Are you feeling overwhelmed by a balance that seems impossible to tackle? You're not aloneâmany people find themselves in similar situations, and that's where partial account payment offers come into play. This flexible option allows you to settle your debt bit by bit, making it more manageable while helping you regain control of your finances. Curious to learn more about how to craft an effective letter for this kind of proposal?

Professional Greeting

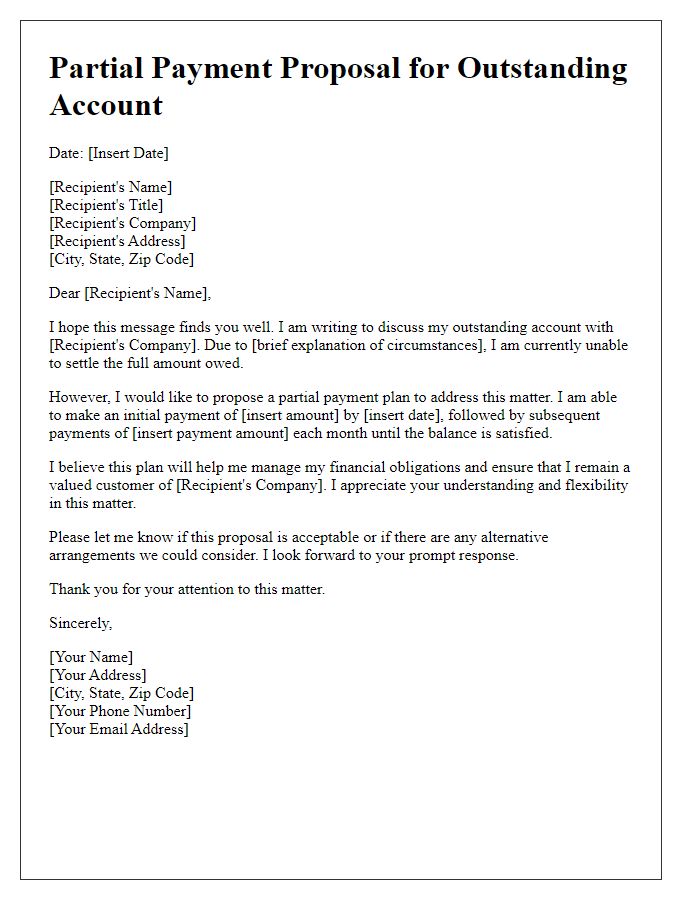

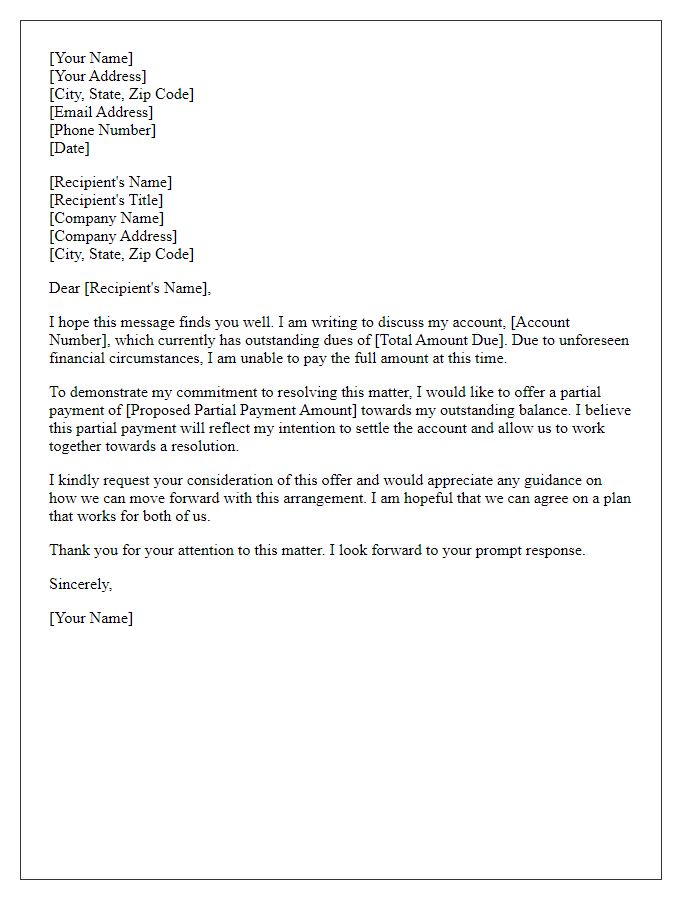

An offer for partial account payment can be an effective strategy to settle outstanding debts while maintaining a professional relationship with the creditor. In such correspondence, it's crucial to highlight the amount of debt, the proposed payment, and the reasons for offering a partial payment, such as financial hardship or unforeseen circumstances. The letter should begin with a formal greeting, addressing the creditor by name or title, followed by a clear statement outlining the current situation regarding the account balance. Ensure to provide specific details regarding the payment proposed, including the amount and payment timeline, emphasizing a sincere willingness to resolve the debt amicably.

Clear Account Reference

In a financial context, a partial account payment offer can significantly influence the resolution of outstanding balances. A clear account reference is essential for ensuring accurate identification of the client's account within financial systems, such as Enterprise Resource Planning (ERP) systems or customer relationship management software. For instance, an account reference number might include a combination of letters and numbers that correlate to an individual's unpaid bills or debt obligations. Providing a clear account reference facilitates streamlined communication between the client and the financial institution, such as Credit Unions or Banks, reducing the potential for miscommunication. It also allows for efficient record-keeping during payment processing, ensuring that the received payments are applied correctly, therefore, helping to mitigate further interest charges or late fees associated with the account.

Explanation of Financial Situation

Due to unforeseen circumstances, my financial situation has significantly changed, leading to difficulties in meeting my full financial obligations. Recent events, such as loss of employment in a tech company and unexpected medical expenses exceeding $5,000, have resulted in a temporary cash flow problem. Currently, I am receiving unemployment benefits, amounting to $300 weekly, which is insufficient to cover my monthly budget of $2,000. Despite my efforts to find new employment opportunities in the competitive job market, I have faced numerous rejections. As a result, I am seeking to negotiate a partial payment arrangement for my outstanding account balance of $4,000, which would provide some financial relief during this challenging time. Addressing this matter promptly will help avoid further complications and allow me to work towards a viable solution for settling my obligations.

