Are you considering a co-signer release from your financial obligations? This process can be a crucial step toward reclaiming your independence and improving your credit score. Understanding the necessary steps and documentation can make this journey smoother and less stressful. Dive into our article to discover everything you need to know about co-signer releases!

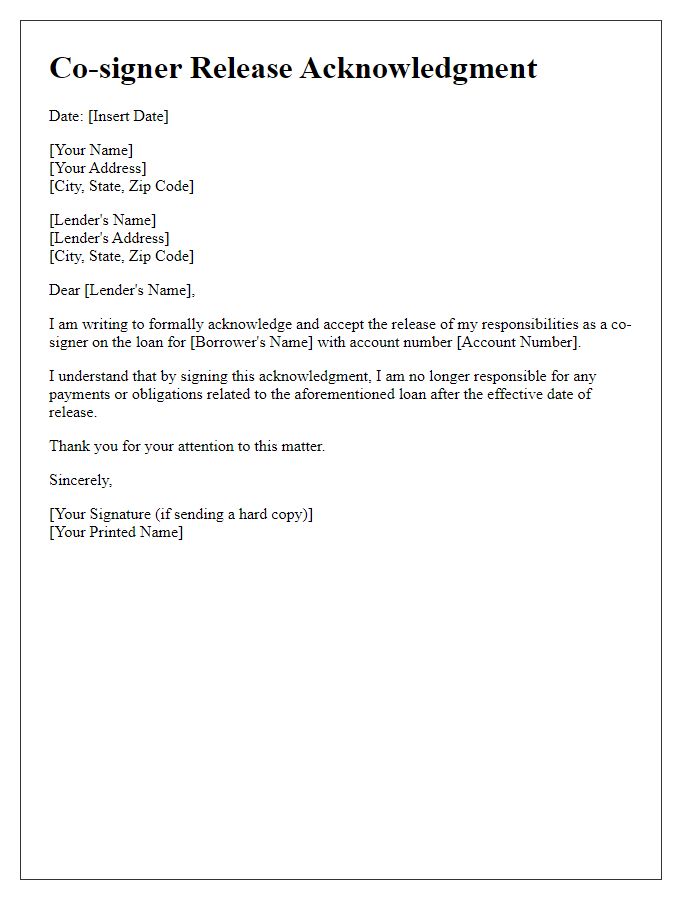

Legal terminology and clarity

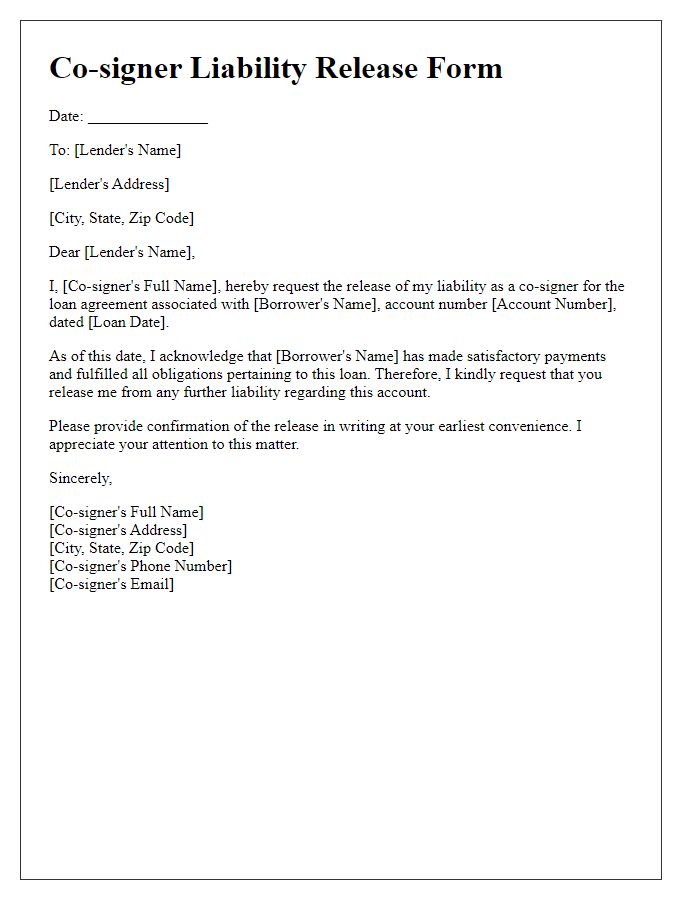

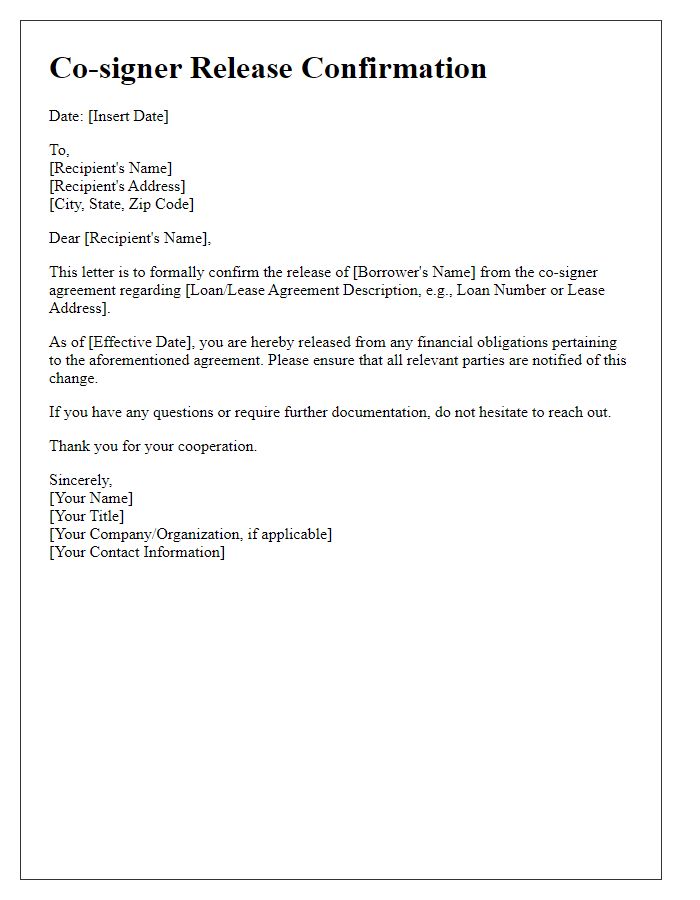

A co-signer release is a formal document that allows a co-signer to be removed from the financial obligation of a loan or lease. This release is often sought in circumstances where the primary borrower has demonstrated consistent repayment behavior over a specified period, typically six to twelve months. Legal terms such as "discharge of obligation," "mutual consent," and "indemnification" must be clearly articulated. The document should identify all parties involved, including the primary borrower and lender, and explicitly state that the co-signer will no longer be held liable for any future payments. Additionally, include the loan or lease details, including account numbers and dates, to ensure clarity. Both parties should acknowledge their agreement by signing and dating the document in the presence of a notary.

