Are you feeling overwhelmed by unexpected financial challenges? If so, you're not alone, and there's a potential solution waiting for you. Many credit card companies understand that life can throw curveballs, which is why they offer hardship-based terms changes to help ease your burden. Curious about how to initiate this process and what options are available? Read on to discover the steps you can take to regain control of your financial situation!

Personal Identification and Account Details

Personal identification plays a crucial role in establishing credit card account integrity. For individuals facing financial difficulties, providing accurate details is essential for hardship-based credit card terms change requests. These details typically include the full name, account number, and contact information, ensuring the credit card issuer can easily verify the account. Alongside personal data, outlining circumstances such as job loss, medical expenses, or unexpected expenses due to natural disasters strengthens the case for modifying existing terms. Clear communication and documentation of the financial situation can significantly impact the outcome of the request for more manageable payment options or interest rate adjustments.

Explanation of Financial Hardship

Financial hardship often stems from unexpected events such as job loss or substantial medical expenses, significantly impacting an individual's ability to meet monthly credit card payments. Many consumers face a dramatic decline in income; for instance, a sudden layoff can lead to a 100% income reduction, making previous payment plans unfeasible. Moreover, rising costs of living in major urban areas such as New York City or San Francisco can exacerbate financial strain, making basic necessities increasingly unaffordable. Medical emergencies can also lead to thousands of dollars in unplanned expenditures, creating additional financial burdens. Consequently, obtaining relief through adjusted credit card terms--such as reduced interest rates or lower minimum payments--can be pivotal for individuals navigating these challenging circumstances. By applying for changes in terms, they can work towards regaining financial stability while managing essential expenses.

Request for Specific Changes in Terms

Financial hardships often lead consumers, like individuals facing job loss or medical emergencies, to seek adjustments in credit card terms. For instance, significant events such as the COVID-19 pandemic have left many Americans struggling to meet their financial obligations. In these circumstances, consumers may request lower interest rates, extended payment due dates, or increased credit limits to alleviate financial strain. An effective approach involves detailing personal experiences, including relevant financial figures, such as monthly income or outstanding debt amounts, while explicitly outlining these specific changes in credit card terms. This request aims to foster understanding and cooperation between the consumer and the financial institution, often based in established regulations that support consumers during challenging times.

Supporting Documentation

When seeking a hardship-based credit card terms change, providing supporting documentation is essential to strengthen your case. Key documents include a detailed hardship letter outlining financial difficulties, such as job loss or unexpected medical expenses, like hospitalization averaging $5,000. Recent pay stubs or tax returns can illustrate income changes, while bank statements from the last three months may reveal cash flow issues. Additionally, legal documents or notices, such as eviction notices or foreclosure letters, highlight urgent situations. Personal identification, including a government-issued ID, is crucial for verification purposes. Collectively, this documentation presents a compelling narrative of financial distress to creditors, facilitating discussions for more manageable payment terms or interest rate reductions.

Contact Information and Preferred Communication Method

Contact information is crucial for facilitating communication regarding hardship-based credit card term changes. Provide a complete mailing address, including street name, number, city, state, and ZIP code, ensuring accurate delivery of correspondence. Include a reliable phone number with area code for immediate access; this allows for quick discussions with customer service representatives regarding any financial concerns. Specify an email address for digital interactions, enabling the exchange of documents and updates rapidly. Preferred communication methods should be indicated clearly; options like phone calls, emails, or written letters can enhance the interaction experience based on individual comfort. Having multiple contact avenues allows credit card representatives to reach out during sensitive financial discussions effectively, ensuring timely resolution of issues.