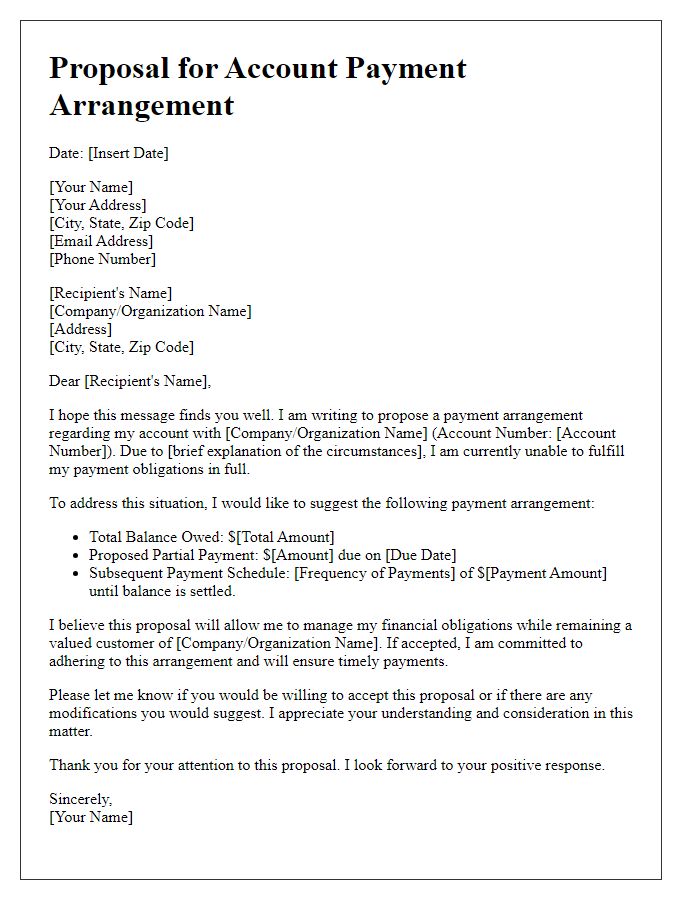

Proposed Payment Terms

Partial account payments can help maintain a positive relationship between creditors and debtors while managing financial obligations. A structured proposal includes specific details such as the total outstanding balance, the amount proposed for each installment, and the timeline for payments. For instance, a debtor may offer to pay $500 monthly against a $5,000 balance over ten months. Including the reasoning behind the financial struggle enhances transparency. Setting up a clear communication channel for updates also assists in maintaining trust. This structured approach ensures both parties have a mutual understanding of expectations and obligations.

Contact Information for Follow-up

To facilitate effective follow-up regarding the partial account payment offer, please include key information such as the customer's account number (e.g., 12345-X), the date of communication (e.g., October 10, 2023), and the specific payment terms (e.g., 50% of the total balance). Essential contact details should consist of the customer's primary email address (e.g., customer@example.com) and a dedicated phone number (e.g., (555) 123-4567) for direct inquiries. Additionally, the representative's name and title (e.g., John Smith, Customer Relations Manager) should be provided for clear communication channels.