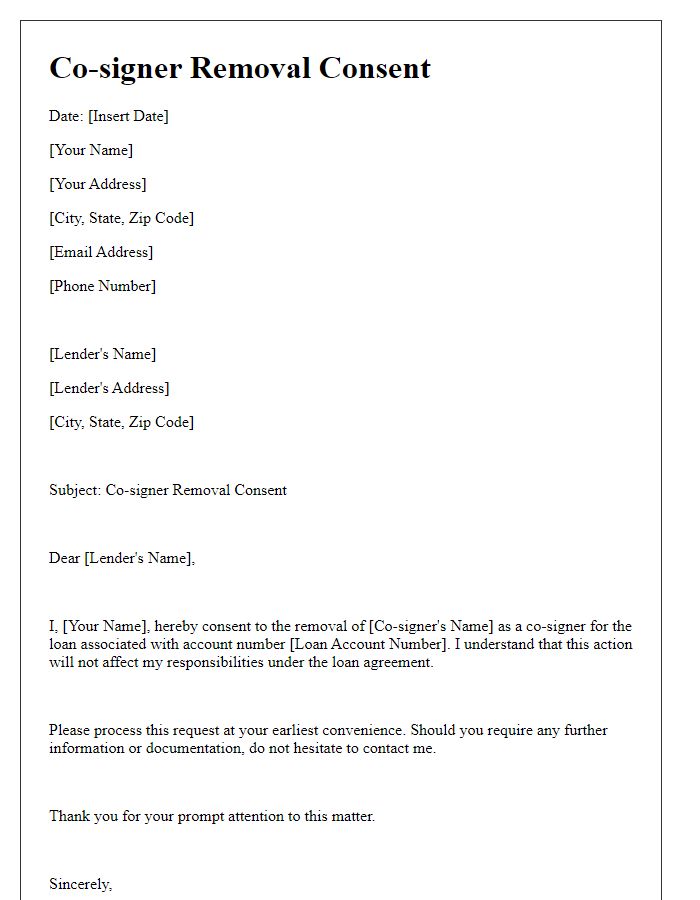

Co-signer's personal and contact information

A co-signer release from obligation is an important legal process, often necessary when a co-signer wishes to withdraw their financial responsibility for a loan or lease agreement. Personal information required includes the co-signer's full name, residential address, and phone number. This information ensures that all parties involved can communicate effectively and that legal documentation can be accurately processed. Additionally, the formal agreement should specify the original loan or lease details, including the borrower's name, account number, and loan amount, thus establishing context and clarity for the request. The request for release may also necessitate the inclusion of signatures and dates to confirm both parties' agreement and all relevant documents, like a final payment statement, may be attached to support the co-signer's release.