Letter Template For Hardship-Based Credit Card Terms Change Samples

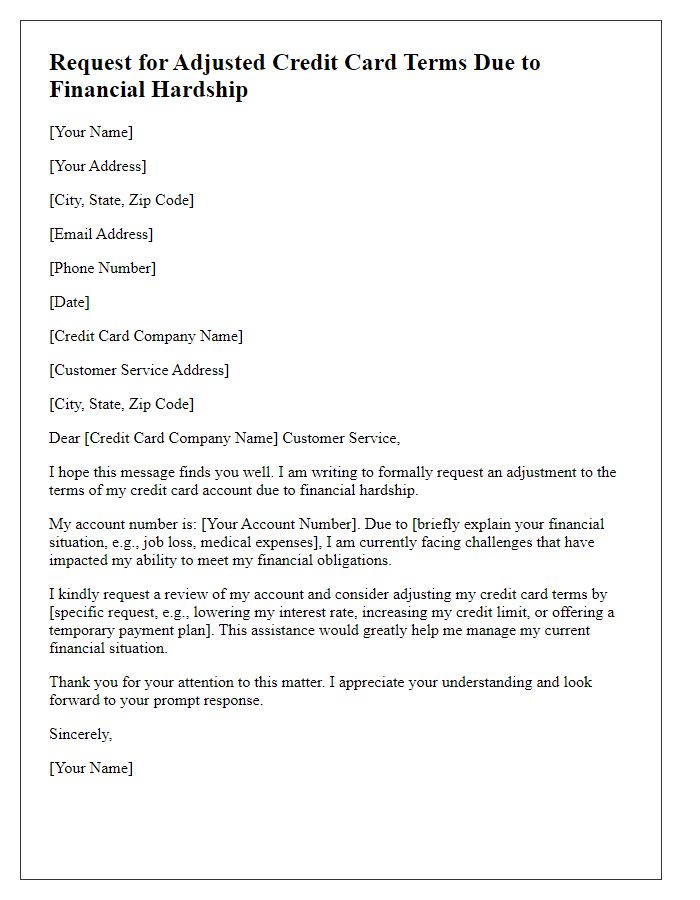

Letter template of request for adjusted credit card terms due to financial hardship.

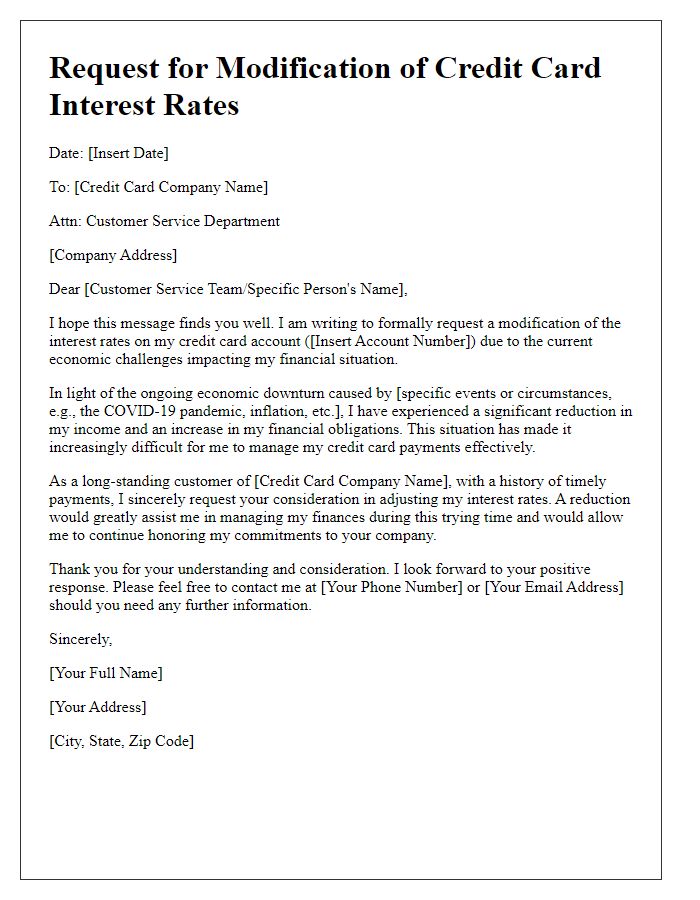

Letter template of appeal for modified credit card interest rates based on economic challenges.