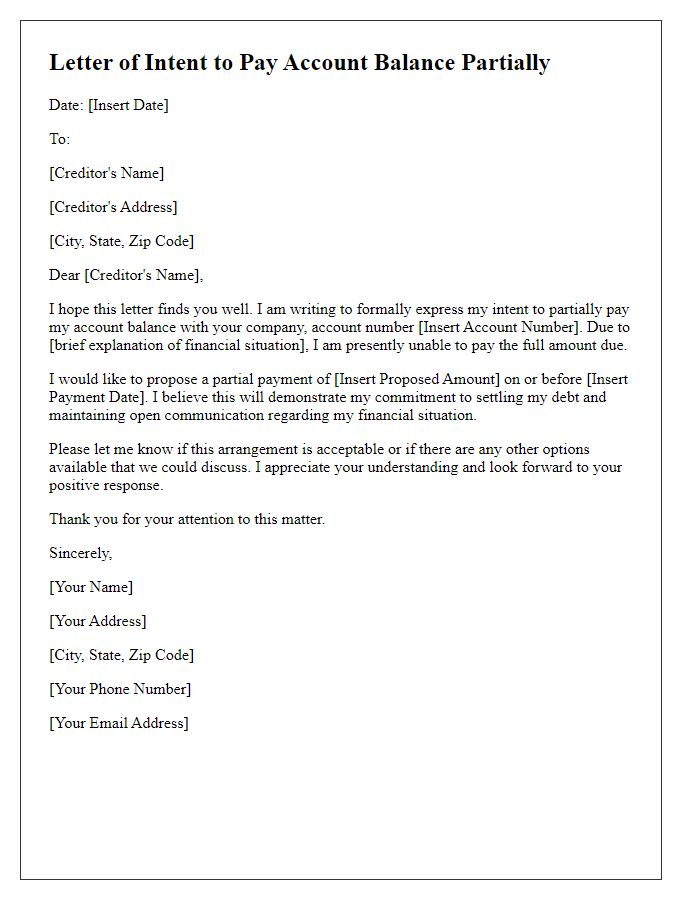

Letter Template For Partial Account Payment Offer Samples

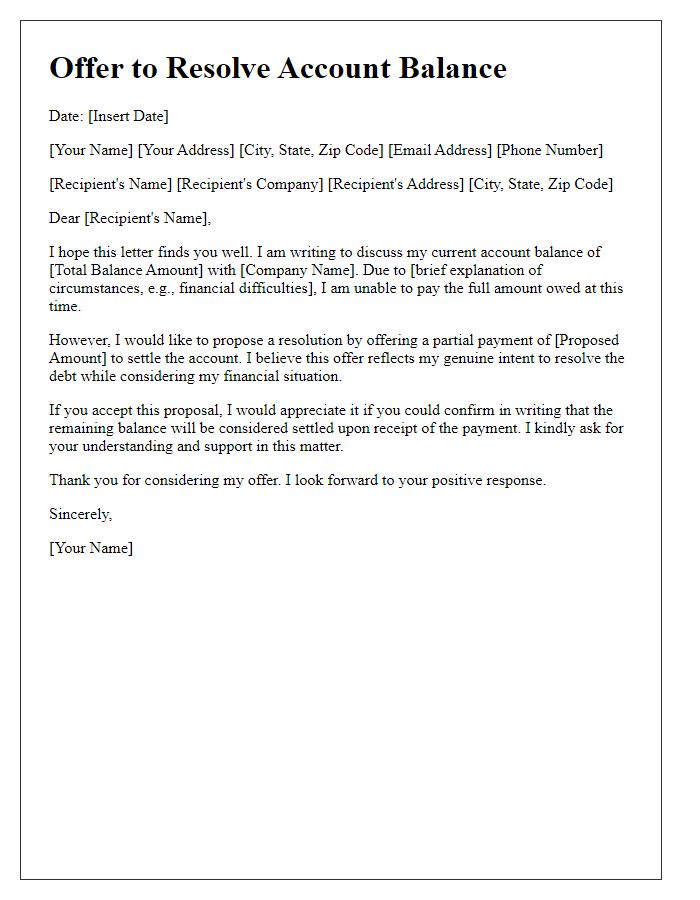