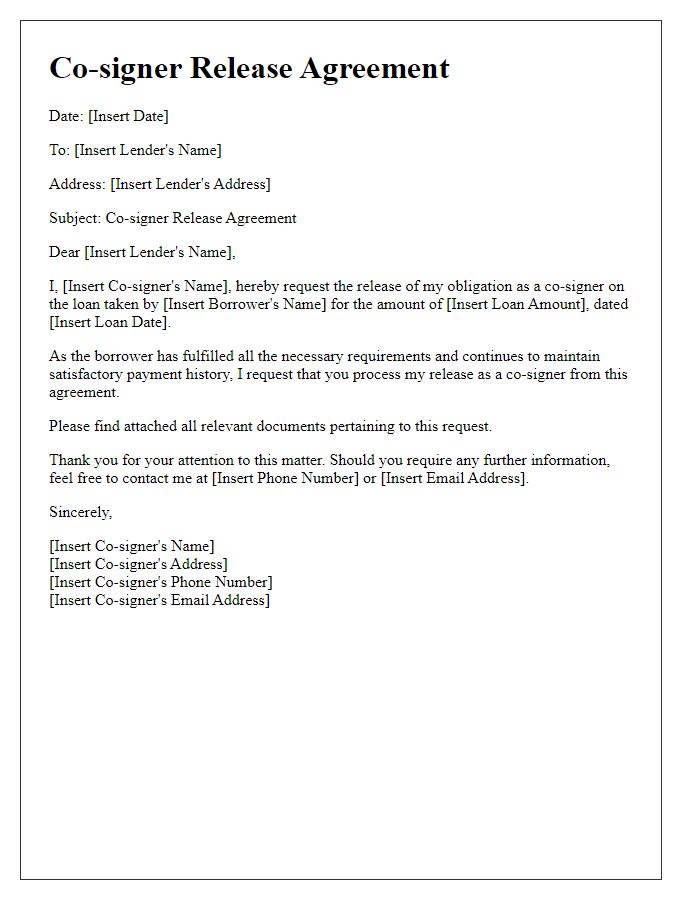

Original loan or agreement details

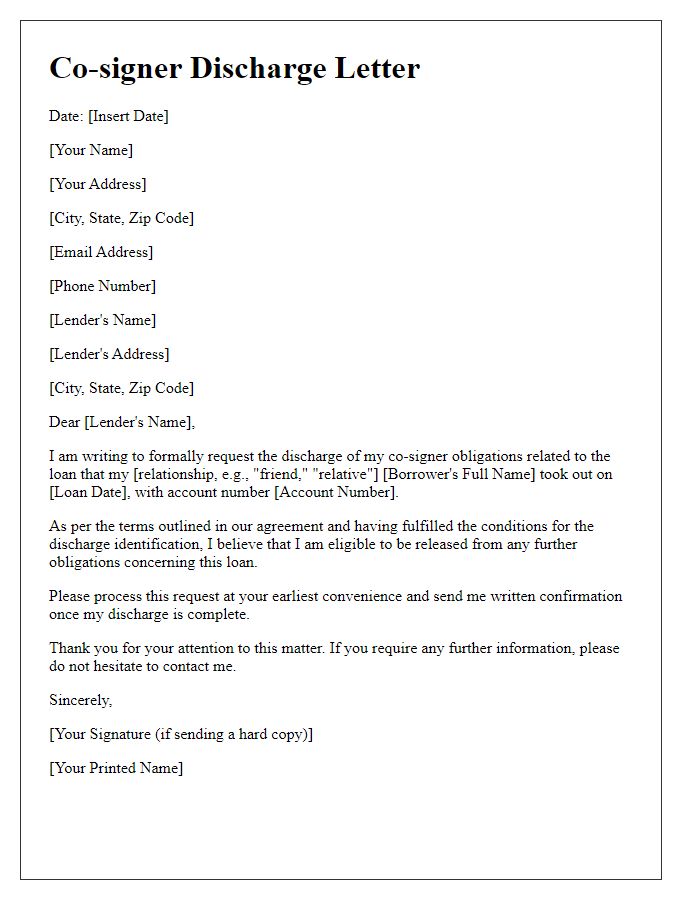

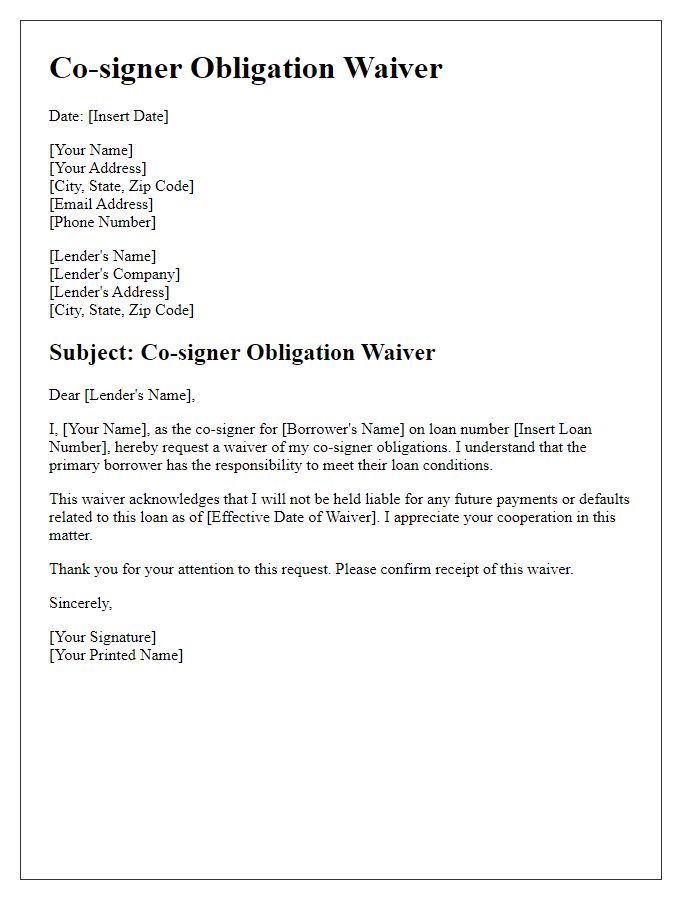

A co-signer release from obligation generally involves the legal arrangement where a secondary party, who guaranteed repayment on a loan, is relieved from their commitment. Typically associated with student loans or mortgages, this process often requires the original loan documents that outline key details such as the principal amount, interest rate, loan term, and account number. The borrower must demonstrate a good payment history, usually with a minimum number of on-time payments, while the lender assesses the borrower's creditworthiness. The release process might include specific forms provided by financial institutions, such as credit analysis and co-signer release application forms, necessitating the submission of personal information and identification to ensure compliance with federal regulations and lender policies.

Reason for release request

A co-signer may seek a release from obligation due to a change in financial circumstances, such as job loss or reduced income, which affects their ability to guarantee a loan. Life events, such as divorce or significant health issues, might prompt this request as