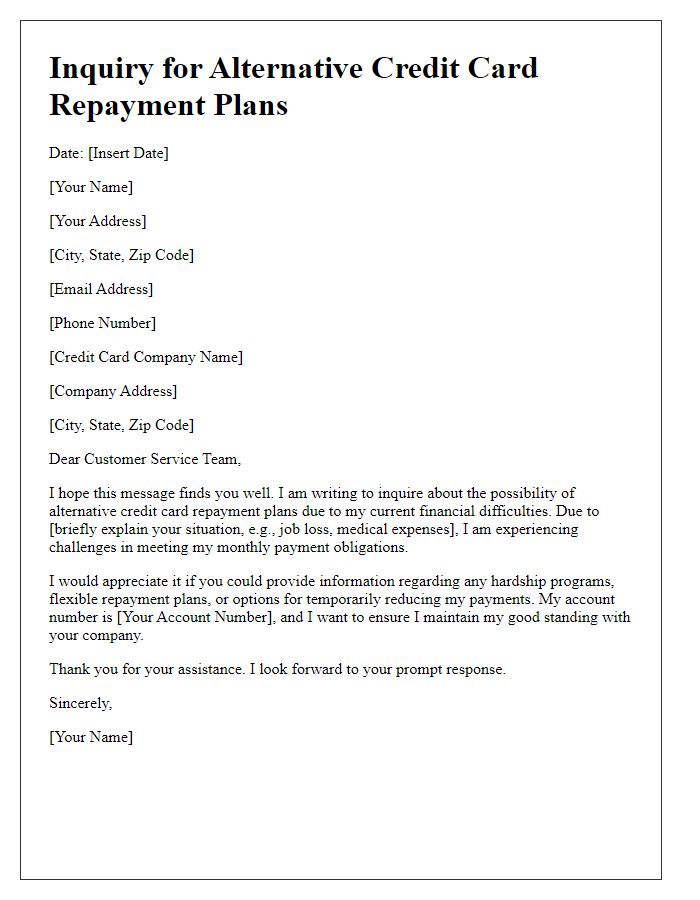

Letter template of inquiry for alternative credit card repayment plans during difficult times.

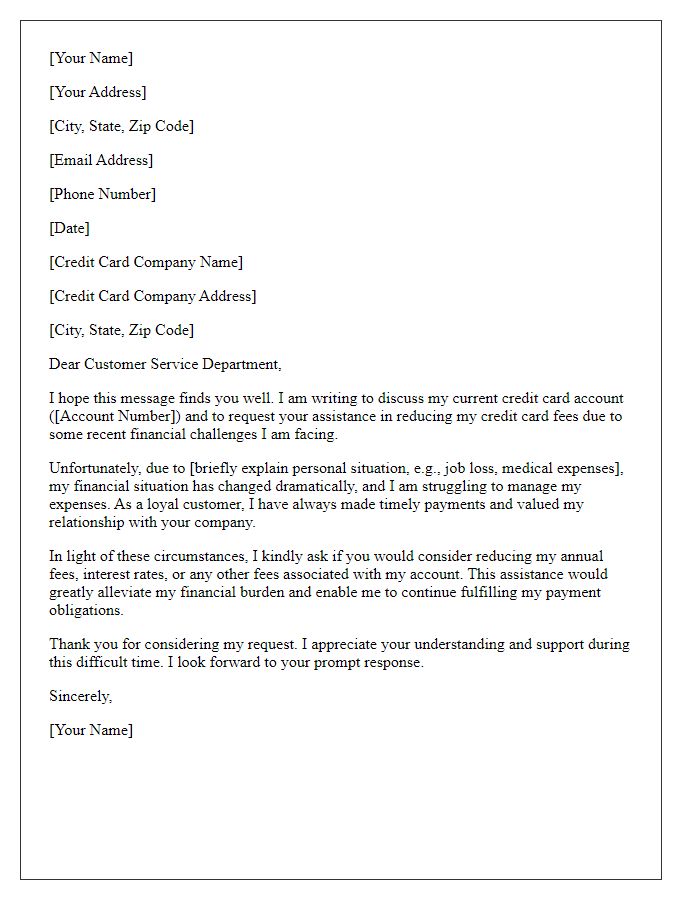

Letter template of solicitation for reduced credit card fees in light of financial struggles.