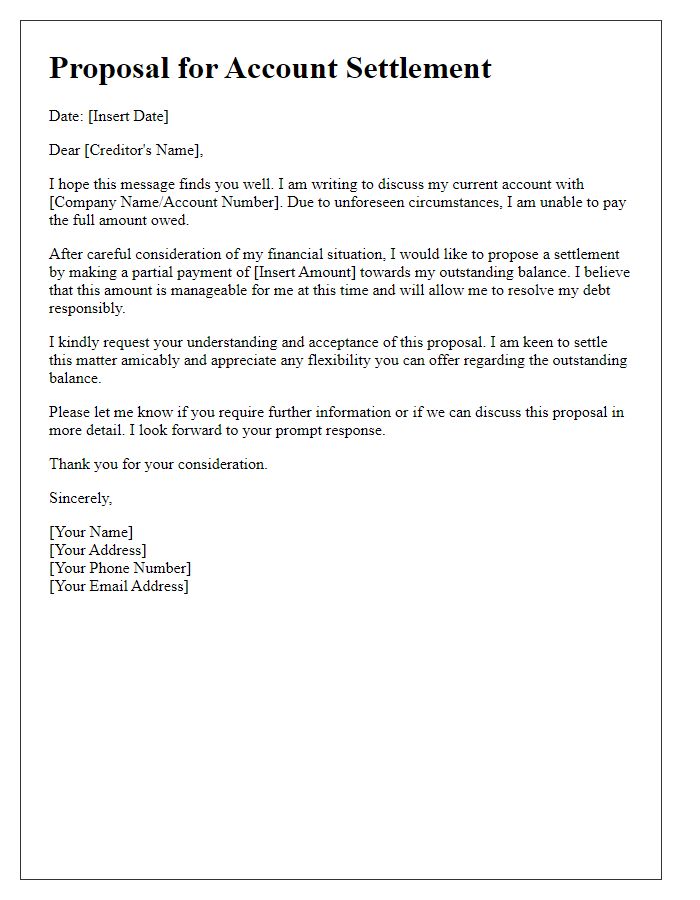

Letter template of Offer to Resolve Account Balance with Partial Payment

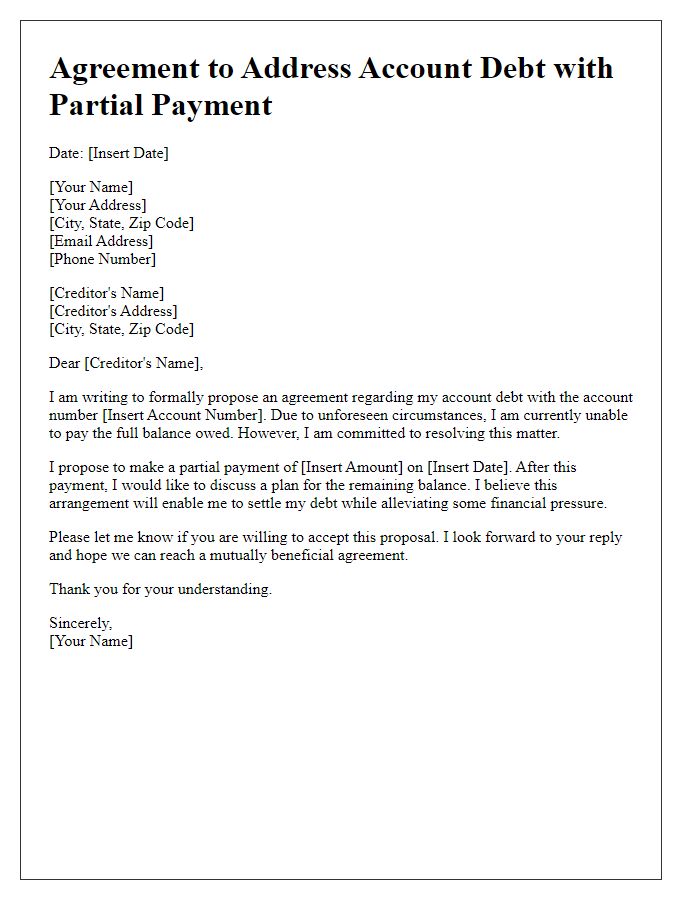