well. Additionally, if the primary borrower has demonstrated consistent repayment behavior over a period of time, the co-signer may feel confident in requesting a release. It is crucial for the co-signer to formally document their request, citing specific reasons, and directly address the financial institution managing the loan, ensuring clarity and completeness in the communication process.

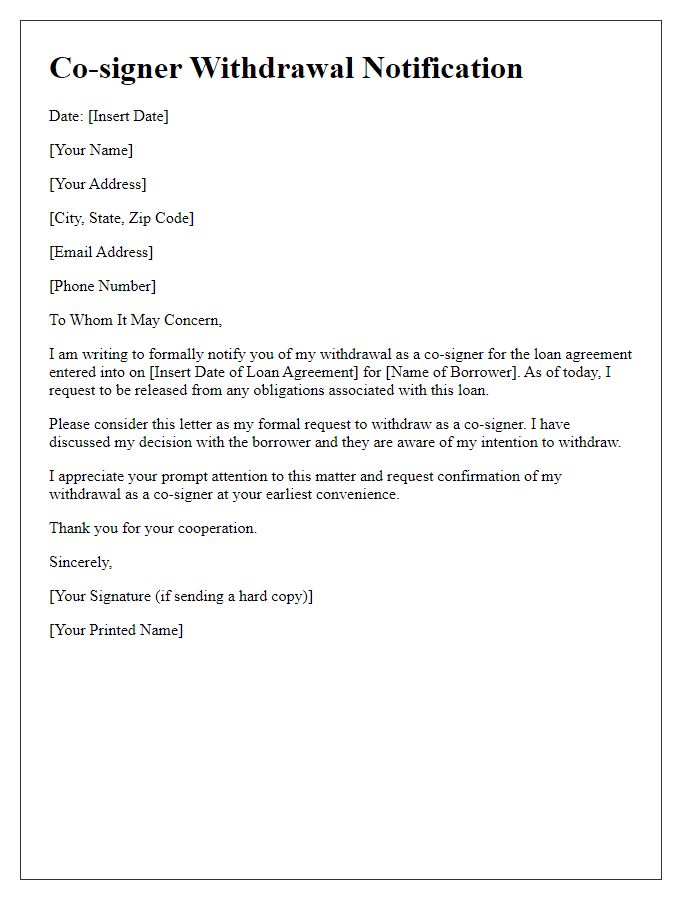

Lender's authorization and acknowledgment

A co-signer release from obligation involves a financial agreement where a co-signer is removed from liability for a loan. This process typically requires a request to the lender, such as a bank or credit union, indicating the release of the co-signer's personal responsibility for the remaining loan balance. Important aspects include the original loan amount, the borrower's payment history, and any specific conditions mandated by the lender for approval of the release. A formal acknowledgment from the lender is crucial, confirming their consent to this change in the loan agreement, which may need to occur after verifying the borrower's capability to manage the loan independently. Legal documentation may also be required to ensure all parties have clear records of the change in responsibility.

Comments