Have you ever wondered how credit inquiries can impact your mortgage process? It's a common concern for many homebuyers, as understanding the intricacies of credit checks can be a bit daunting. In this article, we'll break down the different types of credit inquiries, how they affect your credit score, and the steps you can take to manage them effectively. So, let's dive in and unravel the mysteryâyour mortgage journey awaits!

Personal Information

When individuals apply for a mortgage, credit inquiries, specifically hard inquiries, are generated to assess their creditworthiness. Lenders analyze credit reports provided by agencies such as Experian, TransUnion, and Equifax. Each inquiry could potentially lower credit scores by a few points, depending on the overall credit profile. A typical hard inquiry remains on a credit report for approximately two years, affecting future borrowing capabilities. Understanding the impact of multiple inquiries, particularly within a short timeframe, is essential for borrowers, as mortgage shopping is often encouraged. Rates of inquiries during a 30-day window are generally treated as a single inquiry, minimizing the negative effects on the credit score.

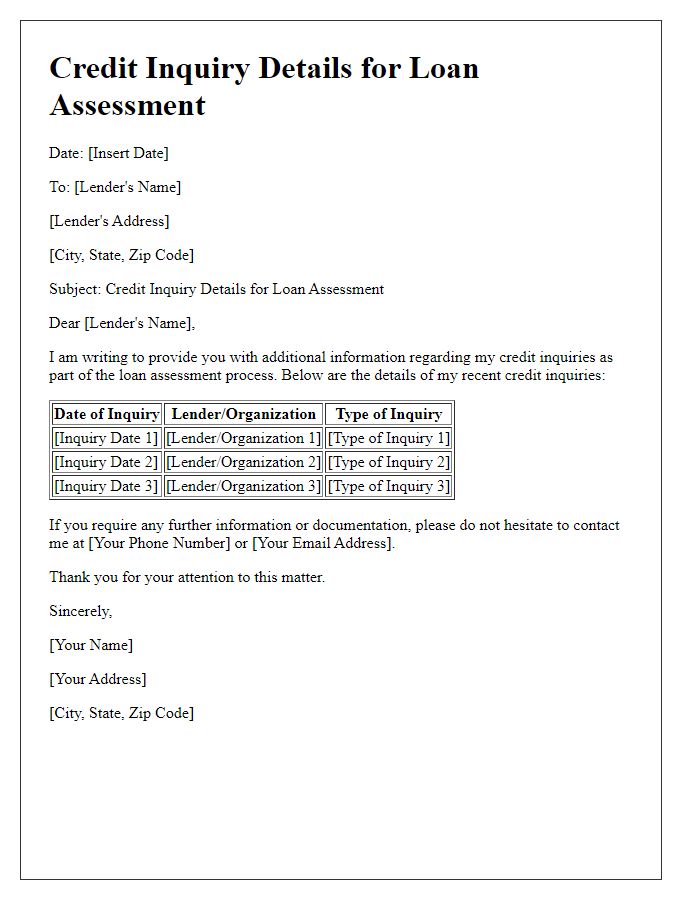

Purpose of Inquiry Explanation

When applying for a mortgage, multiple credit inquiries often arise, primarily from lenders conducting hard inquiries to assess creditworthiness. These inquiries can occur during the mortgage application process, including but not limited to conventional loans, FHA loans, and VA loans. Each lender, including large institutions like Wells Fargo or JPMorgan Chase, may request access to your credit report, which contributes to a temporary dip in credit scores. It is important to note that inquiries related to mortgage applications are typically grouped together by credit scoring models (like FICO and VantageScore) within a 30-day timeframe, minimizing their impact on your overall credit score to encourage consumers to shop around for the best rates. Understanding this process can help alleviate concerns about credit score fluctuations during this significant financial undertaking.

Contextual Background

Credit inquiries during a mortgage process can impact a borrower's credit score significantly. A hard inquiry typically occurs when a lender reviews a borrower's credit report as part of their decision-making process, which is essential for determining loan approval and terms. Each hard inquiry can lower a credit score by a few points, which may be crucial for borrowers seeking competitive mortgage rates. Multiple inquiries within a short period, often within 30 to 45 days, are usually treated as a single inquiry by credit scoring models, allowing borrowers to shop for the best mortgage rates without severely affecting their scores. Understanding the timing and type of credit inquiries is vital for individuals navigating the mortgage landscape, especially between major lending events like the submission of a loan application and the closing date.