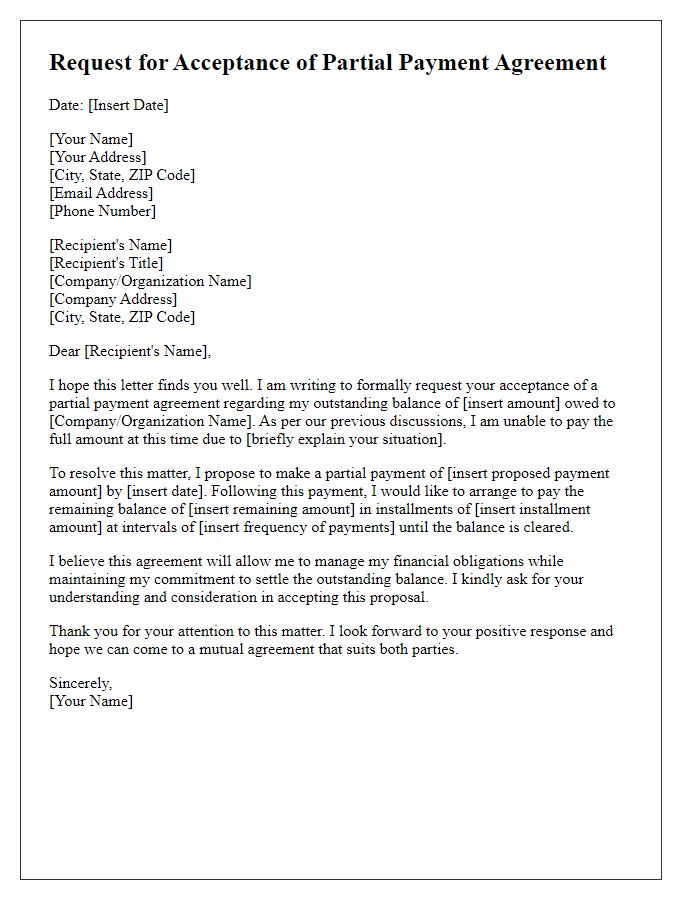

Letter template of Agreement to Address Account Debt with Partial Payment