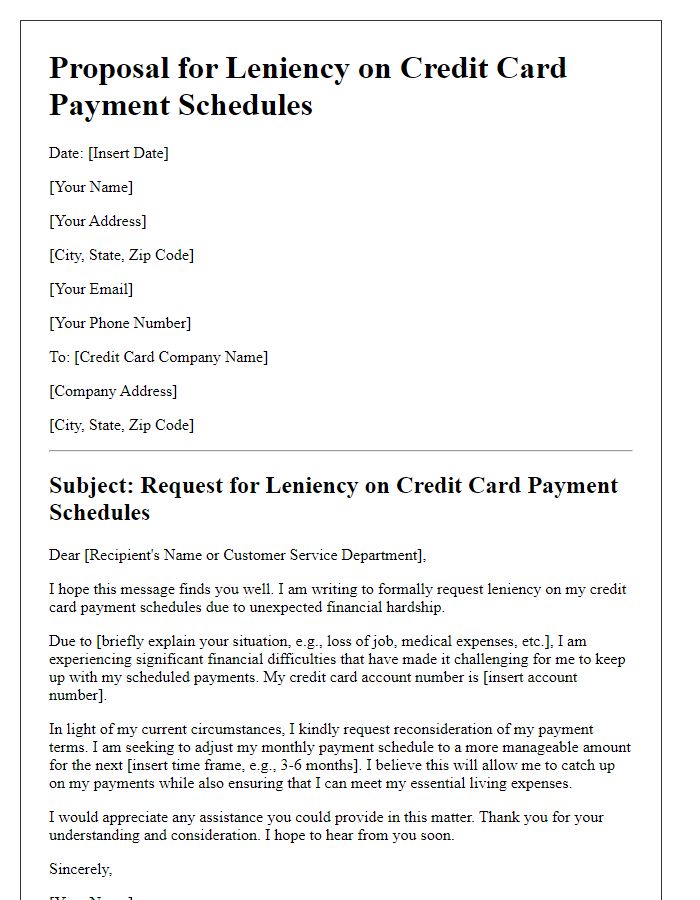

Letter template of proposal for leniency on credit card payment schedules under hardship.