Impact on Credit Score

Multiple credit inquiries during the mortgage loan application process can significantly impact an individual's credit score. Hard inquiries, typically initiated when a lender reviews credit reports in response to a mortgage application, can lower your credit score by approximately 5 to 10 points per inquiry. For example, applying to several lenders within a short period, usually 30 to 45 days, allows credit scoring models like FICO to consider these inquiries as a single event, minimizing overall impact. Mortgage lenders usually assess credit reports from major bureaus such as Experian and TransUnion, analyzing factors like payment history, credit utilization, and the length of credit history. Maintaining a healthy credit profile is crucial during this time to secure optimal mortgage rates and terms.

Reassuring Financial Responsibility

Credit inquiries can impact mortgage applications, particularly due to their association with financial responsibility. Each inquiry typically results from lenders, such as banks or credit unions, evaluating creditworthiness for loans. Multiple inquiries within a short period, usually within 30-45 days, are generally treated as a single request by the credit scoring models, reducing negative impact. Mortgage lenders, such as Fannie Mae or Freddie Mac, favor applicants demonstrating prudent management of credit accounts, including timely payments and low credit utilization rates (below 30% is ideal). Understanding credit inquiries' nature highlights the importance of consistent financial habits, fostering confidence during the mortgage approval process.

Letter Template For Explaining Credit Inquiries During Mortgage Samples

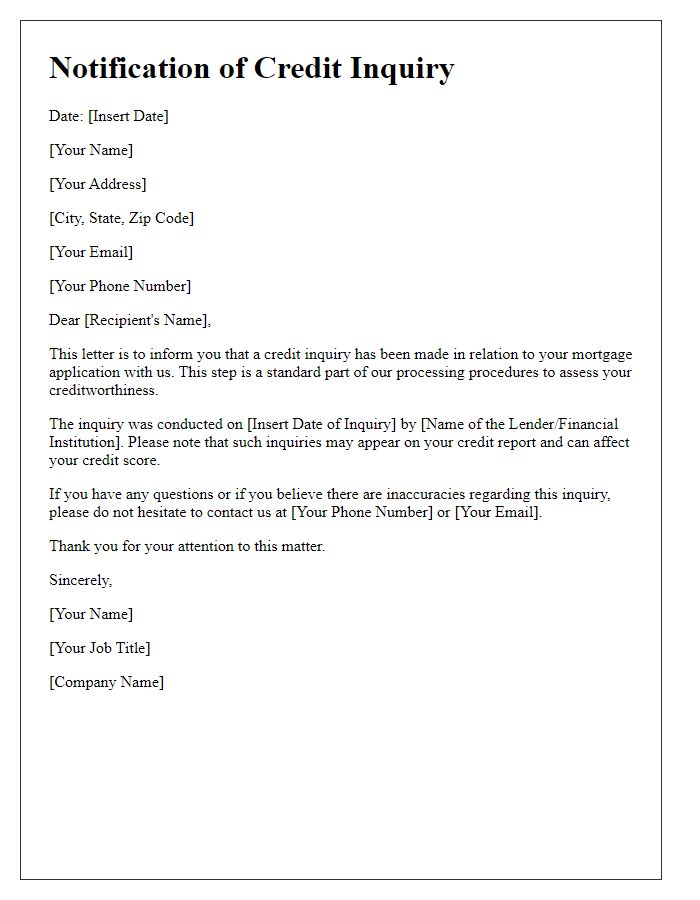

Letter template of notification regarding credit inquiries for mortgage processing