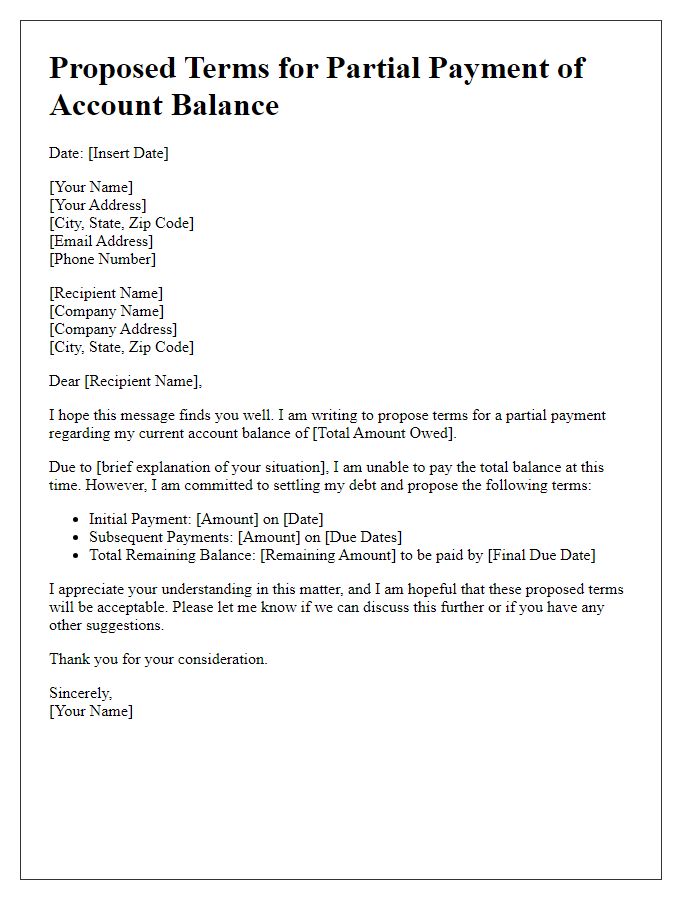

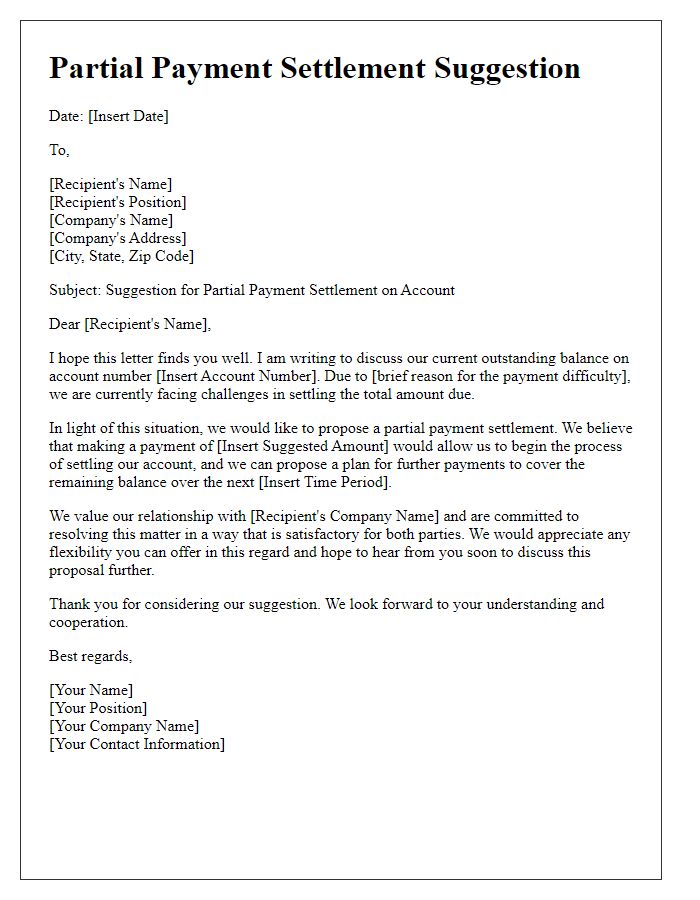

Letter template of Proposed Terms for Partial Payment of Account Balance

Comments