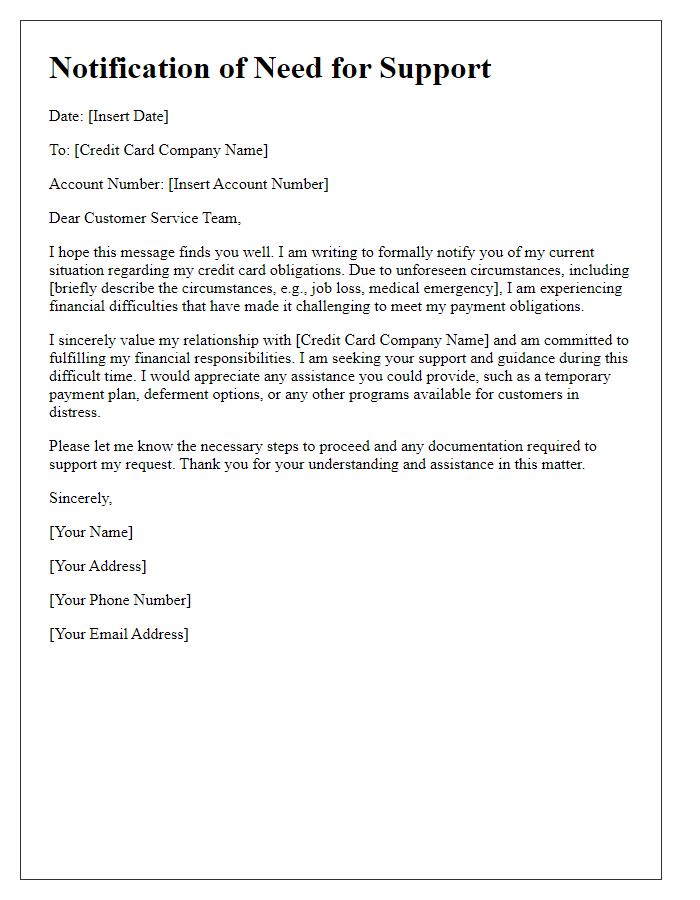

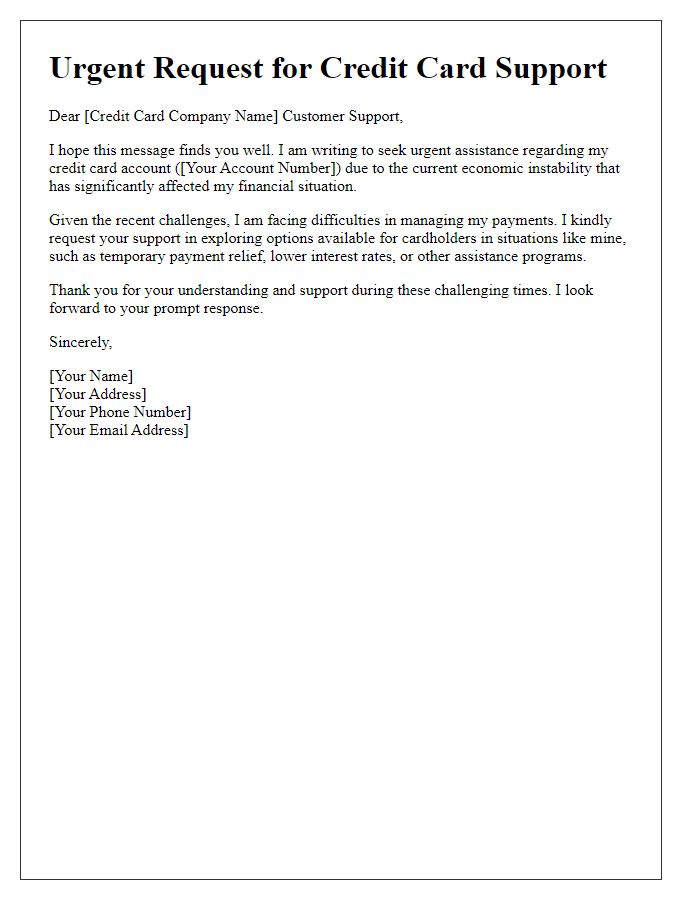

Letter template of notification for needing support with credit card obligations due to unforeseen circumstances.

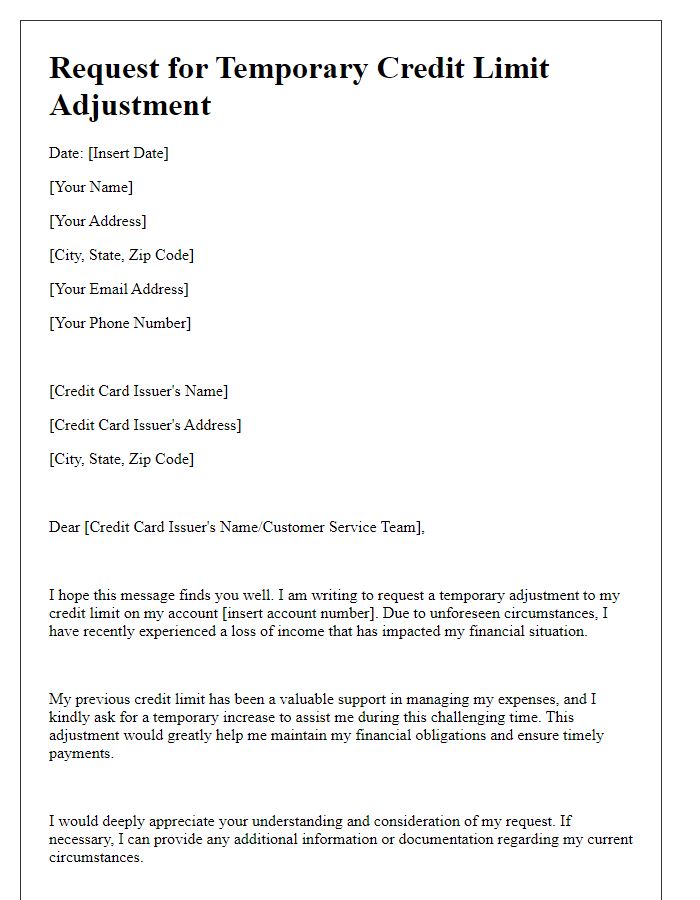

Letter template of request for temporary credit limit adjustments due to income loss.