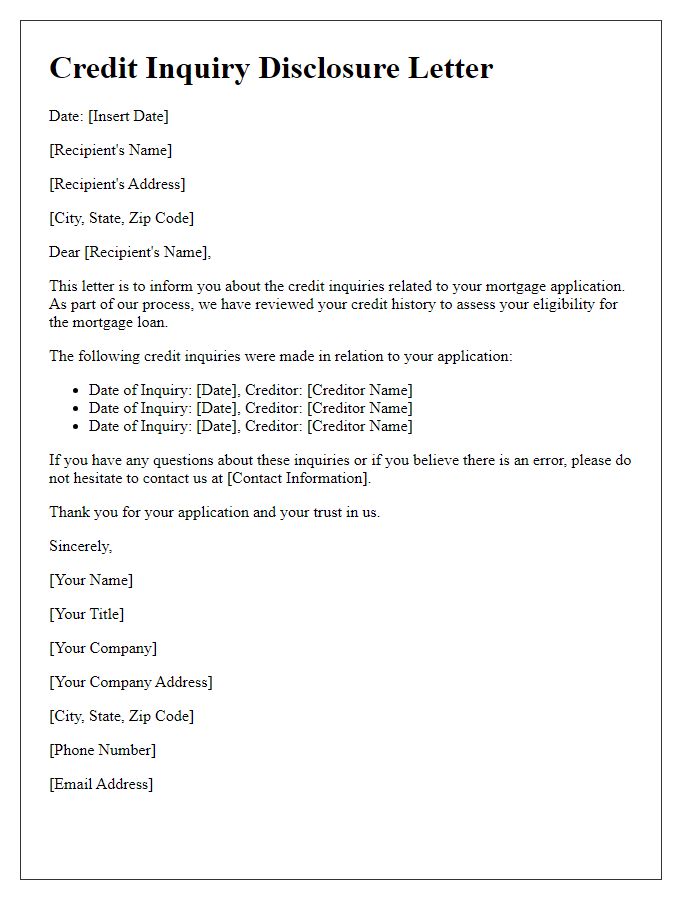

Letter template of disclosure of credit inquiries related to mortgage application

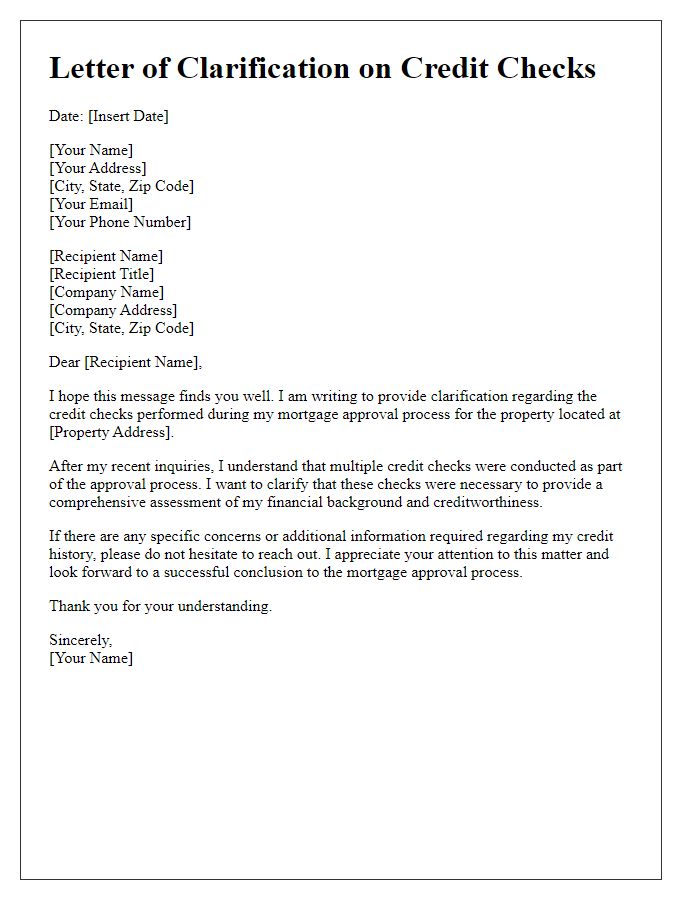

Letter template of clarification on credit checks during mortgage approval

Letter template of explanation for recent credit pulls in mortgage underwriting

Letter template of reasons behind credit inquiries for home loan consideration

Letter template of summary of credit evaluations during the mortgage process

Letter template of overview of credit checks for residential mortgage application

Letter template of description of credit inquiry impacts on mortgage eligibility

Comments