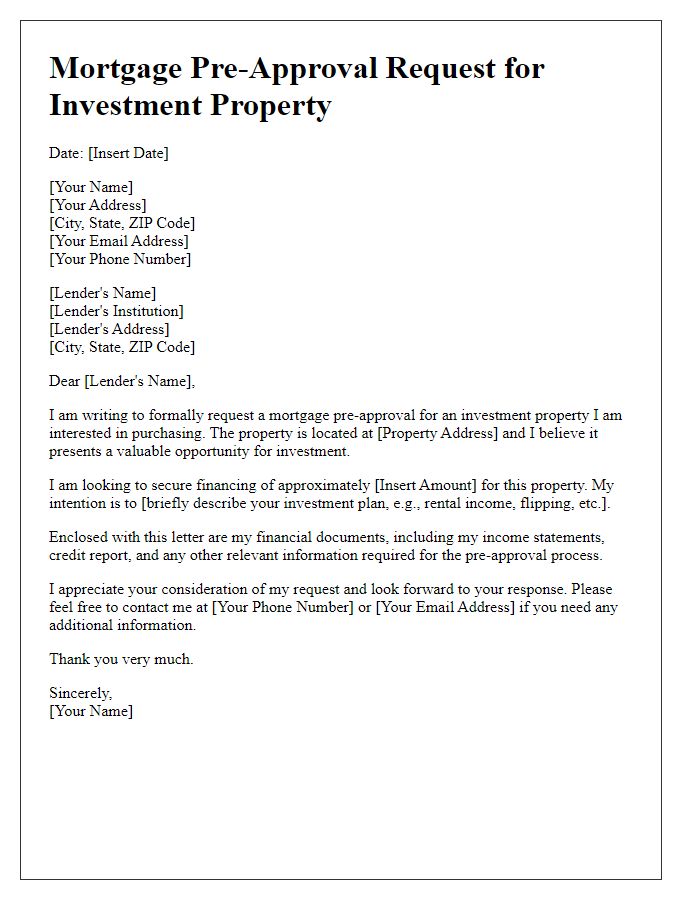

Letter template of mortgage pre-approval request for investment property

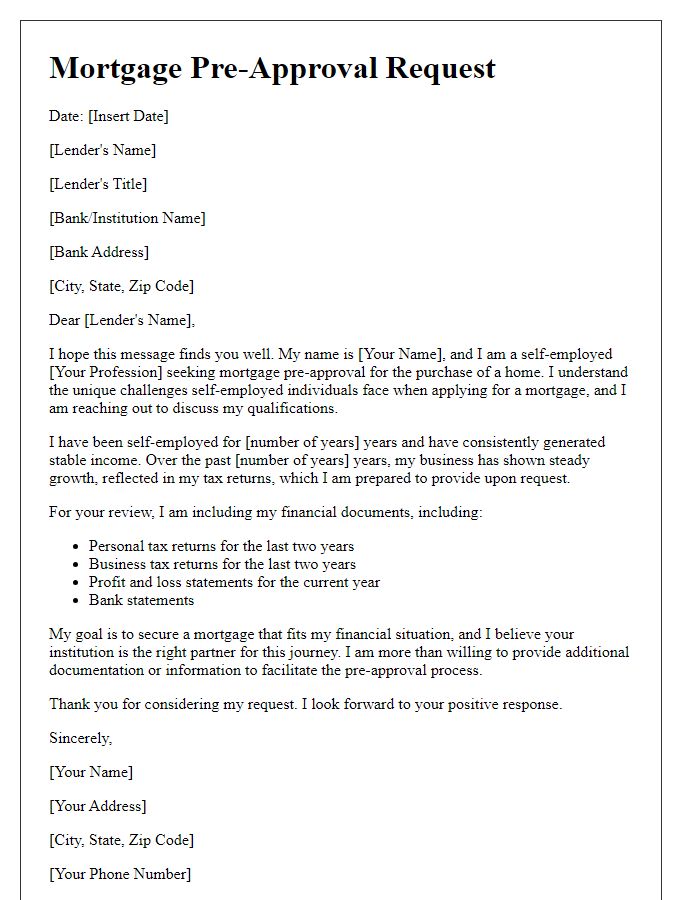

Letter template of mortgage pre-approval plea for self-employed individuals

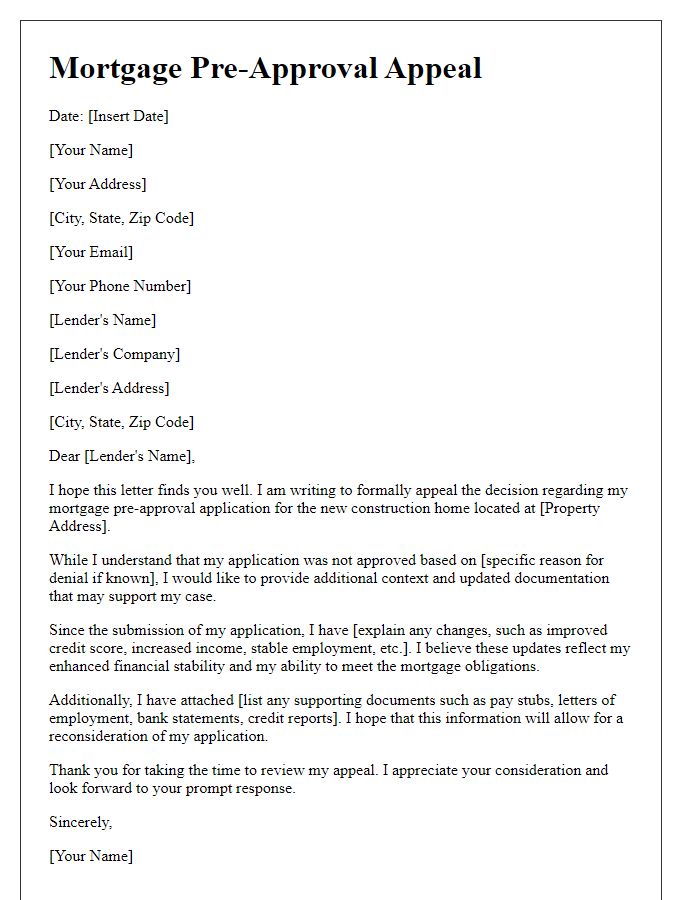

Letter template of mortgage pre-approval appeal for a new construction home

Comments