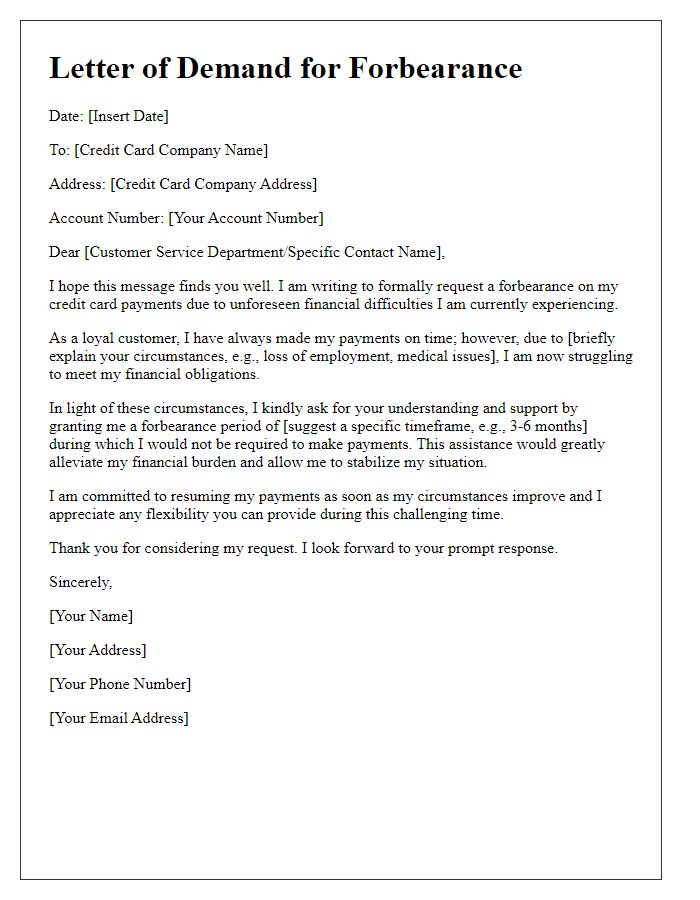

Letter template of demand for forbearance on credit card payments amidst financial distress.

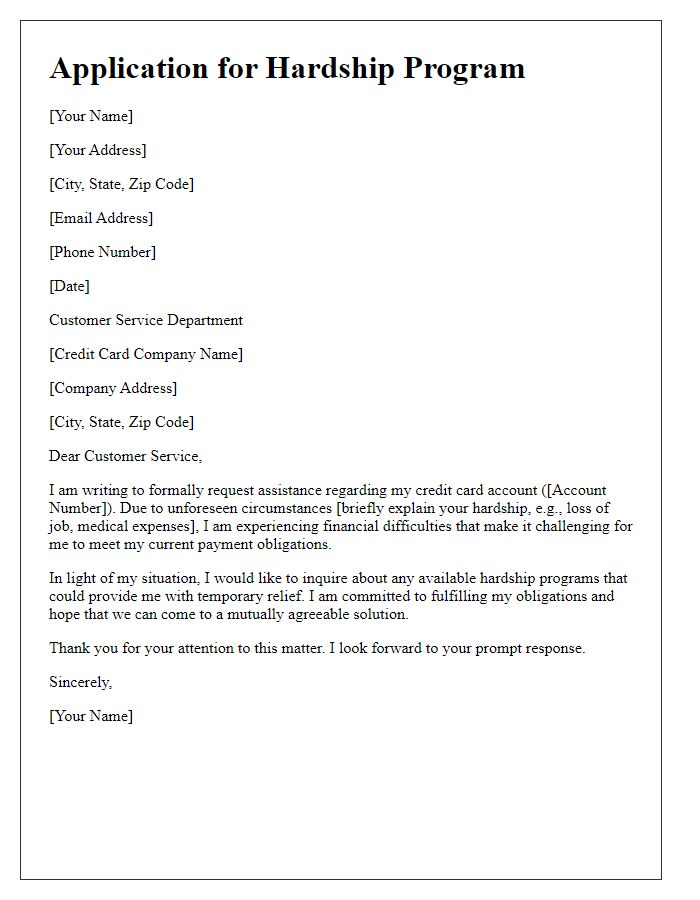

Letter template of application for hardship programs related to credit card accounts.

Comments